Form T2200 Declaration of Conditions of Employment - Canada

What Is Form T2200?

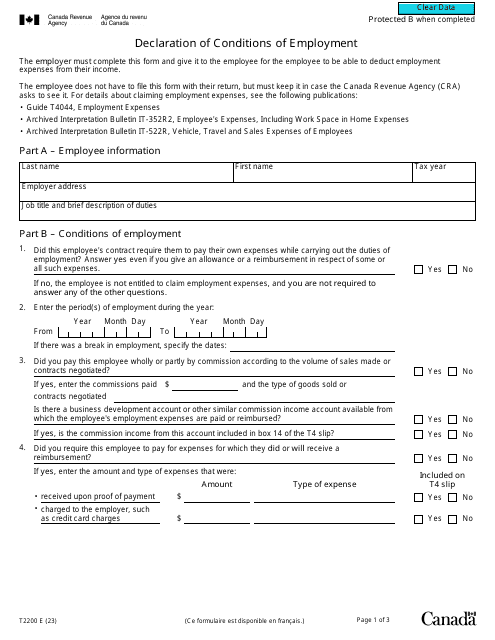

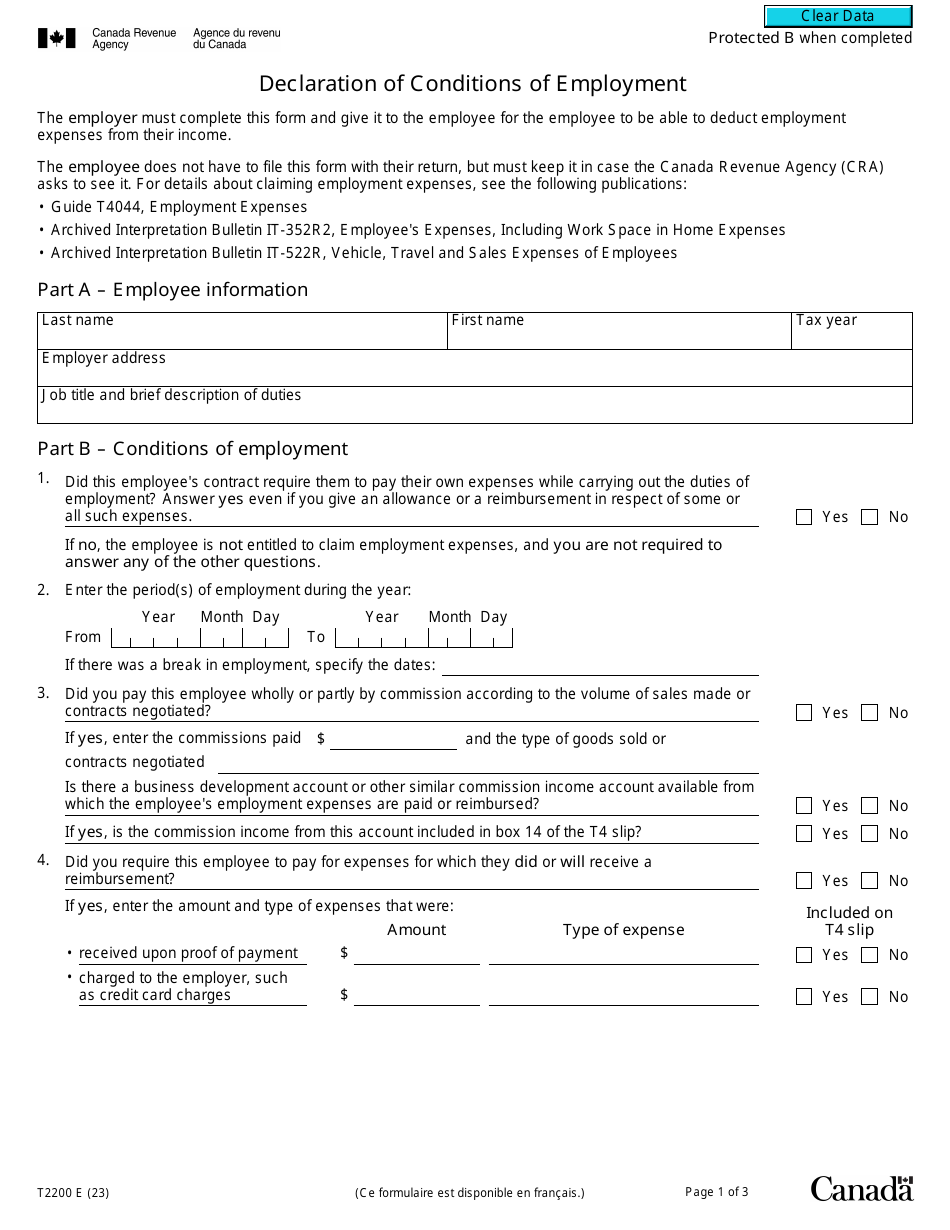

Form T2200, Declaration of Conditions of Employment , is a document that is supposed to be completed by an employer and given to their employee. The purpose of the document is to provide the employee with information about employment expenses that can be deducted from their income. This form was issued by the Canadian Revenue Agency (CRA) and was last revised on . A fillable T2200 Form is available for download below.

