Free Small Estate Affidavit Forms and Templates

What Is a Small Estate Affidavit?

A Small Estate Affidavit is a formal statement prepared to handle a small estate of the deceased individual that did not compose a last will and testament before their passing.

Alternate Name:

- Affidavit of Small Estate.

If you want to avoid the probate process and save yourself and other heirs time and money, you can choose this route to settle the estate. Whether you are a legal heir of the person that died or they appointed you as their executor or guardian of their assets, you are entitled to draft a list of assets and heirs and file it with the local probate court to make sure every person named in the affidavit gets their share of the estate.

Small Estate Affidavit by State

Before you start composing an affidavit to settle a small estate without a will, you need to figure out the legal way to address your case since every situation is unique depending on location and the size of the estate. Below you will see a list of all the states - select an Affidavit of Small Estate Form for the state where the majority of the deceased person's assets are situated and follow the local laws and procedures to make sure the estate is claimed correctly and no interested parties or third parties question the authenticity of your documentation and the validity of the process.

| Alabama | Hawaii | Massachusetts | New Mexico | South Dakota |

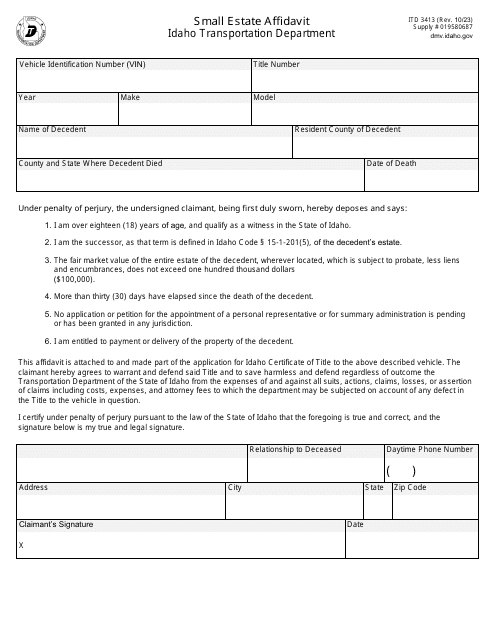

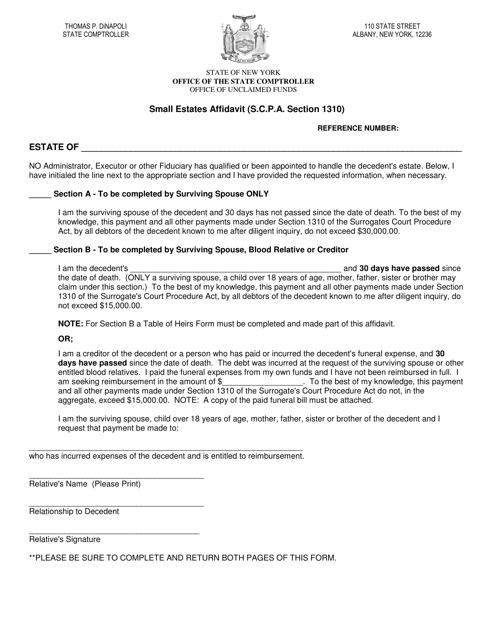

| Alaska | Idaho | Michigan | New York | Tennessee |

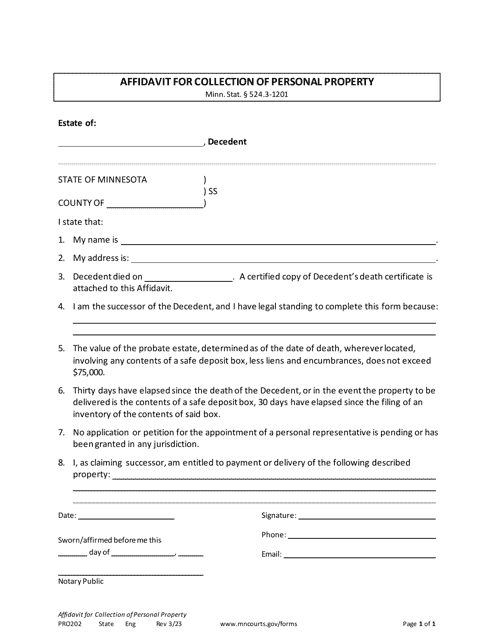

| Arizona | Illinois | Minnesota | North Carolina | Texas |

| Arkansas | Indiana | Mississippi | North Dakota | Utah |

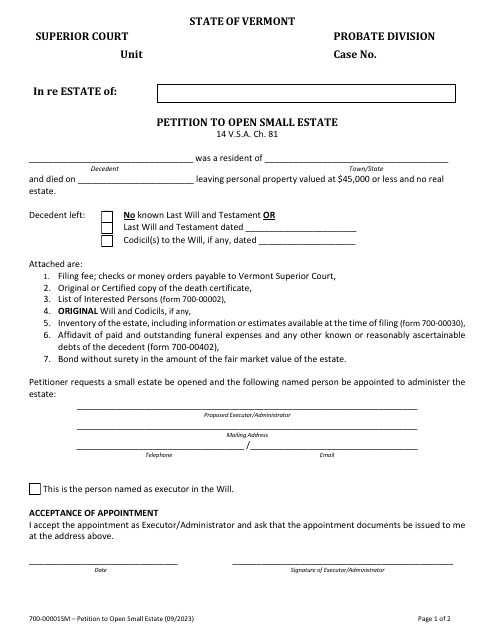

| California | Iowa | Missouri | Ohio | Vermont |

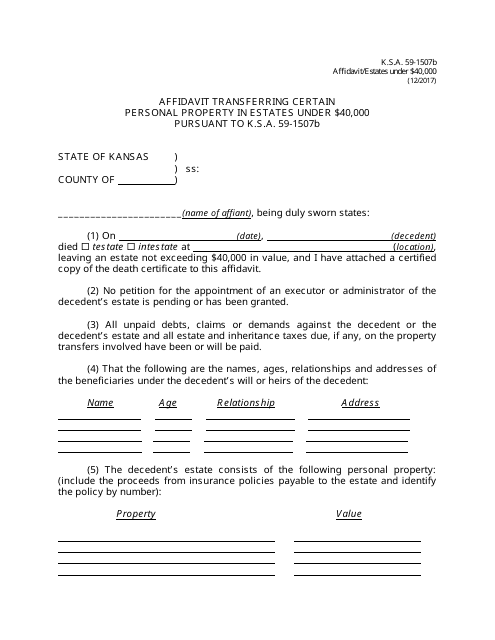

| Colorado | Kansas | Montana | Oklahoma | Virginia |

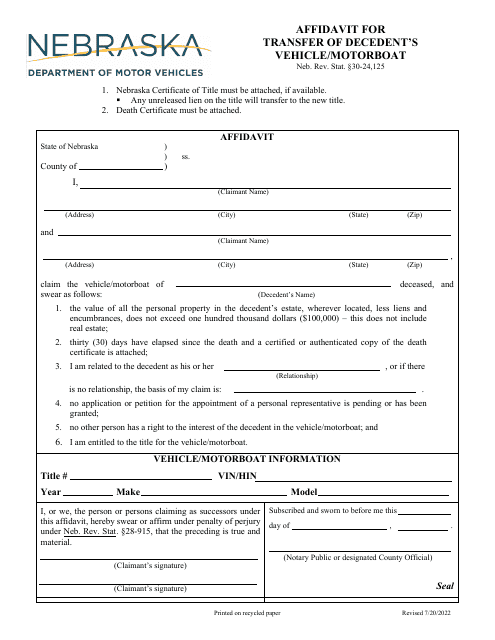

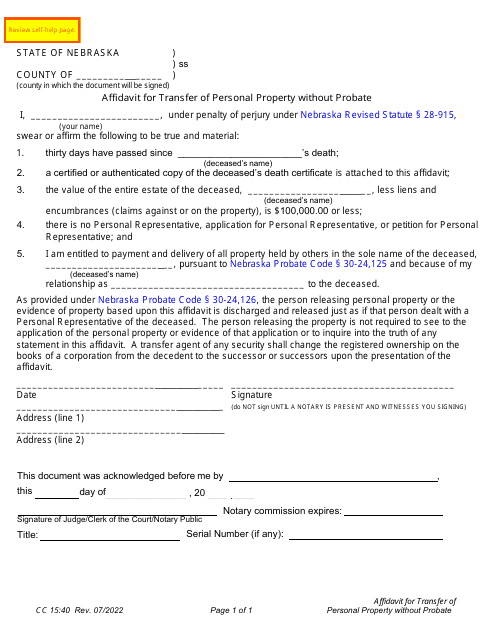

| Connecticut | Kentucky | Nebraska | Oregon | Washington |

| Delaware | Louisiana | Nevada | Pennsylvania | West Virginia |

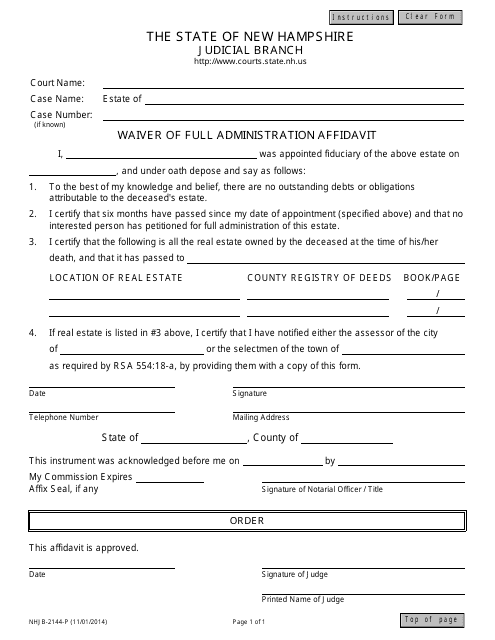

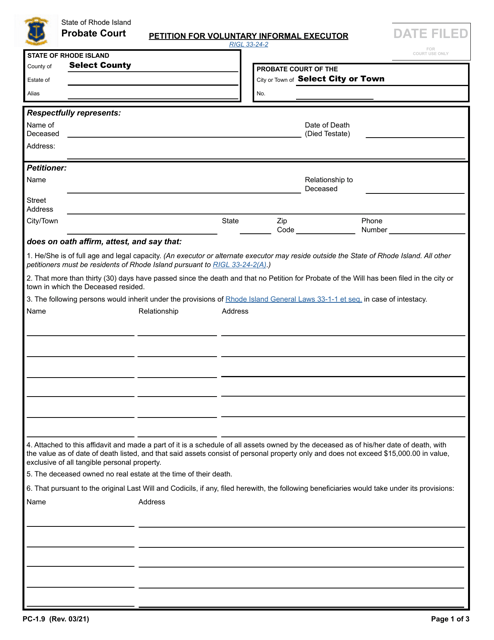

| Florida | Maine | New Hampshire | Rhode Island | Wisconsin |

| Georgia | Maryland | New Jersey | South Carolina | Wyoming |

How Do I Get a Small Estate Affidavit?

