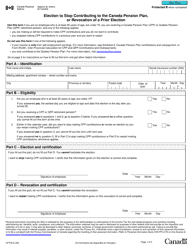

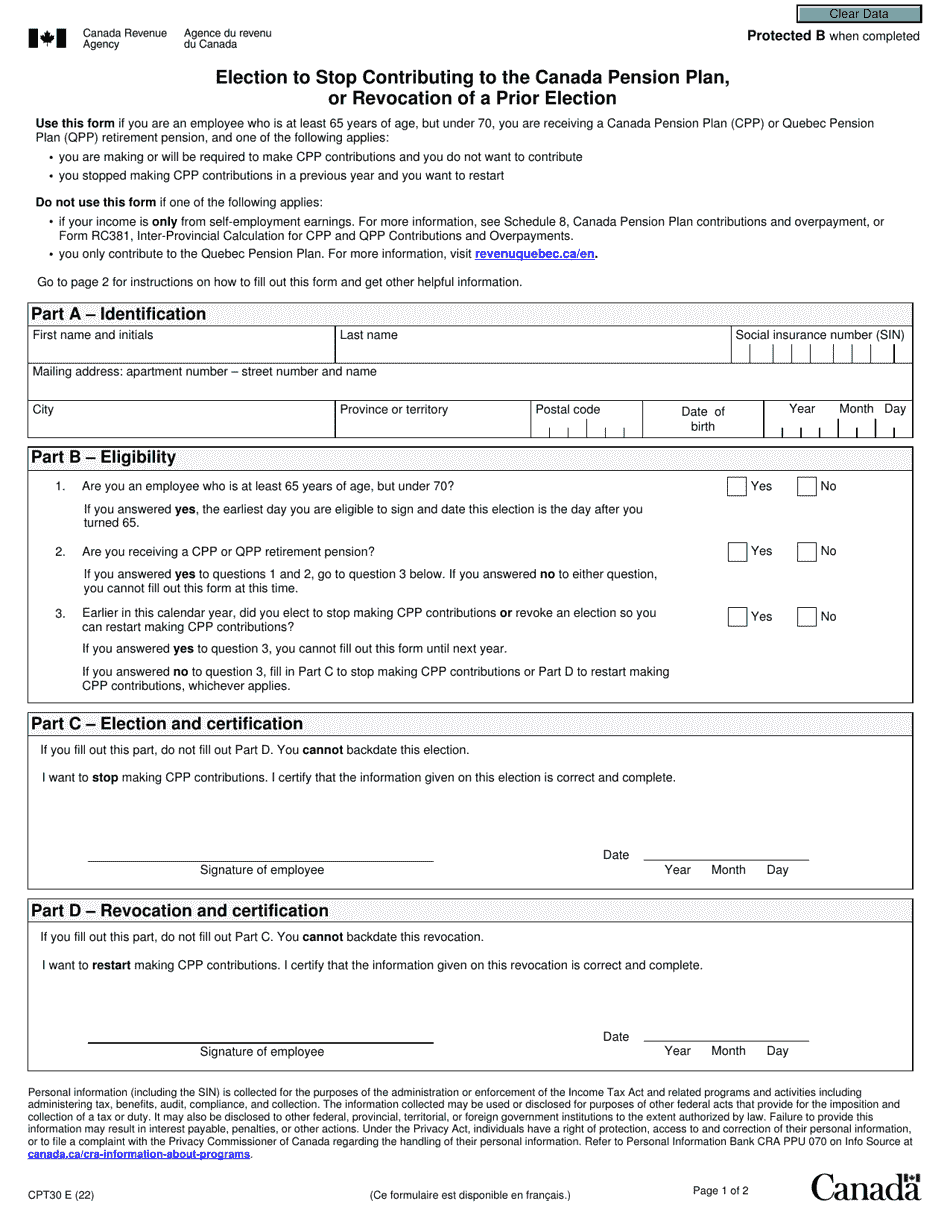

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CPT30

for the current year.

Form CPT30 Election to Stop Contributing to the Canada Pension Plan, or Revocation of a Prior Election - Canada

