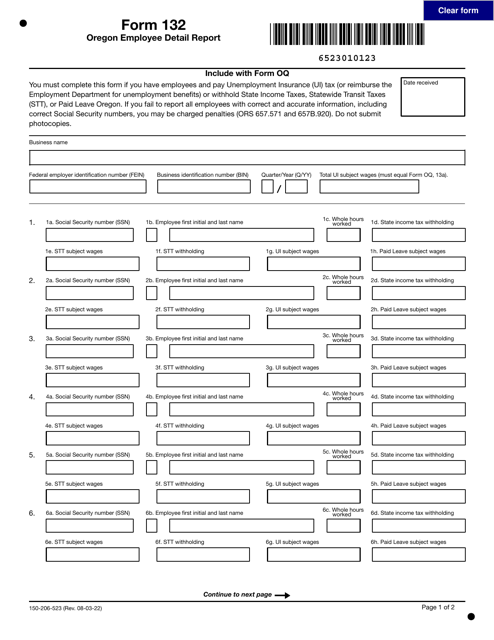

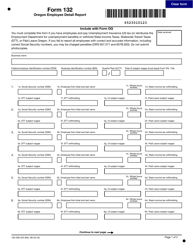

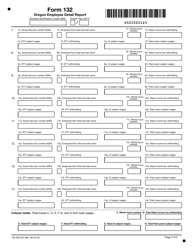

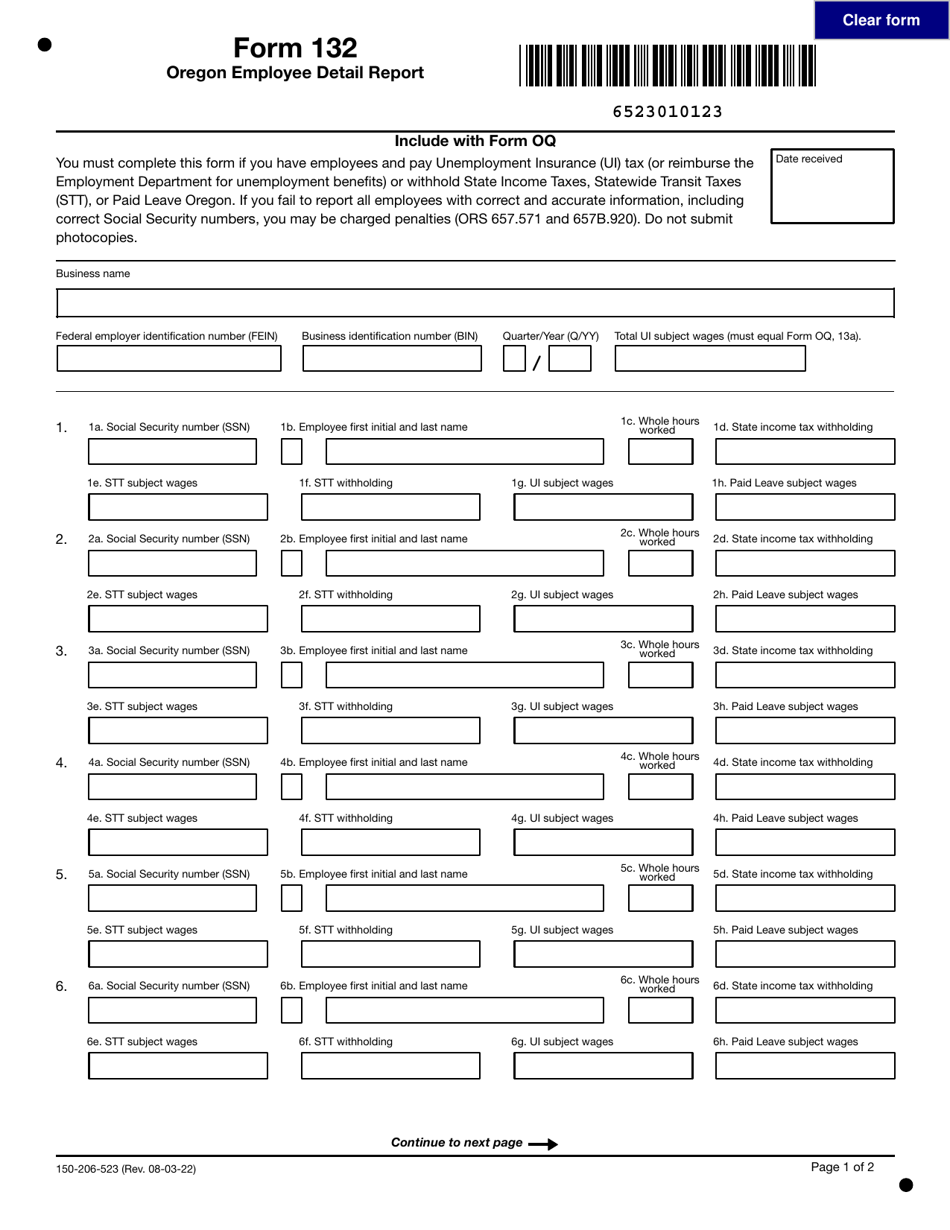

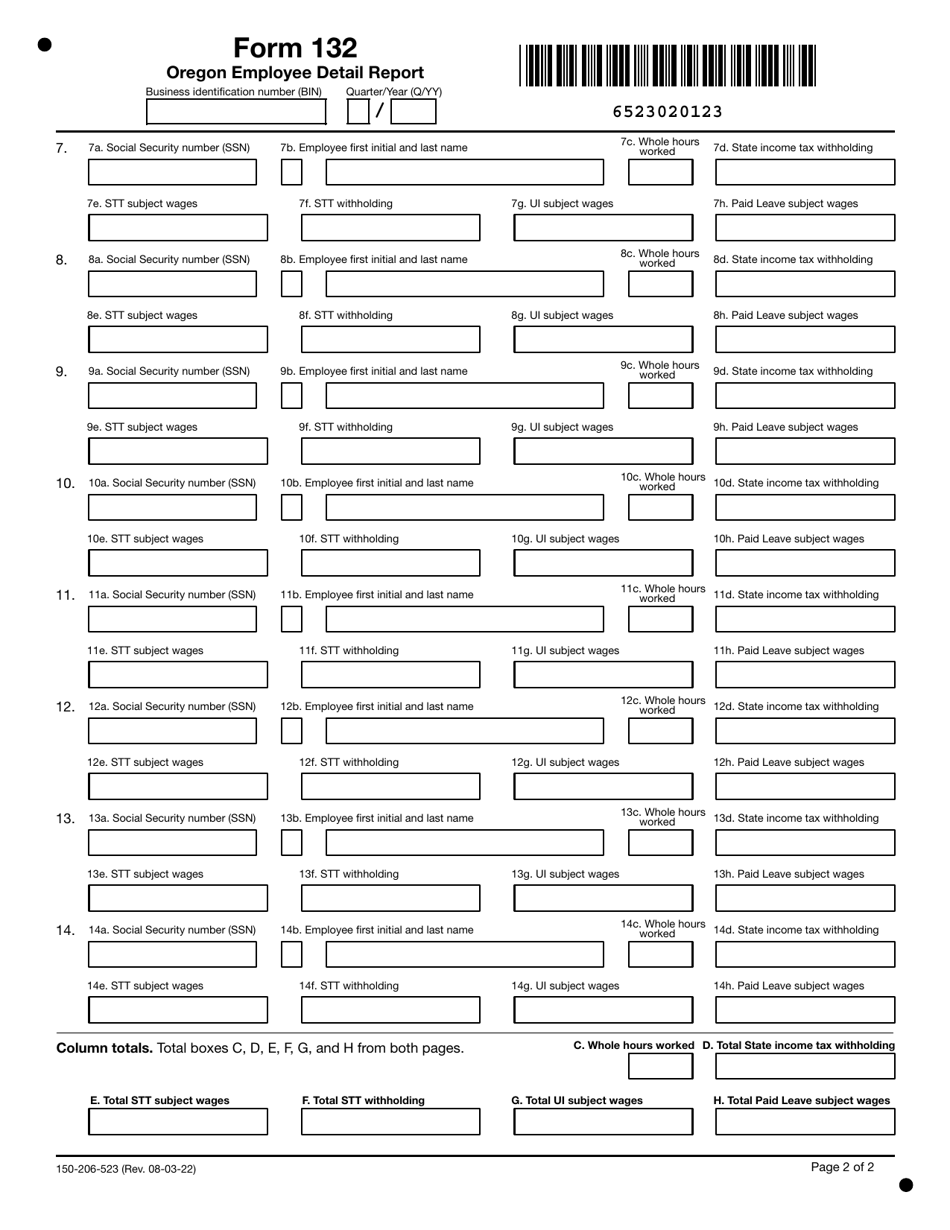

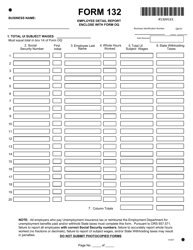

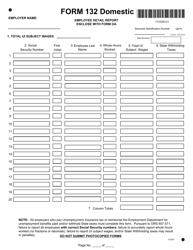

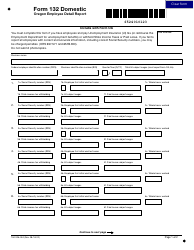

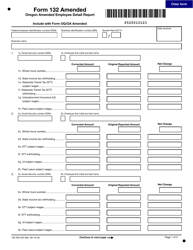

Form 132 (150-206-523) Oregon Employee Detail Report - Oregon

What Is Form 132 (150-206-523)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form 132?

A: Form 132 is the Oregon Employee Detail Report.

Q: What is the purpose of form 132?

A: The purpose of form 132 is to provide detailed information about employees in the state of Oregon.

Q: Who needs to complete form 132?

A: Employers in Oregon are required to complete form 132 for each employee.

Q: What information is included in form 132?

A: Form 132 includes details such as employee name, Social Security number, wages, and withholding information.

Q: Is form 132 specific to Oregon?

A: Yes, form 132 is specific to the state of Oregon.

Q: Is form 132 mandatory?

A: Yes, employers in Oregon are required to complete form 132 for each employee.

Q: Are there any penalties for not filing form 132?

A: Yes, there may be penalties for not filing form 132 or for filing it late.

Q: Is there a deadline for filing form 132?

A: Yes, form 132 must be filed on a quarterly basis, with specific deadlines set by the Oregon Department of Revenue.

Form Details:

- Released on August 3, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 132 (150-206-523) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.