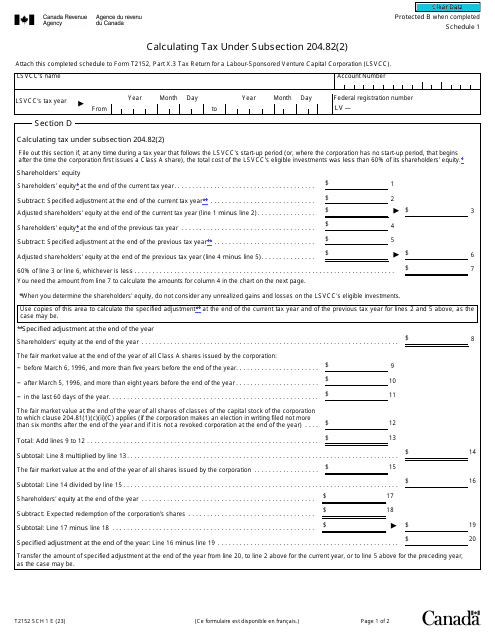

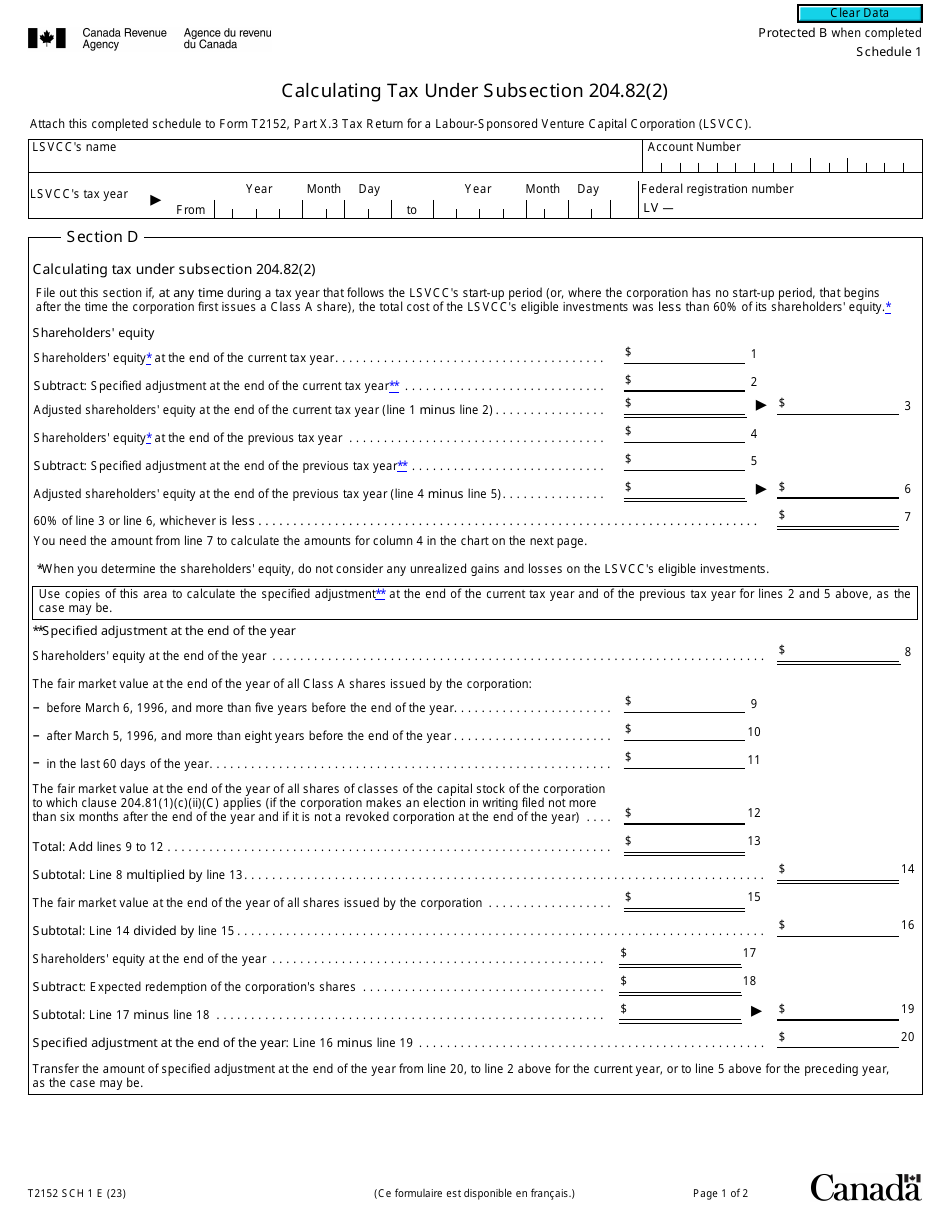

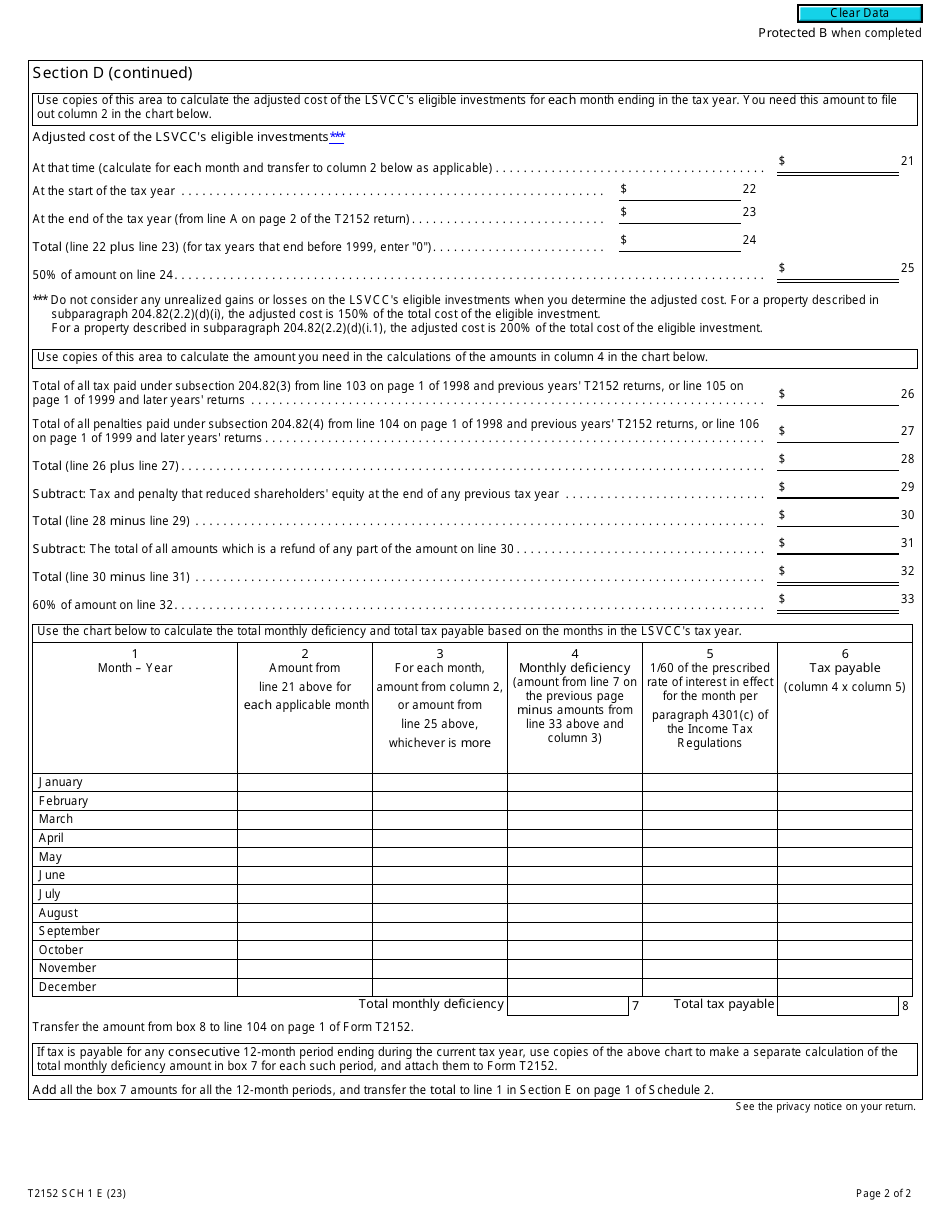

Form T2152 Schedule 1 Calculating Tax Under Subsection 204.82(2) - Canada

Form T2152 Schedule 1 is used in Canada to calculate taxes under Subsection 204.82(2) of the Canadian Income Tax Act. It is a specific form that helps individuals or businesses determine the amount of tax payable on certain income, deductions, and credits.

The Form T2152 Schedule 1 - Calculating Tax Under Subsection 204.82(2) in Canada is filed by individuals who are claiming the disability amount or the transfer of the unused portion of the disability amount.

Form T2152 Schedule 1 Calculating Tax Under Subsection 204.82(2) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2152?

A: Form T2152 is a schedule used in Canada to calculate tax under subsection 204.82(2).

Q: What is Subsection 204.82(2) in Canada's tax laws?

A: Subsection 204.82(2) is a provision in Canada's tax laws that relates to the calculation of tax.

Q: What is the purpose of Schedule 1 on Form T2152?

A: Schedule 1 on Form T2152 is used to calculate tax liability under subsection 204.82(2).

Q: How do I complete Form T2152 Schedule 1?

A: To complete Form T2152 Schedule 1, you'll need to follow the instructions provided on the form and fill in the necessary information.

Q: Do I need to file Form T2152 with my tax return?

A: If you are required to calculate tax under subsection 204.82(2), you will need to file Form T2152 along with your tax return.