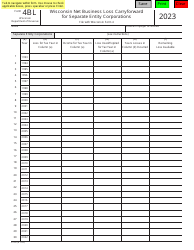

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 4BL, IC-047

for the current year.

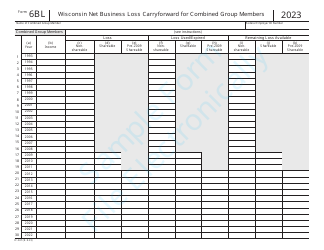

Instructions for Form 4BL, IC-047 Wisconsin Net Business Loss Carryforward for Separate Entity Corporations - Wisconsin

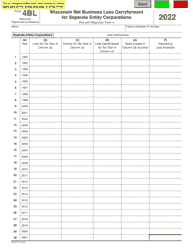

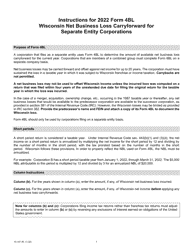

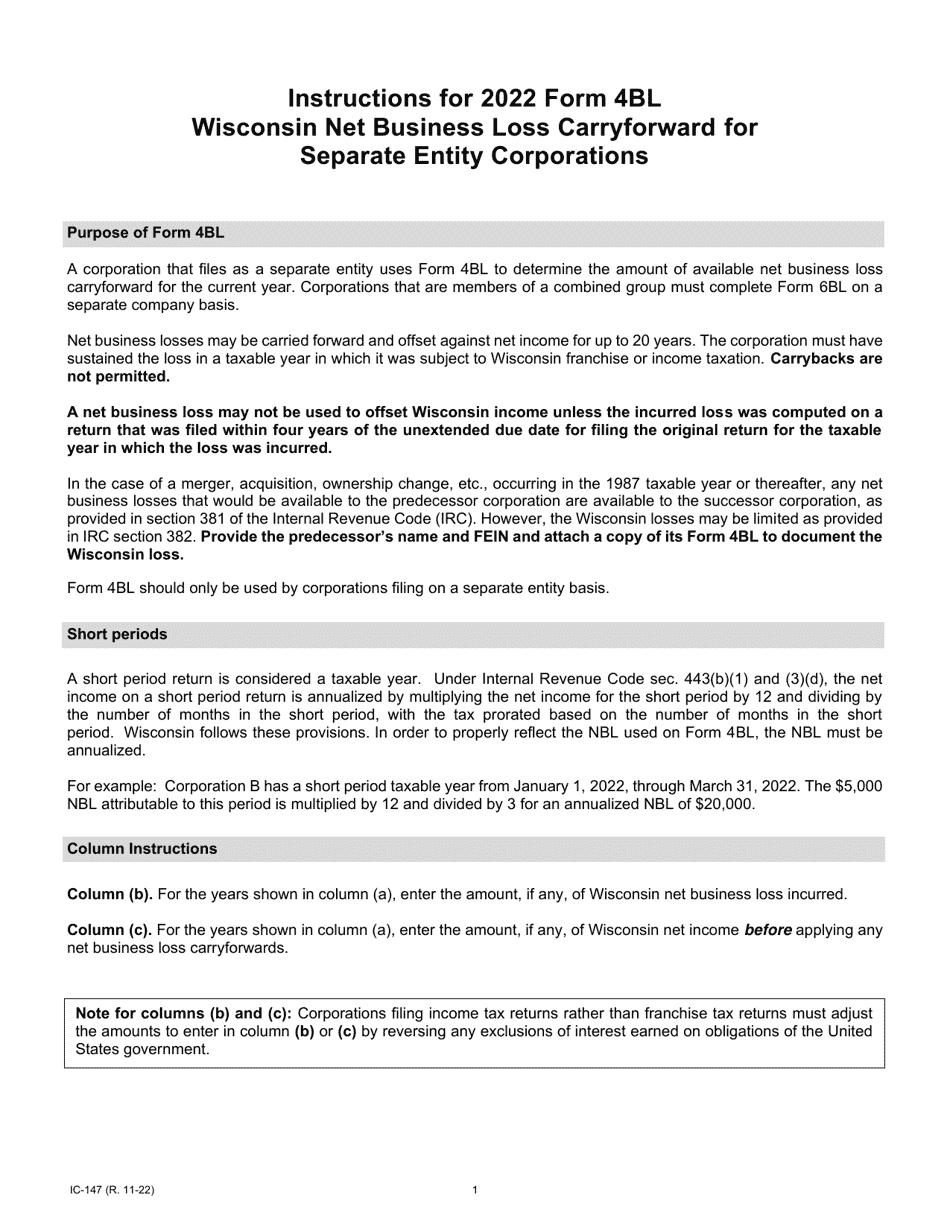

This document contains official instructions for Form 4BL , and Form IC-047 . Both forms are released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form 4BL (IC-047) is available for download through this link.

FAQ

Q: What is Form 4BL?

A: Form 4BL is a tax form used in Wisconsin for net business loss carryforward for separate entity corporations.

Q: Who needs to file Form 4BL?

A: Separate entity corporations in Wisconsin who have a net business loss to carryforward need to file Form 4BL.

Q: What is a net business loss carryforward?

A: A net business loss carryforward is when a business has more deductions and expenses than income in a particular year, and the remaining loss can be carried forward to future years to offset future income and reduce taxes.

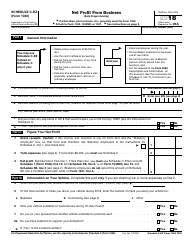

Q: What information is required on Form 4BL?

A: Form 4BL requires you to provide details of the net business loss or losses being carried forward, including the tax year of the loss, the amount of the loss, and any previously claimed losses.

Q: When is the deadline for filing Form 4BL?

A: The deadline for filing Form 4BL is the same as the deadline for filing the corporation's income tax return in Wisconsin, which is usually the 15th day of the 3rd month after the close of the tax year.

Q: Are there any penalties for not filing Form 4BL?

A: Yes, there are penalties for not filing Form 4BL or filing it late. It is important to comply with the filing deadline to avoid these penalties.

Q: Do I need to attach any supporting documents with Form 4BL?

A: You may need to attach copies of your federal income tax returns and schedules that are relevant to the net business loss being carried forward.

Q: Can I get help with filling out Form 4BL?

A: Yes, if you need assistance with filling out Form 4BL, you can contact the Wisconsin Department of Revenue or consult a tax professional.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.