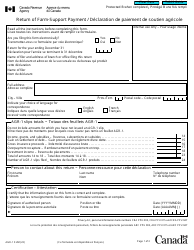

Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment - Canada

What Is Form T1198?

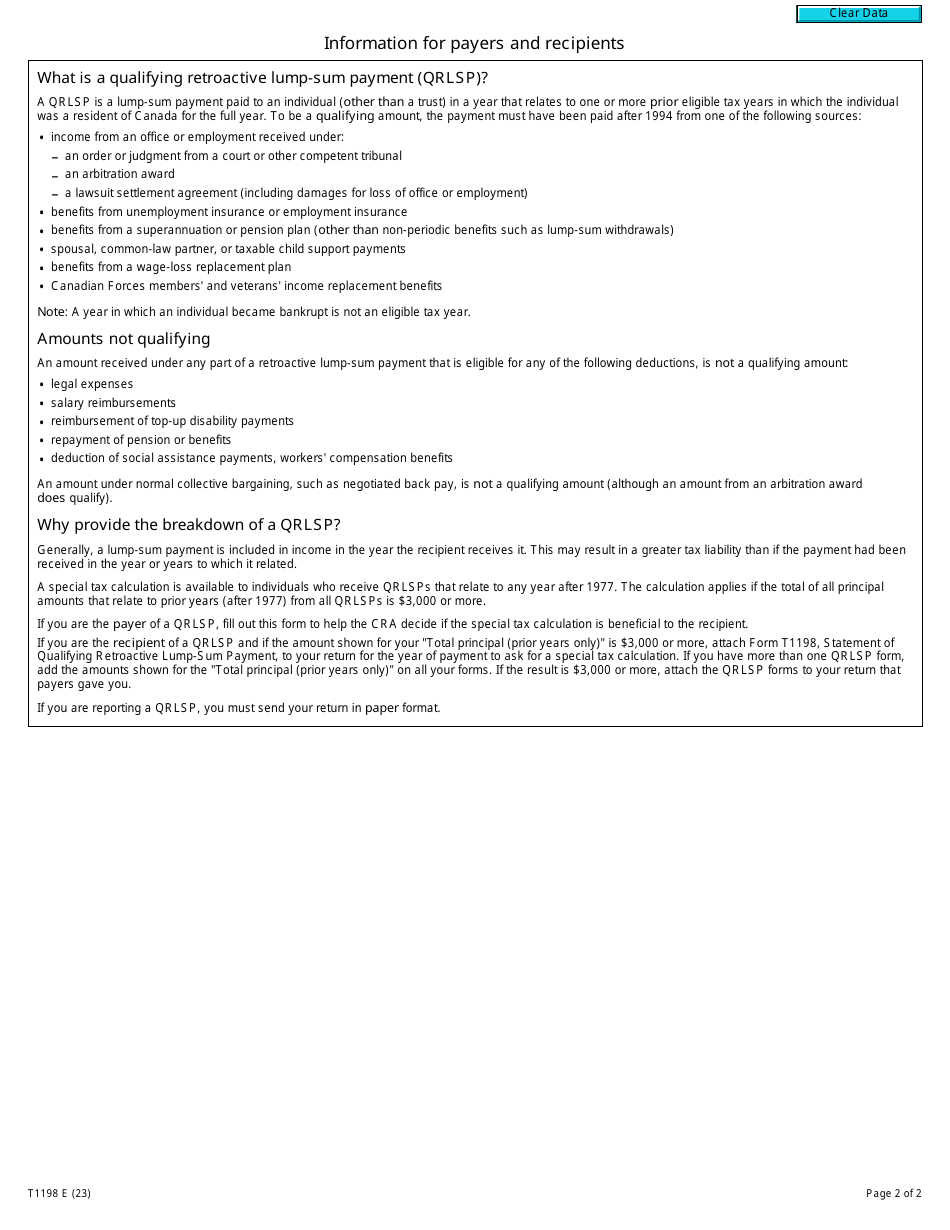

Form T1198, Statement of Qualifying Retroactive Lump-Sum Payment , is a legal document that individuals and companies residing in Canada can fill out if they paid a lump-sum payment in the last twenty-five years to ask the tax authorities to compute taxes differently for the beneficiary and spare them from the necessity to pay all taxes at once.

This form was issued by the Canadian Revenue Agency (CRA). The latest version of the document was released on January 1, 2023 , with all previous editions obsolete. Download a fillable Form T1198 via the link below.

If you got a significant amount of money from a former spouse who finally sent you money to compensate the child support they owed, obtained money after a court order or lawsuit settlement, or received insurance, pension, or income replacement benefits, you may face tax liability that is difficult to cope with. In this case, the person or entity that provided the lump-sum payment needs to file this statement on your behalf - the tax amount will be adjusted and spread over several years.