There are different ways to obtain an Affidavit of Small Estate:

- Fill out one of the templates above to disclose the information about the assets and debts of the person that passed away . Together with the copy of a death certificate, a document that confirms your identity, and the financial documentation that serves as proof of the estate being real, you can file the affidavit with the probate court in your county. It is allowed to submit the papers in person or by traditional mail. Check the website of your local court - you may even get a chance to send the affidavit online paying a filing fee.

- Visit the local probate court and find out the details from the county clerk . If you prefer to use a template you find there and submit the affidavit in person after you get a consultation regarding the relevant regulations, this may be the preferred way for you to deal with the estate.

- Make an appointment with a probate lawyer . If you believe it may be difficult for you to complete the affidavit yourself and you still have to reach out to multiple heirs of the decedent, an attorney will help you to handle the situation. While this is the most expensive way to get an affidavit, usually the fee you are charged covers all steps of the way and you can be sure the documentation is submitted correctly by the person who has an authorization issued by you. Moreover, if you are not sure which assets have encumbrances or liens, a legal consultation may be necessary to correctly calculate the value of the estate and be sure it is under the maximum amount established by the state.

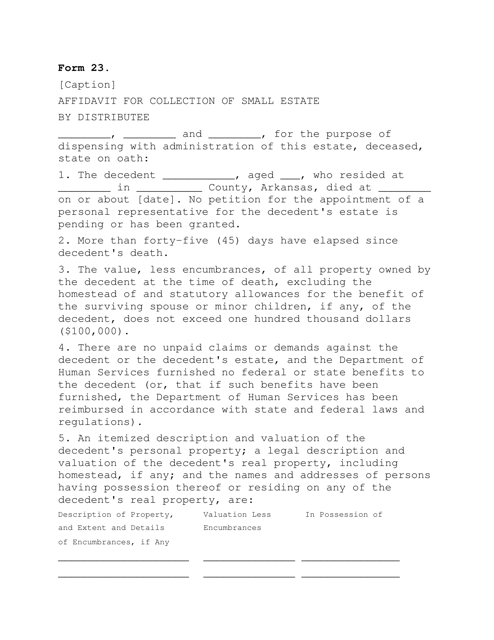

How to Fill Out a Small Estate Affidavit?

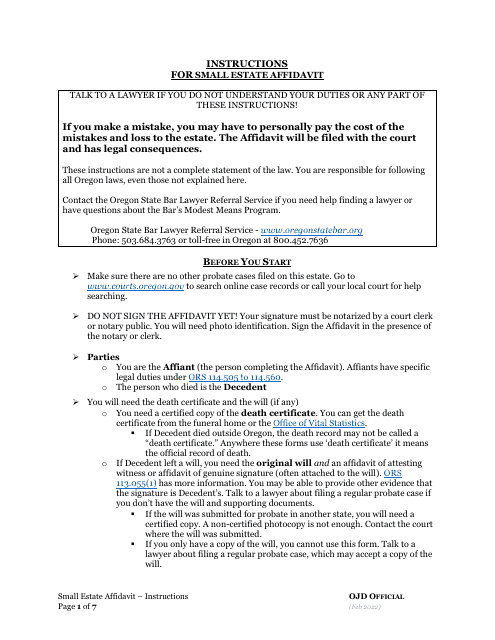

Here is how you need to complete a Small Estate Affidavit Form:

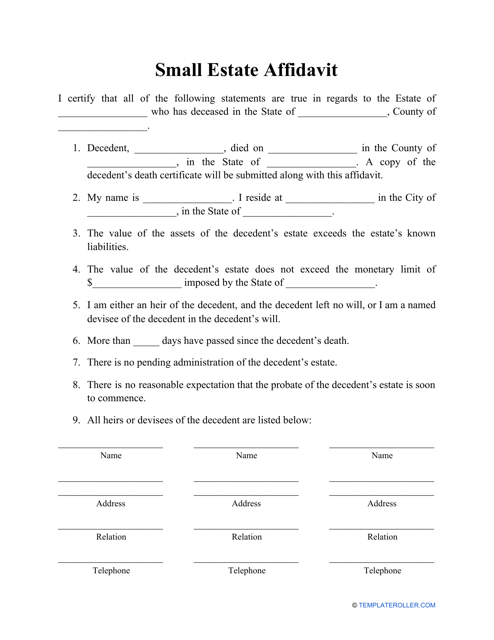

- Indicate the name of the deceased individual and their date and place of death . Confirm the attachment of a copy of the death certificate to the affidavit.

- State your own name and physical address.

- Certify the value of the assets the decedent had in possession at the time of their death does not exceed the limited amount required by the state and record the sum of money in question.

