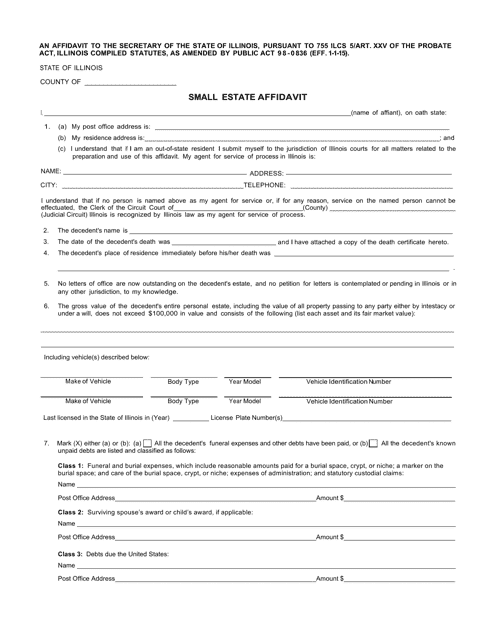

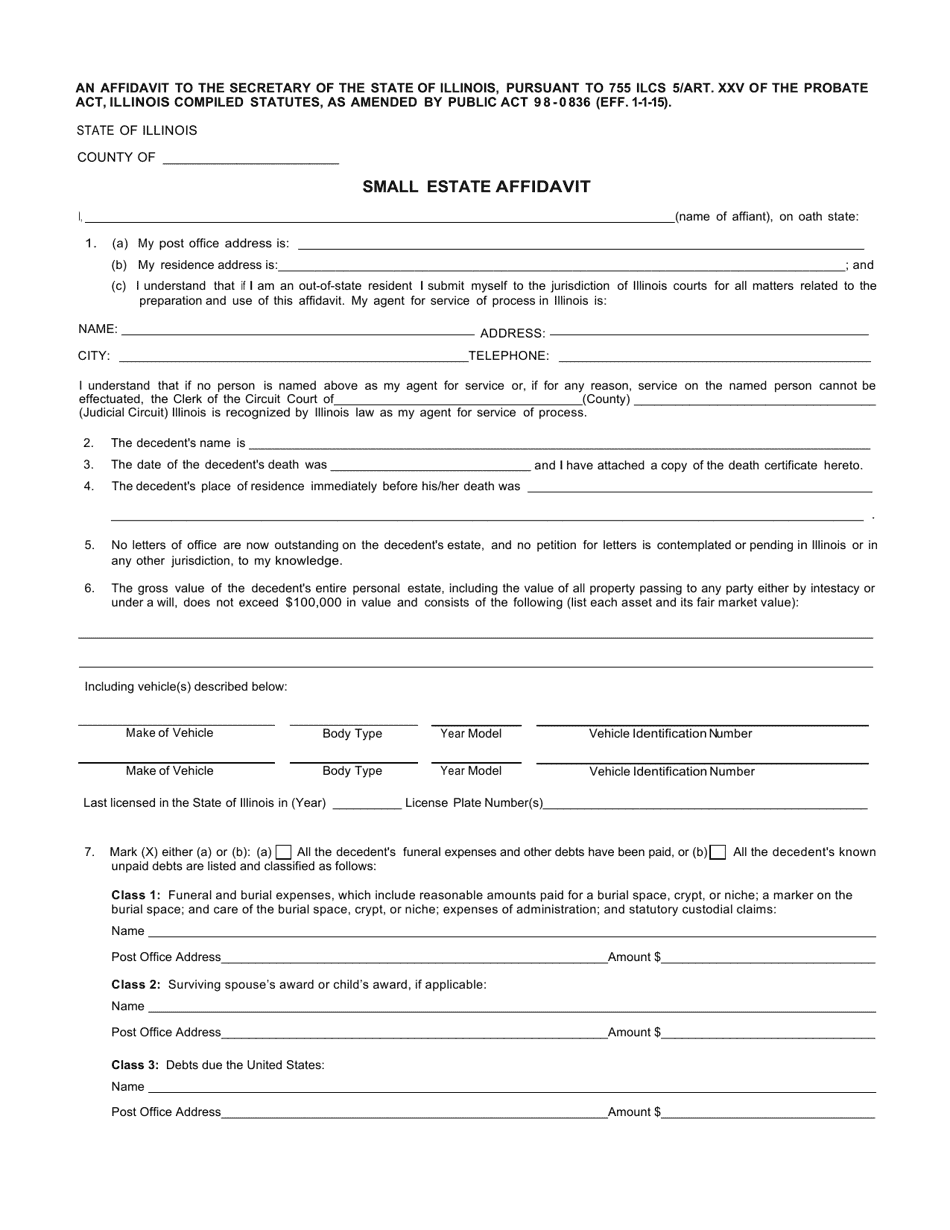

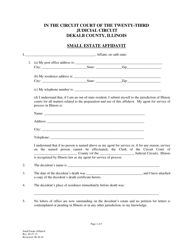

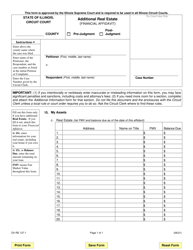

Form RT OPR31 Small Estate Affidavit - Illinois

What Is Form RT OPR31?