Form T1198 Instructions

Follow these steps to prepare Form T1198:

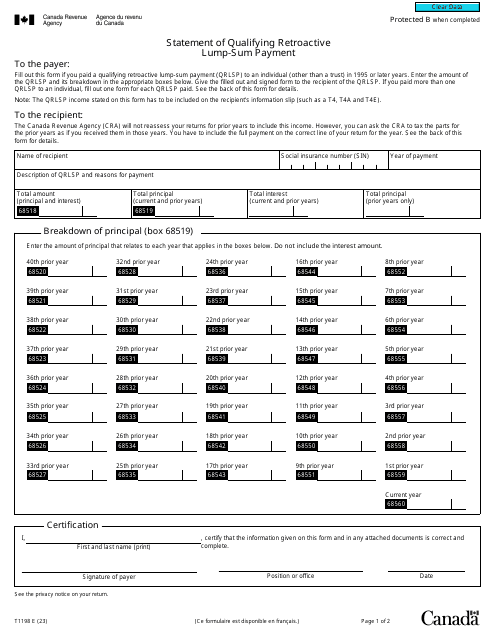

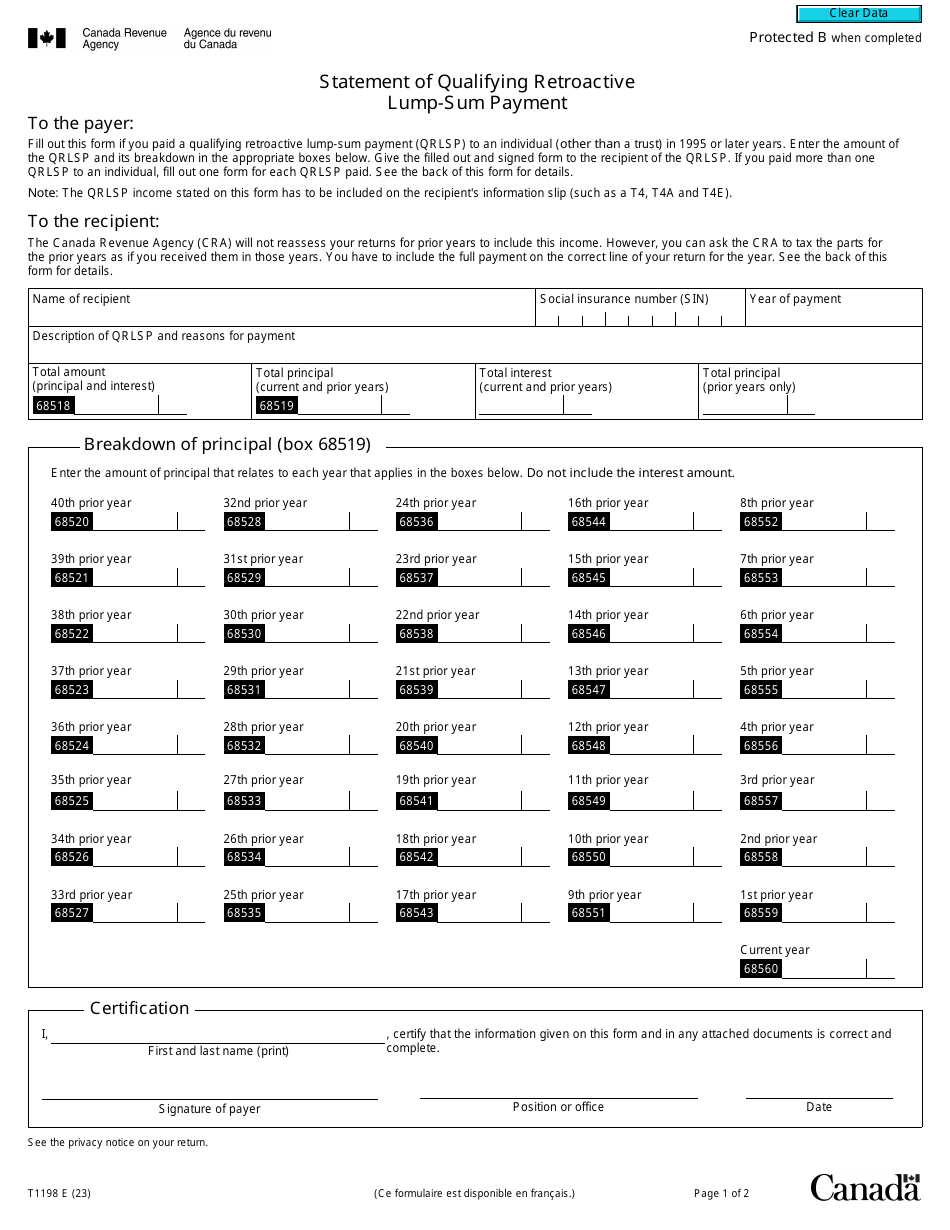

- Indicate the recipient's name, social insurance number, and the year you have made the payment.

- Describe the payment obtained by the recipient and list the circumstances under which it was paid - for instance, the former spouse has provided the recipient with a considerable sum of money considered child support or the beneficiary has claimed unemployment benefits from their insurance provider.

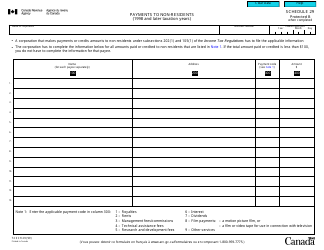

- Write down the total amount of money that was provided and the total principal for the current year and all prior years. Enter the total interest on the lump-sum payment. Provide a breakdown of the principal - record the principal amount for each applicable year without the interest.

- Confirm the information in the form is true and correct to the best of your knowledge, sign the document, state your office or position if applicable, and date the document.

Once the statement is prepared, attach it to your tax documentation and submit all files to the CRA by mail or in person - do not file the information online.