This version of the form is not currently in use and is provided for reference only. Download this version of

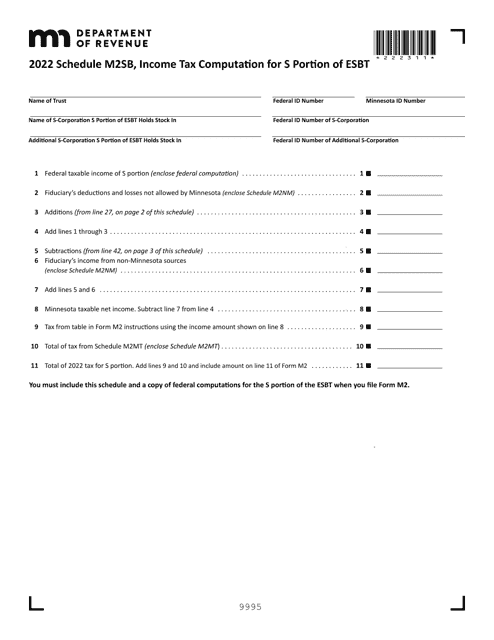

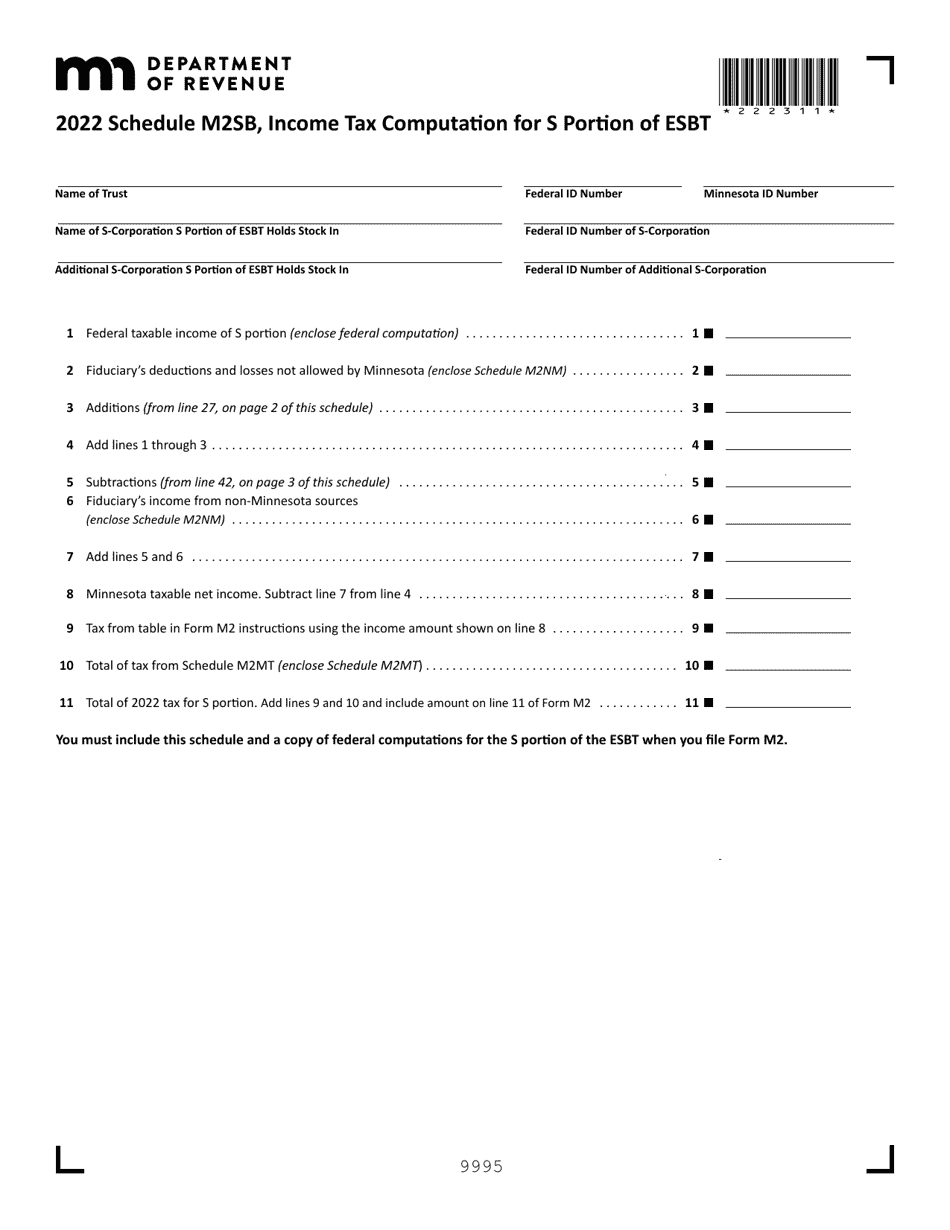

Schedule M2SB

for the current year.

