This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1198

for the current year.

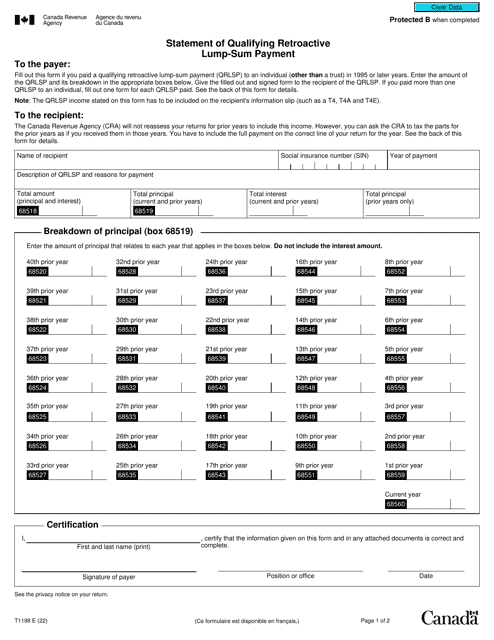

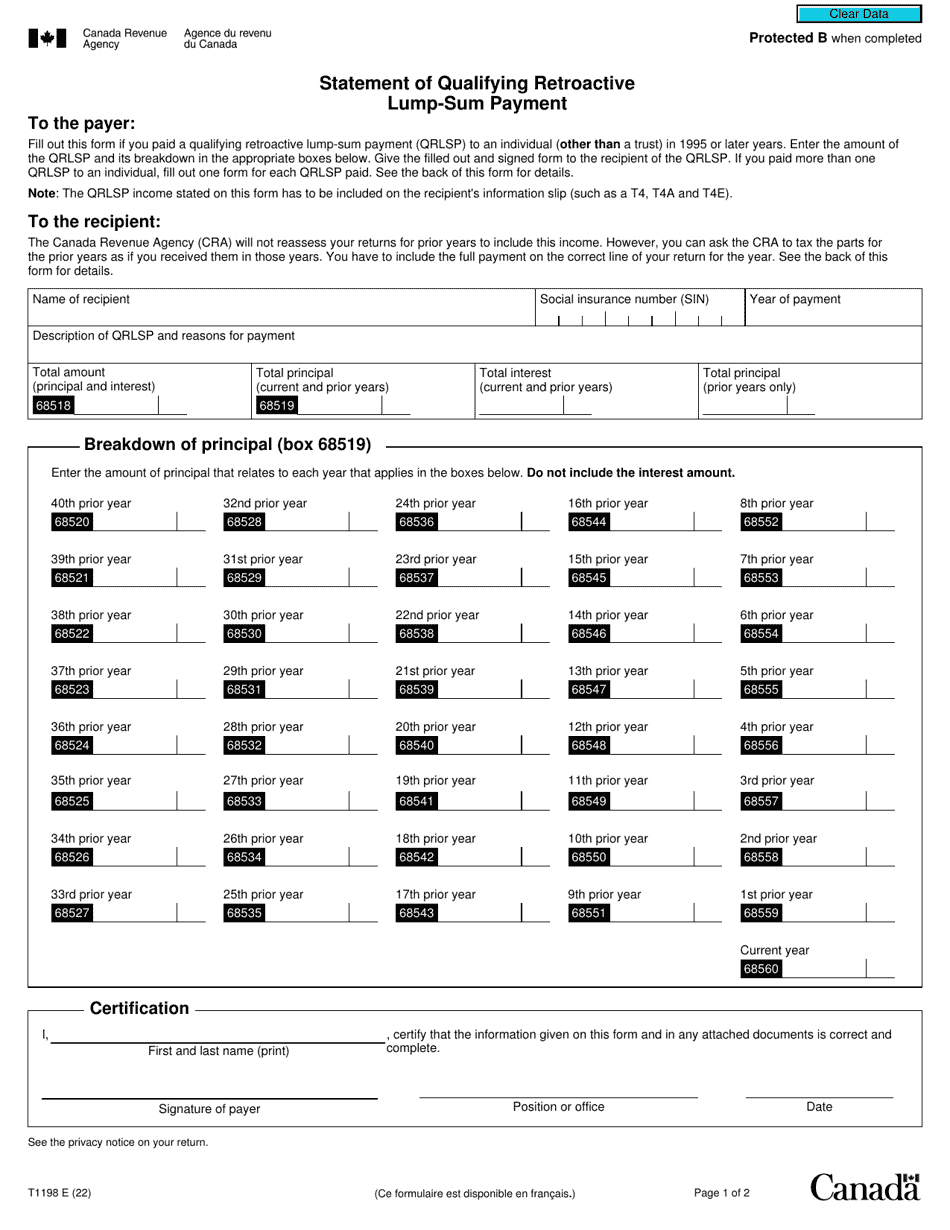

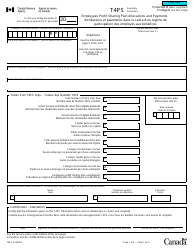

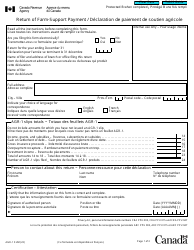

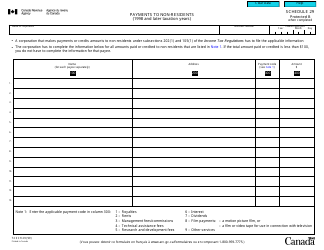

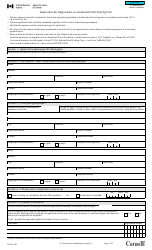

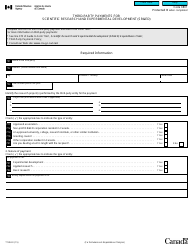

Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment - Canada

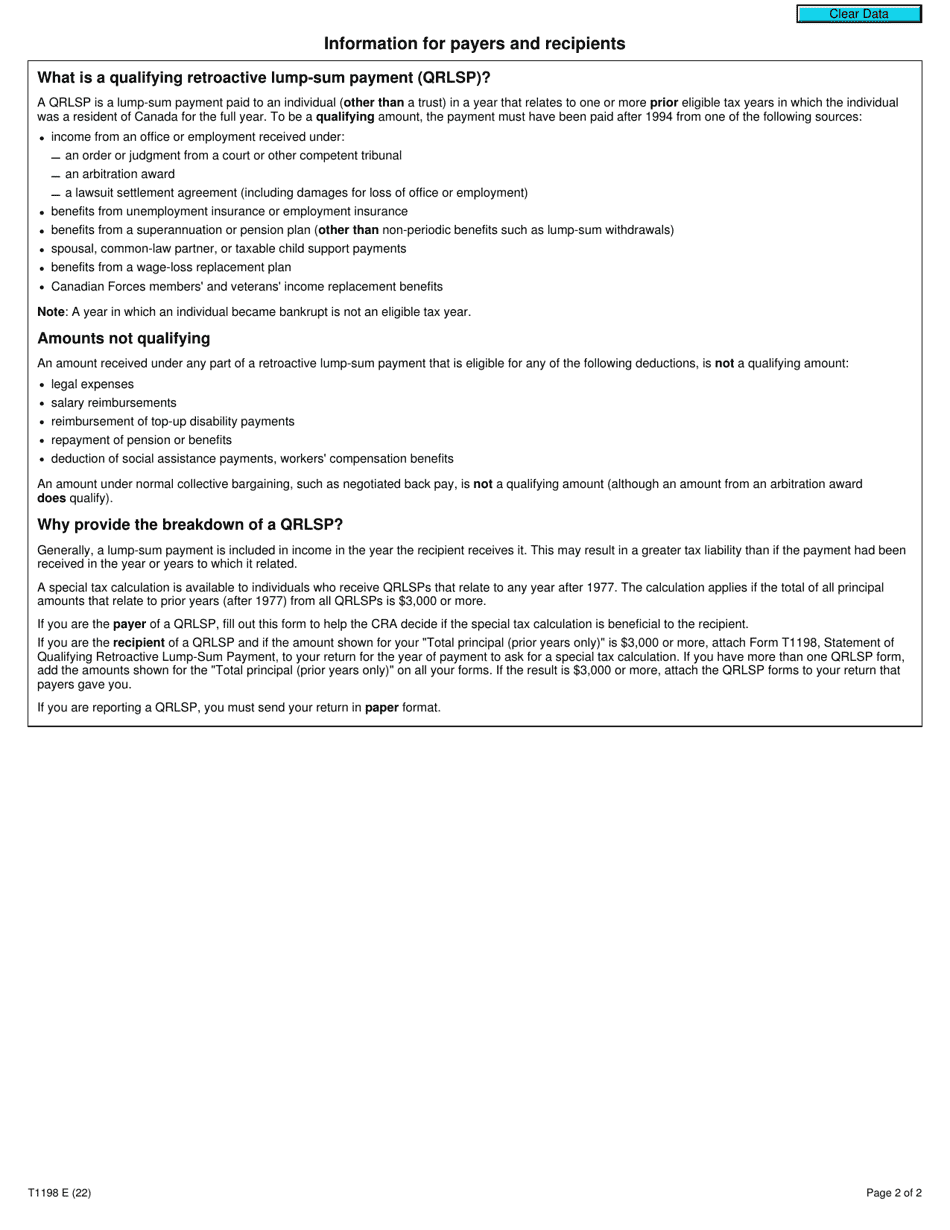

Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment in Canada is used to report any retroactive lump-sum payments received, such as a pension or salary arrears, that may be eligible for special tax treatment. The form helps determine the amount of income that qualifies for this treatment.

The individual receiving the qualifying retroactive lump-sum payment in Canada must file the Form T1198.

FAQ

Q: What is Form T1198?

A: Form T1198 is the Statement of Qualifying Retroactive Lump-Sum Payment in Canada.

Q: What is a Qualifying Retroactive Lump-Sum Payment?

A: A Qualifying Retroactive Lump-Sum Payment refers to a lump sum amount of money that is received in a current tax year, but is for a previous tax year.

Q: Who needs to complete Form T1198?

A: Individuals who receive a Qualifying Retroactive Lump-Sum Payment need to complete Form T1198.

Q: What information is required on Form T1198?

A: Form T1198 requires information about the individual, the payment received, and the tax year to which the payment relates.

Q: What is the purpose of Form T1198?

A: Form T1198 is used to report and calculate the tax payable on a Qualifying Retroactive Lump-Sum Payment.