- Verify your status of the heir and explain the no will. You must also state the period you were required to wait for after their death has expired - usually, it is around thirty days.

- Enter the names and contact information of every heir of the individual that has passed away . It is necessary to specify their relation to the decedent. Confirm all heirs will be made aware of the affidavit after it is filed via a formal notice.

- List the assets from the estate, write down their value, and add a brief description if necessary.

- Indicate all the liabilities and debts of the decedent, the amount they owed, and the name and contact details of every creditor.

- State the names of heirs that have the right to receive certain assets.

- Sign and date the affidavit . It should also contain the names and signatures of two impartial witnesses. To protect the interests of heirs known and unknown at the time of drafting the affidavit, you need to obtain a notary seal for the document. A Notarized Small Estate Affidavit will confirm your own identity whether you are an heir yourself or work on behalf of people that want to receive a portion of the estate.

How Much Is a Small Estate Affidavit?

The fee for filing a Small Estate Affidavit with a probate court can be different depending on various factors - your location, the number of heirs to be notified and negotiated with, and the value of the estate. Since there are different laws in different states, a deceased individual may have dozens of heirs all over the country and abroad, and the maximum value of the estate considered small varies from state to state, every situation is unique.

If you believe you need the help of the attorney to cover all the bases and submit an affidavit for you, ask them the approximate fee for their services before they start their work. Usually, the fee ranges from $1,000 to several thousand. However, you may be charged differently by different lawyers - some of them will charge by the hour (for instance, $200 per hour) or ask for a flat fee ($2,000) to handle the case from start to finish.

Still looking for a related template? Take a look at the related templates and forms below:

Documents:

84

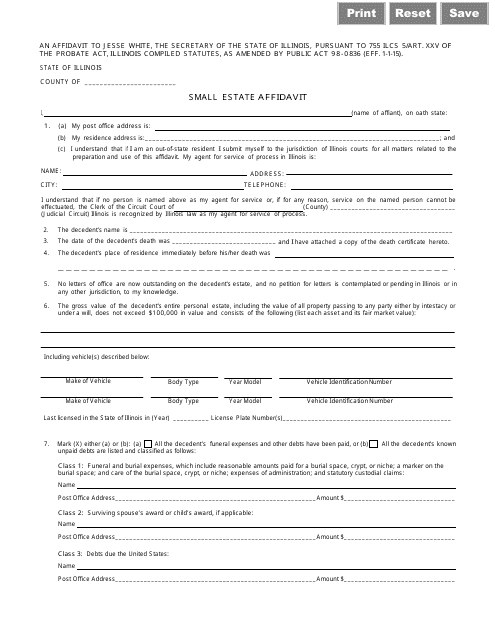

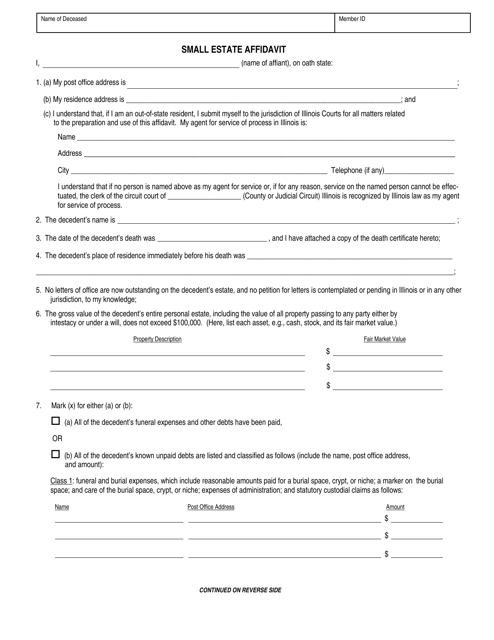

This type of form is used in Illinois and refers to a formal document that gives legal heirs of the deceased individual the right to distribute the latter's assets without having to appear in court.

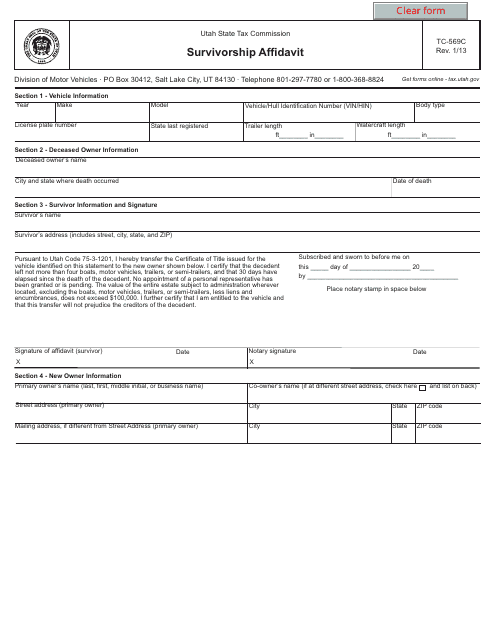

This form is used for completing a survivorship affidavit in the state of Utah. It is used to transfer ownership of property from a deceased individual to one or more surviving co-owners.

