This version of the form is not currently in use and is provided for reference only. Download this version of

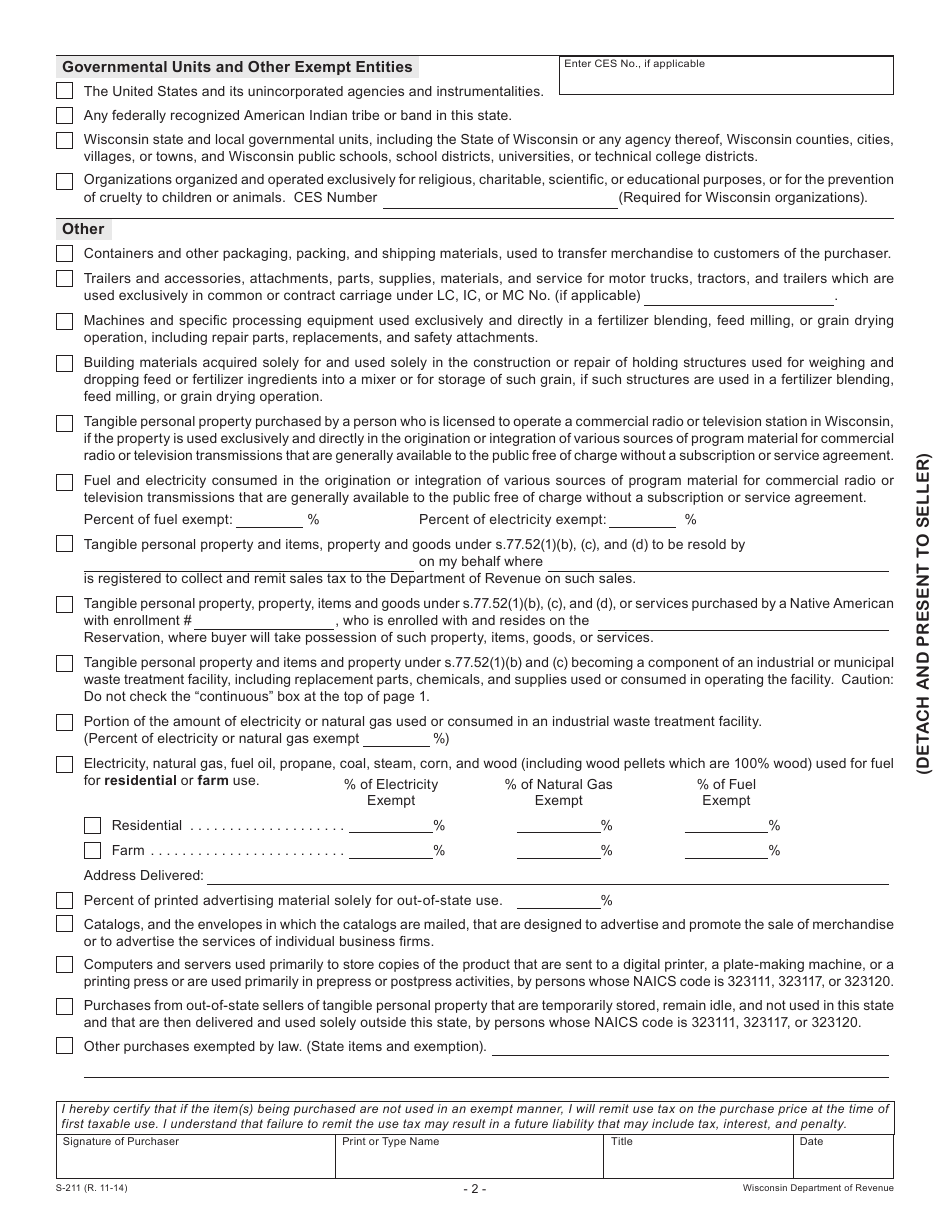

Form S-211

for the current year.

