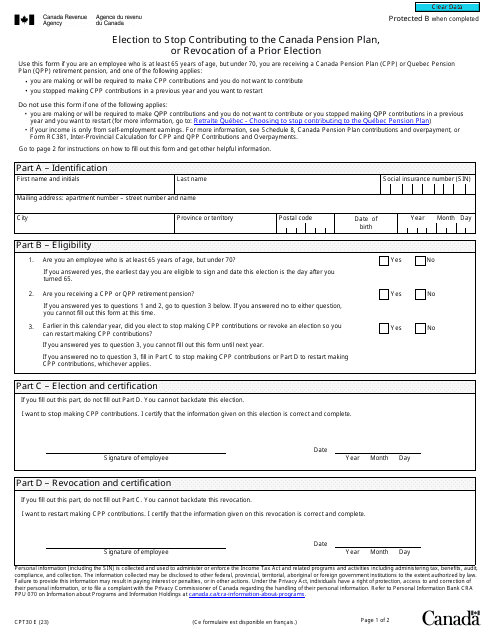

Form CPT30 Election to Stop Contributing to the Canada Pension Plan, or Revocation of a Prior Election - Canada

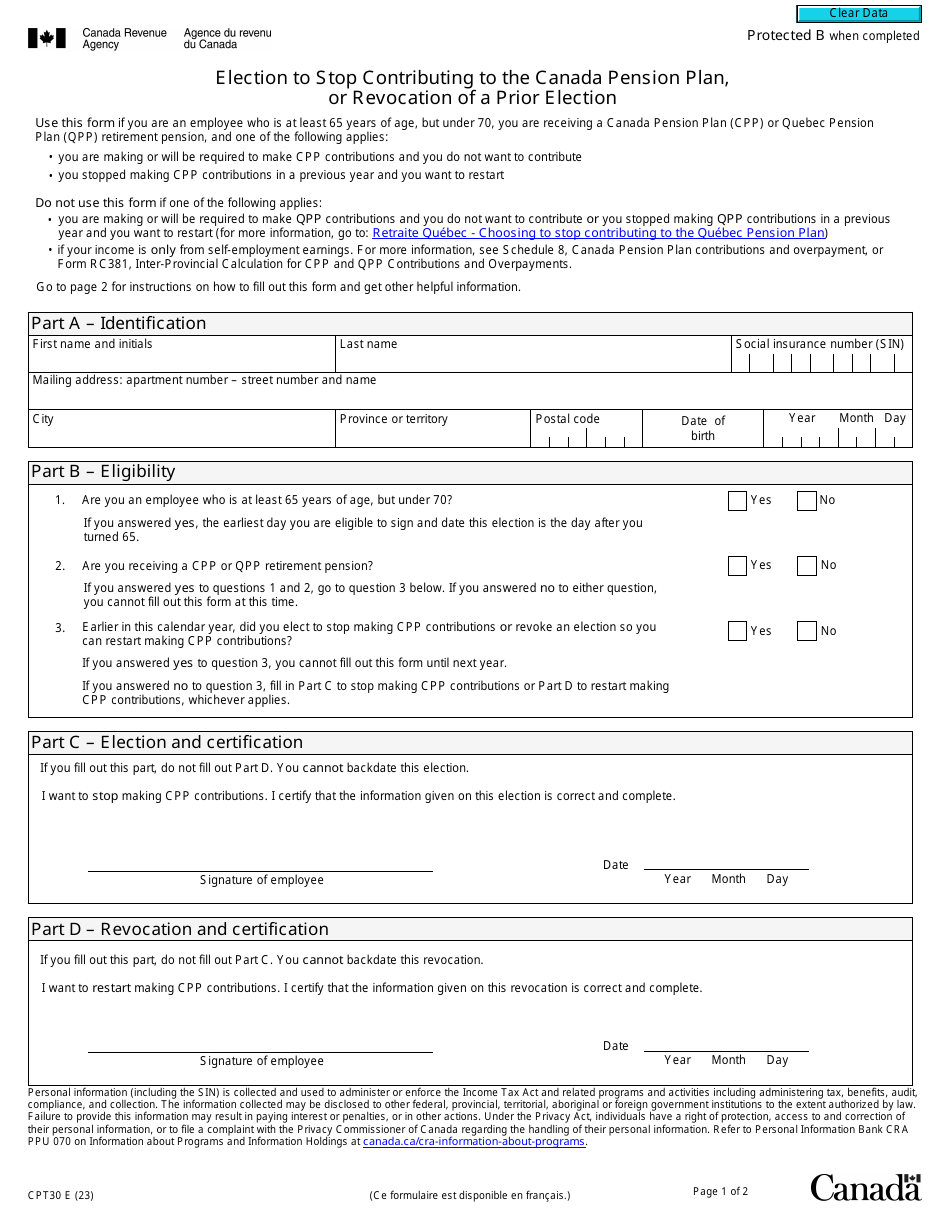

Form CPT30 Election to Stop Contributing to the Canada Pension Plan, or Revocation of a Prior Election is used by individuals who want to opt out of making contributions to the Canada Pension Plan (CPP) or revoke a previous election to stop contributing. It allows individuals to make a choice regarding their participation in the CPP.

The Form CPT30 is usually filed by individuals who want to stop contributing to the Canada Pension Plan or revoke a prior election.

Form CPT30 Election to Stop Contributing to the Canada Pension Plan, or Revocation of a Prior Election - Canada - Frequently Asked Questions (FAQ)

Q: What is Form CPT30?

A: Form CPT30 is a document used to elect to stop contributing to the Canada Pension Plan (CPP) or to revoke a prior election.

Q: What is the Canada Pension Plan (CPP)?

A: The Canada Pension Plan (CPP) is a social insurance program that provides retirement, disability, and survivor benefits to eligible individuals.

Q: Who can use Form CPT30?

A: Individuals who are working in Canada and contributing to the CPP are eligible to use Form CPT30.

Q: Why would someone want to stop contributing to the CPP?

A: Some individuals may choose to stop contributing to the CPP if they have a similar pension plan in another country or if they have reached the maximum CPP pensionable earnings.

Q: Can a prior election to stop contributing to the CPP be revoked?

A: Yes, a prior election to stop contributing to the CPP can be revoked using Form CPT30.

Q: Is there a deadline for submitting Form CPT30?

A: Yes, Form CPT30 must be submitted to the CRA on or before the first day on which the individual wishes to stop contributing to the CPP.

Q: What happens if Form CPT30 is not submitted on time?

A: If Form CPT30 is not submitted on time, the individual will continue to contribute to the CPP until the form is received and processed by the CRA.

Q: Is there a fee to submit Form CPT30?

A: No, there is no fee to submit Form CPT30.

Q: Are there any tax implications for electing to stop contributing to the CPP?

A: There may be tax implications for electing to stop contributing to the CPP, and individuals are advised to consult with a tax professional for guidance.