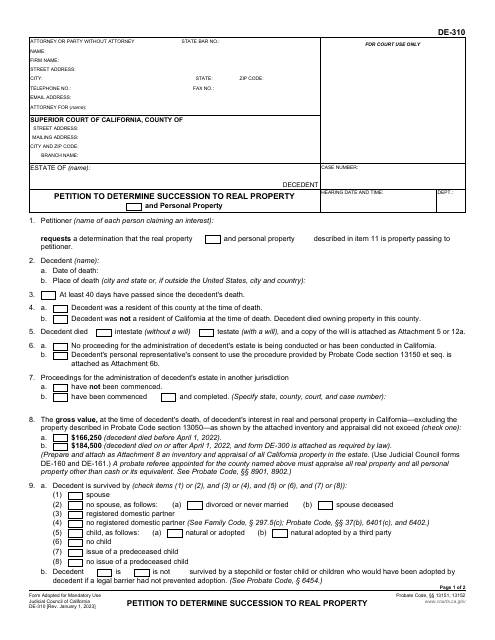

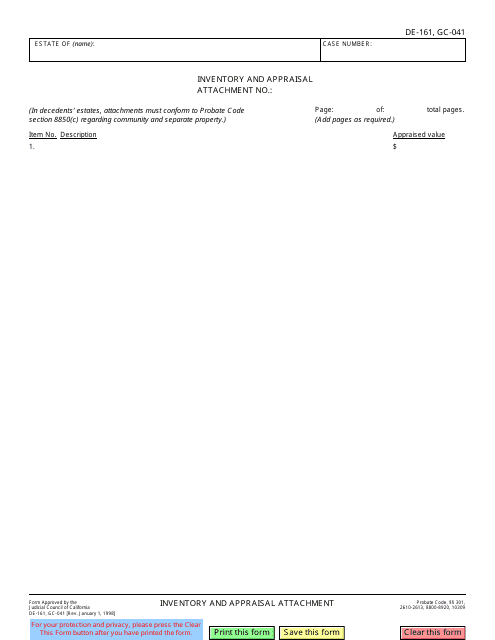

This document is used as an attachment for Form DE-161 (GC-041) in California. It is used to provide an inventory and appraisal of assets.

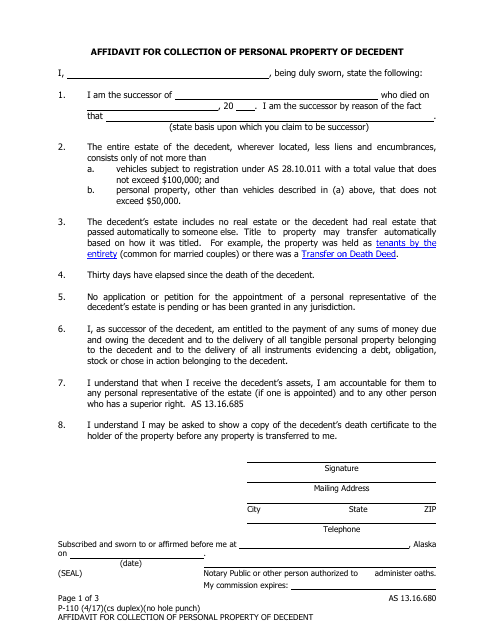

By filling in this type of template in Alaska, this will permit an individual who has inherited a property to become the new legal owner after the passing of the original owner.

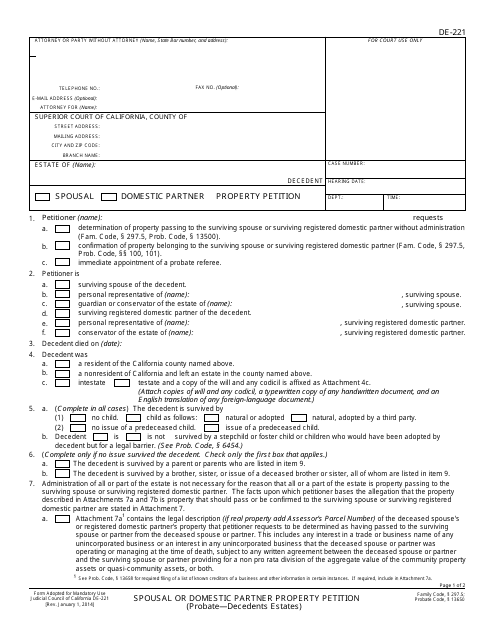

This Form is used for filing a Spousal or Domestic Partner Property Petition in California, which allows individuals to request a fair division of property and assets in a divorce or separation case.

This document is used for transferring personal property in estates valued under $40,000 in the state of Kansas, following the guidelines in K.S.A. 59-1507b.

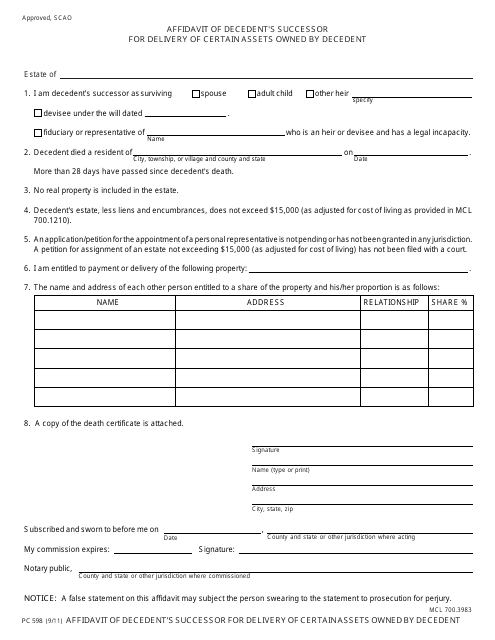

This type of form is used in Michigan and refers to a formal instrument that gives the heirs of the deceased person the right to access and distribute their assets promptly.

