Instructions for Form WQOF Wisconsin Qualified Opportunity Fund Certificate - Wisconsin

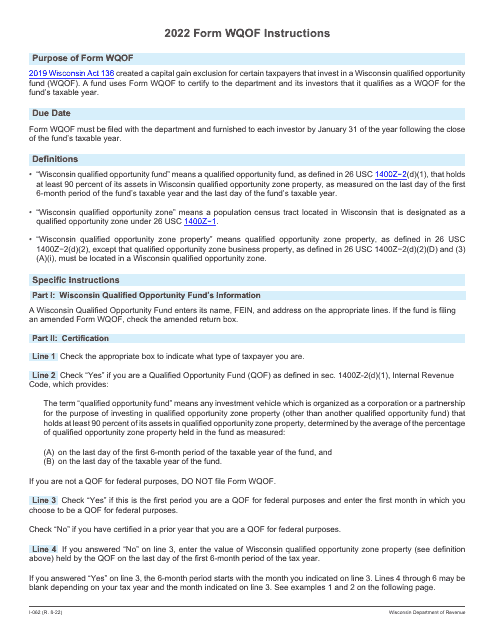

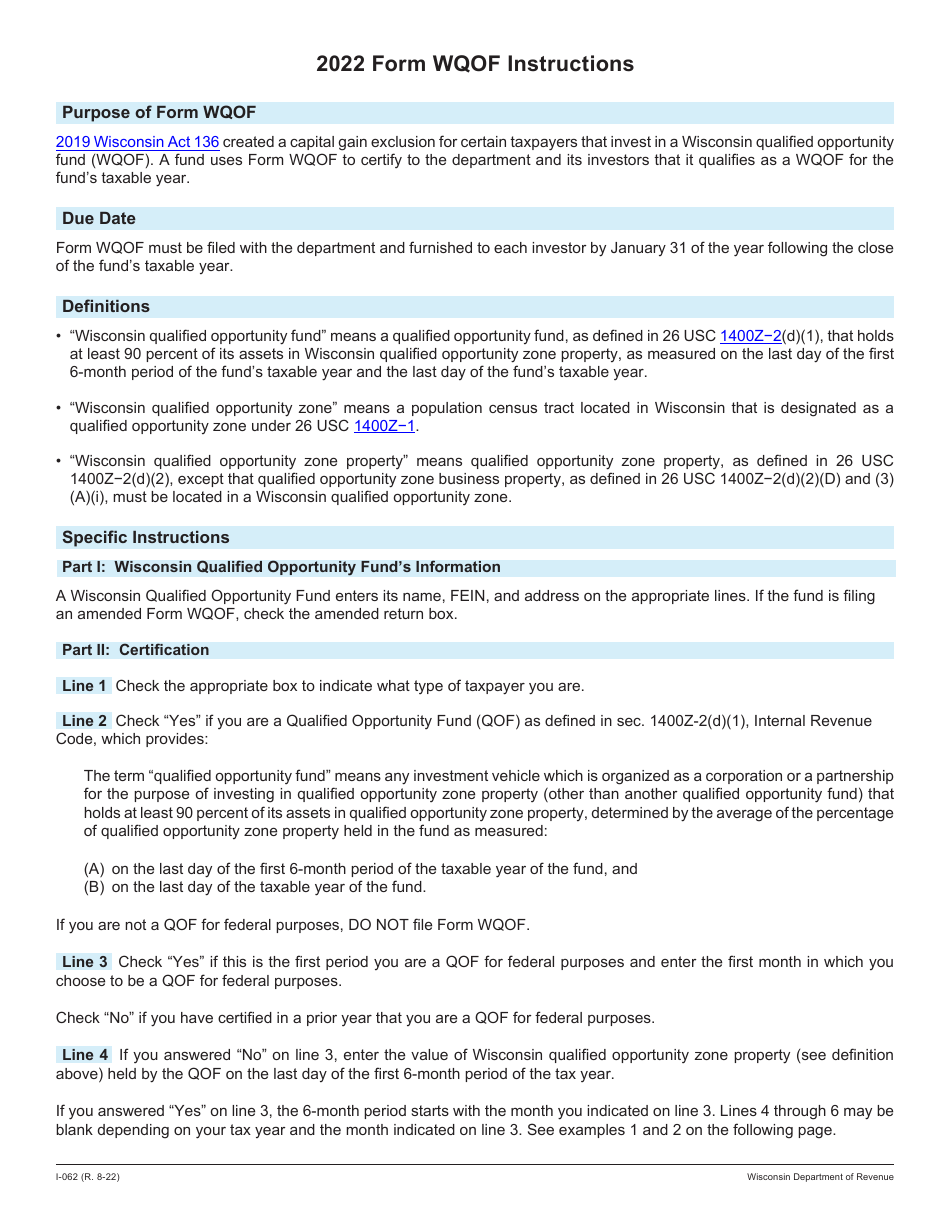

This document contains official instructions for Form WQOF , Wisconsin Qualified Opportunity Fund Certificate - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form WQOF?

A: Form WQOF is the Wisconsin Qualified Opportunity Fund Certificate.

Q: What is a Qualified Opportunity Fund?

A: A Qualified Opportunity Fund is an investment vehicle that invests in qualified opportunity zones.

Q: What is a qualified opportunity zone?

A: A qualified opportunity zone is an economically distressed community designated by the government.

Q: What is the purpose of Form WQOF?

A: The purpose of Form WQOF is to certify that a fund meets the requirements to be a Wisconsin Qualified Opportunity Fund.

Q: Who needs to file Form WQOF?

A: Any fund that wants to be certified as a Wisconsin Qualified Opportunity Fund needs to file Form WQOF.

Q: What information is required on Form WQOF?

A: Form WQOF requires information about the fund, including its name, address, and federal tax identification number.

Q: Is there a filing fee for Form WQOF?

A: Yes, there is a filing fee of $100 for Form WQOF.

Q: Are there any deadlines for filing Form WQOF?

A: Yes, Form WQOF needs to be filed within 90 days of the fund's formation.

Q: Can Form WQOF be filed electronically?

A: No, Form WQOF cannot be filed electronically and must be submitted by mail.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.