This version of the form is not currently in use and is provided for reference only. Download this version of

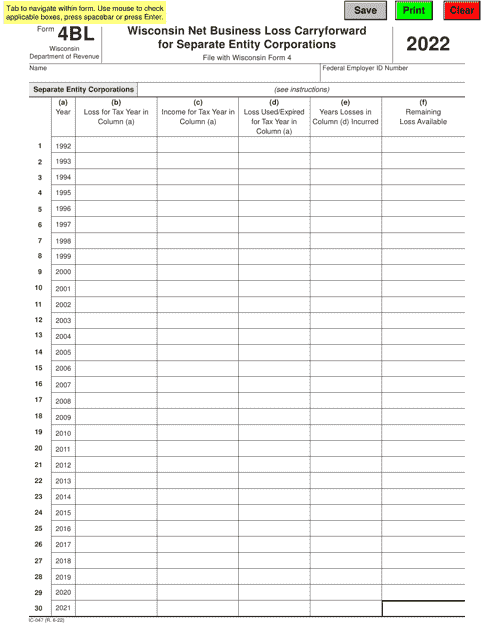

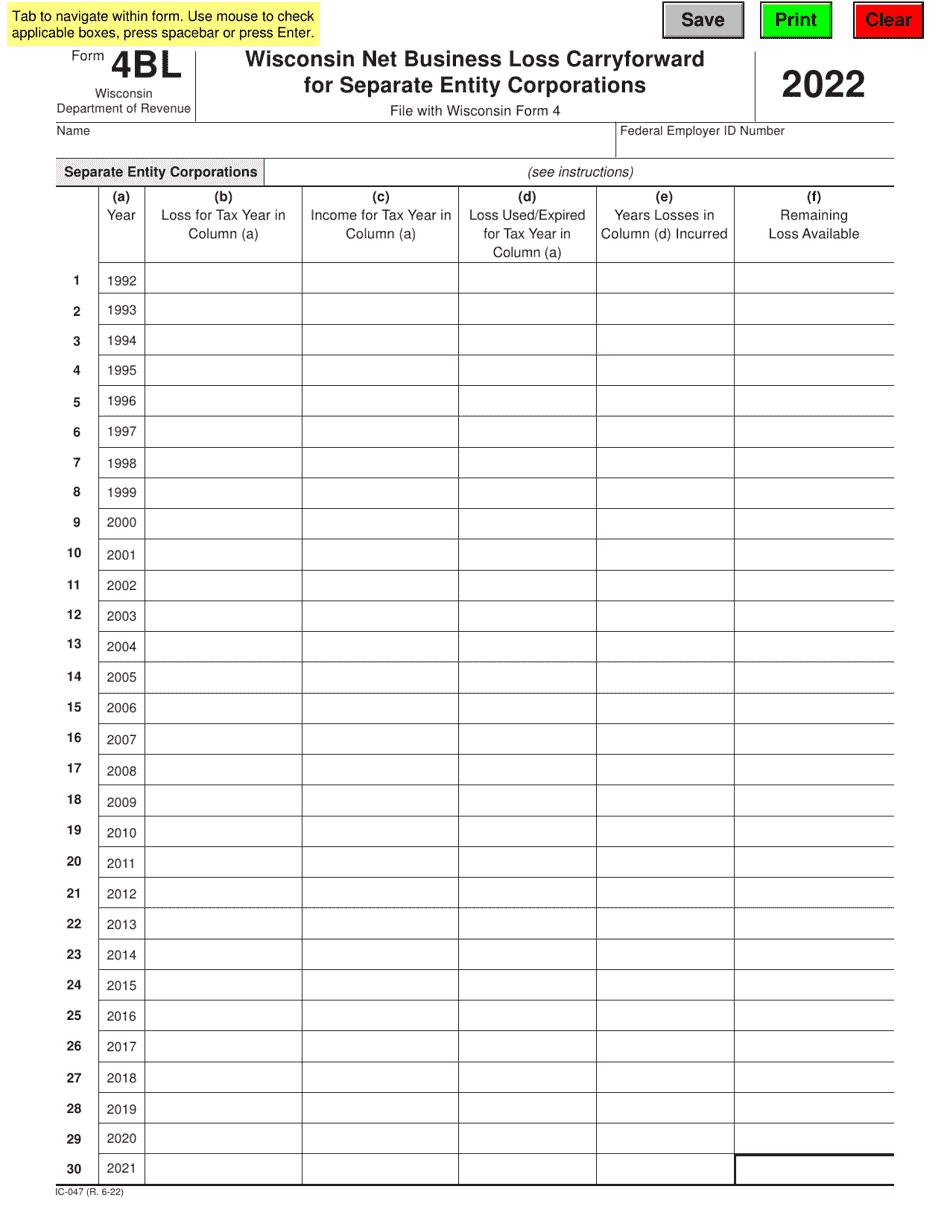

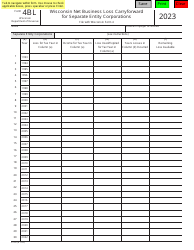

Form 4BL (IC-047)

for the current year.

Form 4BL (IC-047) Wisconsin Net Business Loss Carryforward for Separate Entity Corporations - Wisconsin

What Is Form 4BL (IC-047)?

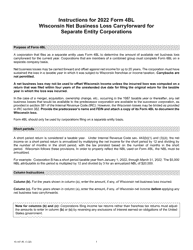

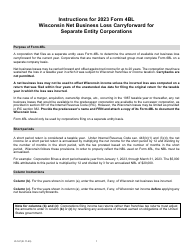

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 4BL (IC-047)?

A: Form 4BL (IC-047) is a form used in Wisconsin to report net business loss carryforward for separate entity corporations.

Q: What is net business loss carryforward?

A: Net business loss carryforward refers to the unused business losses of a corporation that can be utilized to reduce taxable income in future years.

Q: Who needs to file Form 4BL (IC-047)?

A: Separate entity corporations in Wisconsin that have net business loss carryforwards need to file Form 4BL (IC-047).

Q: What information do I need to provide on Form 4BL (IC-047)?

A: On Form 4BL (IC-047), you need to provide details about the corporation, including its name, Federal Employer Identification Number (FEIN), and the amount of net business loss carryforward.

Q: Is there a deadline to file Form 4BL (IC-047)?

A: Yes, Form 4BL (IC-047) must be filed by the due date of the corporate tax return for the taxable year in which the net business loss carryforward is being claimed.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4BL (IC-047) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.