This version of the form is not currently in use and is provided for reference only. Download this version of

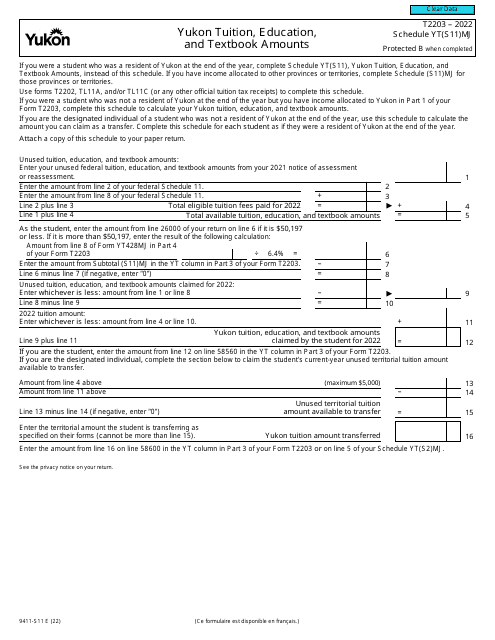

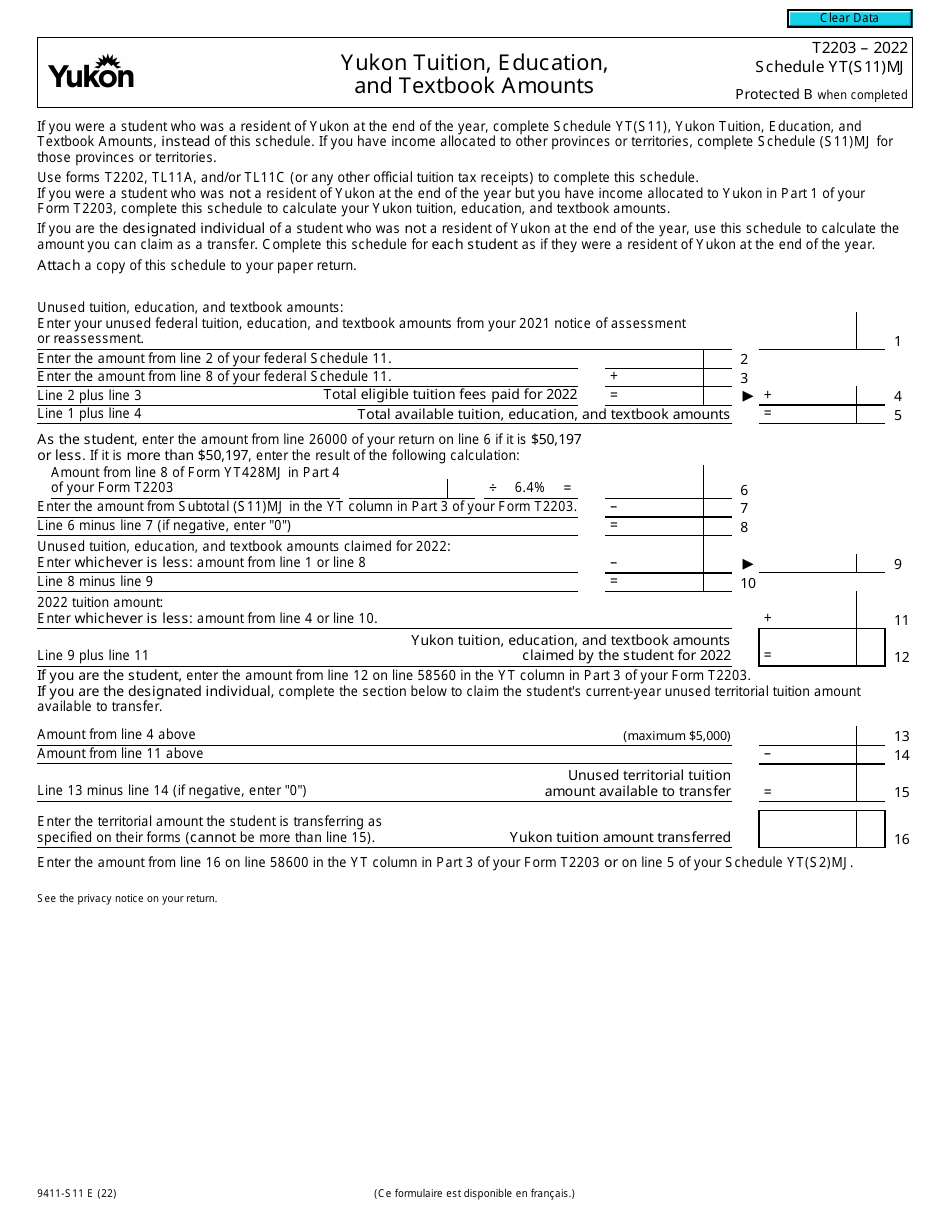

Form T2203 (9411-S11) Schedule YT(S11)MJ

for the current year.

Form T2203 (9411-S11) Schedule YT(S11)MJ Yukon Tuition, Education, and Textbook Amounts - Canada

Form T2203 (9411-S11) Schedule YT(S11)MJ Yukon Tuition, Education, and Textbook Amounts is used in Canada for claiming tuition, education, and textbook amounts in the Yukon territory. It is a tax form that allows individuals to report eligible education expenses and potentially receive tax credits or deductions.

The Form T2203 (9411-S11) Schedule YT(S11)MJ Yukon Tuition, Education, and Textbook Amounts in Canada is filed by individuals who are residents of Yukon and want to claim tuition, education, and textbook amounts.

FAQ

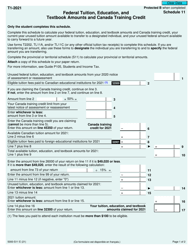

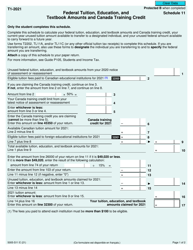

Q: What is Form T2203?

A: Form T2203 is used to claim the Yukon Tuition, Education, and Textbook Amounts in Canada.

Q: What is Schedule YT(S11)MJ?

A: Schedule YT(S11)MJ is a specific schedule of Form T2203 that is used for claiming Yukon Tuition, Education, and Textbook Amounts in Canada.

Q: What are the Yukon Tuition, Education, and Textbook Amounts?

