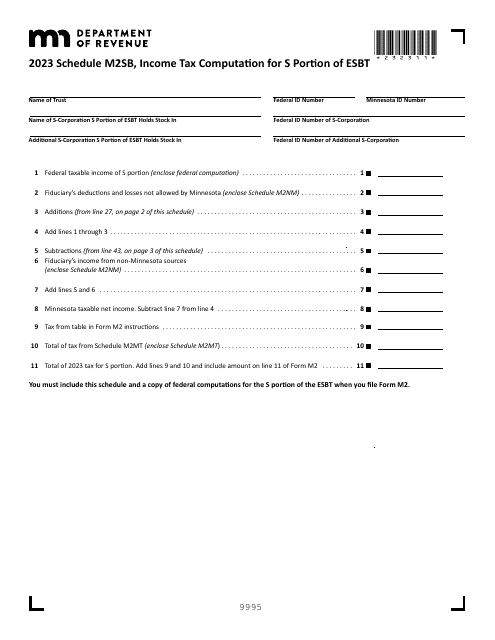

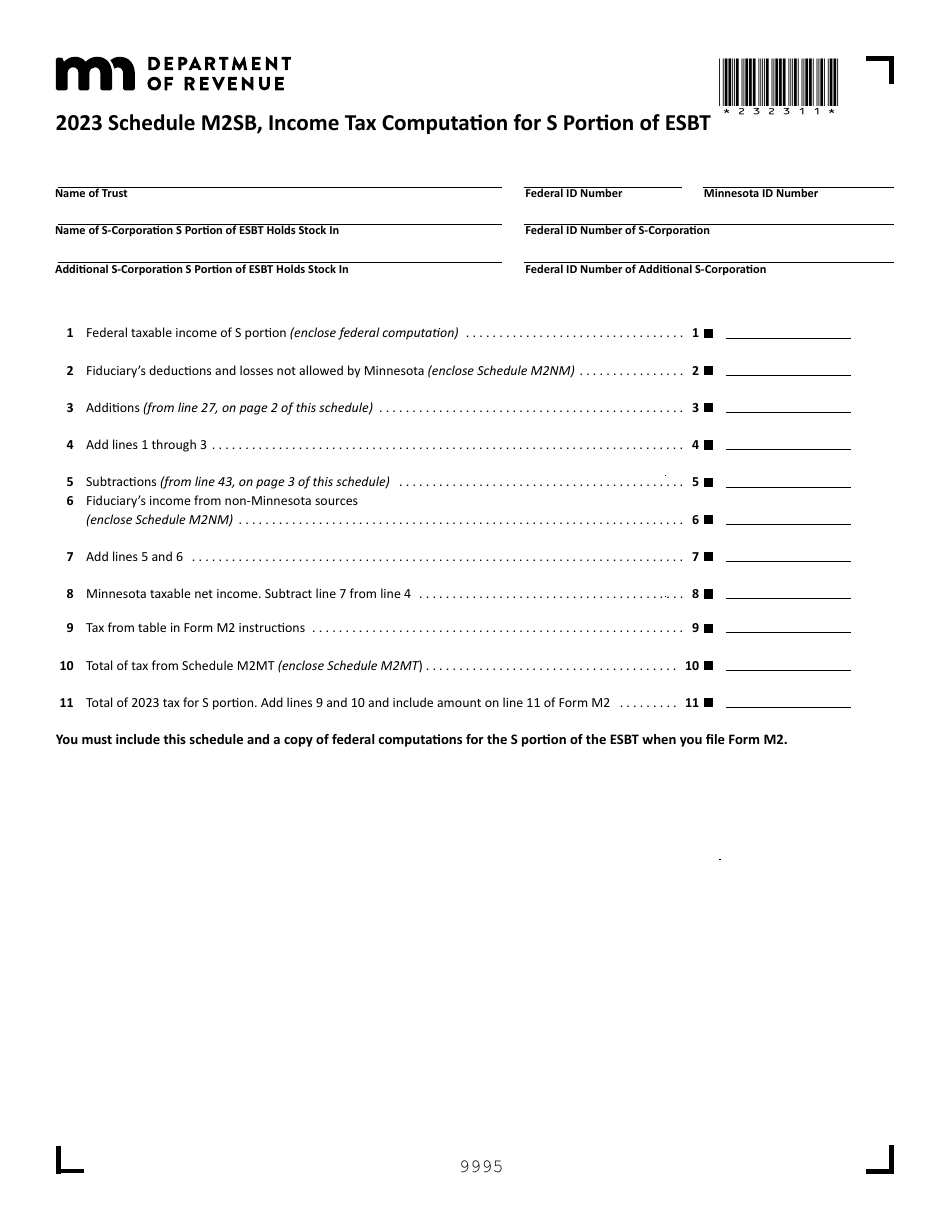

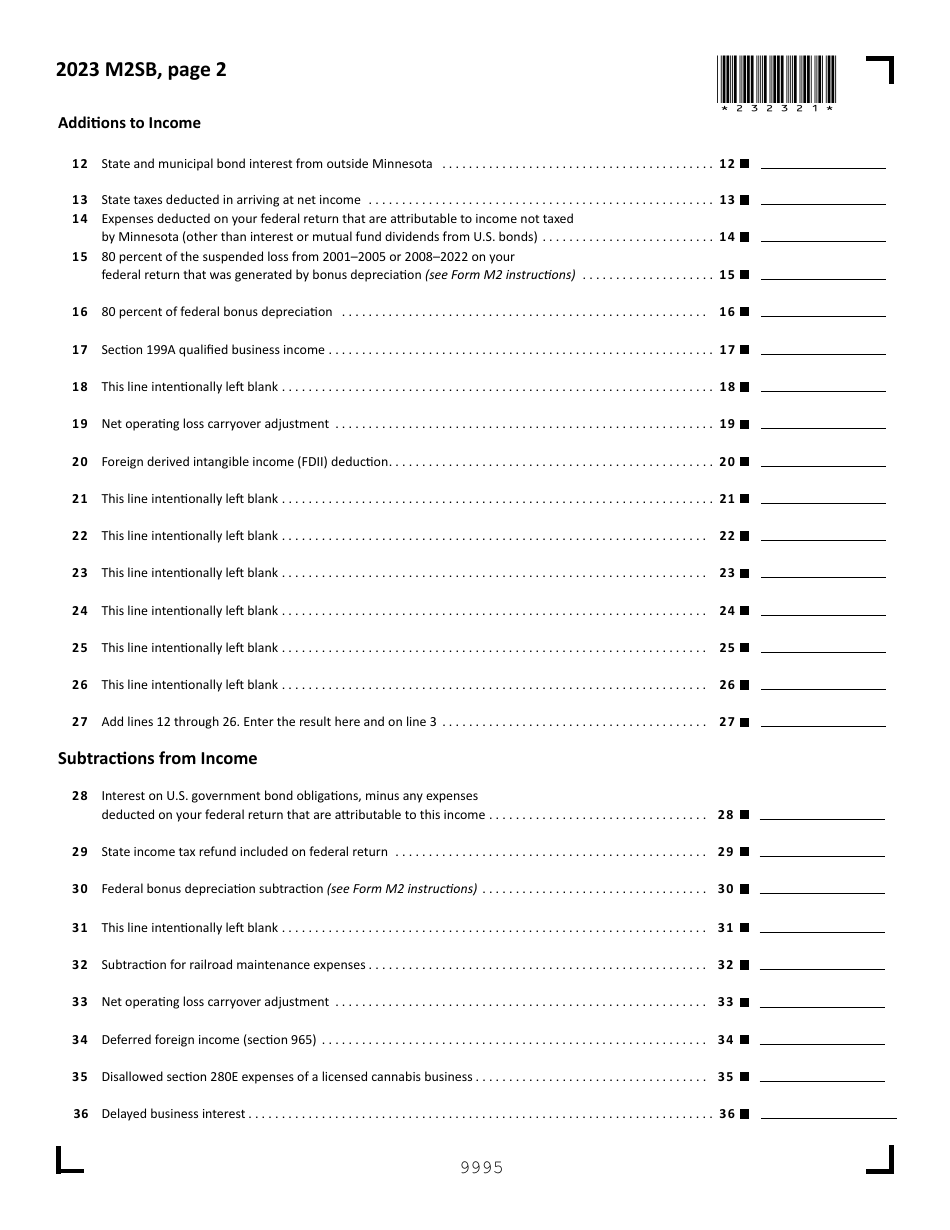