Alternate Names:

- T2200 Tax Form;

- T2200 Income Tax Form.

After the employer has completed Tax Form T2200 they are supposed to hand it to their employee, who must keep it in their records in case the CRA will ask to see it. The employee can use the information presented in the form to deduct work expenses. These expenses can include supplies, advertising, parking, etc. To learn more about what kind of expenses are considered work expenses and which part of them can be deducted the employee can check out the official website of the Government of Canada or see Form T4044, Employment Expenses.

How to Fill Out T2200 Form?

Tax Form T2200 is presented on three pages and contains four parts. These parts include:

- Introduction. The document starts with a title and instructions about the purpose of the document, who must complete it, and what to do with it after it has been filled out.

- Information About the Employee. In the first part of the document, the employer is supposed to designate the personal information of their employee. It includes their full name, tax year, and social insurance number. In addition to this, the employer must designate the home address and business address of their employee, their job title, and a brief description of their abilities.

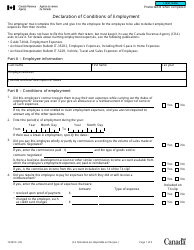

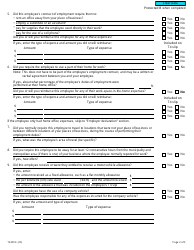

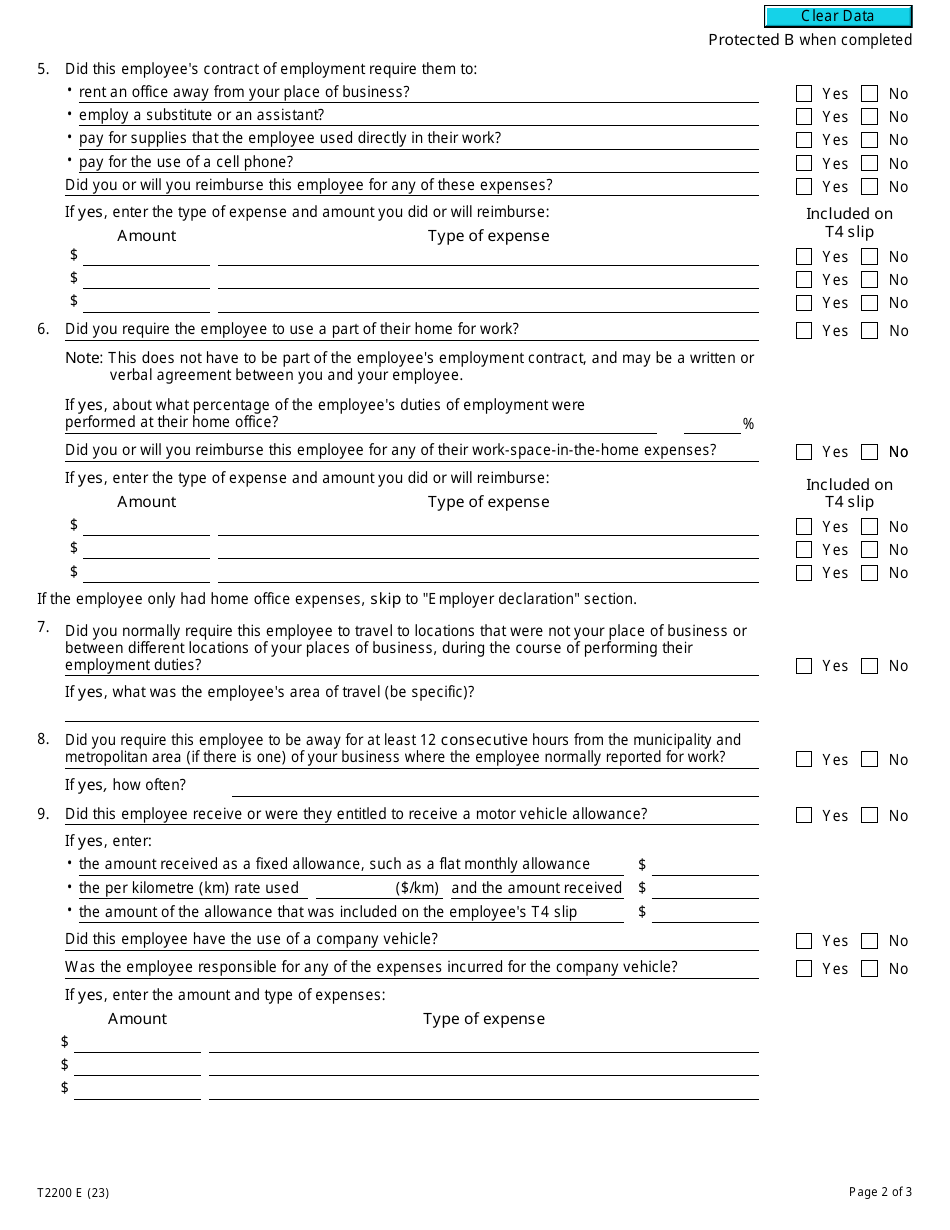

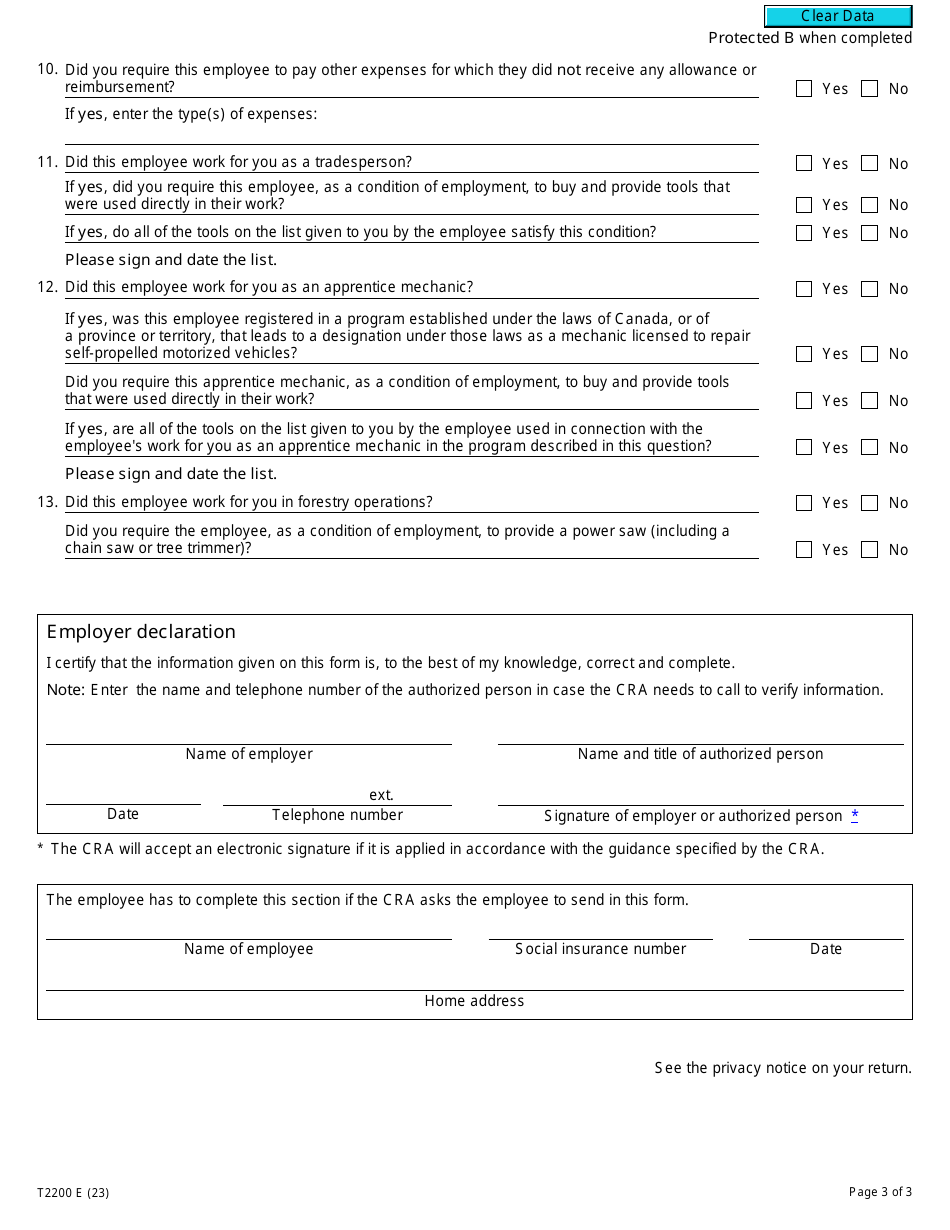

- Conditions of Employment. This is the biggest section of the form and includes 13 questions that the employer must answer. By answering them, the employer will describe the conditions the employee is working in, their employment period, whether they are entitled to a motor vehicle, whether they are required to pay work expenses without receiving an allowance, etc. The employer must also state whether the employment contract requires the employee to rent an office, employ an assistant, or pay for a cell phone. This information will determine what amounts the employee will be able to deduct from their income, therefore the employer must be precise and honest in their answers.

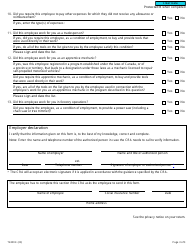

- Employer Declaration. At the end of the form, the employer must certify that the information presented in the form is true and correct. They must indicate the name of the employer, the name and title of the person who is authorized by the employer, telephone number, signature, and the date when the document was signed.