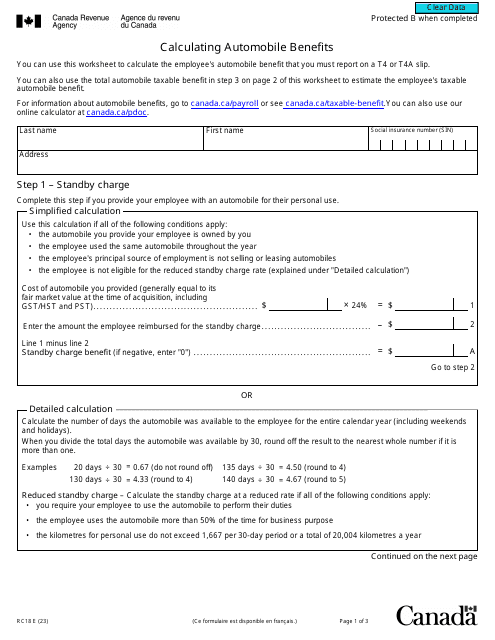

Form RC18 Calculating Automobile Benefits - Canada

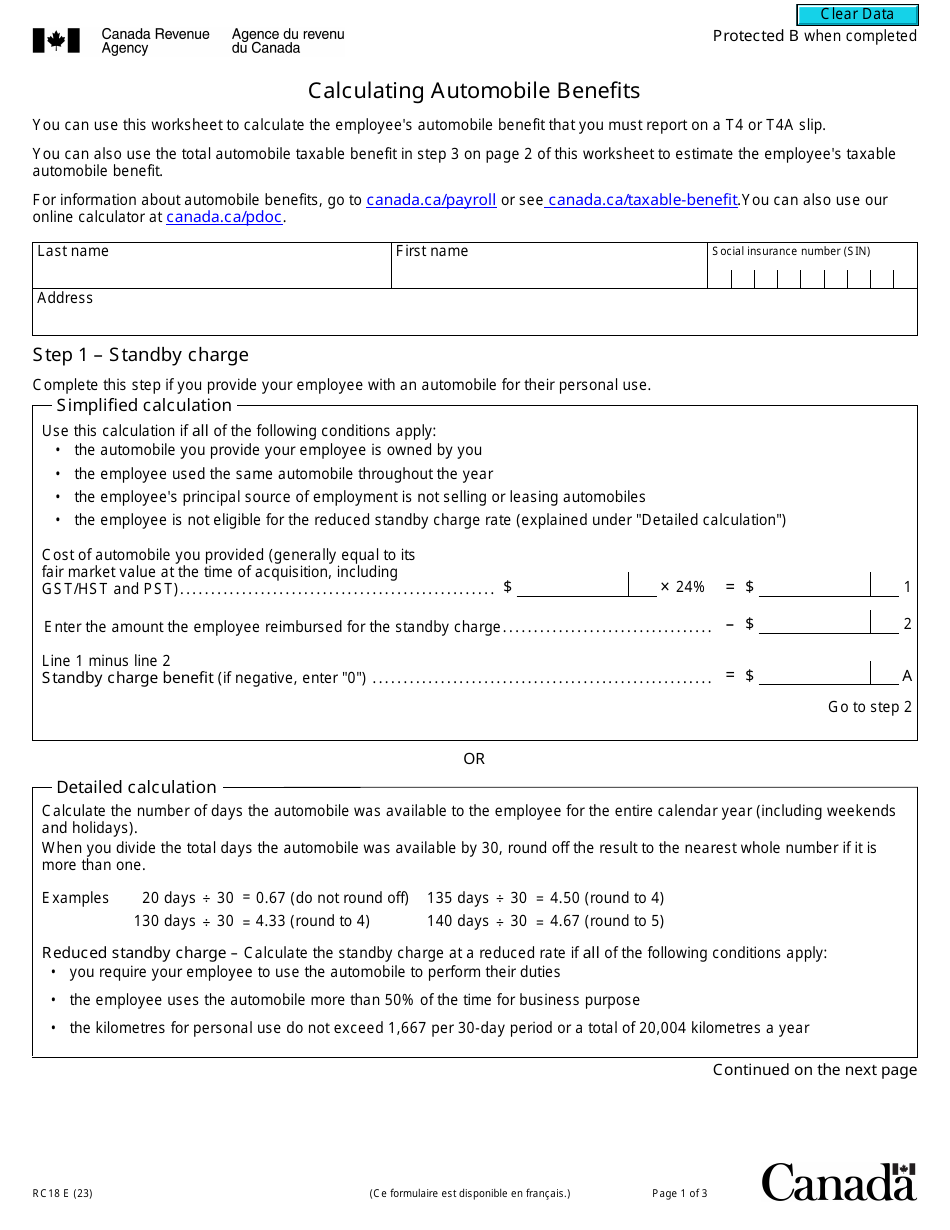

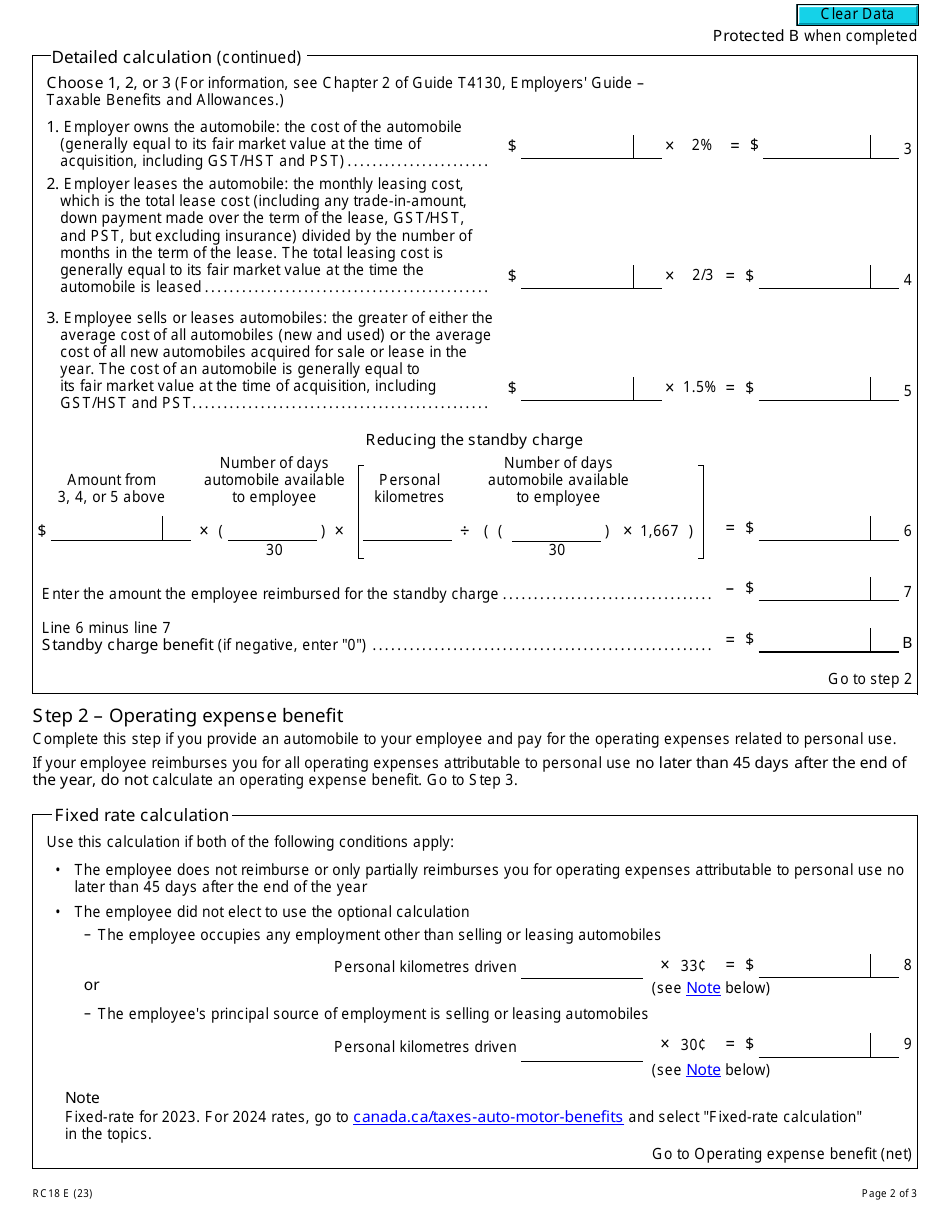

The Form RC18 "Calculating Automobile Benefits" in Canada is used for determining the taxable benefit that an employee incurs from the personal use of an employer-provided vehicle.

The employer or the person responsible for payroll usually files the Form RC18 Calculating Automobile Benefits in Canada.

Form RC18 Calculating Automobile Benefits - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC18?

A: Form RC18 is a tax form in Canada used to calculate automobile benefits.

Q: What are automobile benefits?

A: Automobile benefits refer to the value of any personal use of a company-provided vehicle.

Q: Who needs to fill out Form RC18?

A: Form RC18 needs to be filled out by employees who use a company vehicle for personal purposes.

Q: What information is required on Form RC18?

A: Form RC18 requires details about the make, model, and year of the vehicle, and the percentage of personal use.

Q: How are automobile benefits calculated?

A: Automobile benefits are calculated based on the total annual distance driven, the value of the vehicle, and the percentage of personal use.

Q: Are automobile benefits taxable?

A: Yes, automobile benefits are considered a taxable benefit and need to be included in the employee's income.

Q: When is Form RC18 due?

A: Form RC18 is generally due on or before the employee's personal income tax return deadline.