This version of the form is not currently in use and is provided for reference only. Download this version of

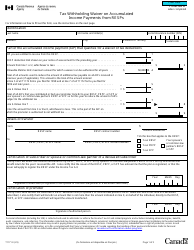

Form T1171

for the current year.

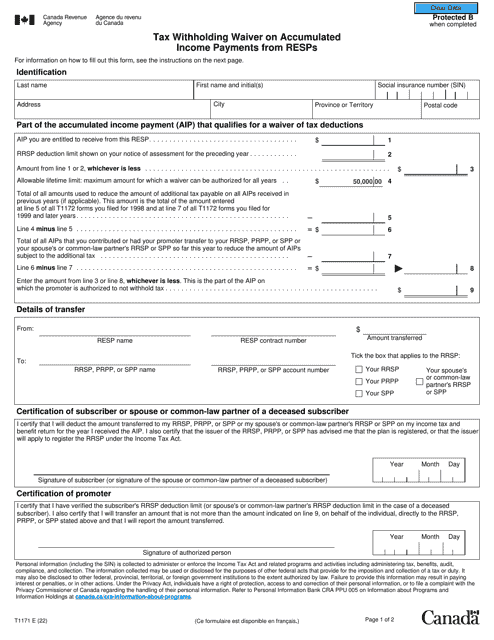

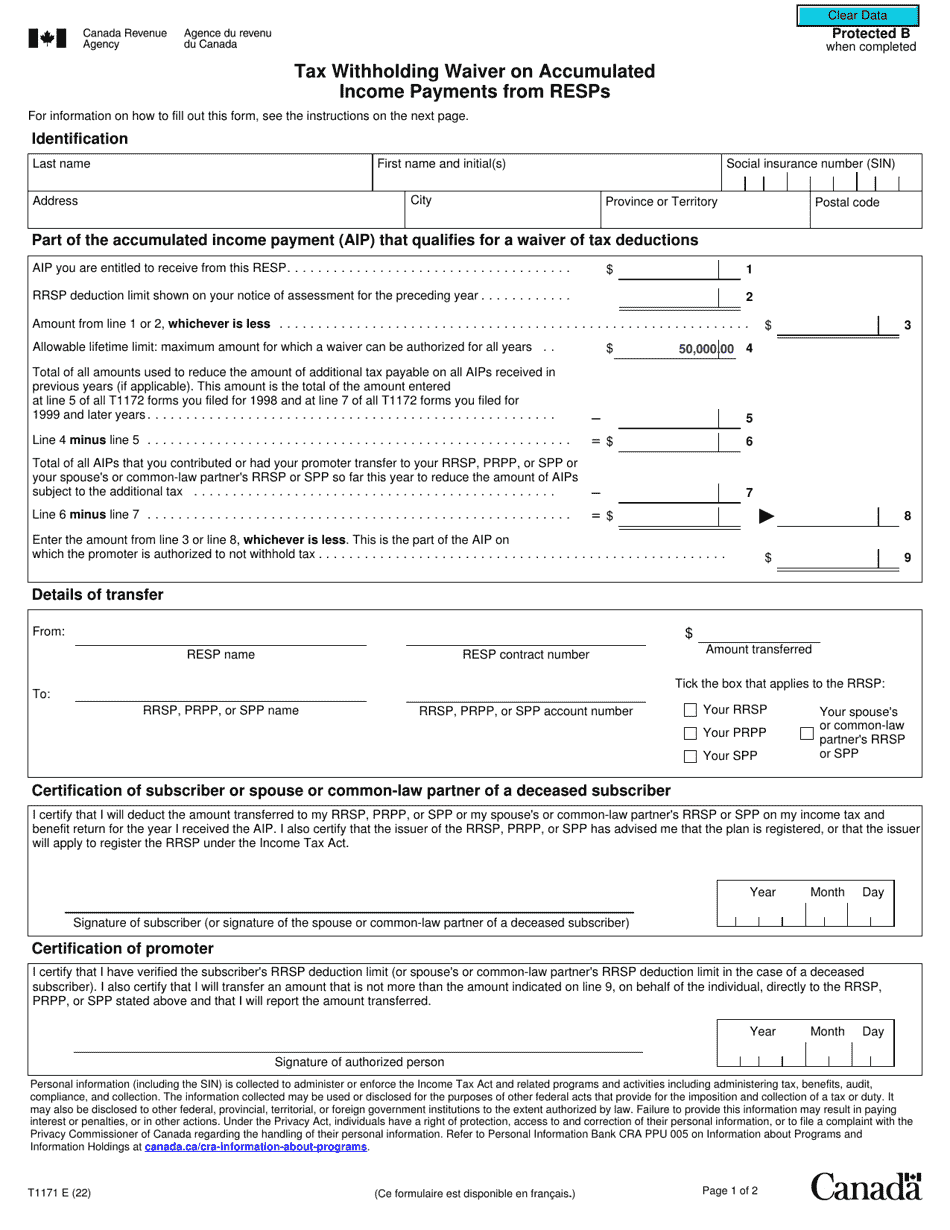

Form T1171 Tax Withholding Waiver on Accumulated Income Payments From Resps - Canada

