This version of the form is not currently in use and is provided for reference only. Download this version of

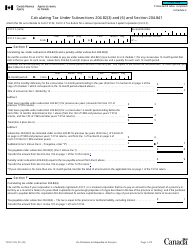

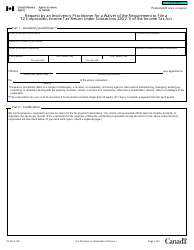

Form T2152 Schedule 1

for the current year.

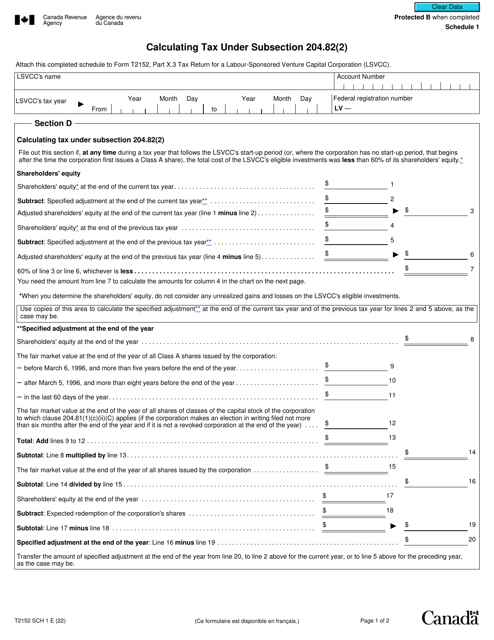

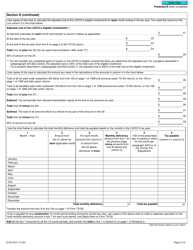

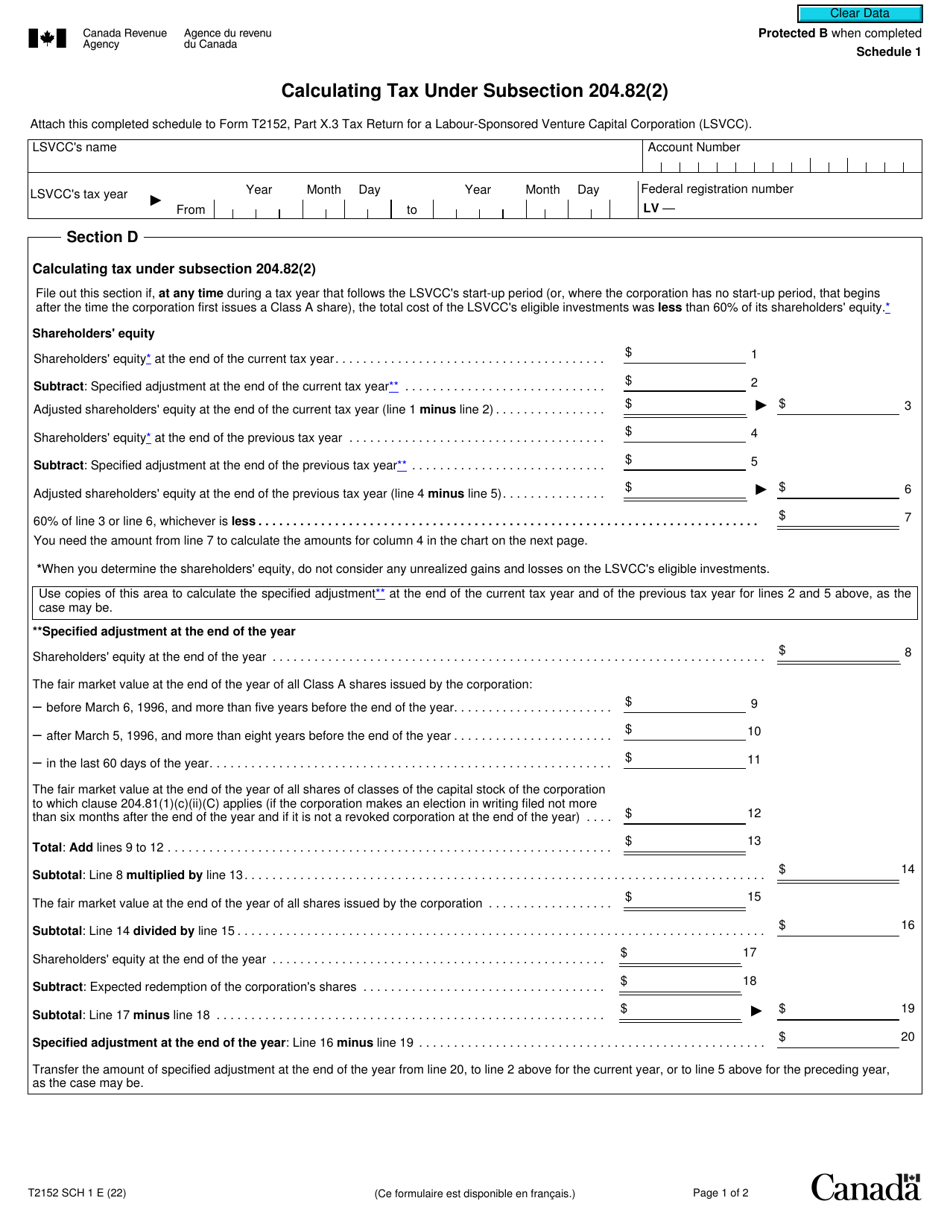

Form T2152 Schedule 1 Calculating Tax Under Subsection 204.82(2) - Canada

Form T2152 Schedule 1 is used in Canada to calculate taxes under Subsection 204.82(2) of the Canadian Income Tax Act. It is a specific form that helps individuals or businesses determine the amount of tax payable on certain income, deductions, and credits.

The Form T2152 Schedule 1 - Calculating Tax Under Subsection 204.82(2) in Canada is filed by individuals who are claiming the disability amount or the transfer of the unused portion of the disability amount.

FAQ

Q: What is Form T2152?

A: Form T2152 is a schedule used in Canada to calculate tax under subsection 204.82(2).

Q: What is Subsection 204.82(2) in Canada's tax laws?

A: Subsection 204.82(2) is a provision in Canada's tax laws that relates to the calculation of tax.

Q: What is the purpose of Schedule 1 on Form T2152?

A: Schedule 1 on Form T2152 is used to calculate tax liability under subsection 204.82(2).

Q: How do I complete Form T2152 Schedule 1?

A: To complete Form T2152 Schedule 1, you'll need to follow the instructions provided on the form and fill in the necessary information.

Q: Do I need to file Form T2152 with my tax return?

A: If you are required to calculate tax under subsection 204.82(2), you will need to file Form T2152 along with your tax return.