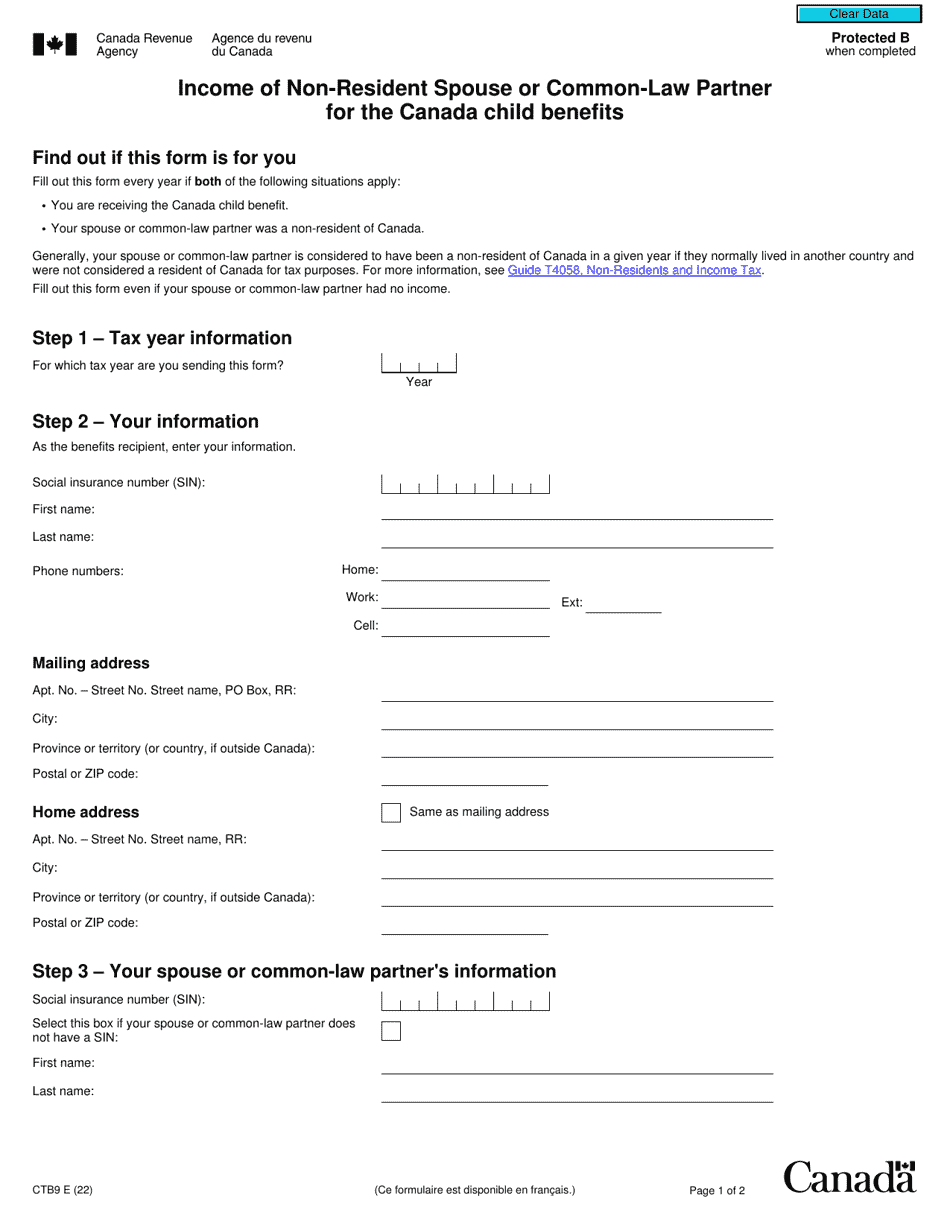

This version of the form is not currently in use and is provided for reference only. Download this version of

