This version of the form is not currently in use and is provided for reference only. Download this version of

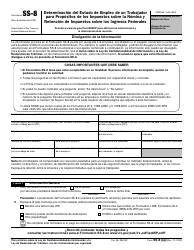

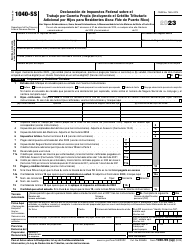

Instructions for IRS Form SS-8

for the current year.

Instructions for IRS Form SS-8 Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding

This document contains official instructions for IRS Form SS-8 , Determination of Federal Employment Taxes and Income Tax Withholding - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form SS-8?

A: IRS Form SS-8 is used to determine worker status for federal employment taxes and income tax withholding.

Q: Why is IRS Form SS-8 used?

A: IRS Form SS-8 is used to determine whether a worker is an employee or an independent contractor for tax purposes.

Q: Who needs to complete IRS Form SS-8?

A: Either the worker or the requestor (the person or entity requesting the determination) may complete Form SS-8.

Q: What information is needed to complete IRS Form SS-8?

A: You will need to provide personal information about the worker, details about the work relationship, and reasons for requesting the determination.

Q: How can IRS Form SS-8 be submitted?

A: Form SS-8 can be submitted by mail or fax to the appropriate IRS office.

Q: How long does it take to receive a determination from the IRS?

A: The IRS aims to issue a determination within 6 months from the date of receipt.

Q: What happens after the IRS makes a determination?

A: The IRS will send a determination letter to both the worker and the requester, explaining their official determination of the worker's status.

Q: What should I do if I disagree with the IRS determination?

A: If you disagree with the IRS determination, you have the right to appeal within 30 days from the date of the determination letter.

Q: Are there any penalties for misclassifying workers?

A: Yes, there can be penalties for misclassifying workers, including back taxes, interest, and potential penalties for failure to withhold and pay employment taxes.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.