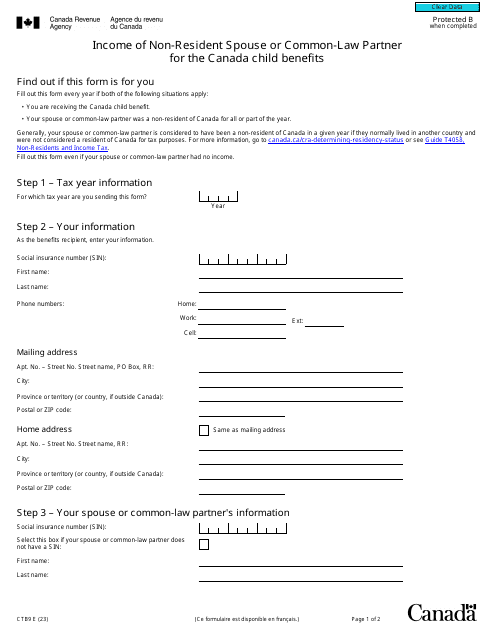

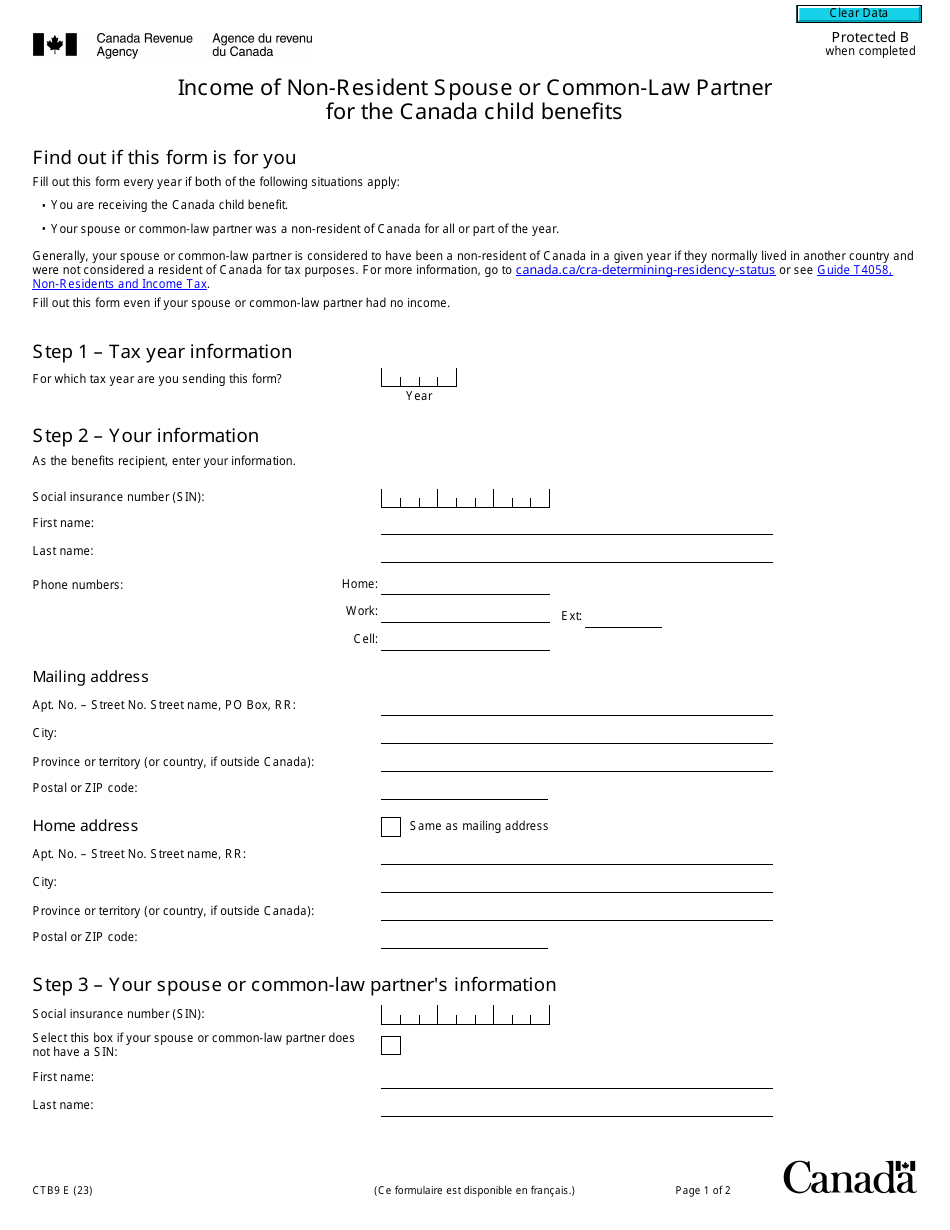

Form CTB9 Income of Non-resident Spouse or Common-Law Partner for the Canada Child Benefits - Canada

Form CTB9 is used by non-resident spouses or common-law partners of Canadian residents to report their income for the purpose of determining eligibility and entitlement to the Canada Child Benefit.

The non-resident spouse or common-law partner files the Form CTB9 for the Canada Child Benefit in Canada.

Form CTB9 Income of Non-resident Spouse or Common-Law Partner for the Canada Child Benefit - Canada - Frequently Asked Questions (FAQ)

Q: What is Form CTB9? A: Form CTB9 is a form used in Canada for reporting the income of non-resident spouse or common-law partner for the Canada Child Benefit.

Q: Who is required to fill out Form CTB9? A: The non-resident spouse or common-law partner is required to fill out Form CTB9 if they are eligible for the Canada Child Benefit.

Q: What is the purpose of Form CTB9? A: The purpose of Form CTB9 is to report the income of the non-resident spouse or common-law partner, which is used to calculate the Canada Child Benefit.

Q: When should I submit Form CTB9? A: Form CTB9 should be submitted as soon as possible after the end of each tax year, or when requested by the CRA.

Q: Is Form CTB9 only applicable for non-residents? A: Yes, Form CTB9 is only applicable for non-resident spouses or common-law partners.

Q: What happens if I don't submit Form CTB9? A: If Form CTB9 is not submitted, the non-resident spouse or common-law partner may not be eligible for the Canada Child Benefit.

Q: Are there any penalties for not submitting Form CTB9? A: There may be penalties or consequences for not submitting Form CTB9, including the loss of the Canada Child Benefit.

Q: Can I submit Form CTB9 by mail? A: Yes, Form CTB9 can be submitted by mail to the address provided on the form.