This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC18

for the current year.

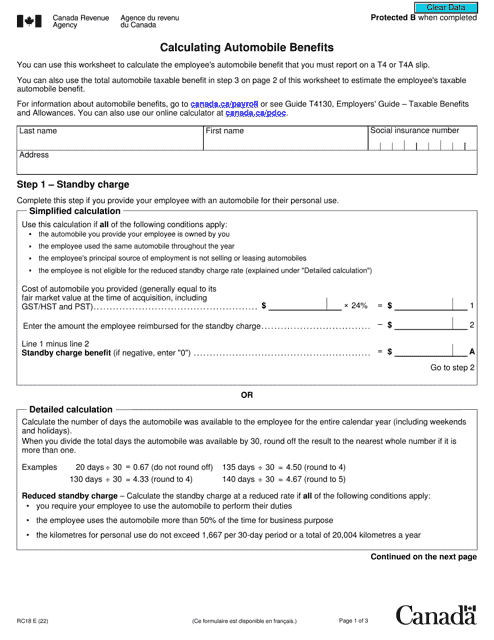

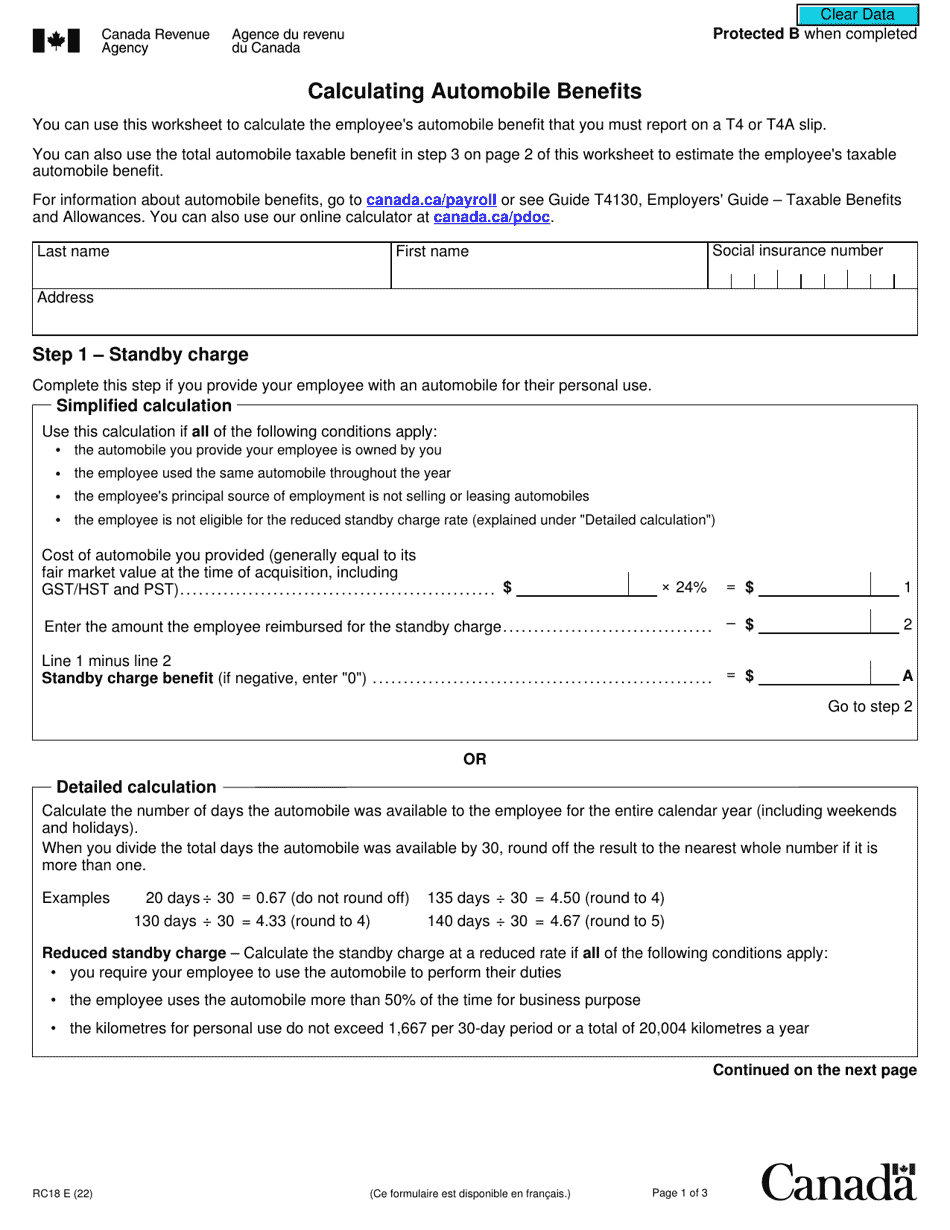

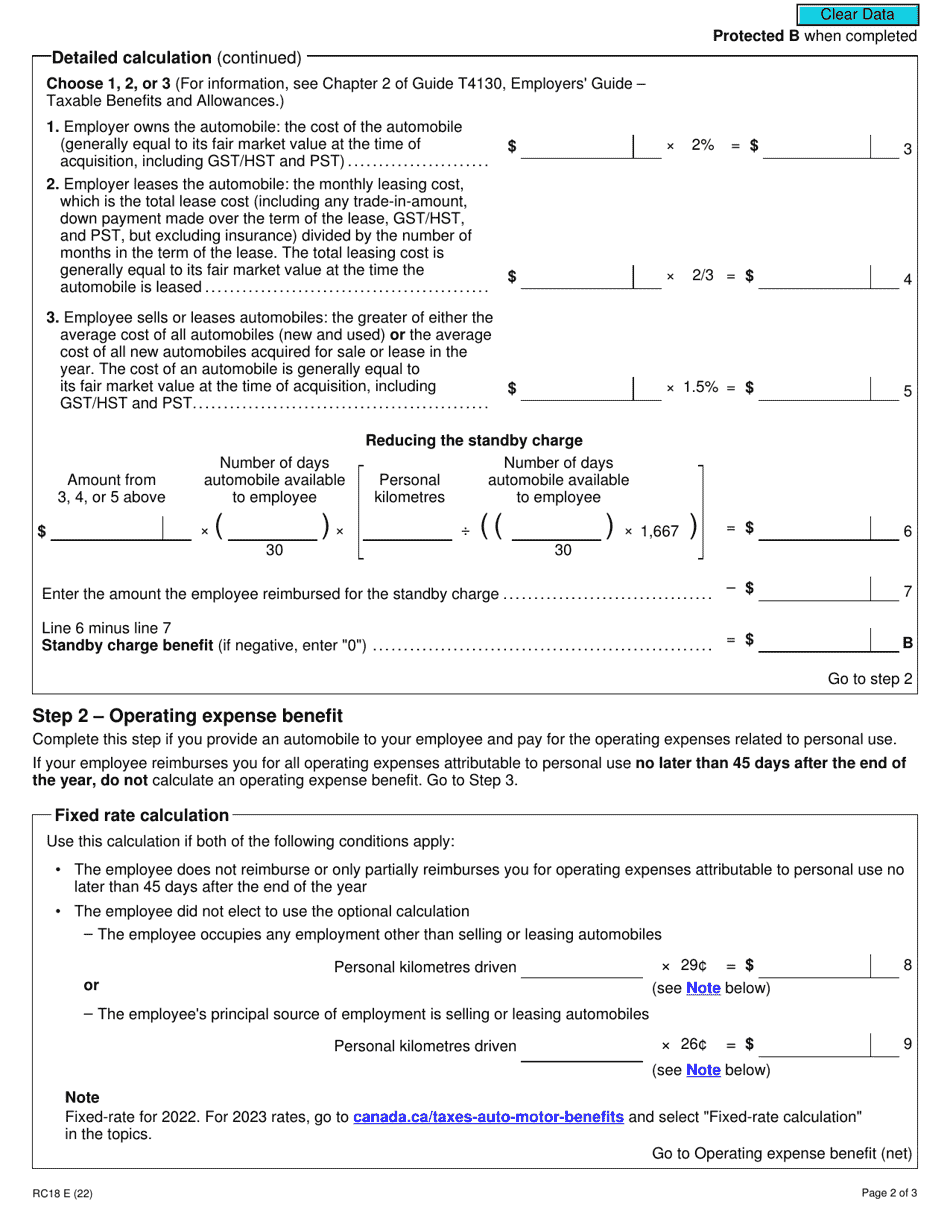

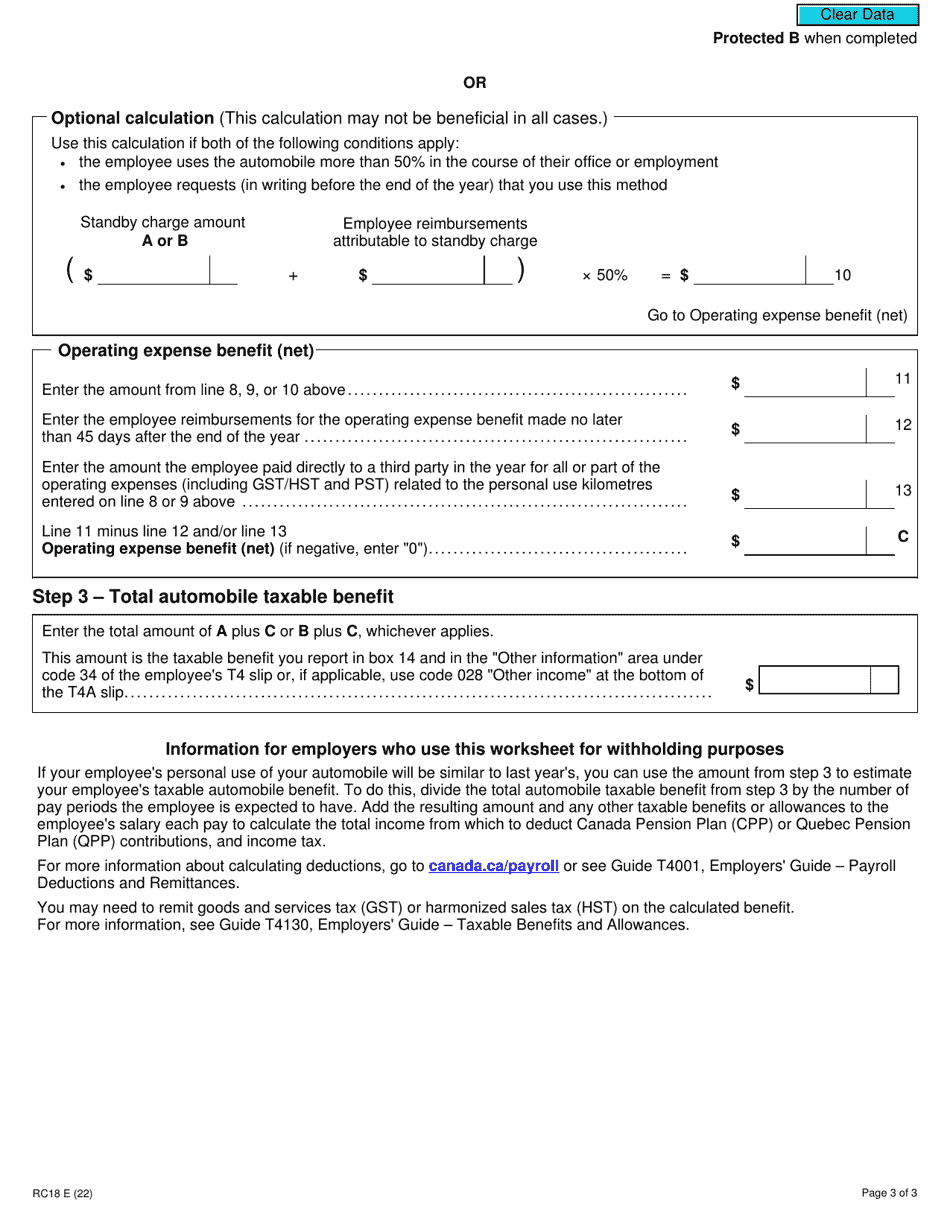

Form RC18 Calculating Automobile Benefits - Canada

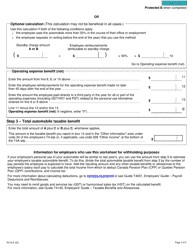

The Form RC18 "Calculating Automobile Benefits" in Canada is used for determining the taxable benefit that an employee incurs from the personal use of an employer-provided vehicle.

