This version of the form is not currently in use and is provided for reference only. Download this version of

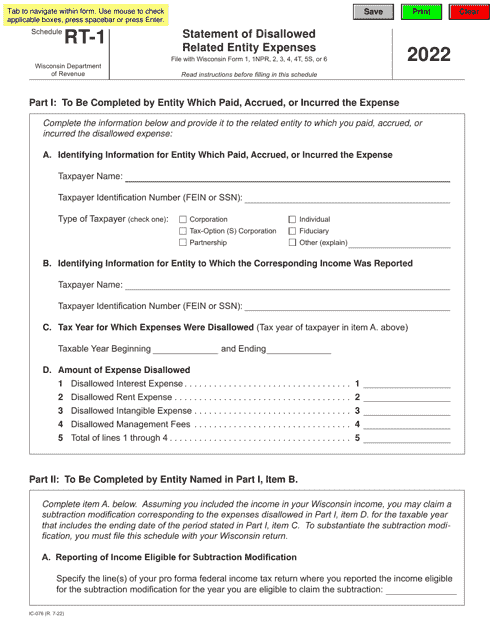

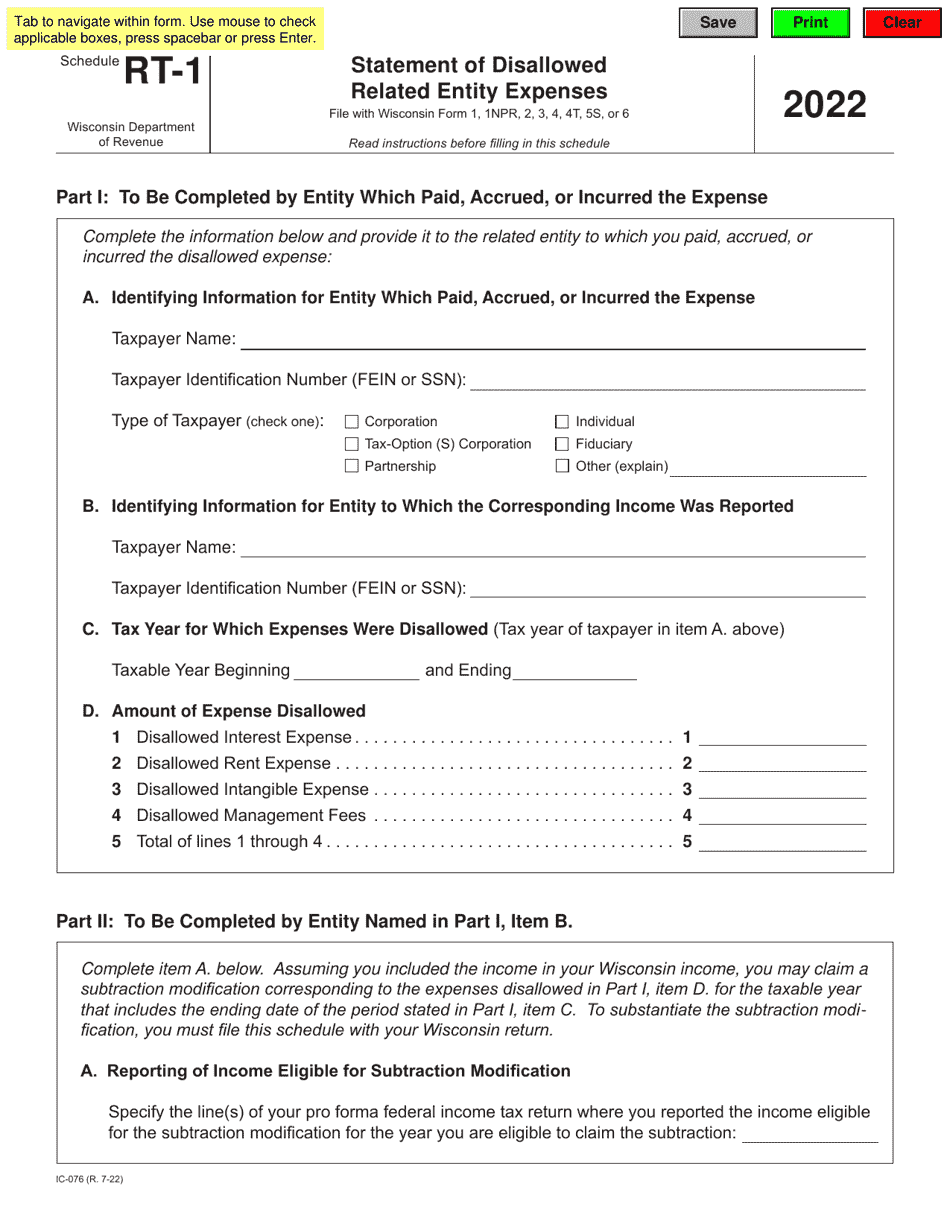

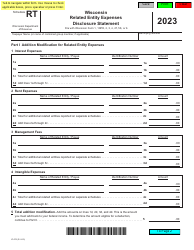

Form IC-076 Schedule RT-1

for the current year.

Form IC-076 Schedule RT-1 Statement of Disallowed Related Entity Expenses - Wisconsin

What Is Form IC-076 Schedule RT-1?

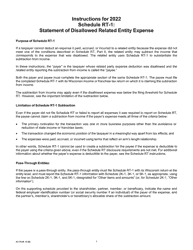

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-076 Schedule RT-1?

A: Form IC-076 Schedule RT-1 is a statement used in Wisconsin that reports disallowed related entity expenses.

Q: What are disallowed related entity expenses?

A: Disallowed related entity expenses are expenses incurred by a related entity that cannot be deducted.

Q: Who needs to file Form IC-076 Schedule RT-1?

A: Taxpayers in Wisconsin who have disallowed related entity expenses need to file Form IC-076 Schedule RT-1.

Q: How do I fill out Form IC-076 Schedule RT-1?

A: You need to provide information about the disallowed related entity expenses incurred.

Q: Is there a deadline for filing Form IC-076 Schedule RT-1?

A: Yes, the deadline for filing Form IC-076 Schedule RT-1 is usually the same as the deadline for filing your Wisconsin income tax return.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-076 Schedule RT-1 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.