A: The Yukon Tuition, Education, and Textbook Amounts are tax credits that can be claimed by eligible individuals in Yukon, Canada for educational expenses.

Q: Who can claim the Yukon Tuition, Education, and Textbook Amounts?

A: Canadian residents who paid eligible tuition fees and education amounts for themselves, their spouse or common-law partner or their children can claim the Yukon Tuition, Education, and Textbook Amounts.

Q: Why should I claim the Yukon Tuition, Education, and Textbook Amounts?

A: Claiming the Yukon Tuition, Education, and Textbook Amounts can help reduce the amount of tax you owe or increase your tax refund.

Q: When should I file Form T2203 (9411-S11) Schedule YT(S11)MJ?

A: You should file Form T2203 (9411-S11) Schedule YT(S11)MJ along with your annual income tax return, typically by April 30th of the following year.

Q: Are there any restrictions or limitations on claiming the Yukon Tuition, Education, and Textbook Amounts?

A: Yes, there are certain restrictions and limitations on claiming these amounts. It is important to review the eligibility criteria and guidelines provided by the CRA to ensure you meet all requirements.

Q: Is the Yukon Tuition, Education, and Textbook Amounts a refundable tax credit?

A: No, the Yukon Tuition, Education, and Textbook Amounts are non-refundable tax credits, meaning they can only be used to reduce your tax payable and cannot generate a refund if you have no tax owing.