This is a legally binding document used in Minnesota to settle a small estate in the absence of a will.

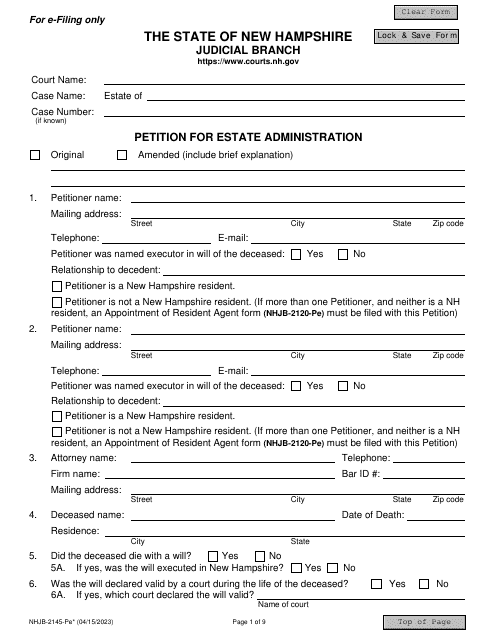

This form is used for waiving the requirement of full administration in the probate process in New Hampshire.

For individuals that reside in the state of New York, this type of form is a legal document that allows an individual inheriting a small estate to become the new legal owner after the decedent has passed away.

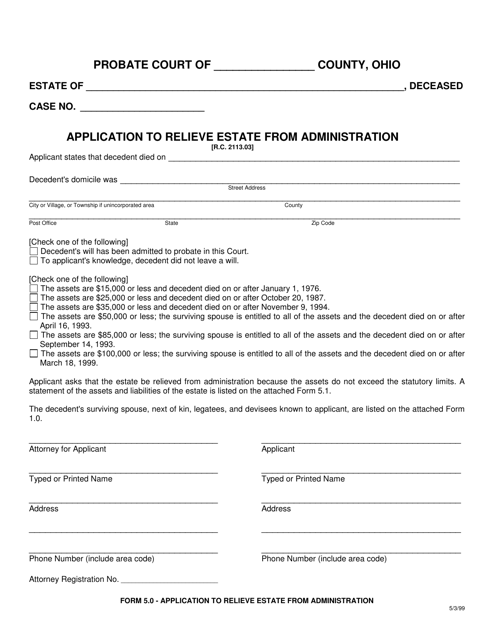

Filling in this type of form provides the legal power for an individual to collect a small estate property from an individual that has passed away in the state of Ohio.

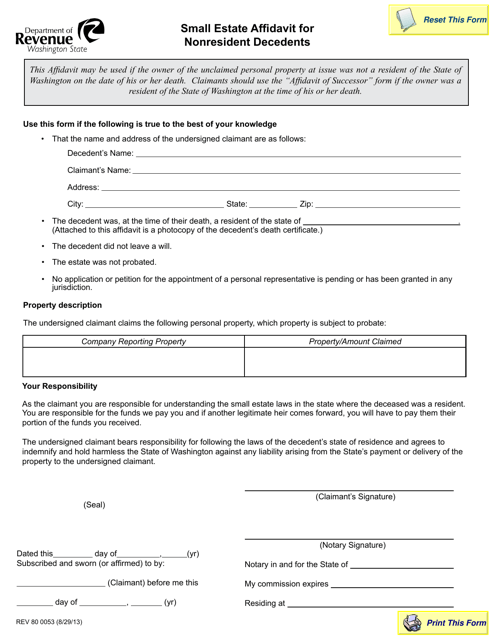

This Form is used for filing a Small Estate Affidavit for Nonresident Decedents in Washington state. It allows nonresident individuals to settle the estate of a deceased person with a smaller value of assets.

