This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2200

for the current year.

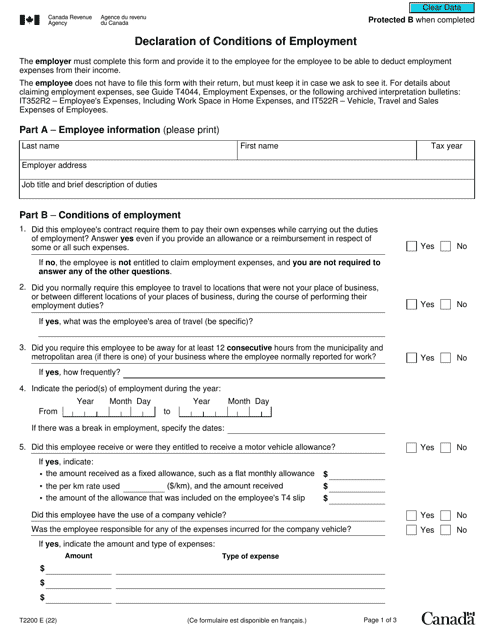

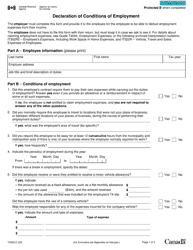

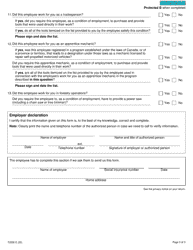

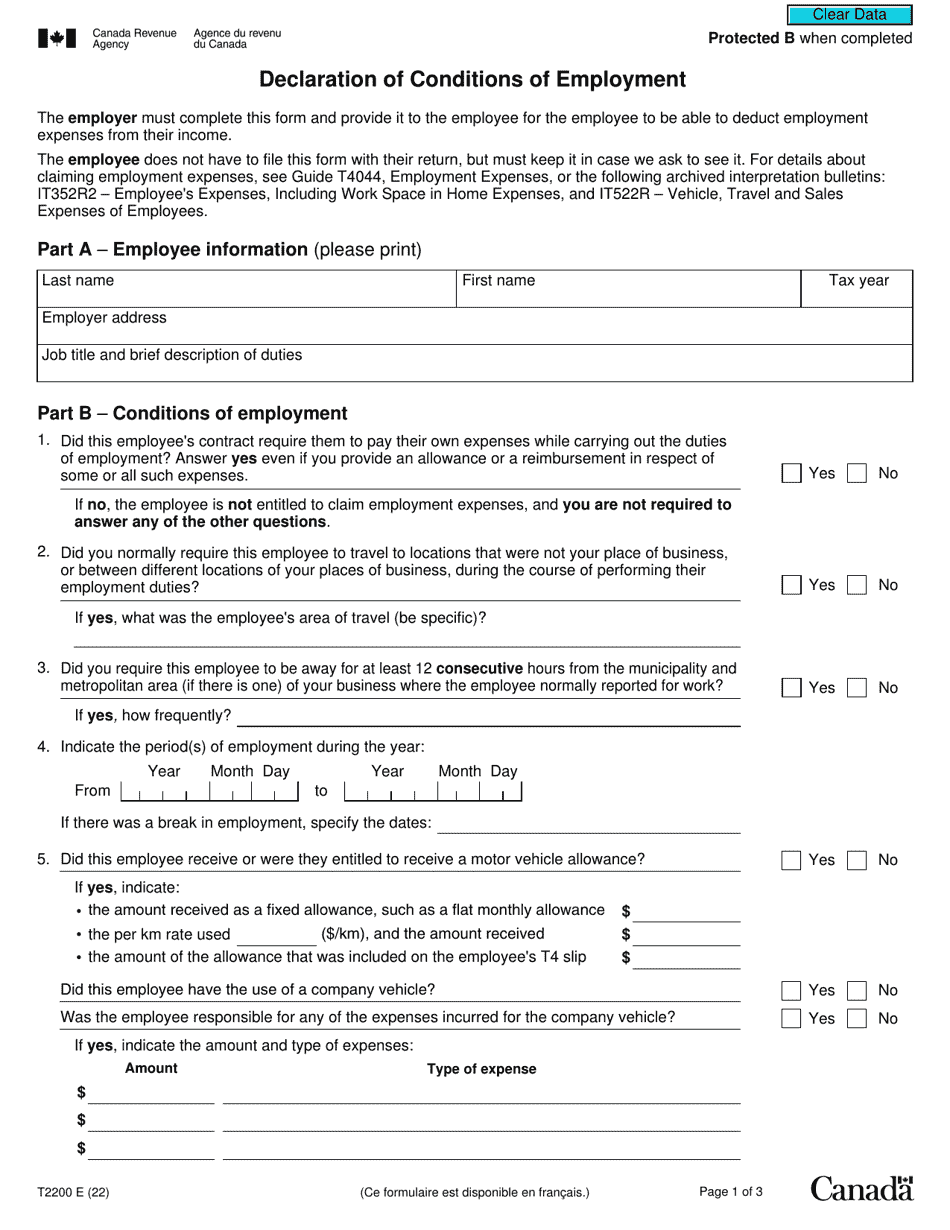

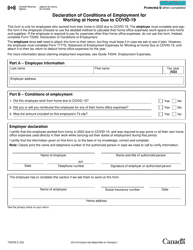

Form T2200 Declaration of Conditions of Employment - Canada

