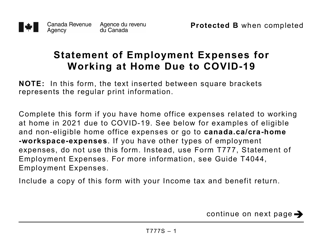

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T777

for the current year.

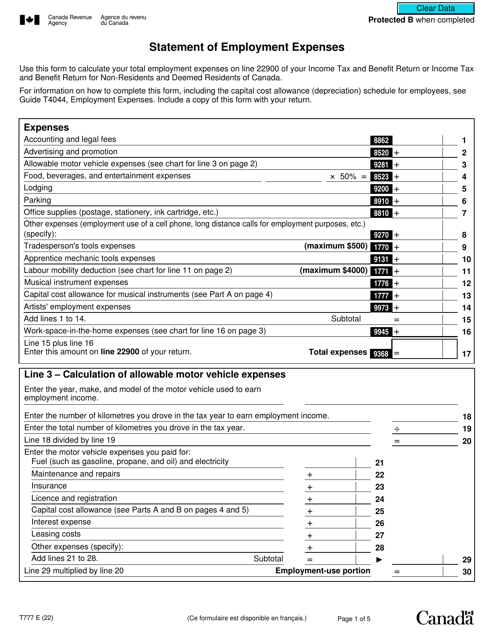

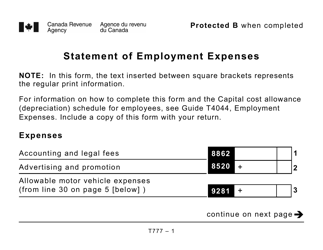

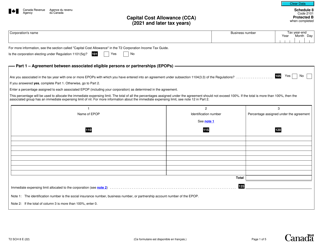

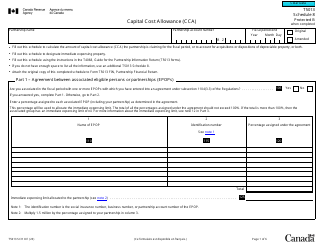

Form T777 Statement of Employment Expenses - Canada

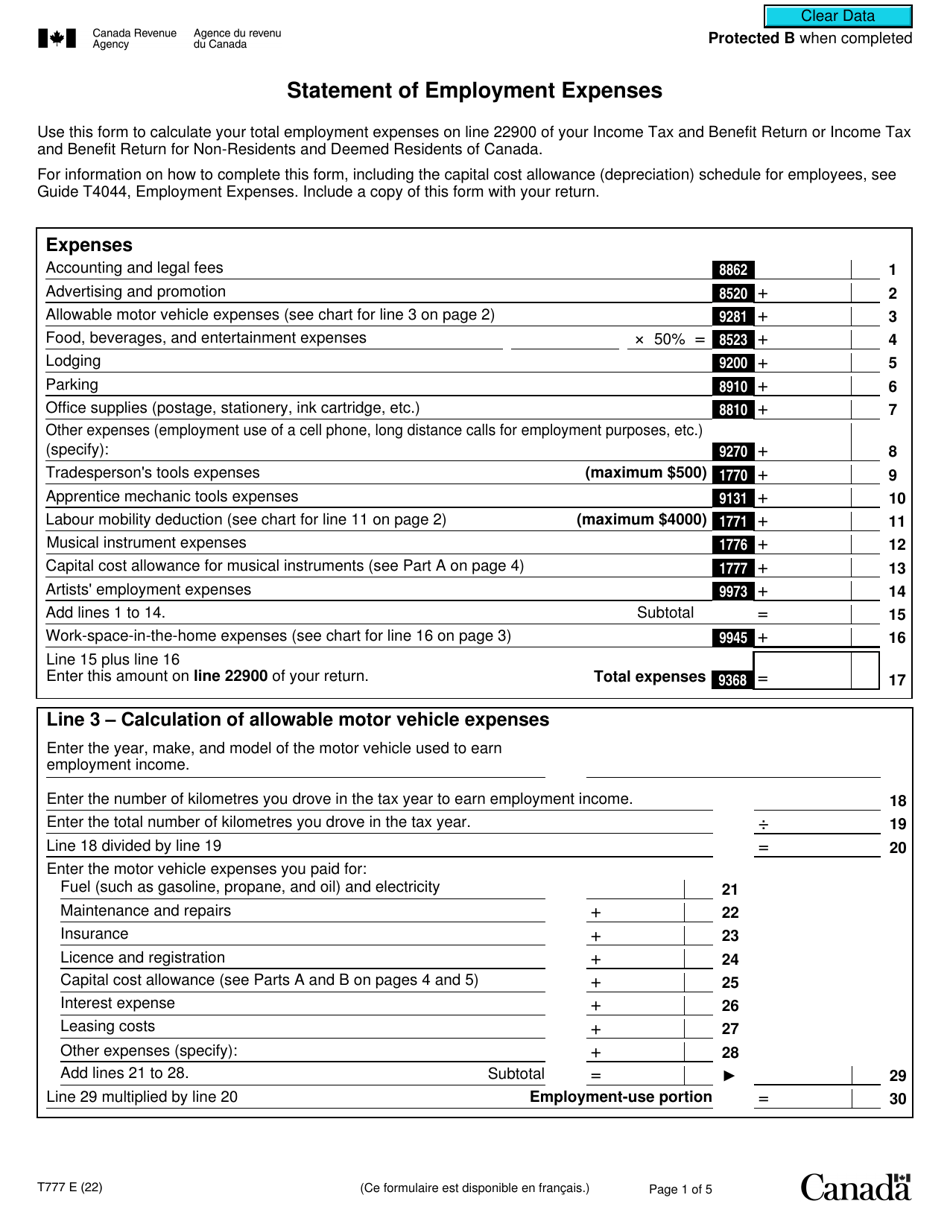

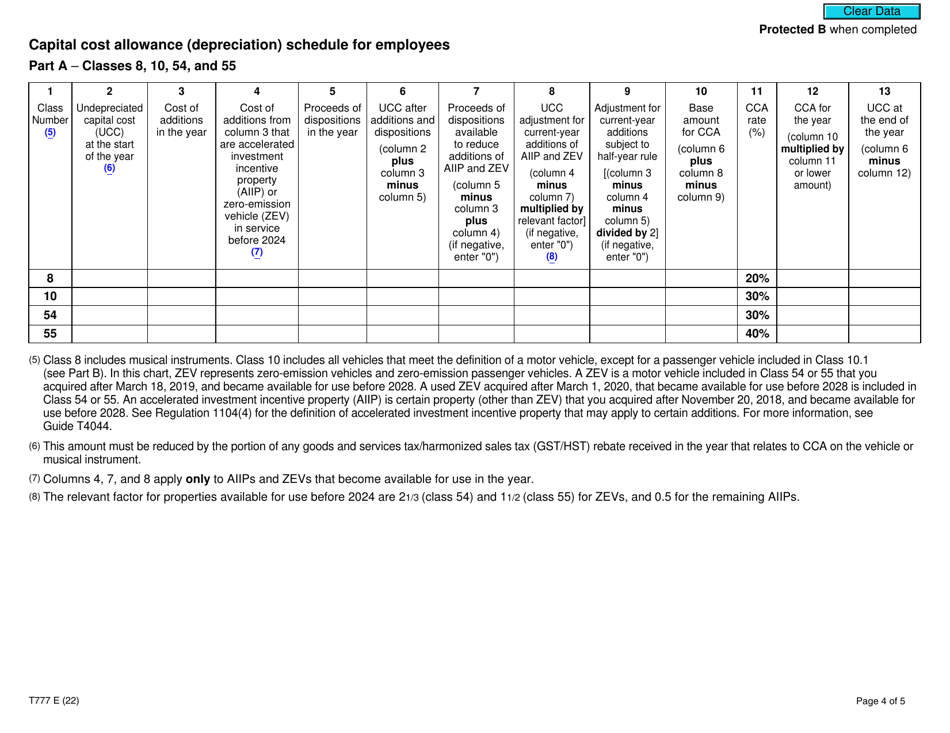

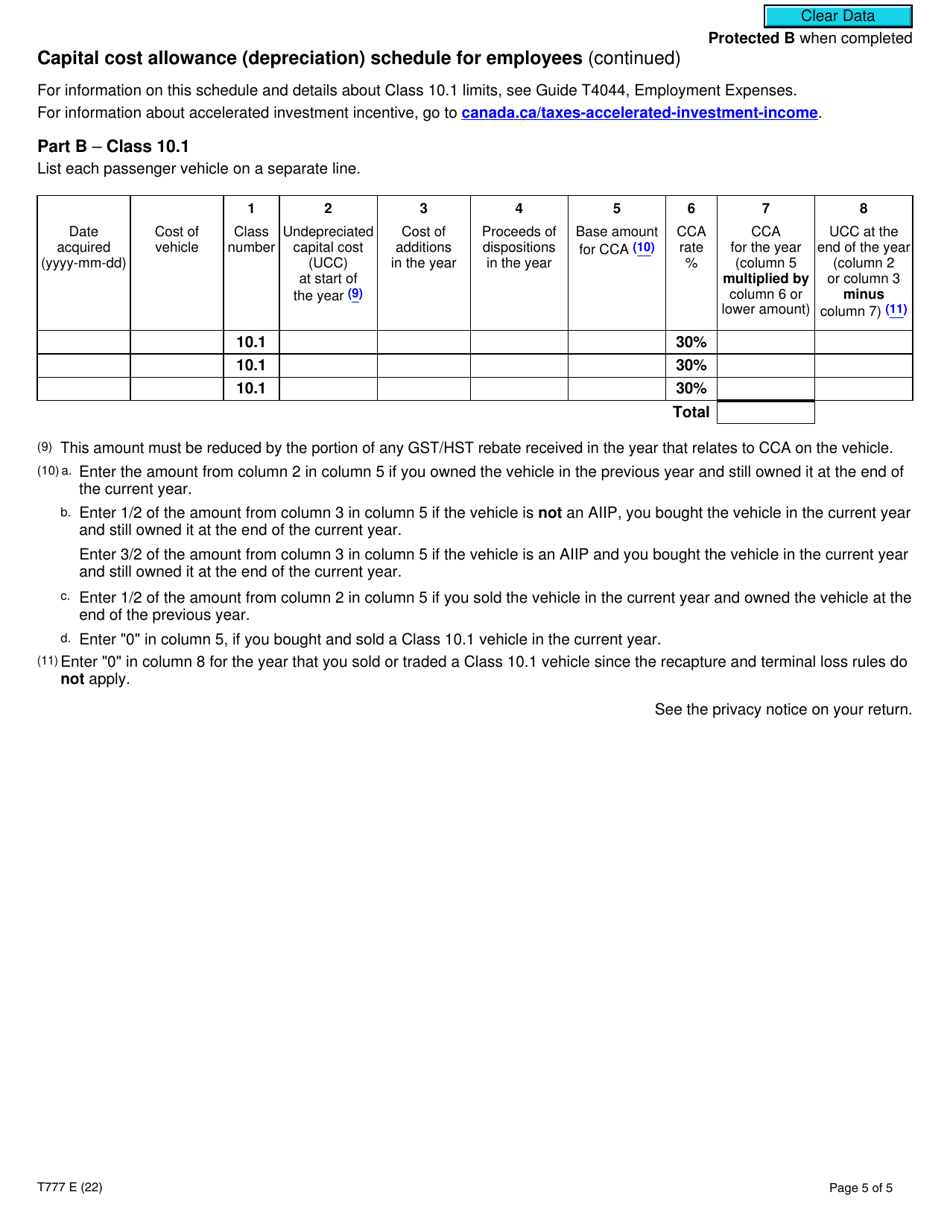

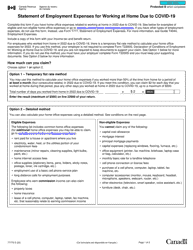