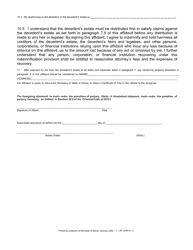

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Small Estate Affidavit?

A: A Small Estate Affidavit is a legal document used to transfer property from a deceased person to their heirs when the estate is under a certain value.

Q: When is a Small Estate Affidavit used in Illinois?

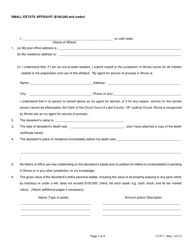

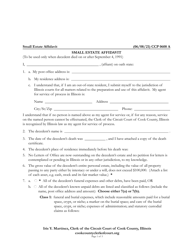

A: A Small Estate Affidavit is used in Illinois when the total value of the deceased person's estate is $100,000 or less.

Q: Who can file a Small Estate Affidavit in Illinois?

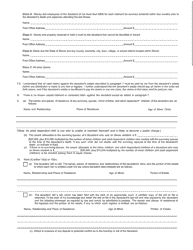

A: The deceased person's spouse, children, parents, or siblings can file a Small Estate Affidavit in Illinois.

Q: Do I need an attorney to file a Small Estate Affidavit in Illinois?

A: While not required, it is recommended to consult with an attorney to ensure the process is done correctly.