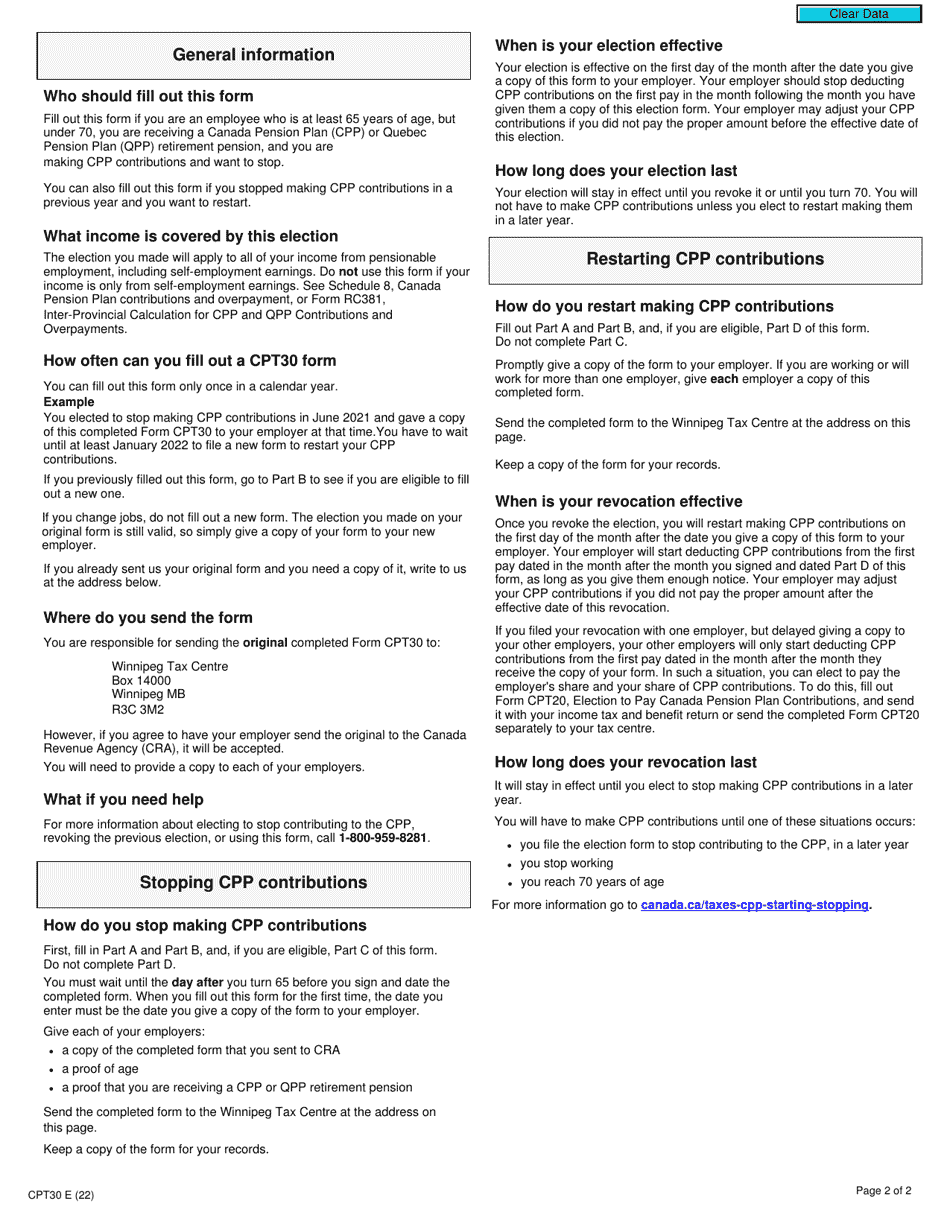

Form CPT30 Election to Stop Contributing to the Canada Pension Plan, or Revocation of a Prior Election is used by individuals who want to opt out of making contributions to the Canada Pension Plan (CPP) or revoke a previous election to stop contributing. It allows individuals to make a choice regarding their participation in the CPP.

The Form CPT30 is usually filed by individuals who want to stop contributing to the Canada Pension Plan or revoke a prior election.

FAQ

Q: What is Form CPT30?

A: Form CPT30 is a document used to elect to stop contributing to the Canada Pension Plan (CPP) or to revoke a prior election.

Q: What is the Canada Pension Plan (CPP)?

A: The Canada Pension Plan (CPP) is a social insurance program that provides retirement, disability, and survivor benefits to eligible individuals.

Q: Who can use Form CPT30?

A: Individuals who are working in Canada and contributing to the CPP are eligible to use Form CPT30.

Q: Why would someone want to stop contributing to the CPP?

A: Some individuals may choose to stop contributing to the CPP if they have a similar pension plan in another country or if they have reached the maximum CPP pensionable earnings.

Q: Can a prior election to stop contributing to the CPP be revoked?

A: Yes, a prior election to stop contributing to the CPP can be revoked using Form CPT30.

Q: Is there a deadline for submitting Form CPT30?

A: Yes, Form CPT30 must be submitted to the CRA on or before the first day on which the individual wishes to stop contributing to the CPP.

Q: What happens if Form CPT30 is not submitted on time?

A: If Form CPT30 is not submitted on time, the individual will continue to contribute to the CPP until the form is received and processed by the CRA.

Q: Is there a fee to submit Form CPT30?

A: No, there is no fee to submit Form CPT30.

Q: Are there any tax implications for electing to stop contributing to the CPP?

A: There may be tax implications for electing to stop contributing to the CPP, and individuals are advised to consult with a tax professional for guidance.