The employer or the person responsible for payroll usually files the Form RC18 Calculating Automobile Benefits in Canada.

FAQ

Q: What is Form RC18?

A: Form RC18 is a tax form in Canada used to calculate automobile benefits.

Q: What are automobile benefits?

A: Automobile benefits refer to the value of any personal use of a company-provided vehicle.

Q: Who needs to fill out Form RC18?

A: Form RC18 needs to be filled out by employees who use a company vehicle for personal purposes.

Q: What information is required on Form RC18?

A: Form RC18 requires details about the make, model, and year of the vehicle, and the percentage of personal use.

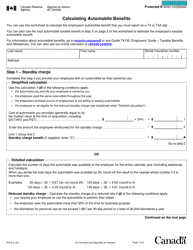

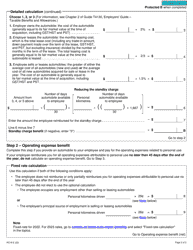

Q: How are automobile benefits calculated?

A: Automobile benefits are calculated based on the total annual distance driven, the value of the vehicle, and the percentage of personal use.

Q: Are automobile benefits taxable?

A: Yes, automobile benefits are considered a taxable benefit and need to be included in the employee's income.

Q: When is Form RC18 due?

A: Form RC18 is generally due on or before the employee's personal income tax return deadline.