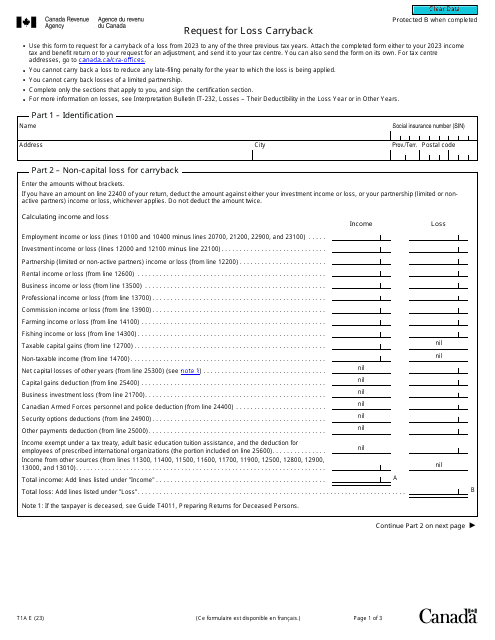

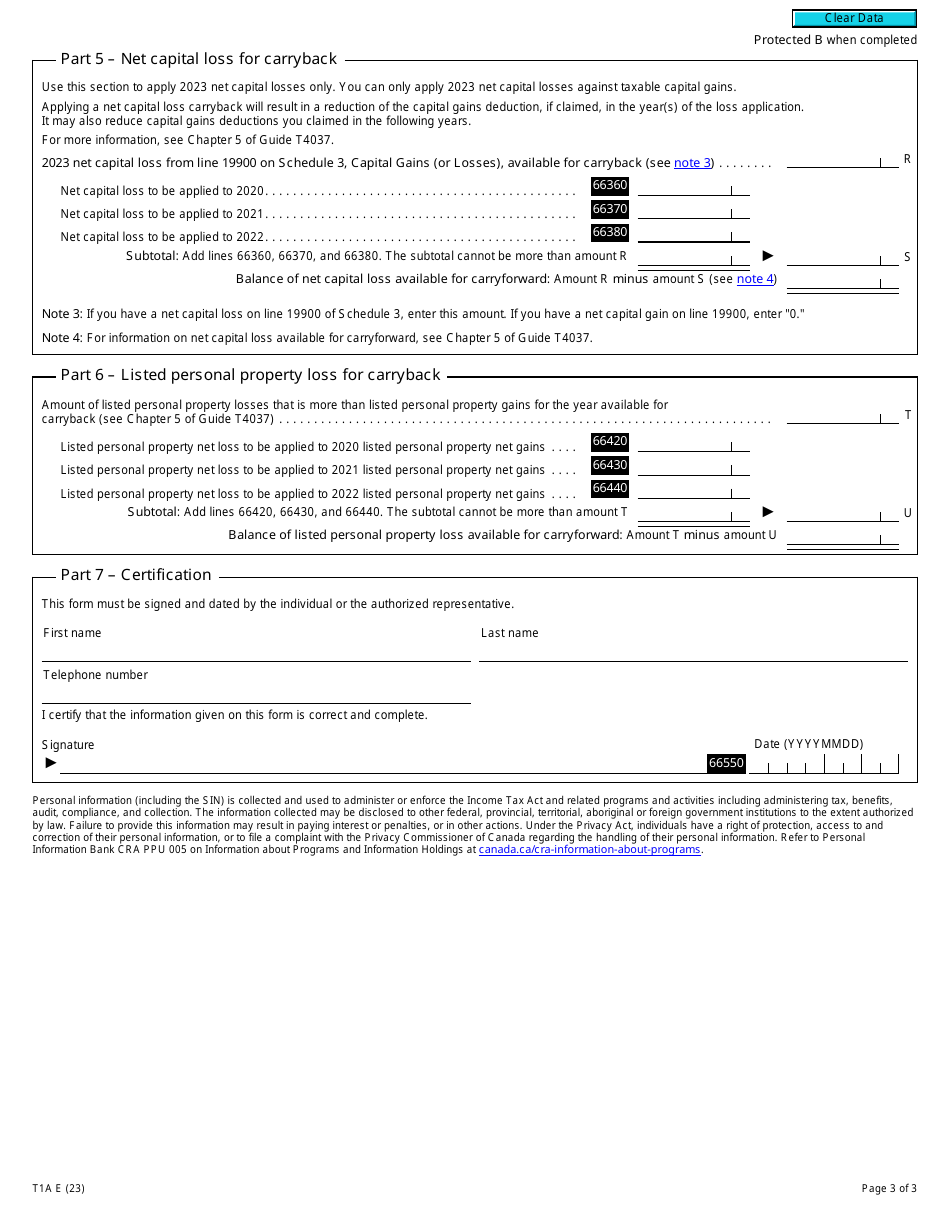

Form T1A Request for Loss Carryback - Canada

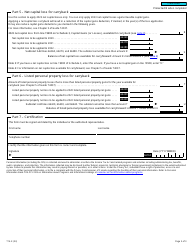

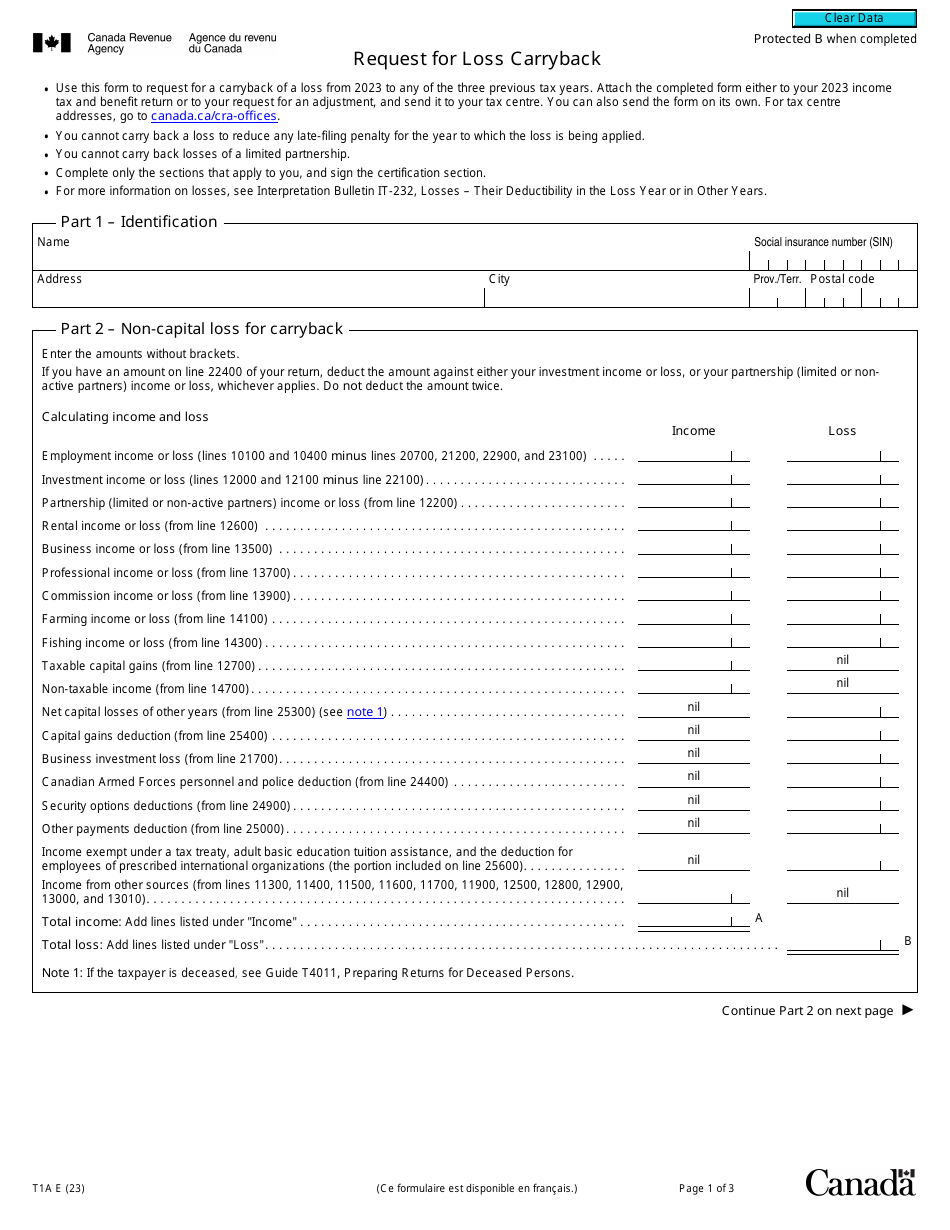

Form T1A Request forLoss Carryback in Canada is used to request the carryback of net capital losses, non-capital losses, or farming or fishing losses to a previous tax year. This allows taxpayers to apply these losses against income earned in a previous year, potentially resulting in a tax refund.

The Form T1A, Request for Loss Carryback, is filed by individuals or businesses in Canada who want to apply a tax loss from a current year's income against a previous year's income.

Form T1A Request for Loss Carryback - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1A?

A: Form T1A is a request for loss carryback in Canada.

Q: What is loss carryback?

A: Loss carryback is the ability to apply a current year's losses to a prior year's income to reduce taxes owing.

Q: Who is eligible to file Form T1A?

A: Individuals and corporations in Canada who have experienced a loss in one year and want to apply it to a prior year's income.

Q: What is the purpose of Form T1A?

A: The purpose of Form T1A is to request the carryback of a loss from the current year to a prior year for tax purposes.

Q: Are there any time limits for filing Form T1A?

A: Yes, for individuals, Form T1A must be filed within three years from the end of the tax year in which the loss occurred. For corporations, the time limit is two years.

Q: Is there a fee to file Form T1A?

A: No, there is no fee to file Form T1A.

Q: What documentation is required when filing Form T1A?

A: In general, you will need to provide supporting documentation that shows the loss incurred and the income from the prior year you want to apply it to.

Q: Can I carry forward any unused losses if my Form T1A request is denied?

A: Yes, if your Form T1A request is denied, you can still carry forward the loss and apply it to future years' income.