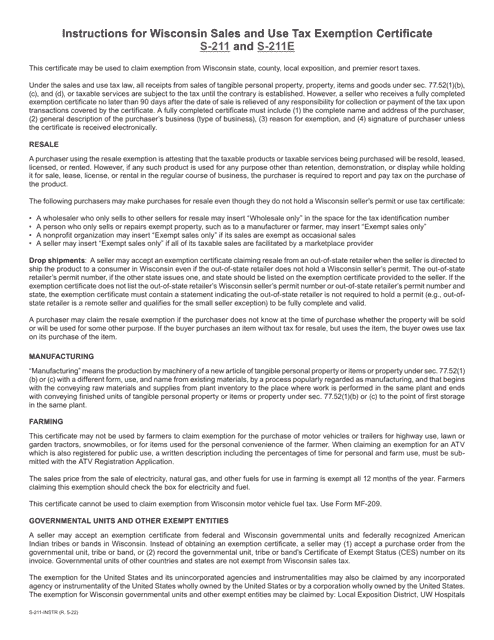

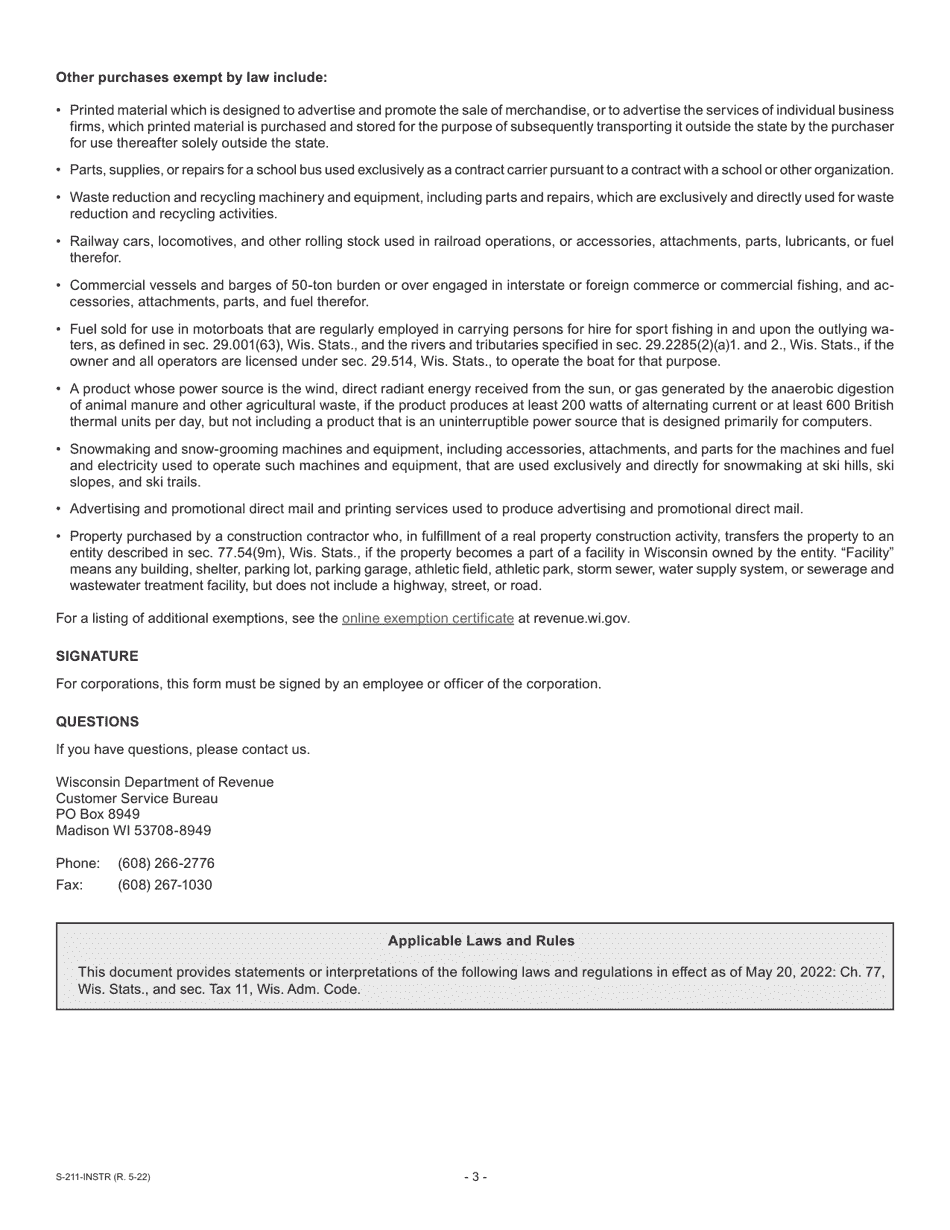

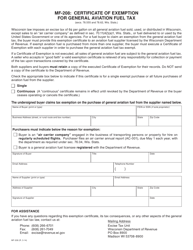

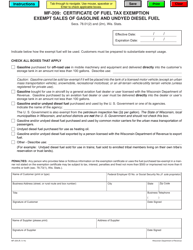

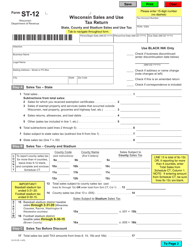

Instructions for Form S-211, S-211E Sales and Use Tax Exemption Certificate - Wisconsin

