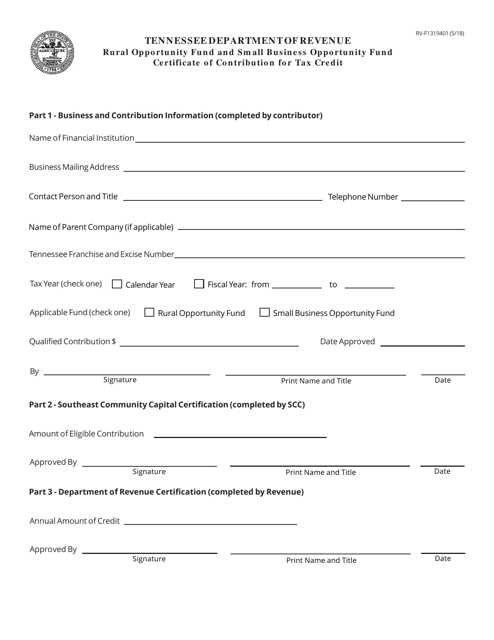

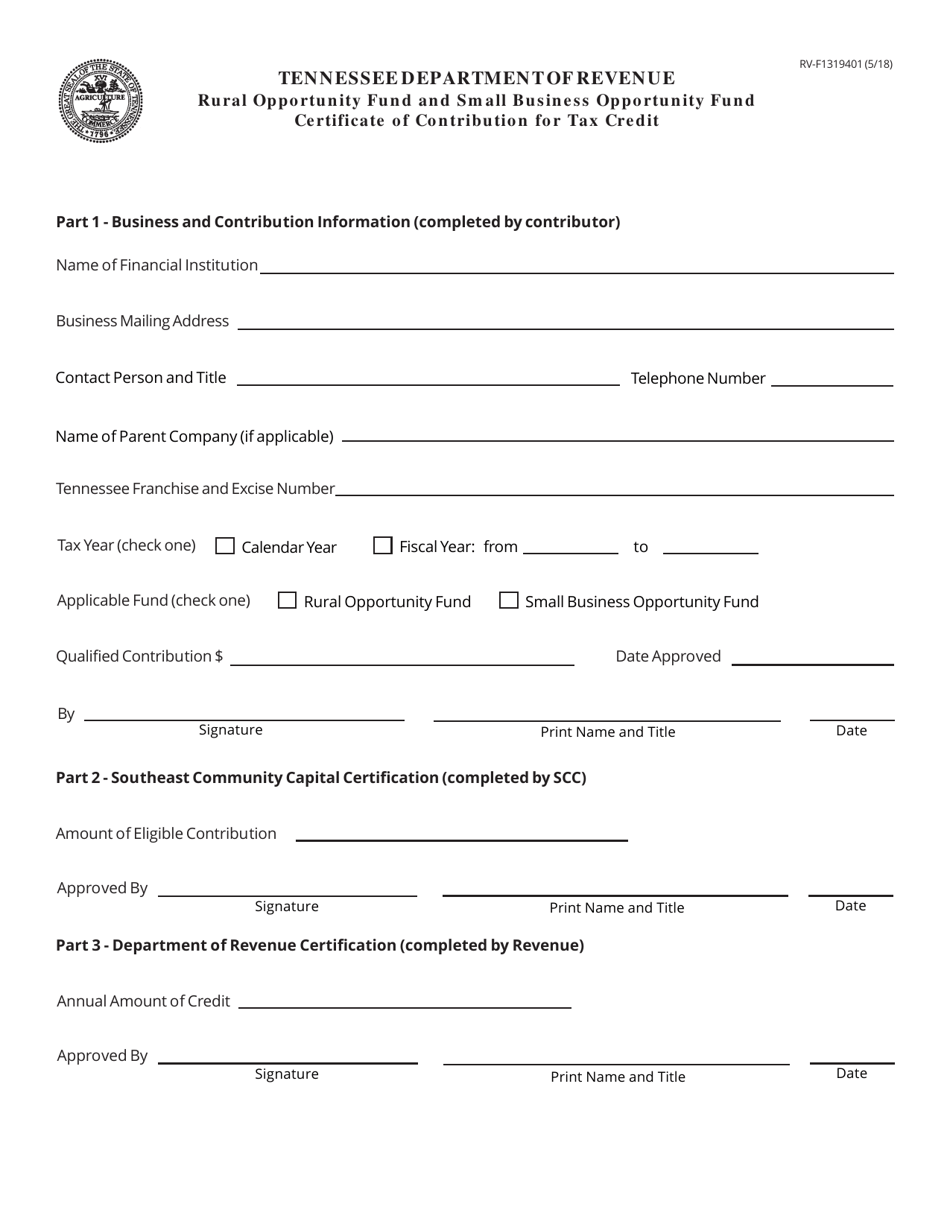

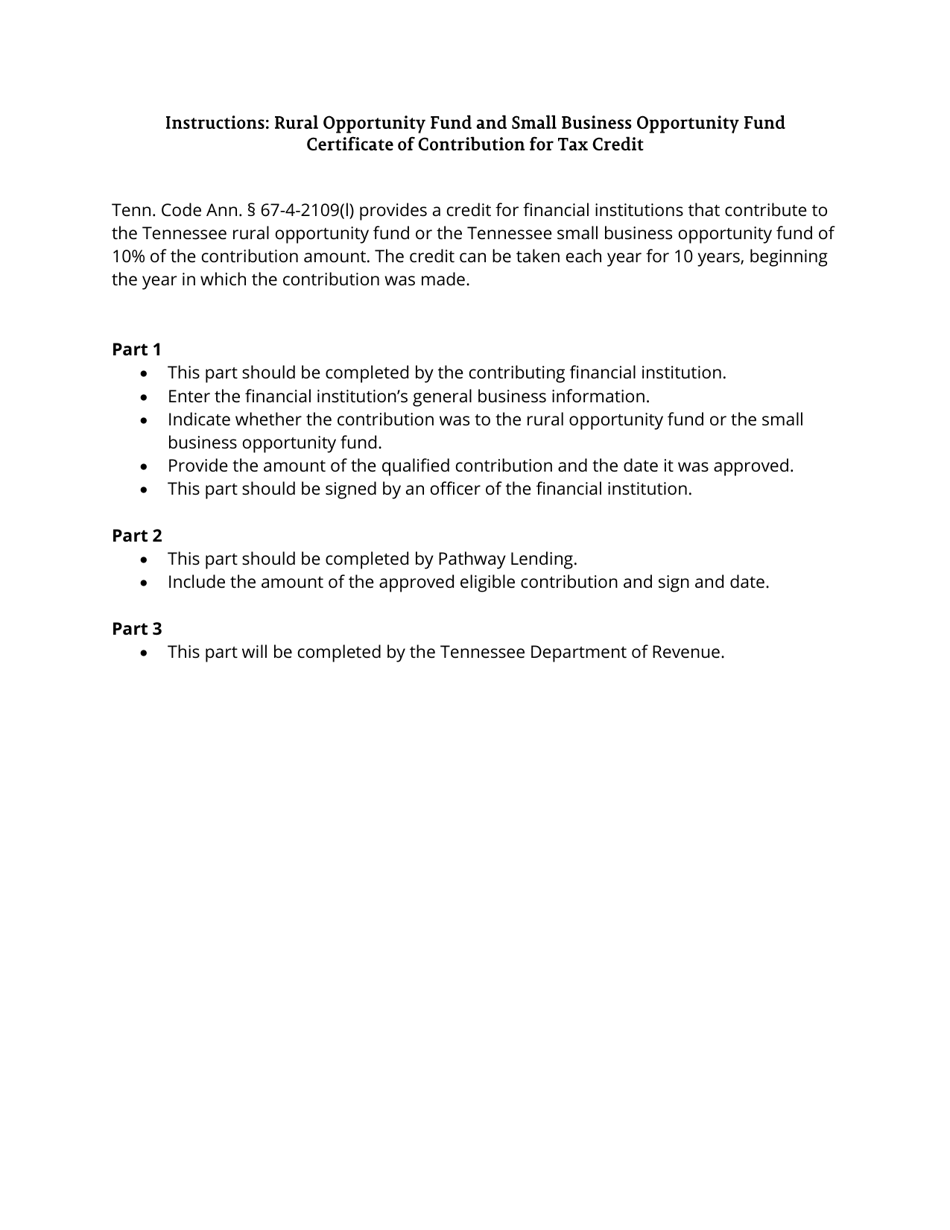

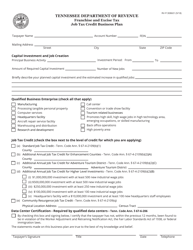

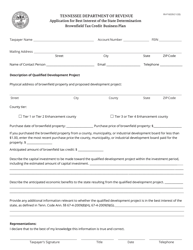

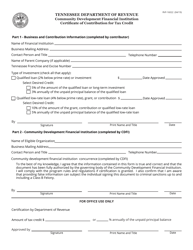

Form RV-F1319401 Rural Opportunity Fund and Small Business Opportunity Fund Certificate of Contribution for Tax Credit - Tennessee

What Is Form RV-F1319401?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RV-F1319401 form?

A: The RV-F1319401 form is the Certificate of Contribution for Tax Credit specifically for the Rural Opportunity Fund and Small Business Opportunity Fund in Tennessee.

Q: What is the purpose of the Certificate of Contribution for Tax Credit?

A: The purpose of the Certificate of Contribution for Tax Credit is to claim tax credits for contributions made to the Rural Opportunity Fund and Small Business Opportunity Fund in Tennessee.

Q: What are the Rural Opportunity Fund and Small Business Opportunity Fund?

A: The Rural Opportunity Fund and Small Business Opportunity Fund are initiatives in Tennessee aimed at promoting economic development in rural areas and supporting small businesses.

