This version of the form is not currently in use and is provided for reference only. Download this version of

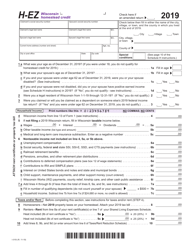

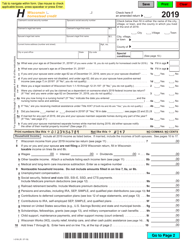

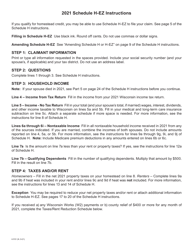

Instructions for Form I-015I Schedule H-EZ

for the current year.

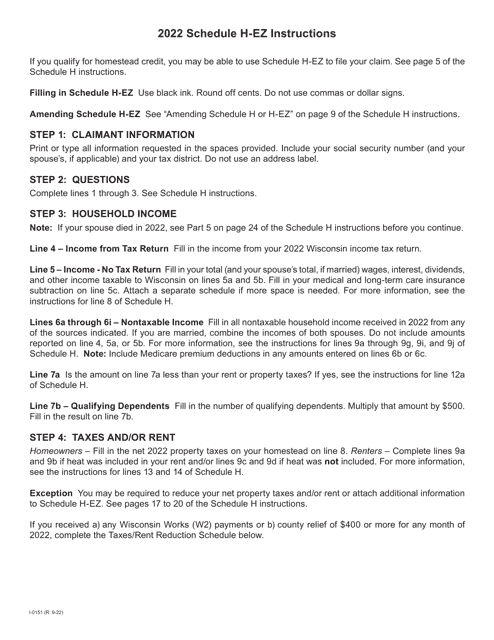

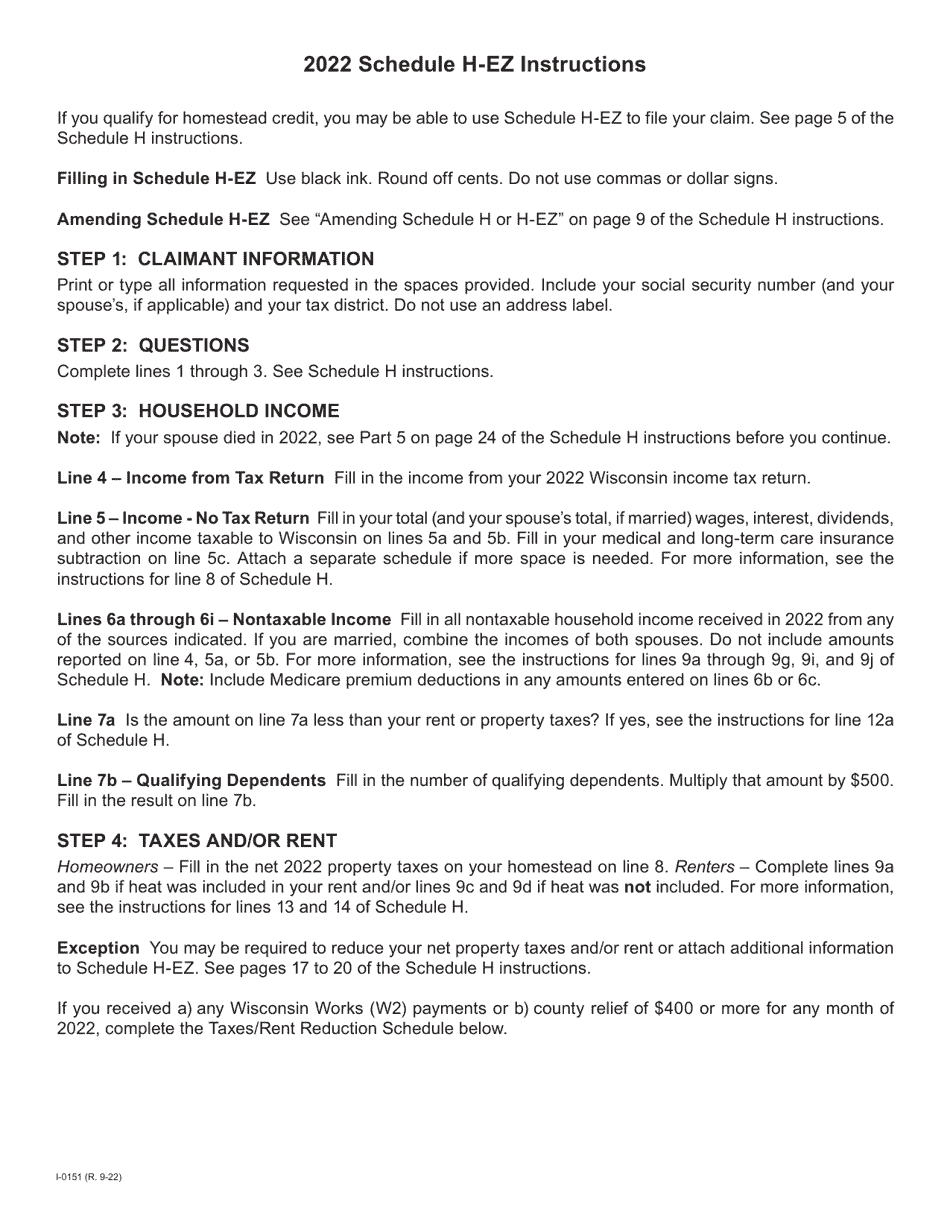

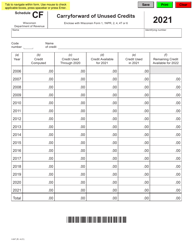

Instructions for Form I-015I Schedule H-EZ Homestead Credit Claim (Easy Form) - Wisconsin

This document contains official instructions for Form I-015I Schedule H-EZ, Homestead Credit Claim (Easy Form) - a form released and collected by the Wisconsin Department of Revenue.

FAQ

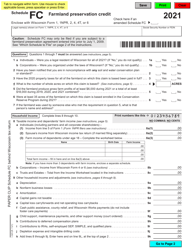

Q: What is Form I-015I Schedule H-EZ?

A: Form I-015I Schedule H-EZ is a simplified version of the Homestead Credit Claim form in Wisconsin.

Q: Who can use Form I-015I Schedule H-EZ?

A: Form I-015I Schedule H-EZ can be used by eligible Wisconsin residents who want to claim the Homestead Credit.

Q: What is the Homestead Credit?

A: The Homestead Credit is a tax benefit available to eligible Wisconsin residents to help offset property taxes or rent paid for their primary residence.

Q: How do I qualify for the Homestead Credit?

A: To qualify for the Homestead Credit, you must meet certain income and residency requirements set by the Wisconsin Department of Revenue.

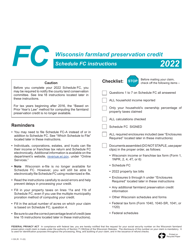

Q: Do I need to attach any other documents with Form I-015I Schedule H-EZ?

A: No, you do not need to attach any other documents with Form I-015I Schedule H-EZ. However, you should keep records of your income and rent or property tax payments for verification purposes.

Q: When is the deadline to file Form I-015I Schedule H-EZ?

A: The deadline to file Form I-015I Schedule H-EZ is typically April 15th of each year, which is the same as the deadline for filing your federal income tax return.

Q: Can I e-file Form I-015I Schedule H-EZ?

A: No, Form I-015I Schedule H-EZ cannot be e-filed. You must mail the completed form to the Wisconsin Department of Revenue.

Q: Is there a fee to file Form I-015I Schedule H-EZ?

A: No, there is no fee to file Form I-015I Schedule H-EZ.

Q: How long does it take to receive the Homestead Credit?

A: Processing times can vary, but it typically takes about 8-12 weeks to receive the Homestead Credit once your claim has been approved by the Wisconsin Department of Revenue.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.