This version of the form is not currently in use and is provided for reference only. Download this version of

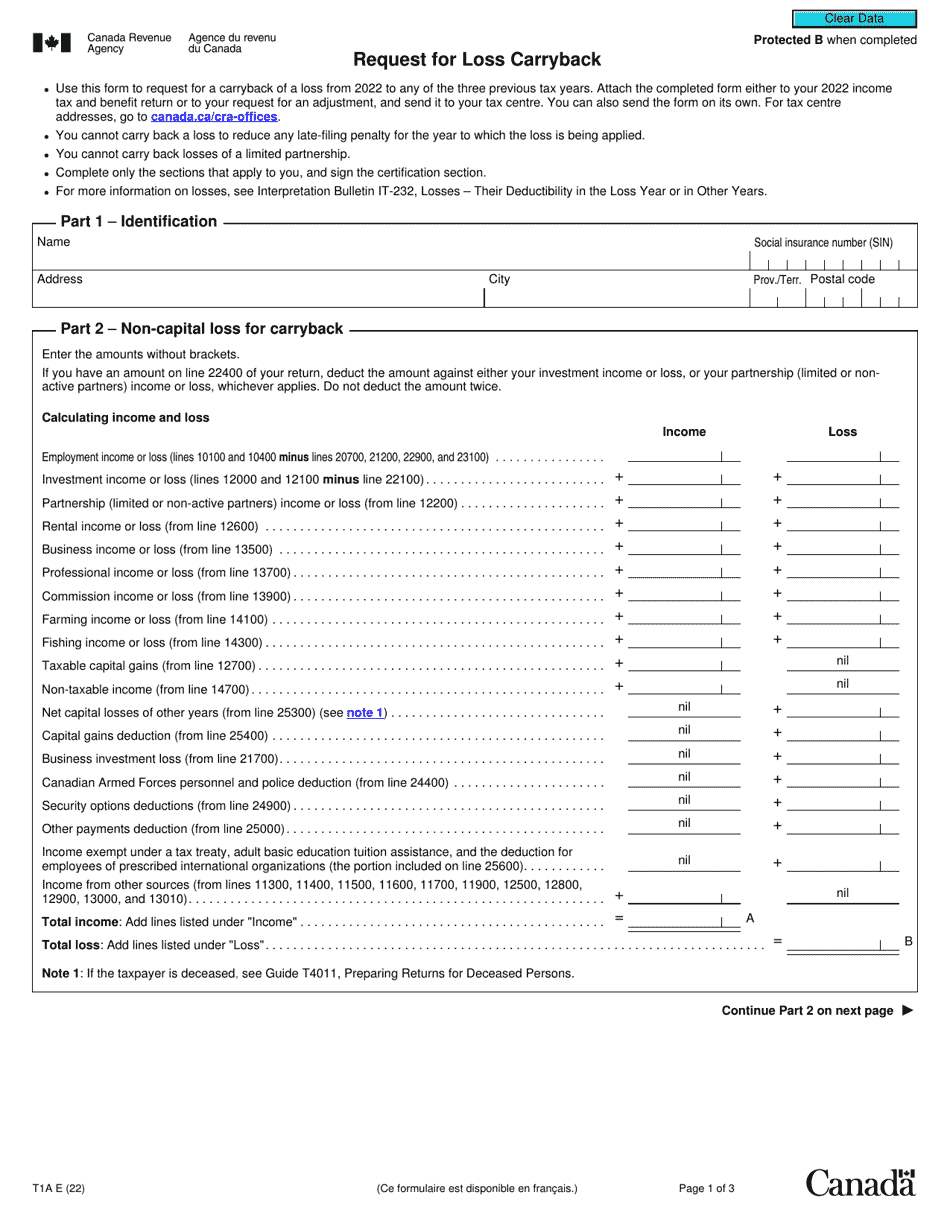

Form T1A

for the current year.