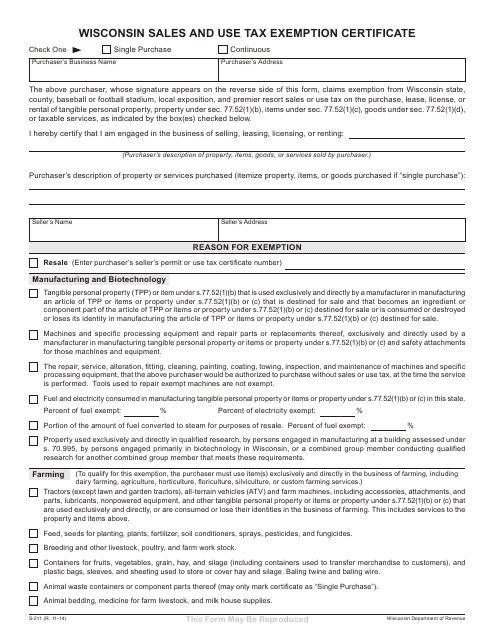

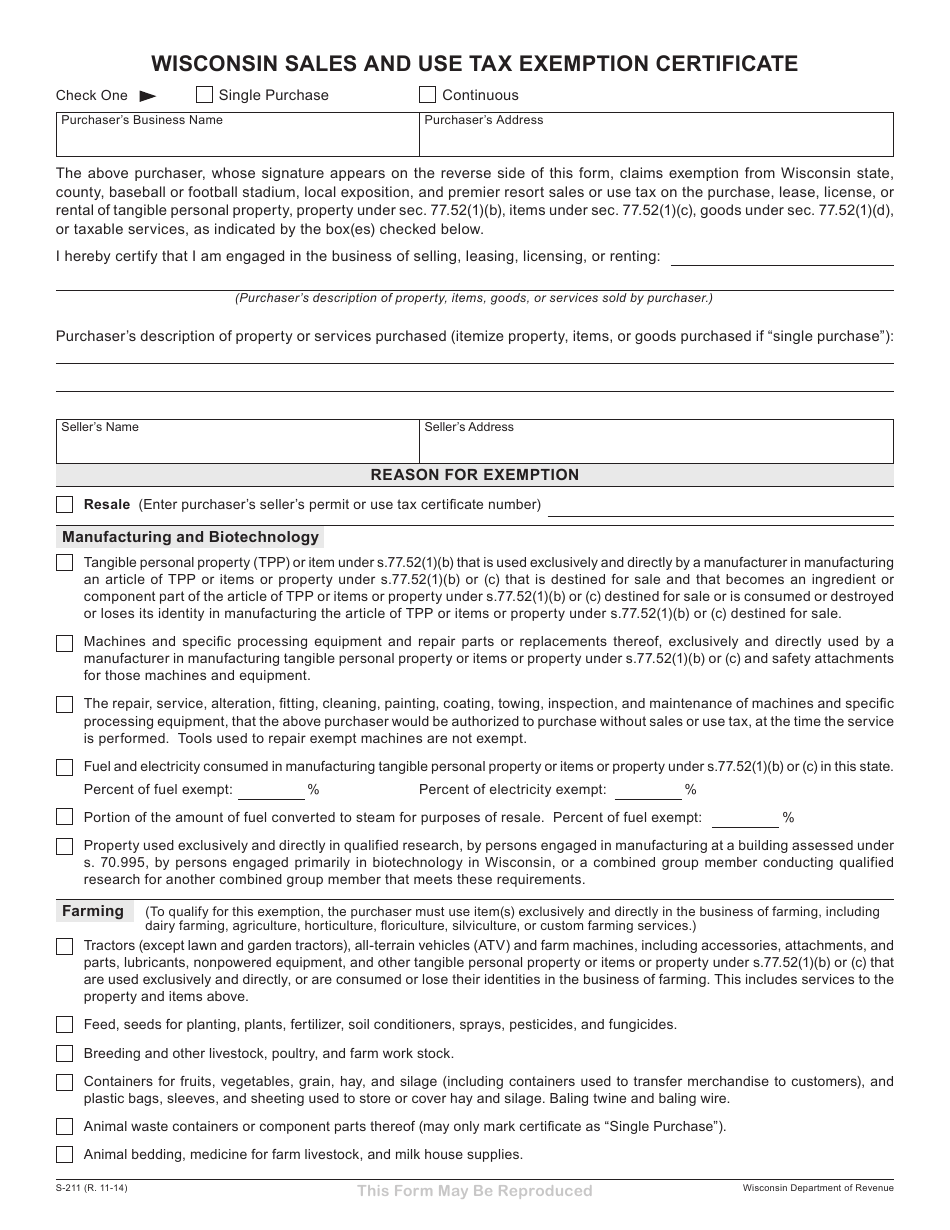

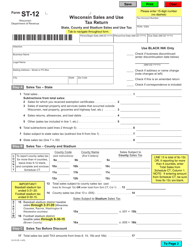

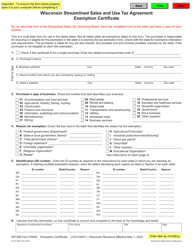

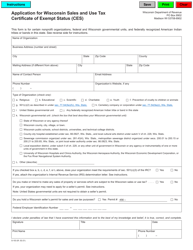

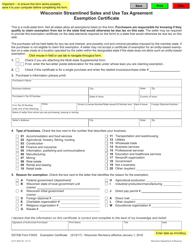

Form S-211 Wisconsin Sales and Use Tax Exemption Certificate - Wisconsin

What Is Form S-211?