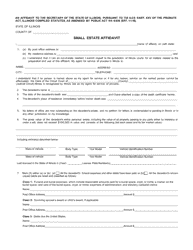

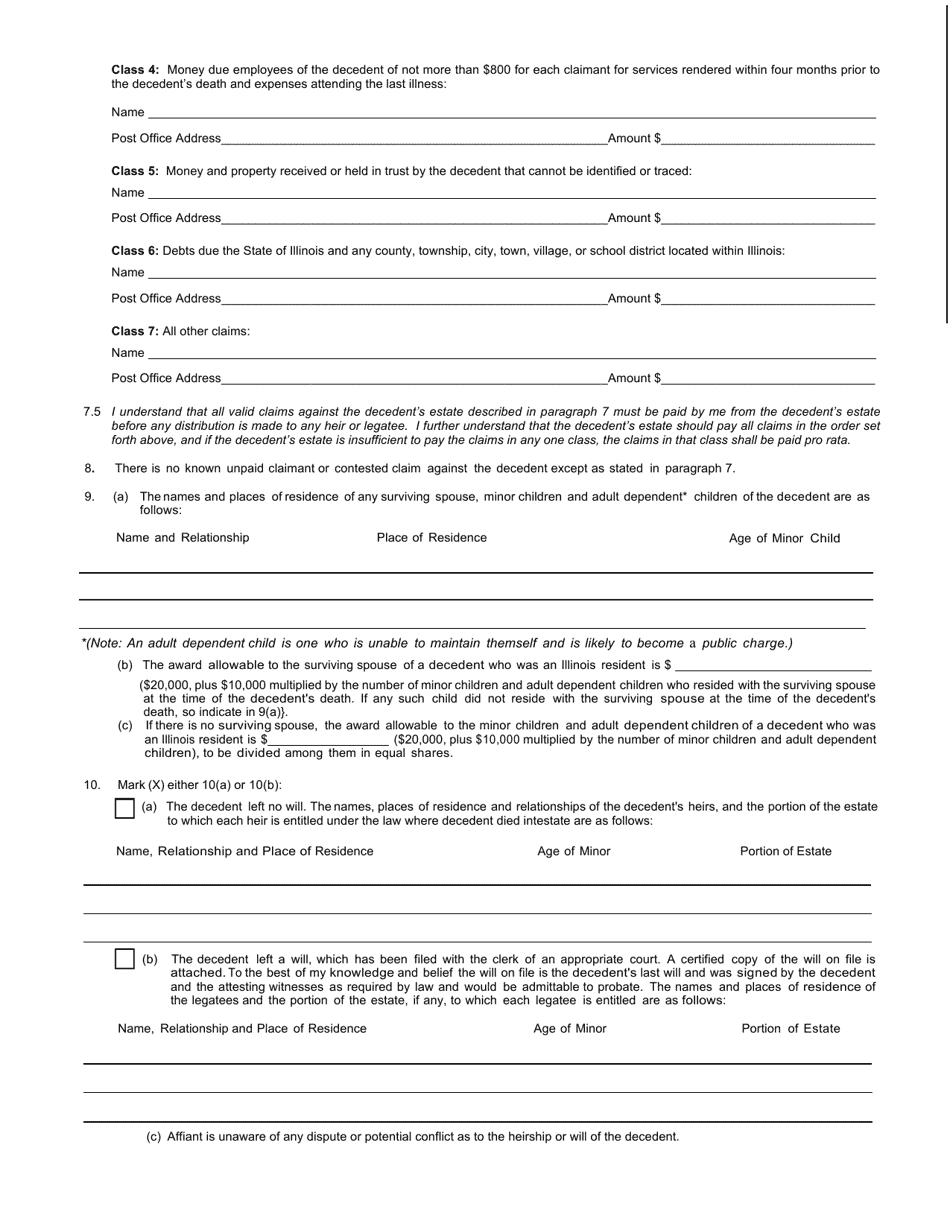

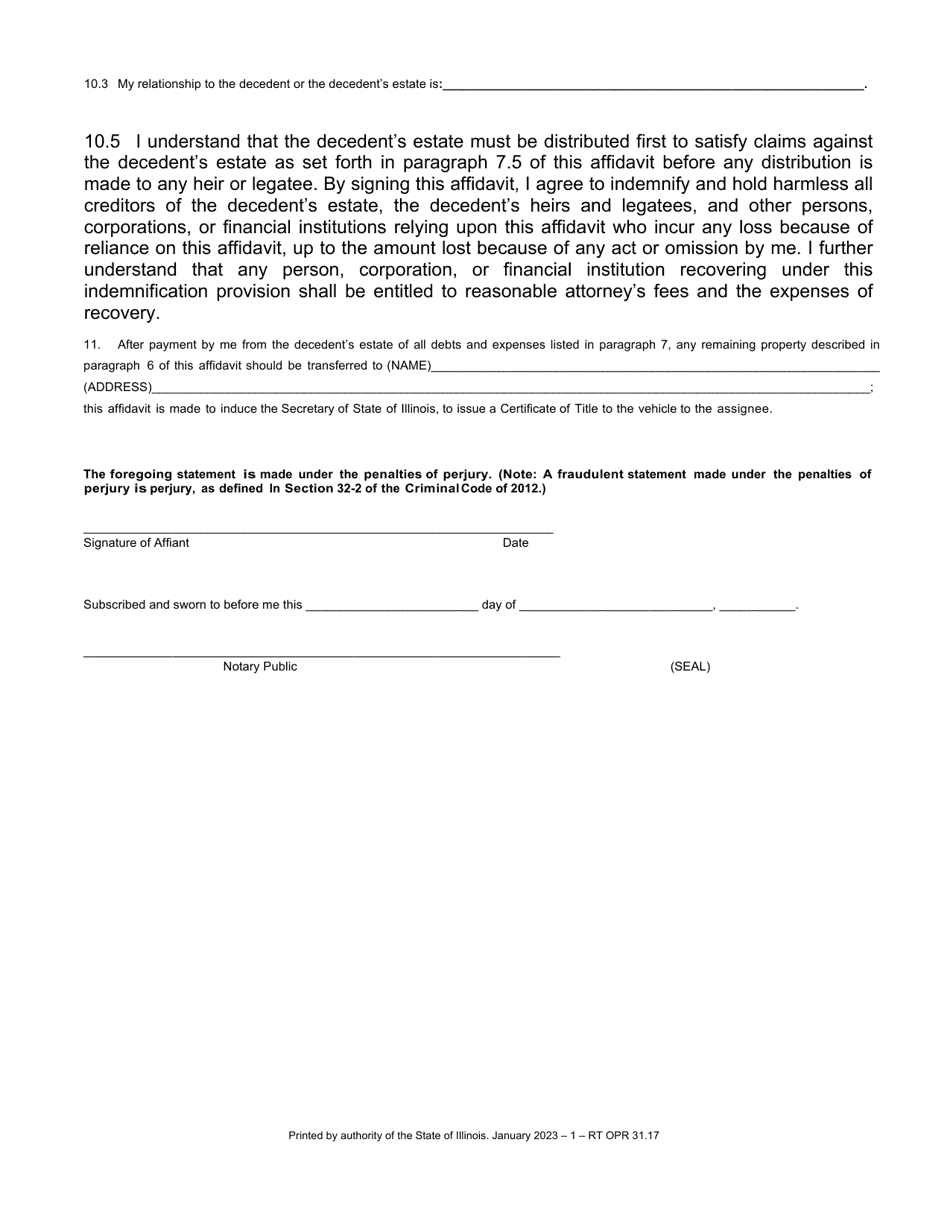

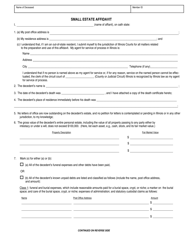

Q: What information is required in a Small Estate Affidavit?

A: The Small Estate Affidavit requires information about the deceased person, their assets, and their heirs.

Q: How long does it take to process a Small Estate Affidavit in Illinois?

A: The processing time for a Small Estate Affidavit can vary, but it typically takes a few weeks to several months.

Q: What happens after a Small Estate Affidavit is approved?

A: Once the Small Estate Affidavit is approved, the property can be transferred to the heirs and they can take ownership.

Q: Can a Small Estate Affidavit be used for real estate in Illinois?

A: No, a Small Estate Affidavit cannot be used for real estate in Illinois. A different process is required for transferring real estate.

Q: Is a Small Estate Affidavit subject to estate taxes?

A: No, a Small Estate Affidavit is not subject to estate taxes in Illinois.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RT OPR31 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.