Form T1171 Tax Withholding Waiver on Accumulated Income Payments From Resps - Canada

Fill PDF Online

Fill out online for free

without registration or credit card

What Is Form T1171?

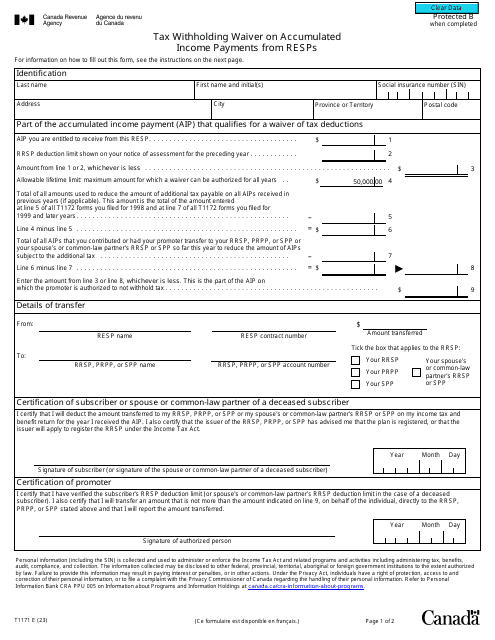

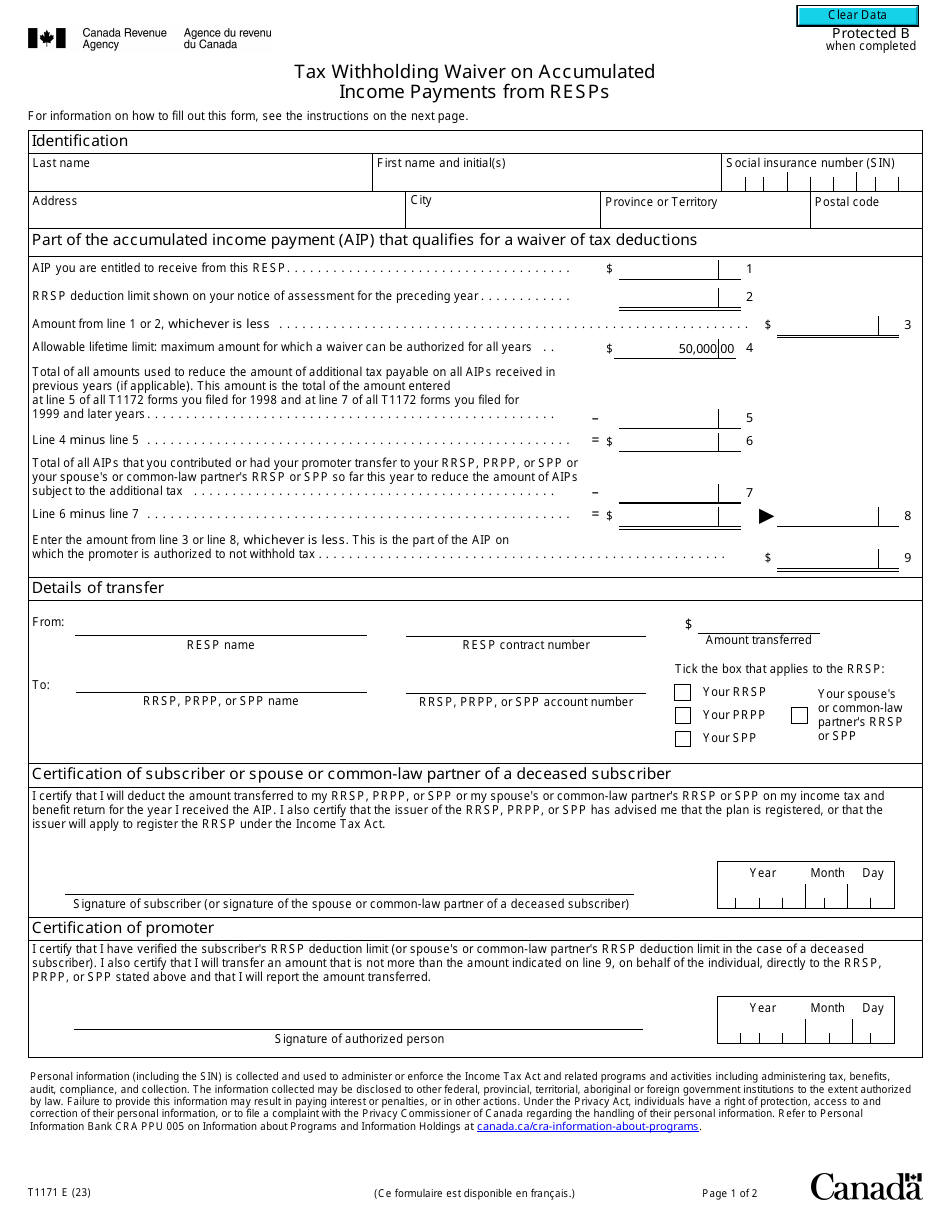

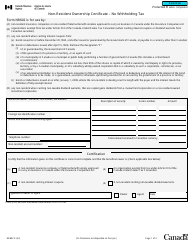

Form T1171, Tax Withholding Waiver on Accumulated Income Payments From RESPs , is a formal document a Canadian resident fills out to inform their Registered Education Savings Plan (RESP) provider - a financial institution like a trust company or bank - about their decision to withhold tax payments on Accumulated Income Payments (AIPs) they are eligible to receive from the RESP.

Alternate Name:

- RESP Tax Form.

This form was issued by the Canadian Revenue Agency (CRA) on January 1, 2023 , with all previous editions obsolete. You can download a fillable RESP Tax Form through the link below.

Form T1171 Instructions

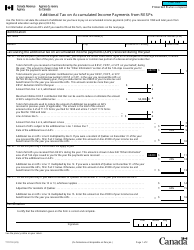

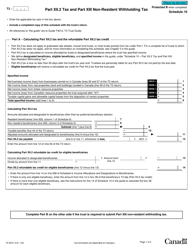

Follow these steps to prepare the T1171 Form:

- Enter your full name, social insurance number, and current address. Write down the amount of the AIP you are going to receive.

- State the deduction limit on the registered retirement savings plan - you can find it in the notice of assessment you have received for the previous year. Record the smaller amount on the third line of the form.

- Calculate the total amount of money you have saved in previous years. Deduct the number above from the allowable lifetime limit of $50,000.

- Indicate the total amount you and your spouse or common-law partner have put into your savings this year.

- Deduct the number above from the sum of money you have computed for Line 6. Choose the lower number between Lines 3 and 8 and write it down - this will be considered the AIP part on which you authorize the promoter not to withhold tax.

- State the name of the provider and the number of the contract you have signed with them.

- Indicate the amount of money transferred and specify the recipient - the name of the savings plan and the account number. Check the box to show which savings plan will remain untouched and who it belongs to.