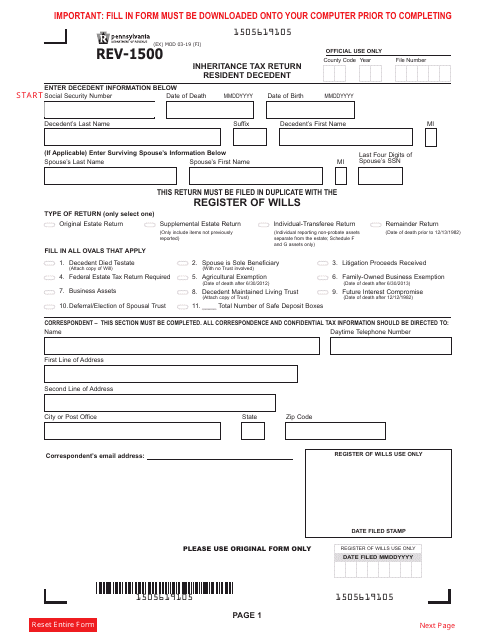

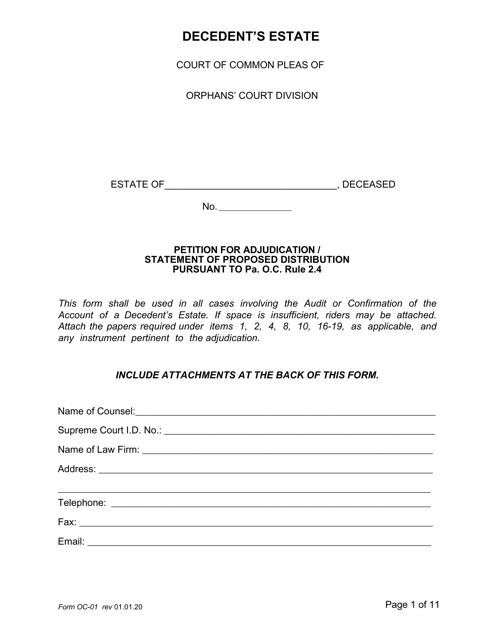

This form is used for filing a petition for adjudication or a statement of proposed distribution in Pennsylvania, according to the Pennsylvania Orphans' Court Rule 2.4.

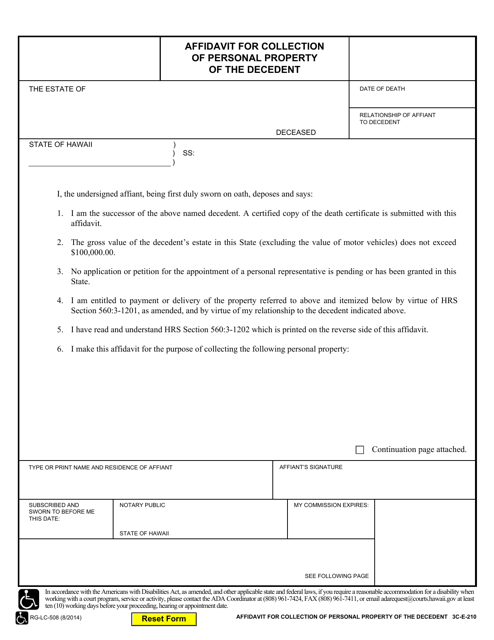

An individual residing in Hawaii may use this type of template to claim the assets of an individual that passed away if their estate is small enough and the heir believes it is possible to skip the usual probate proceeding.

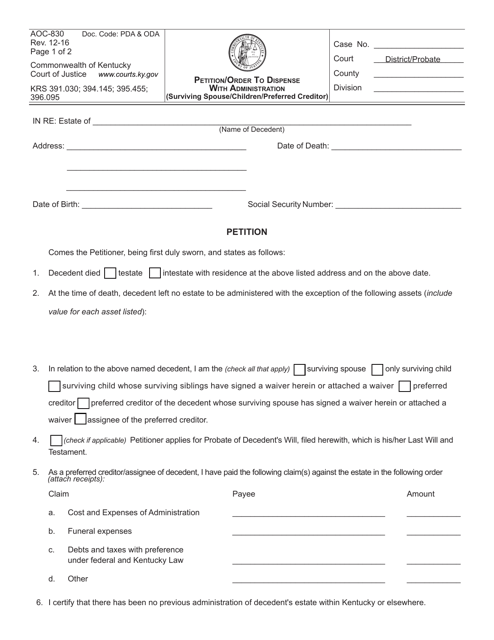

This is a legally binding document used in Kentucky to settle a small estate in the absence of a will.

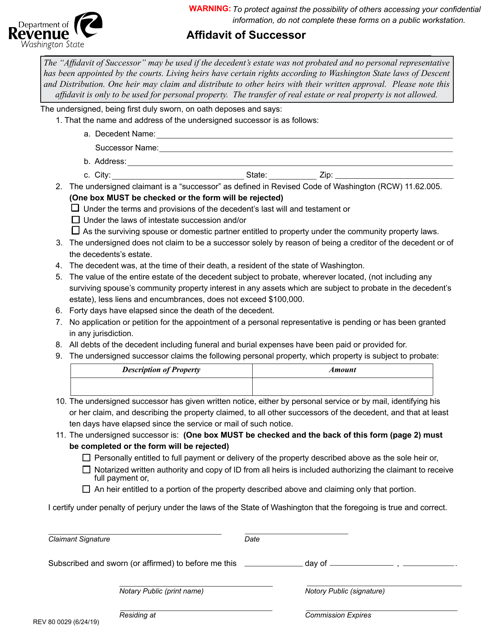

This Form is used for filing an Affidavit of Successor in the state of Washington. It is a legal document used to declare an individual as the rightful successor to a deceased person's assets and property.

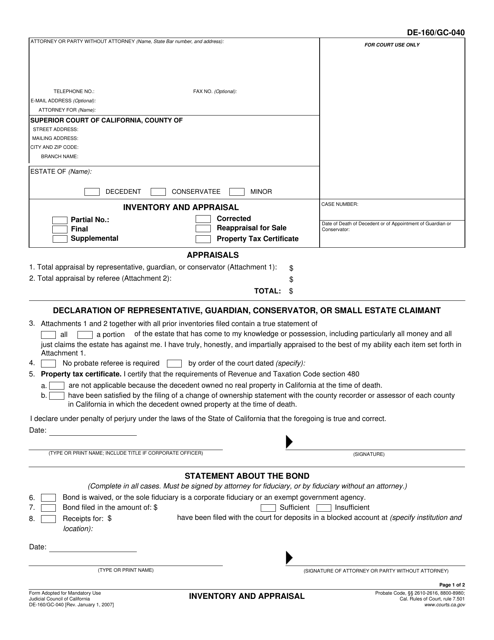

This form is used for inventory and appraisal purposes in California.