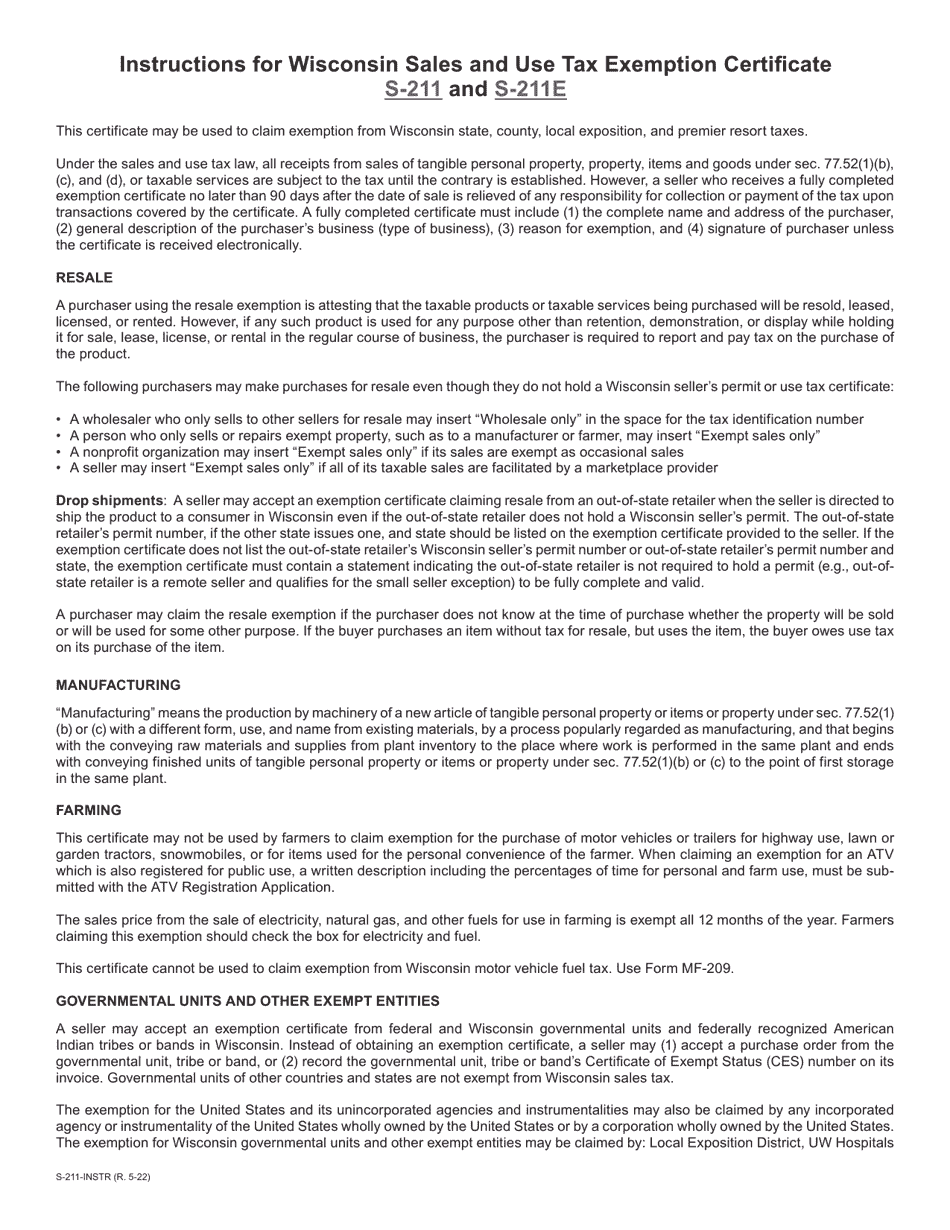

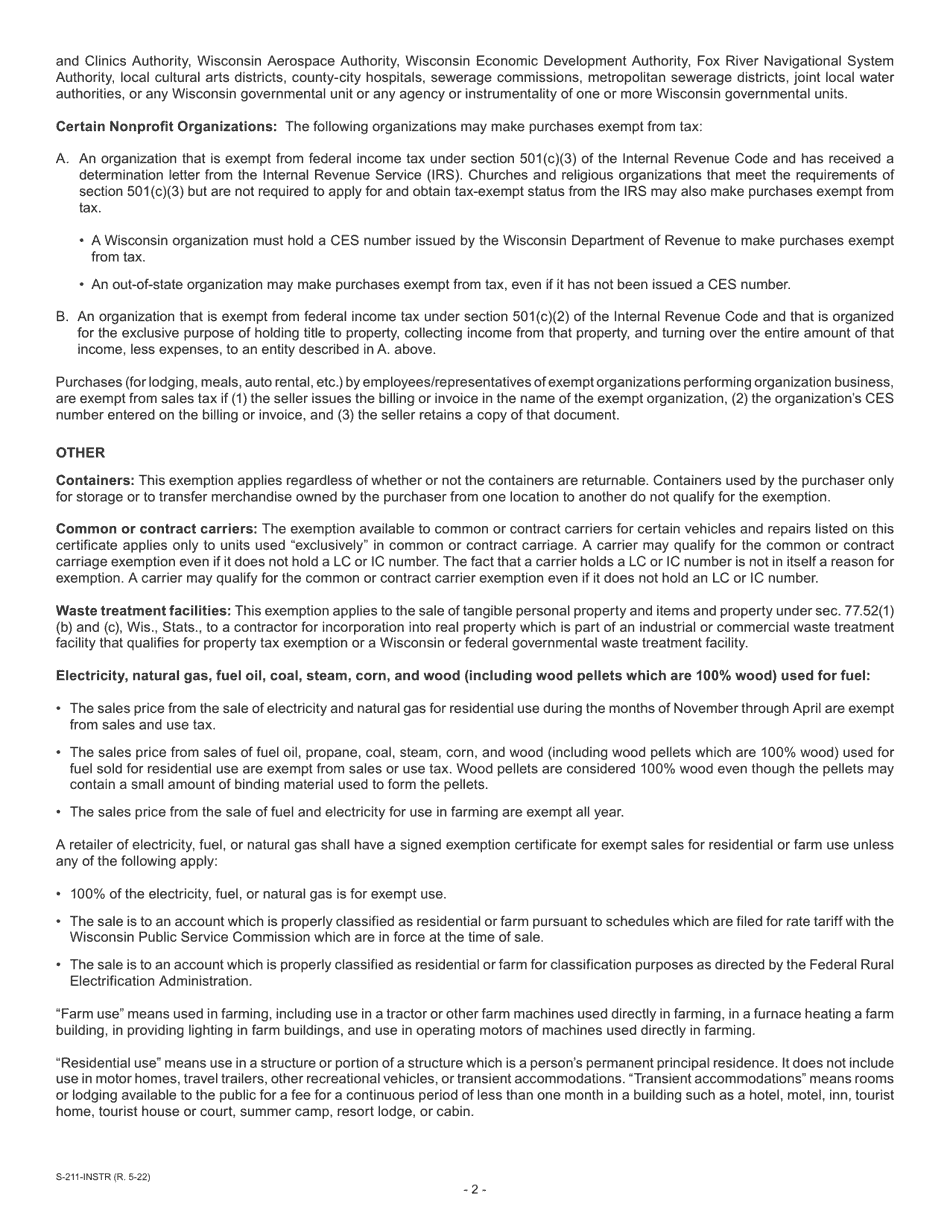

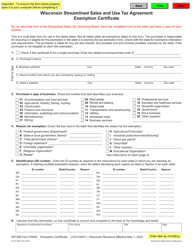

This document contains official instructions for Form S-211 , and Form S-211E . Both forms are released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form S-211 is available for download through this link.

FAQ

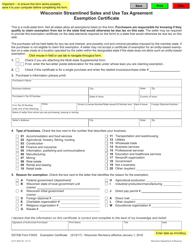

Q: What is Form S-211?

A: Form S-211 is the Sales and Use Tax Exemption Certificate for Wisconsin.

Q: What is the purpose of Form S-211?

A: The purpose of Form S-211 is to claim exemption from sales and use tax in Wisconsin.

Q: Who needs to fill out Form S-211?

A: Any person or entity who wishes to claim exemption from sales and use tax in Wisconsin needs to fill out Form S-211.

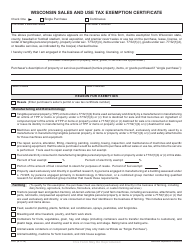

Q: What information is required on Form S-211?

A: Form S-211 requires information such as the purchaser's name, address, and Wisconsin tax number, as well as a description of the items being purchased and the reason for the exemption.

Q: How do I submit Form S-211?

A: Form S-211 should be completed and submitted to the seller when claiming exemption from sales and use tax in Wisconsin.

Q: How long is Form S-211 valid for?

A: Form S-211 is valid for a single purchase transaction and must be filled out for each individual transaction.

Q: Are there any fees associated with Form S-211?

A: No, there are no fees associated with Form S-211.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.