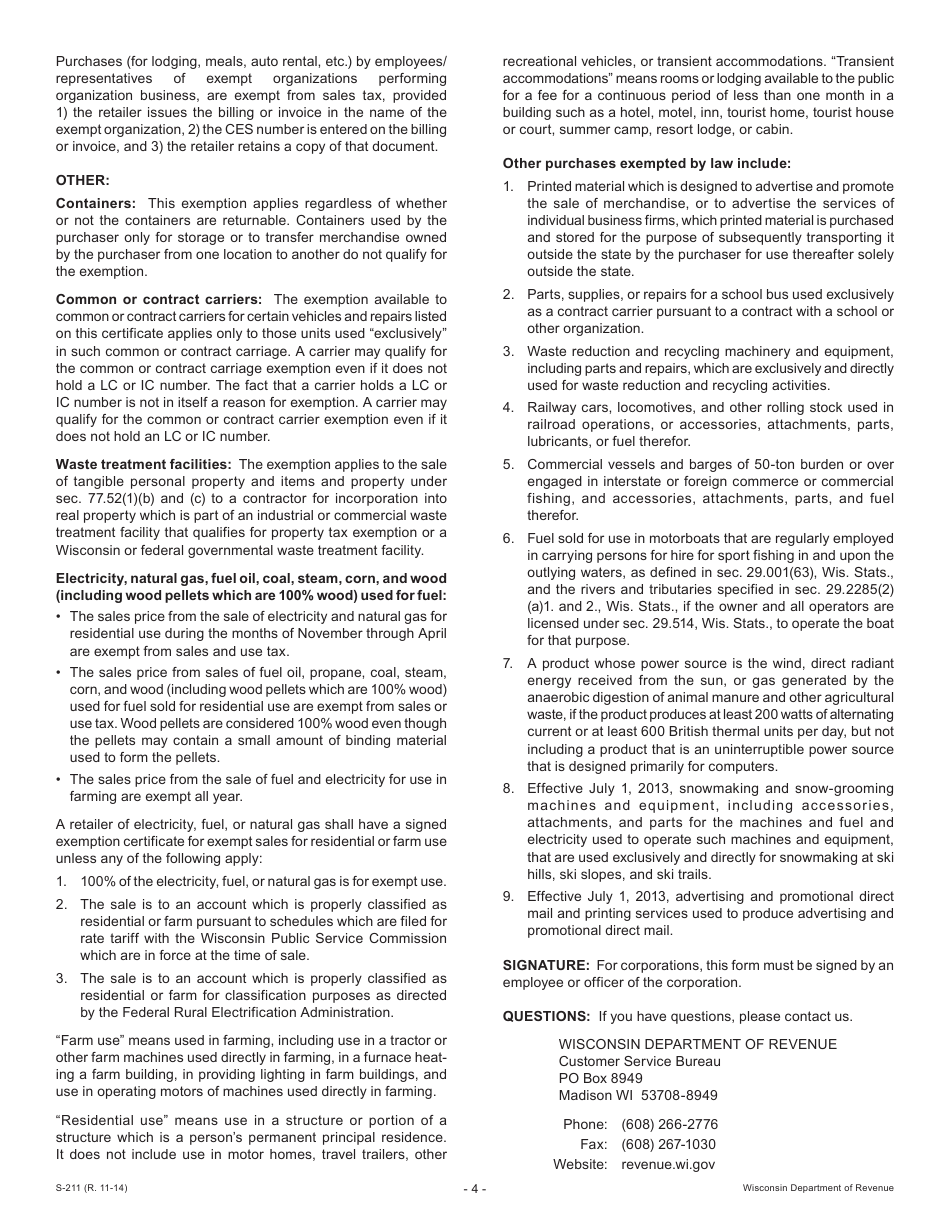

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-211?

A: Form S-211 is the Wisconsin Sales and Use Tax Exemption Certificate.

Q: What is the purpose of Form S-211?

A: The purpose of Form S-211 is to claim exemption from sales and use tax in Wisconsin.

Q: Who can use Form S-211?

A: Businesses and organizations that qualify for a sales and use tax exemption in Wisconsin can use Form S-211.

Q: What information is required on Form S-211?

A: Form S-211 requires information such as the taxpayer's name, address, sales tax number, and a description of the purchased items.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S-211 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.