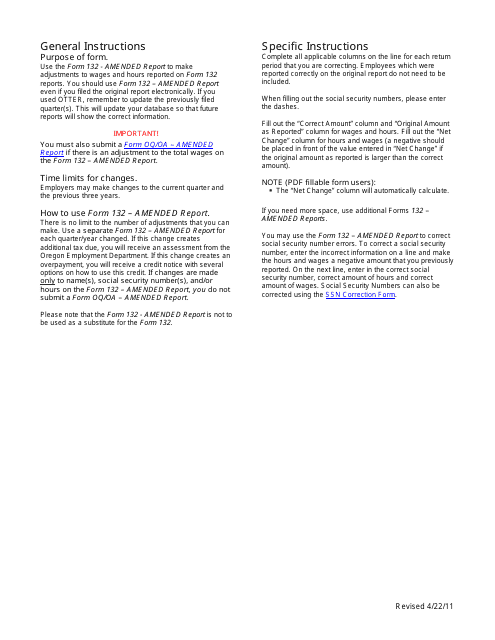

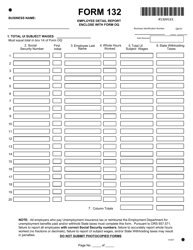

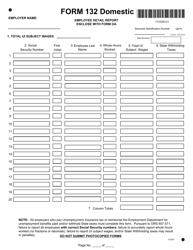

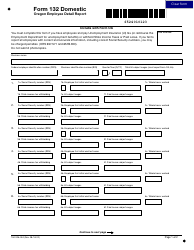

Instructions for Form 132 Amended Report - Oregon

This document contains official instructions for Form 132 , Amended Report - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 132 (150-206-523) is available for download through this link.

FAQ

Q: What is Form 132?

A: Form 132 is an amended report that is used in Oregon.

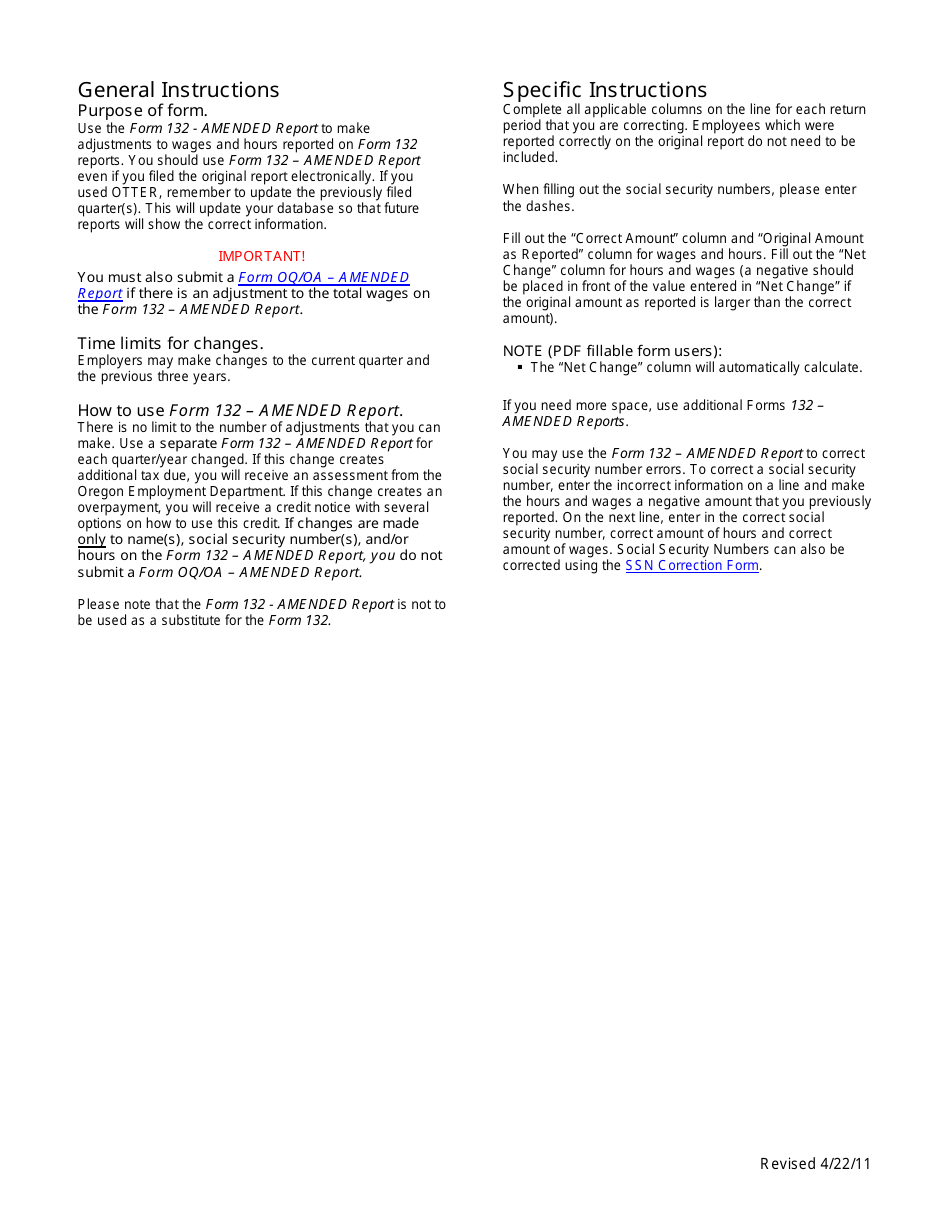

Q: When should I file Form 132?

A: You should file Form 132 if you need to make changes or corrections to a previously filed report in Oregon.

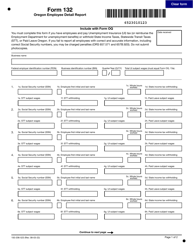

Q: What information do I need to fill out Form 132?

A: You will need to provide your taxpayer identification number, the period covered by the original report, the incorrect information that needs to be corrected, and the correct information.

Q: Is there a deadline for filing Form 132?

A: The deadline for filing Form 132 depends on the type of report you are amending. It is best to check the instructions provided with the form or contact the Oregon Department of Revenue for specific deadlines.

Q: What happens after I file Form 132?

A: After you file Form 132, the Oregon Department of Revenue will review your amended report and make any necessary adjustments to your tax records.

Q: Is there a fee for filing Form 132?

A: No, there is no fee for filing Form 132 in Oregon.

Q: What should I do if I have multiple corrections to make on my reports?

A: If you have multiple corrections to make on your reports, you should file a separate Form 132 for each correction.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.