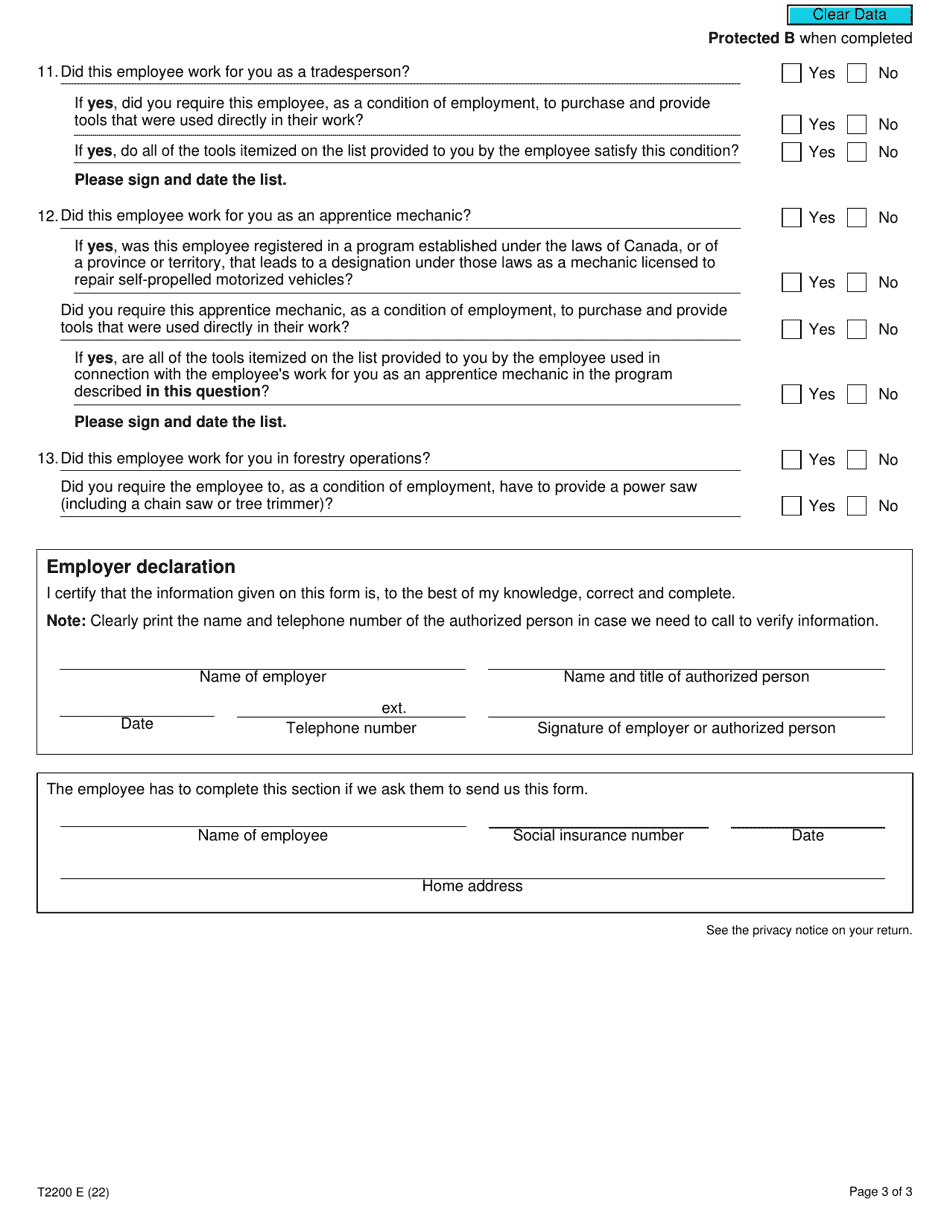

The Form T2200 Declaration of Conditions of Employment in Canada is used by employees to claim certain employment expenses as deductions on their personal income tax return. It is provided by the employer to certify that the employee is required to cover expenses related to their job duties.