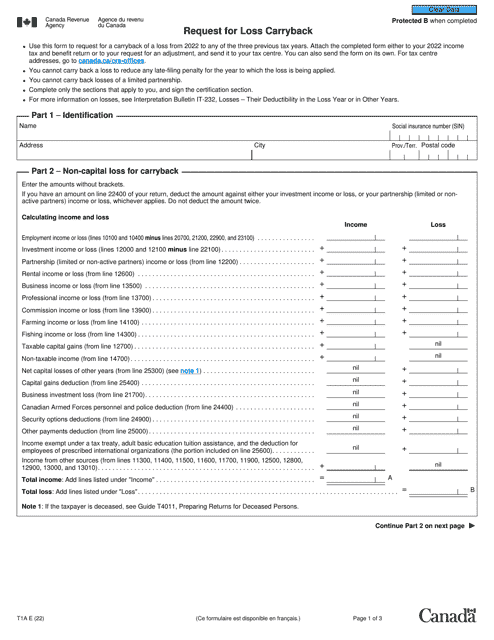

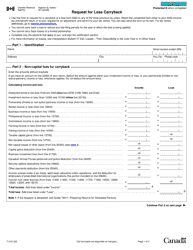

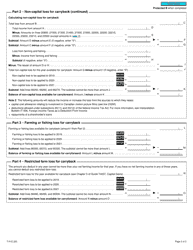

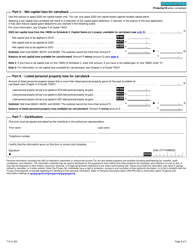

Form T1A Request for Loss Carryback - Canada

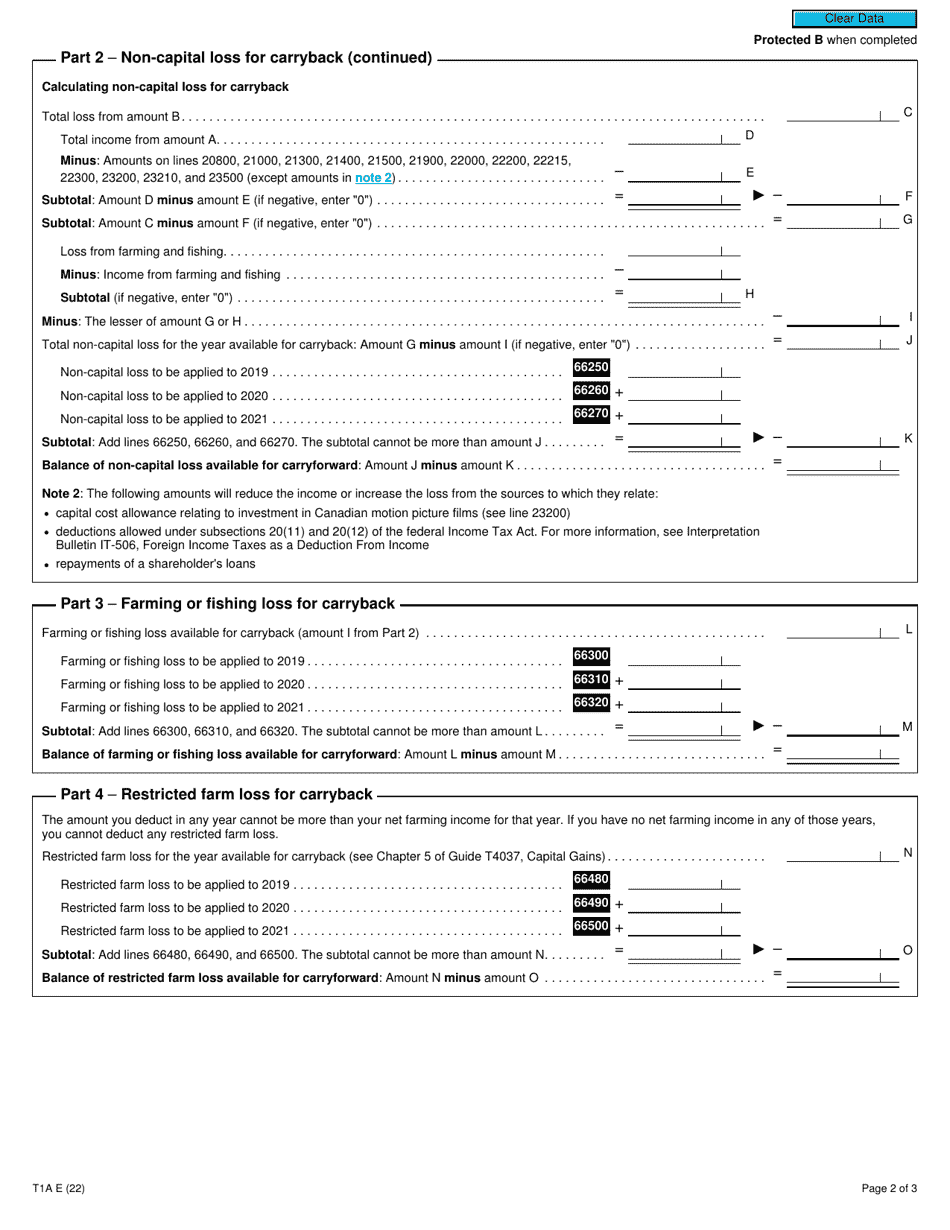

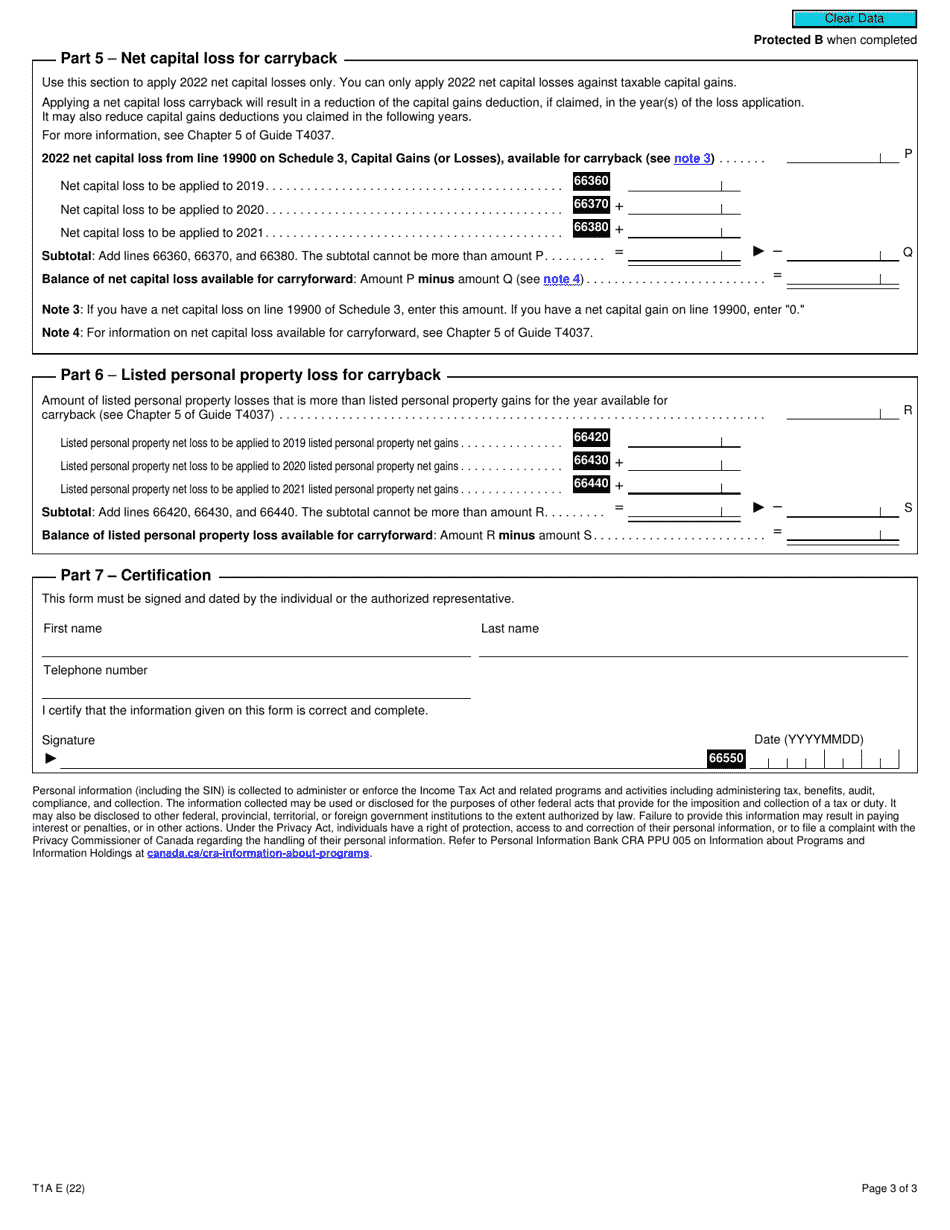

Form T1A Request forLoss Carryback in Canada is used to request the carryback of net capital losses, non-capital losses, or farming or fishing losses to a previous tax year. This allows taxpayers to apply these losses against income earned in a previous year, potentially resulting in a tax refund.

The Form T1A, Request for Loss Carryback, is filed by individuals or businesses in Canada who want to apply a tax loss from a current year's income against a previous year's income.

FAQ

Q: What is Form T1A?

A: Form T1A is a request for loss carryback in Canada.

Q: What is loss carryback?

A: Loss carryback is the ability to apply a current year's losses to a prior year's income to reduce taxes owing.

Q: Who is eligible to file Form T1A?

A: Individuals and corporations in Canada who have experienced a loss in one year and want to apply it to a prior year's income.

Q: What is the purpose of Form T1A?

A: The purpose of Form T1A is to request the carryback of a loss from the current year to a prior year for tax purposes.

Q: Are there any time limits for filing Form T1A?

A: Yes, for individuals, Form T1A must be filed within three years from the end of the tax year in which the loss occurred. For corporations, the time limit is two years.

Q: Is there a fee to file Form T1A?

A: No, there is no fee to file Form T1A.

Q: What documentation is required when filing Form T1A?

A: In general, you will need to provide supporting documentation that shows the loss incurred and the income from the prior year you want to apply it to.

Q: Can I carry forward any unused losses if my Form T1A request is denied?

A: Yes, if your Form T1A request is denied, you can still carry forward the loss and apply it to future years' income.