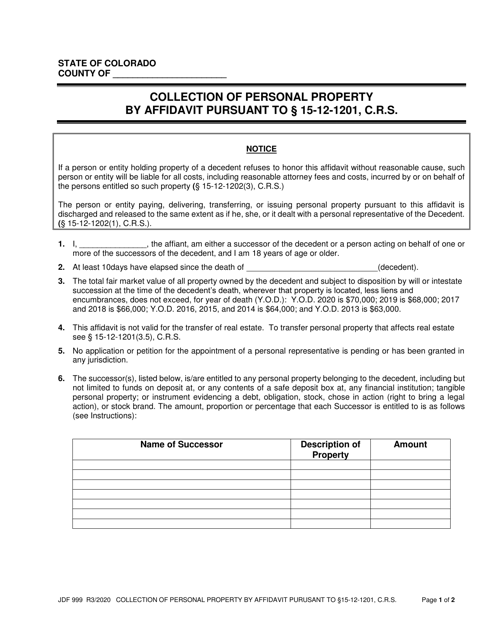

This form is used for the collection of personal property through an affidavit in the state of Colorado, in accordance with the Colorado Revised Statutes section 15-12-1201.

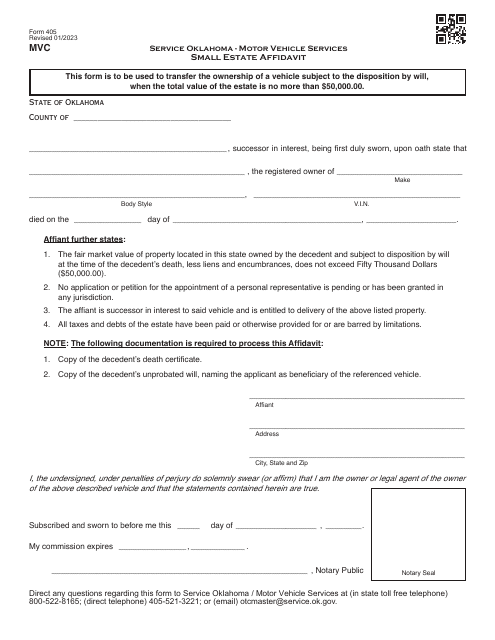

This form is used to manage the property of a deceased person when their assets are small enough to not require the traditional and long probate process.

This Form is used for declaring a small estate in Illinois and is typically used when the deceased had minimal assets or property.

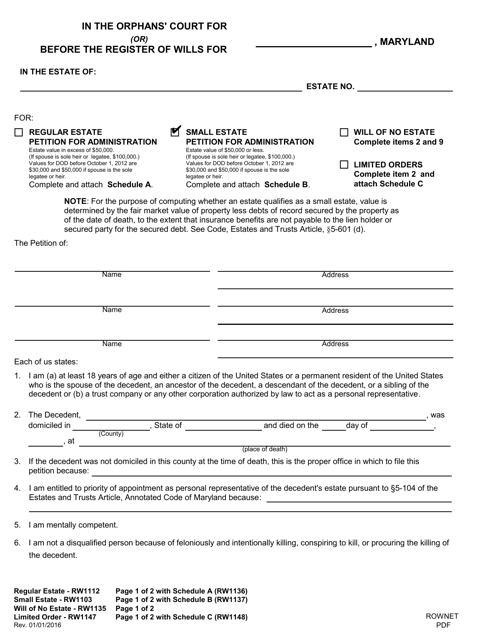

This is a legally binding document used in Maryland to settle a small estate in the absence of a will.

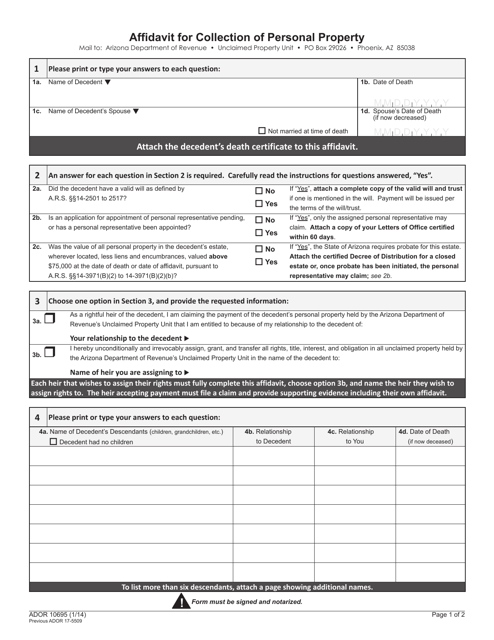

This Form is used for collecting personal property in the state of Arizona through an affidavit.

This document is used for transferring property in the state of Arizona when the estate is small. It allows for a simplified process when there is no need for probate court involvement.

This type of form is used in Arkansas and gives legal permission for a person to collect a property that they have rightfully inherited after the owner has passed.