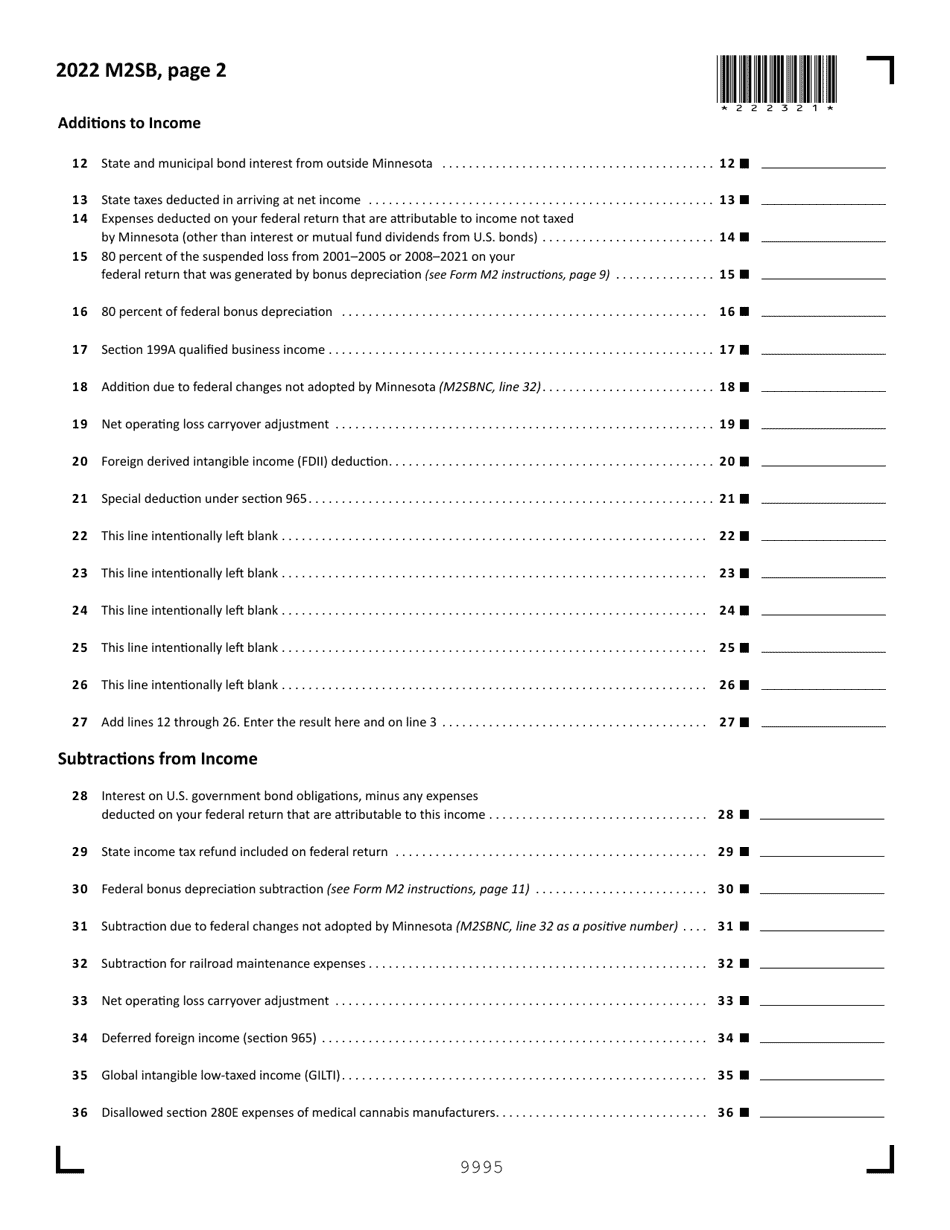

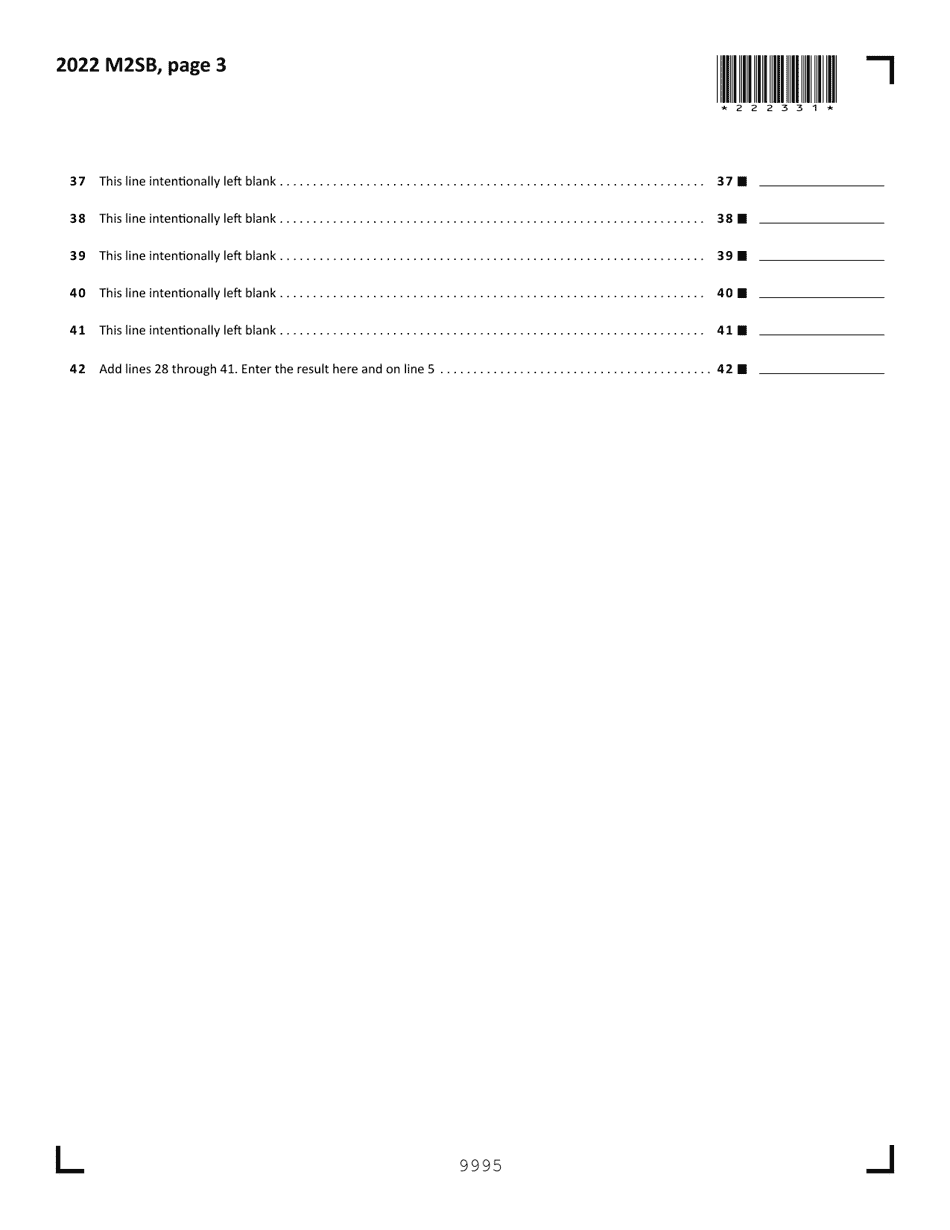

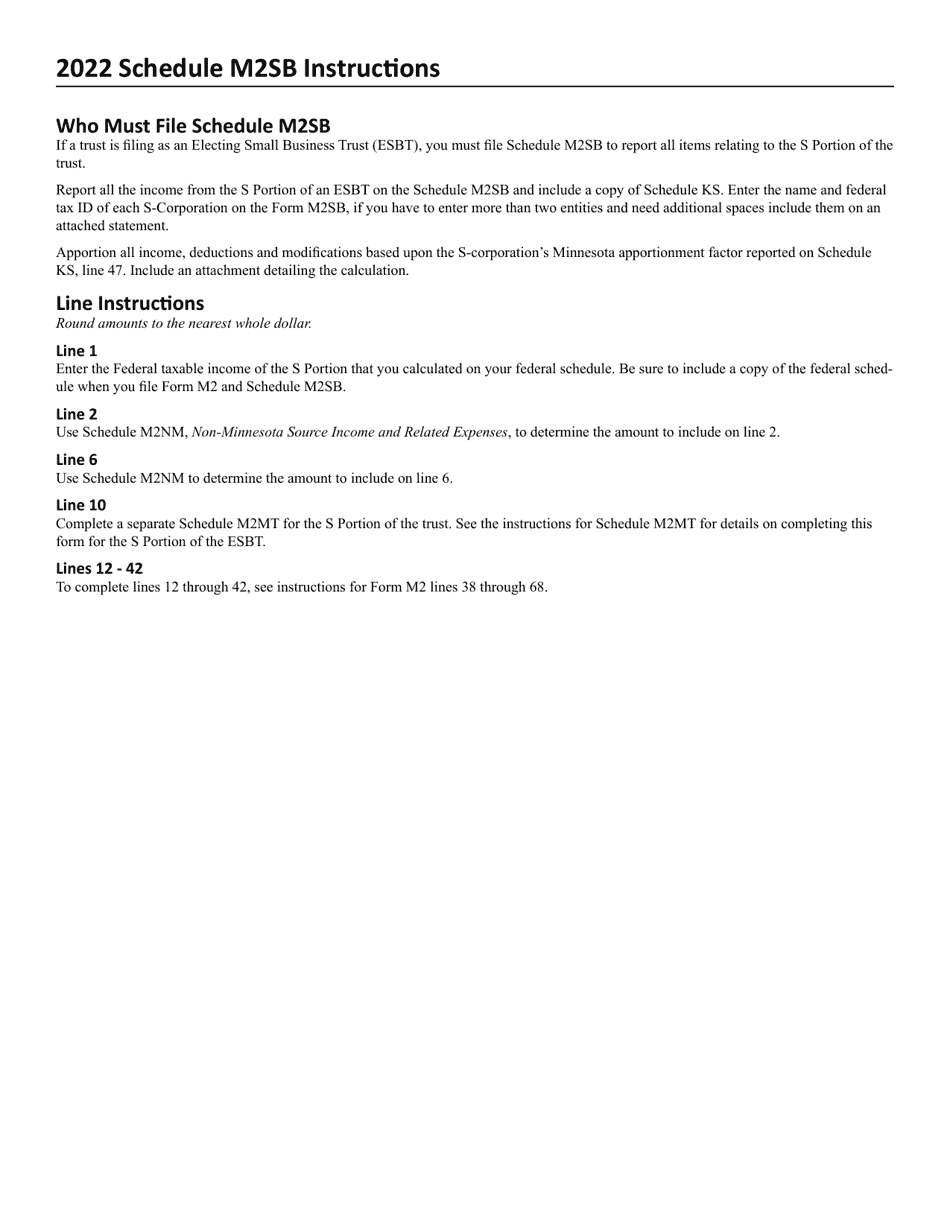

Schedule M2SB Income Tax Computation for S Portion of Esbt - Minnesota

What Is Schedule M2SB?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M2SB?

A: Schedule M2SB is an income tax computation for the S portion of an Electing Small Business Trust (ESBT) in Minnesota.

Q: What is an ESBT?

A: ESBT stands for Electing Small Business Trust. It is a type of trust that is eligible to elect to be treated as an S corporation for federal income tax purposes.

Q: What is the S portion of an ESBT?

A: The S portion of an ESBT refers to the portion of the trust's income and deductions that are attributable to the trust's ownership of S corporation stock.

Q: Why do I need to file Schedule M2SB?

A: If you are a trustee of an ESBT in Minnesota, you need to file Schedule M2SB to compute the trust's income tax liability for the S portion of the trust.

Q: What information do I need to complete Schedule M2SB?

A: To complete Schedule M2SB, you will need the trust's federal Schedule K-1, as well as information about the trust's income, deductions, and credits.

Q: Is Schedule M2SB only for Minnesota residents?

A: No, Schedule M2SB is not only for Minnesota residents. If you are a trustee of an ESBT that owns S corporation stock and has Minnesota-source income, you may need to file Schedule M2SB.

Q: Are there any special rules or requirements for Schedule M2SB?

A: Yes, there are specific rules and requirements for completing Schedule M2SB, including certain limitations and adjustments that may apply to the trust's income and deductions.

Q: When is the deadline to file Schedule M2SB?

A: The deadline to file Schedule M2SB is generally the same as the deadline to file the trust's Minnesota income tax return, which is usually April 15th.

Q: Can I e-file Schedule M2SB?

A: Yes, you can e-file Schedule M2SB if you are filing your trust's Minnesota income tax return electronically.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M2SB by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.