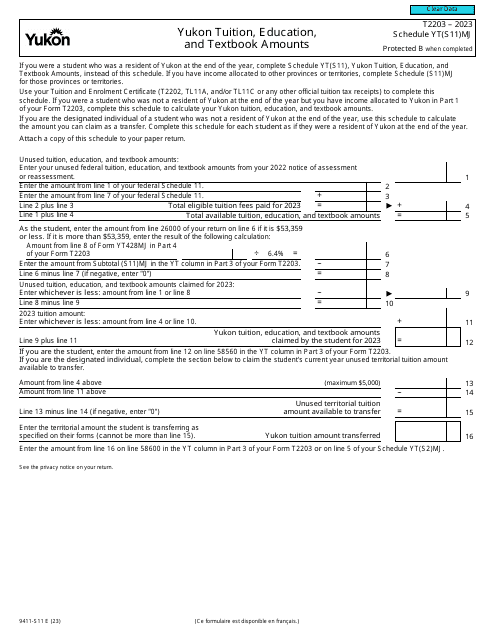

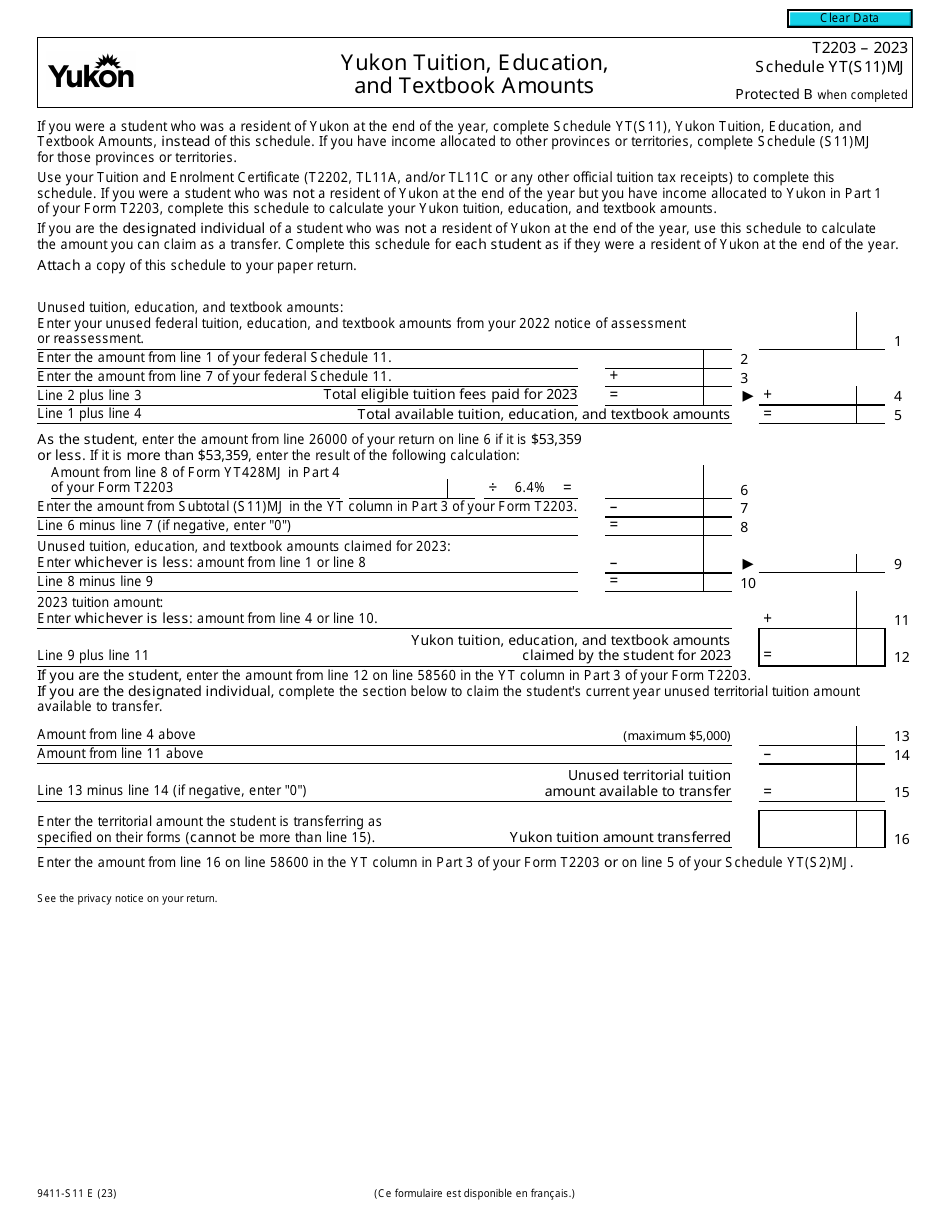

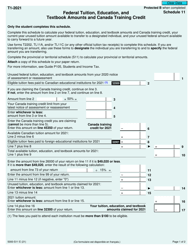

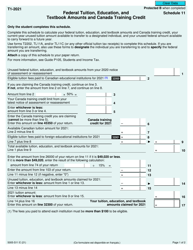

Form T2203 (9411-S11) Schedule YT(S11)MJ Yukon Tuition, Education, and Textbook Amounts - Canada

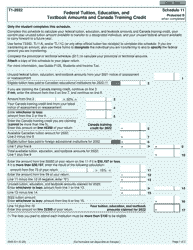

Form T2203 (9411-S11) Schedule YT(S11)MJ Yukon Tuition, Education, and Textbook Amounts is used in Canada for claiming tuition, education, and textbook amounts in the Yukon territory. It is a tax form that allows individuals to report eligible education expenses and potentially receive tax credits or deductions.

The Form T2203 (9411-S11) Schedule YT(S11)MJ Yukon Tuition, Education, and Textbook Amounts in Canada is filed by individuals who are residents of Yukon and want to claim tuition, education, and textbook amounts.

Form T2203 (9411-S11) Schedule YT(S11)MJ Yukon Tuition, Education, and Textbook Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2203?

A: Form T2203 is used to claim the Yukon Tuition, Education, and Textbook Amounts in Canada.

Q: What is Schedule YT(S11)MJ?

A: Schedule YT(S11)MJ is a specific schedule of Form T2203 that is used for claiming Yukon Tuition, Education, and Textbook Amounts in Canada.

Q: What are the Yukon Tuition, Education, and Textbook Amounts?