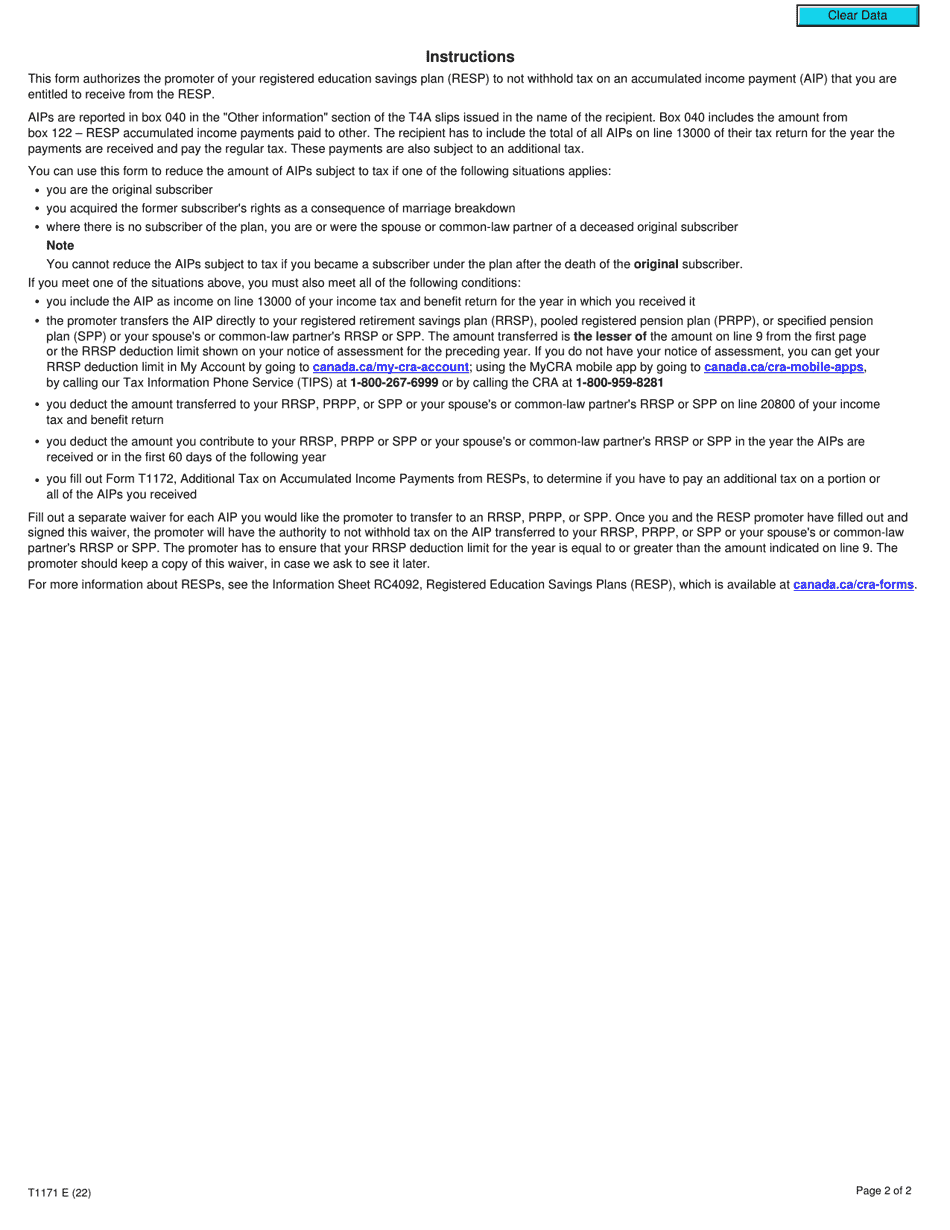

Form T1171 Tax Withholding Waiver on Accumulated Income Payments from RESPs is used in Canada to request a waiver of tax withholding on accumulated income payments from Registered Education Savings Plans (RESPs). It helps reduce the amount of tax withheld from these payments.

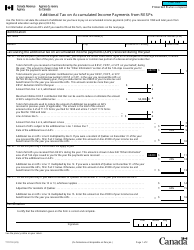

The subscriber or annuitant of the Registered Education Savings Plan (RESP) files the Form T1171 Tax Withholding Waiver on Accumulated Income Payments.

FAQ

Q: What is Form T1171?

A: Form T1171 is a tax withholding waiver on accumulated income payments from RESPs in Canada.

Q: What are accumulated income payments?

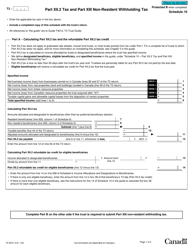

A: Accumulated income payments are the earnings and growth within a registered education savings plan (RESP).

Q: Why would I need a tax withholding waiver?

A: You would need a tax withholding waiver if you meet certain conditions and wish to withdraw the accumulated income from your RESP without having taxes withheld at source.

Q: What are the conditions for obtaining a tax withholding waiver?

A: The conditions for obtaining a tax withholding waiver include being a resident of Canada, having unused RESP contribution room, and providing proof of enrollment in a qualifying post-secondary institution.

Q: How do I apply for a tax withholding waiver using Form T1171?

A: To apply for a tax withholding waiver using Form T1171, you must complete and submit the form to the Canada Revenue Agency (CRA) along with supporting documents.

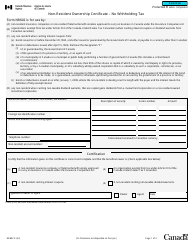

Q: Can I apply for a tax withholding waiver retroactively?

A: No, you cannot apply for a tax withholding waiver retroactively. The waiver must be obtained prior to the withdrawal of accumulated income from the RESP.

Q: What happens if I don't have a tax withholding waiver?

A: If you do not have a tax withholding waiver, the financial institution holding your RESP will be required to withhold taxes at a prescribed rate on the accumulated income payments.

Q: Is the tax withholding waiver applicable to all types of withdrawals from an RESP?

A: No, the tax withholding waiver applies specifically to accumulated income payments. It does not apply to other types of withdrawals, such as contributions or grants.

Q: Can I transfer my tax withholding waiver to someone else?

A: No, the tax withholding waiver is specific to the individual beneficiary of the RESP and cannot be transferred to another person.