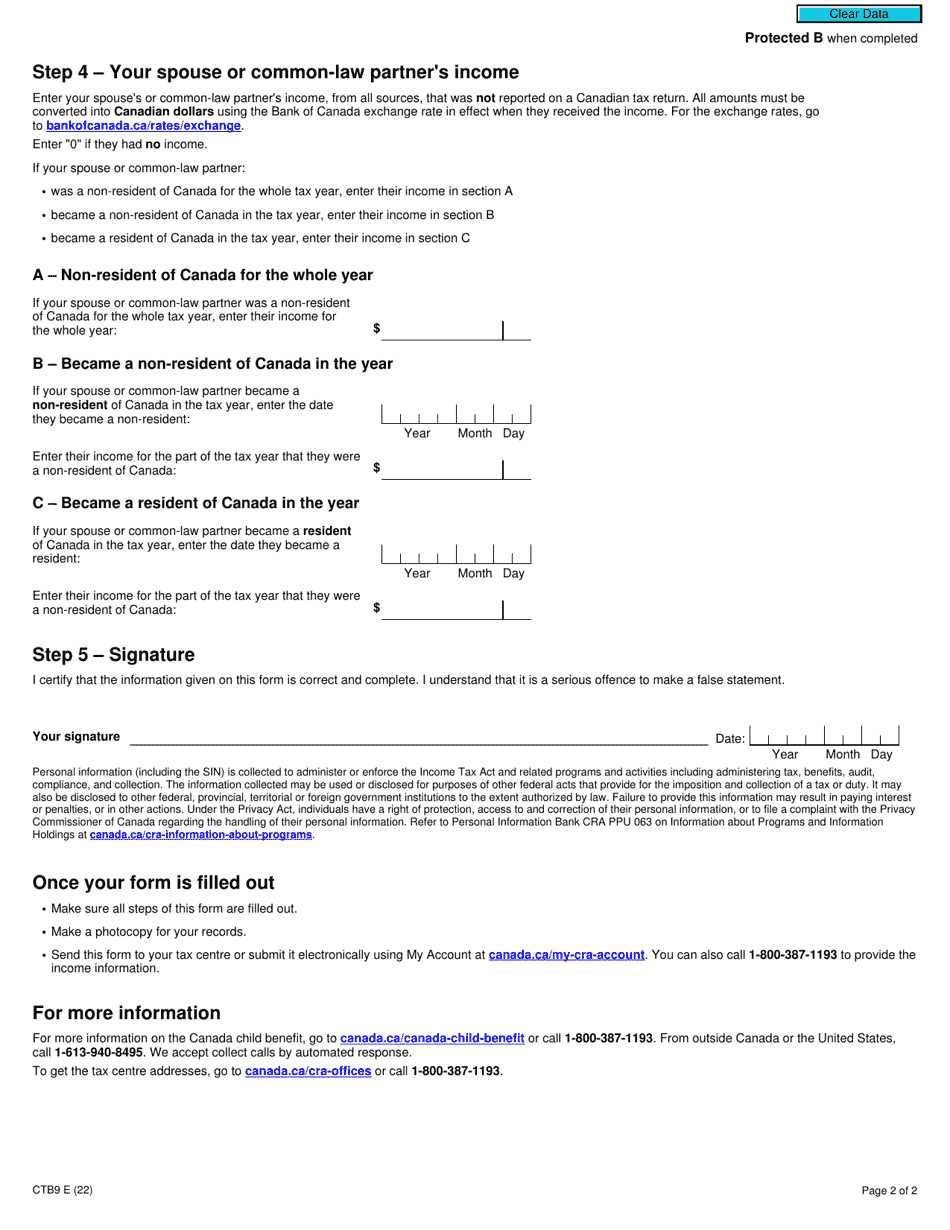

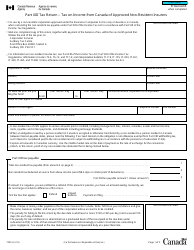

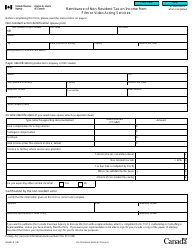

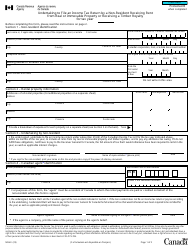

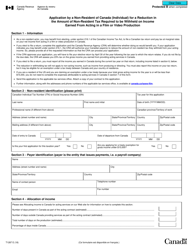

Form CTB9

for the current year.

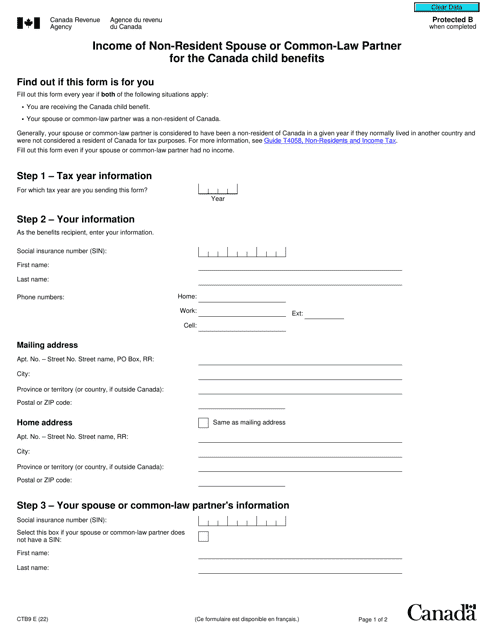

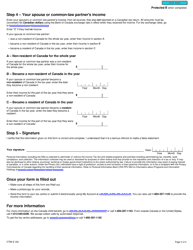

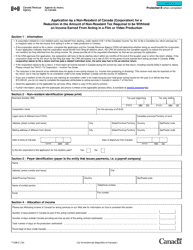

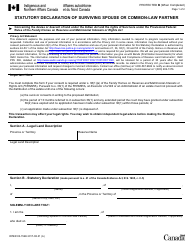

Form CTB9 Income of Non-resident Spouse or Common-Law Partner for the Canada Child Benefit - Canada

Form CTB9 is used by non-resident spouses or common-law partners of Canadian residents to report their income for the purpose of determining eligibility and entitlement to the Canada Child Benefit.

The non-resident spouse or common-law partner files the Form CTB9 for the Canada Child Benefit in Canada.

FAQ

Q: What is Form CTB9?

A: Form CTB9 is a form used in Canada for reporting the income of non-resident spouse or common-law partner for the Canada Child Benefit.

Q: Who is required to fill out Form CTB9?

A: The non-resident spouse or common-law partner is required to fill out Form CTB9 if they are eligible for the Canada Child Benefit.

Q: What is the purpose of Form CTB9?

A: The purpose of Form CTB9 is to report the income of the non-resident spouse or common-law partner, which is used to calculate the Canada Child Benefit.

Q: When should I submit Form CTB9?

A: Form CTB9 should be submitted as soon as possible after the end of each tax year, or when requested by the CRA.

Q: Is Form CTB9 only applicable for non-residents?

A: Yes, Form CTB9 is only applicable for non-resident spouses or common-law partners.

Q: What happens if I don't submit Form CTB9?

A: If Form CTB9 is not submitted, the non-resident spouse or common-law partner may not be eligible for the Canada Child Benefit.

Q: Are there any penalties for not submitting Form CTB9?

A: There may be penalties or consequences for not submitting Form CTB9, including the loss of the Canada Child Benefit.

Q: Can I submit Form CTB9 by mail?

A: Yes, Form CTB9 can be submitted by mail to the address provided on the form.