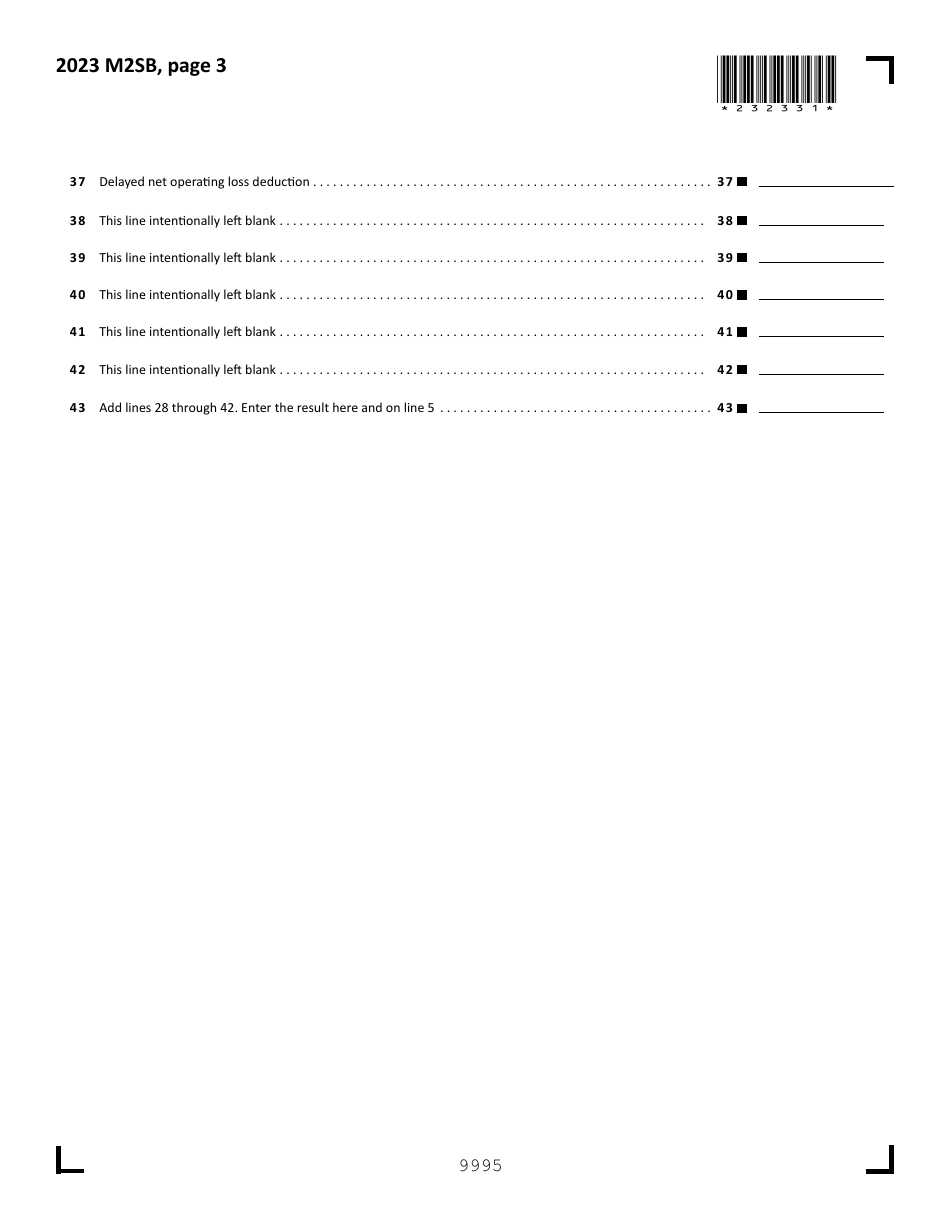

Schedule M2SB Income Tax Computation for S Portion of Esbt - Minnesota

Fill PDF Online

Fill out online for free

without registration or credit card