Q: What is the tax credit available for contributions to the Rural Opportunity Fund and Small Business Opportunity Fund?

A: The tax credit available for contributions to the Rural Opportunity Fund and Small Business Opportunity Fund is specified by the state of Tennessee.

Q: How do I obtain the RV-F1319401 form?

A: You can obtain the RV-F1319401 form from the appropriate government agency or department responsible for tax credits in Tennessee.

Q: Are there any eligibility criteria to claim the tax credits?

A: Yes, there may be eligibility criteria specified by the state of Tennessee to claim the tax credits. It is recommended to refer to the instructions accompanying the RV-F1319401 form or consult with the relevant government agency.

Q: Can I claim tax credits for contributions made to other funds?

A: No, the RV-F1319401 form is specifically for claiming tax credits for contributions made to the Rural Opportunity Fund and Small Business Opportunity Fund in Tennessee.

Q: Is the tax credit refundable?

A: The refundability of the tax credit may be determined by the state of Tennessee. It is advisable to refer to the instructions or consult with the appropriate government agency for detailed information.

Q: When should I submit the RV-F1319401 form?

A: The submission deadline for the RV-F1319401 form may be specified by the state of Tennessee. It is recommended to refer to the instructions or consult with the relevant government agency for the deadline.

Q: Can I claim tax credits for contributions made in previous tax years?

A: The availability of tax credits for contributions made in previous tax years may vary. It is advisable to consult with the appropriate government agency or refer to the instructions for the RV-F1319401 form to determine eligibility.

Q: What supporting documents do I need to submit with the RV-F1319401 form?

A: The supporting documents required to be submitted with the RV-F1319401 form may vary. It is advisable to refer to the instructions or consult with the relevant government agency for the specific requirements.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1319401 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.