A: The Yukon Tuition, Education, and Textbook Amounts are tax credits that can be claimed by eligible individuals in Yukon, Canada for educational expenses.

Q: Who can claim the Yukon Tuition, Education, and Textbook Amounts?

A: Canadian residents who paid eligible tuition fees and education amounts for themselves, their spouse or common-law partner or their children can claim the Yukon Tuition, Education, and Textbook Amounts.

Q: Why should I claim the Yukon Tuition, Education, and Textbook Amounts?

A: Claiming the Yukon Tuition, Education, and Textbook Amounts can help reduce the amount of tax you owe or increase your tax refund.

Q: When should I file Form T2203 (9411-S11) Schedule YT(S11)MJ?

A: You should file Form T2203 (9411-S11) Schedule YT(S11)MJ along with your annual income tax return, typically by April 30th of the following year.

Q: Are there any restrictions or limitations on claiming the Yukon Tuition, Education, and Textbook Amounts?

A: Yes, there are certain restrictions and limitations on claiming these amounts. It is important to review the eligibility criteria and guidelines provided by the CRA to ensure you meet all requirements.

Q: Is the Yukon Tuition, Education, and Textbook Amounts a refundable tax credit?

A: No, the Yukon Tuition, Education, and Textbook Amounts are non-refundable tax credits, meaning they can only be used to reduce your tax payable and cannot generate a refund if you have no tax owing.