The Form T2200 Declaration of Conditions of Employment in Canada is filed by employees.

FAQ

Q: What is Form T2200?

A: Form T2200 is a declaration of conditions of employment for Canadian employees.

Q: Who needs to fill out Form T2200?

A: Employees who incur employment expenses that are not reimbursed by their employer may need to fill out Form T2200.

Q: What is the purpose of Form T2200?

A: The purpose of Form T2200 is to certify that an employee is required to pay for certain expenses related to their employment.

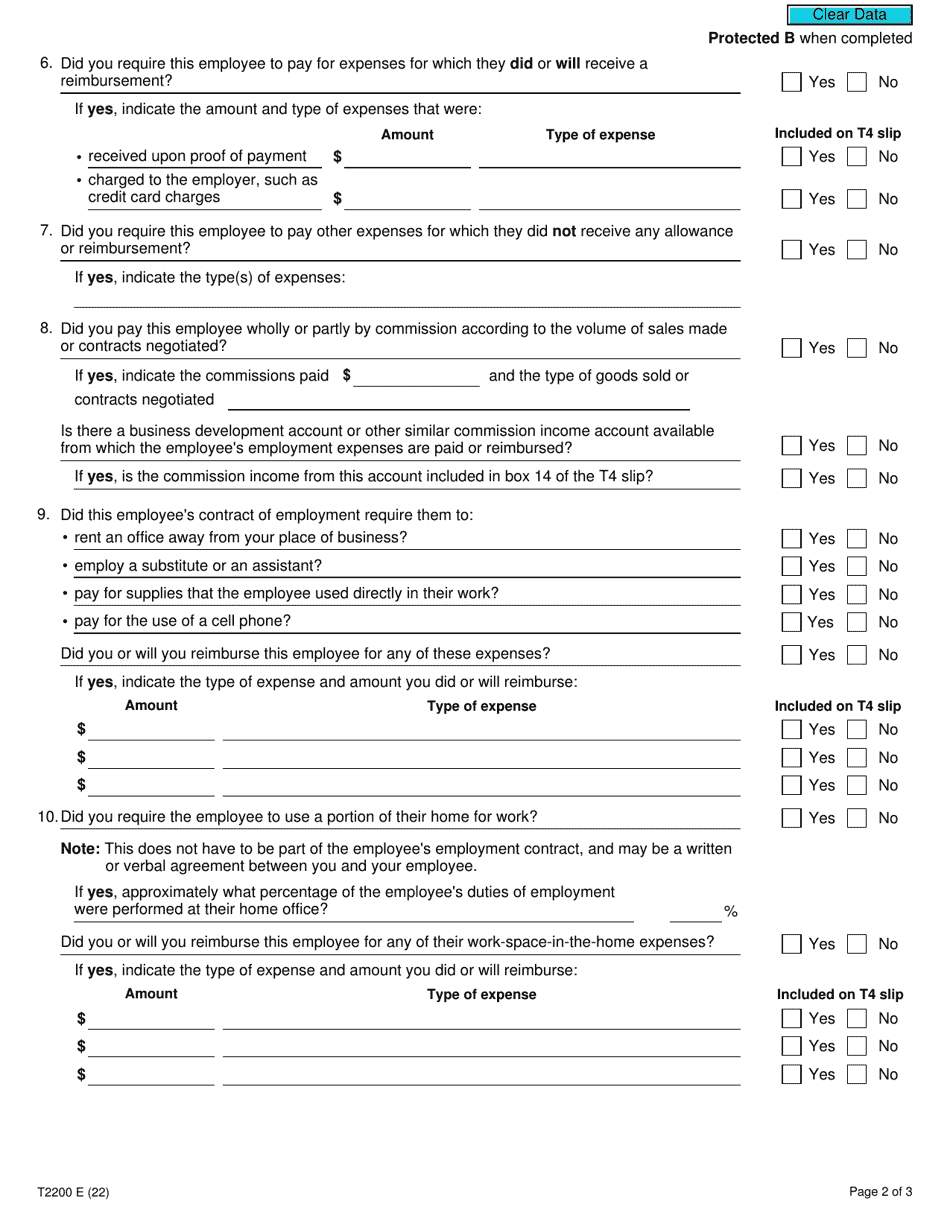

Q: What expenses can be claimed on Form T2200?

A: Expenses such as vehicle expenses, home office expenses, and certain work supplies may be claimed on Form T2200.

Q: Are all expenses fully deductible on Form T2200?

A: No, only expenses that meet specific criteria outlined by the Canada Revenue Agency can be claimed.

Q: Do I need to submit Form T2200 with my tax return?

A: Form T2200 does not need to be submitted with your tax return, but you should keep it on file in case the CRA requests it for verification.