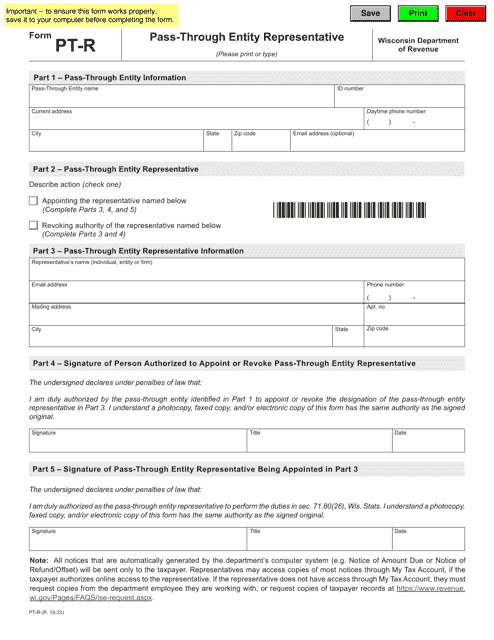

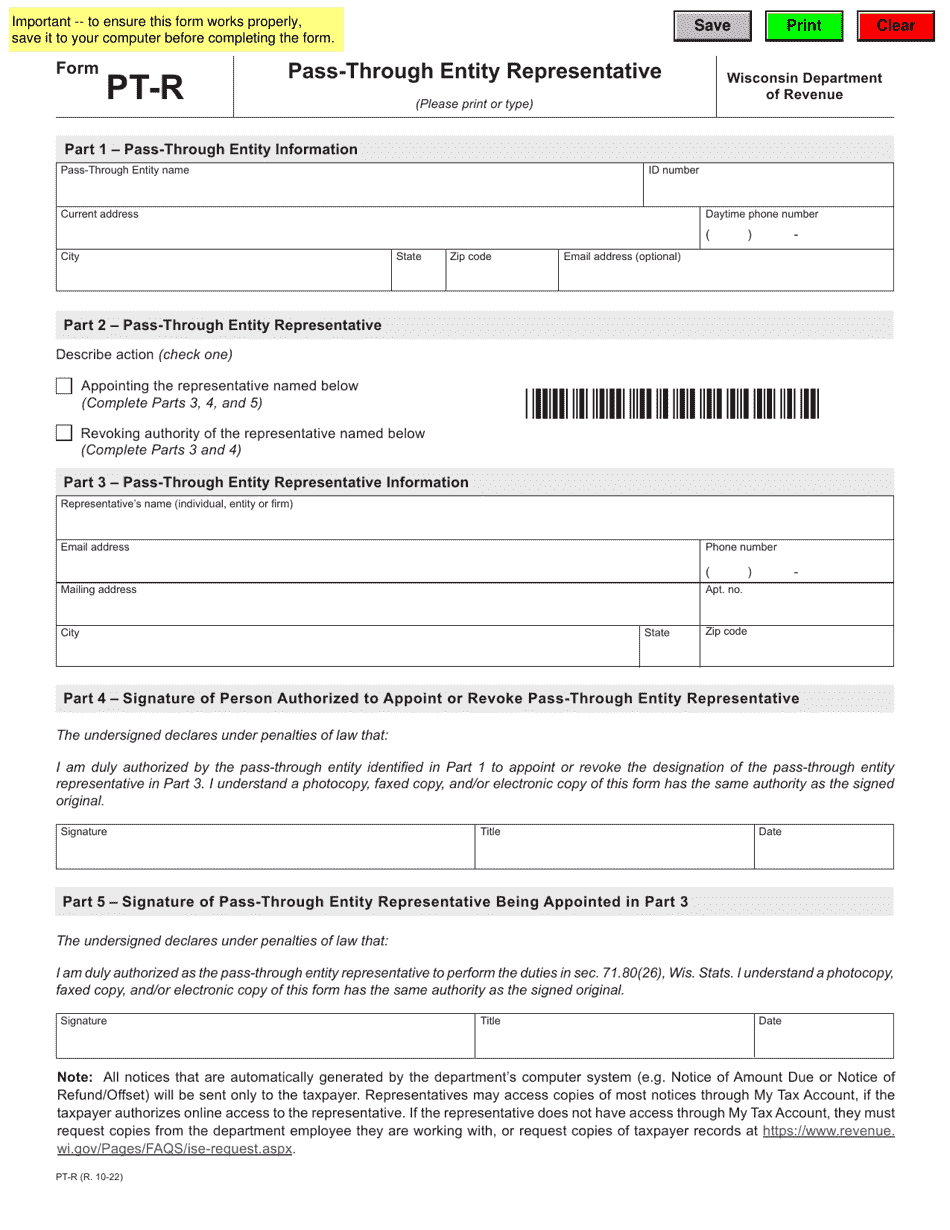

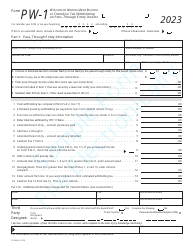

Form PT-R Pass-Through Entity Representative - Wisconsin

What Is Form PT-R?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PT-R?

A: Form PT-R is the Pass-Through Entity Representative form in Wisconsin.

Q: What is a Pass-Through Entity Representative?

A: A Pass-Through Entity Representative is someone designated by a pass-through entity to interact with the Wisconsin Department of Revenue.

Q: Why is Form PT-R required?

A: Form PT-R is required to designate a representative for a pass-through entity to handle tax matters with the Wisconsin Department of Revenue.

Q: Who can be a Pass-Through Entity Representative?

A: A Pass-Through Entity Representative can be an individual who is an officer, manager, member, partner, shareholder, or other similar position in the pass-through entity.

Q: Is there a deadline for filing Form PT-R?

A: Yes, Form PT-R must be filed with the Wisconsin Department of Revenue by the due date of the pass-through entity's Wisconsin income or franchise tax return.

Q: What happens if Form PT-R is not filed?

A: If Form PT-R is not filed, the pass-through entity may face penalties and the Wisconsin Department of Revenue may contact the entity directly regarding tax matters.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-R by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.