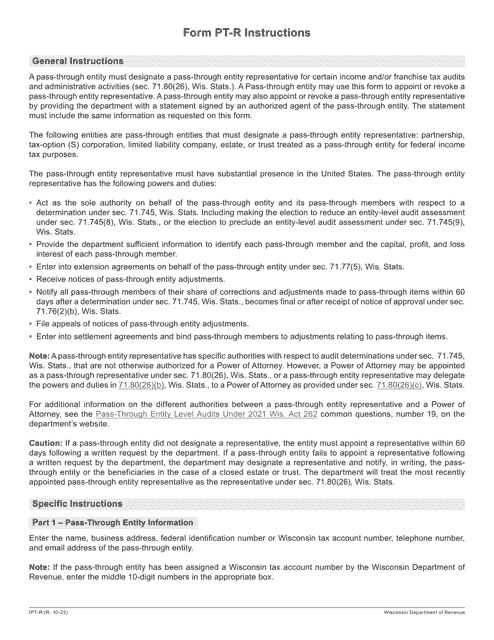

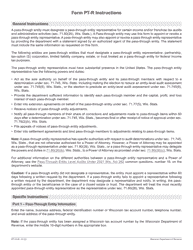

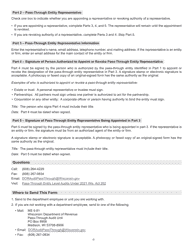

Instructions for Form PT-R Pass-Through Entity Representative - Wisconsin

This document contains official instructions for Form PT-R , Pass-Through Entity Representative - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form PT-R is available for download through this link.

FAQ

Q: What is Form PT-R?

A: Form PT-R is a form used in Wisconsin for the appointment of a pass-through entity (PTE) representative.

Q: What is a pass-through entity (PTE)?

A: A pass-through entity (PTE) is a legal entity that does not pay taxes itself, but passes through its income, losses, deductions, and credits to its owners, who then report them on their individual tax returns.

Q: Who should use Form PT-R?

A: Form PT-R should be used by a pass-through entity (PTE) to appoint a representative who will have the authority to receive and provide information on behalf of the entity in matters related to Wisconsin taxes.

Q: Why is it necessary to appoint a pass-through entity (PTE) representative?

A: Appointing a representative ensures that the pass-through entity (PTE) can comply with Wisconsin tax laws and receive important communications related to its tax matters.

Q: When should Form PT-R be filed?

A: Form PT-R should be filed within 90 days of the creation or acquisition of a pass-through entity (PTE), or within 90 days of a change in the representative.

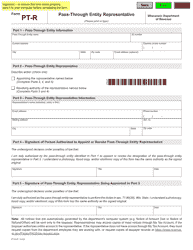

Q: What information is required on Form PT-R?

A: Form PT-R requires information such as the name and address of the pass-through entity (PTE), the name and contact information of the representative, and the effective date of the appointment.

Q: Is there a fee for filing Form PT-R?

A: No, there is no fee for filing Form PT-R.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.