Form T777 Statement of Employment Expenses is used in Canada to claim deductions for employment expenses. It allows individuals to report expenses they have incurred while earning employment income. This form helps individuals reduce their taxable income and potentially lower their tax liability.

The Form T777 Statement of Employment Expenses in Canada is typically filed by individuals who want to claim deductible expenses related to their employment.

FAQ

Q: What is Form T777?

A: Form T777 is a statement used in Canada to report employment expenses.

Q: Who is required to file Form T777?

A: Any individual in Canada who wants to claim employment expenses can file Form T777.

Q: What are employment expenses?

A: Employment expenses are expenses incurred by an individual in the course of performing their employment duties.

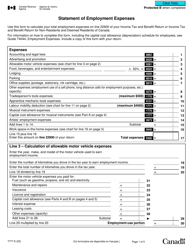

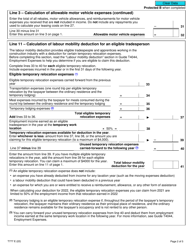

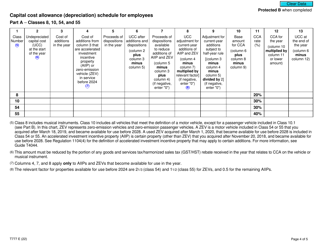

Q: What types of expenses can be claimed on Form T777?

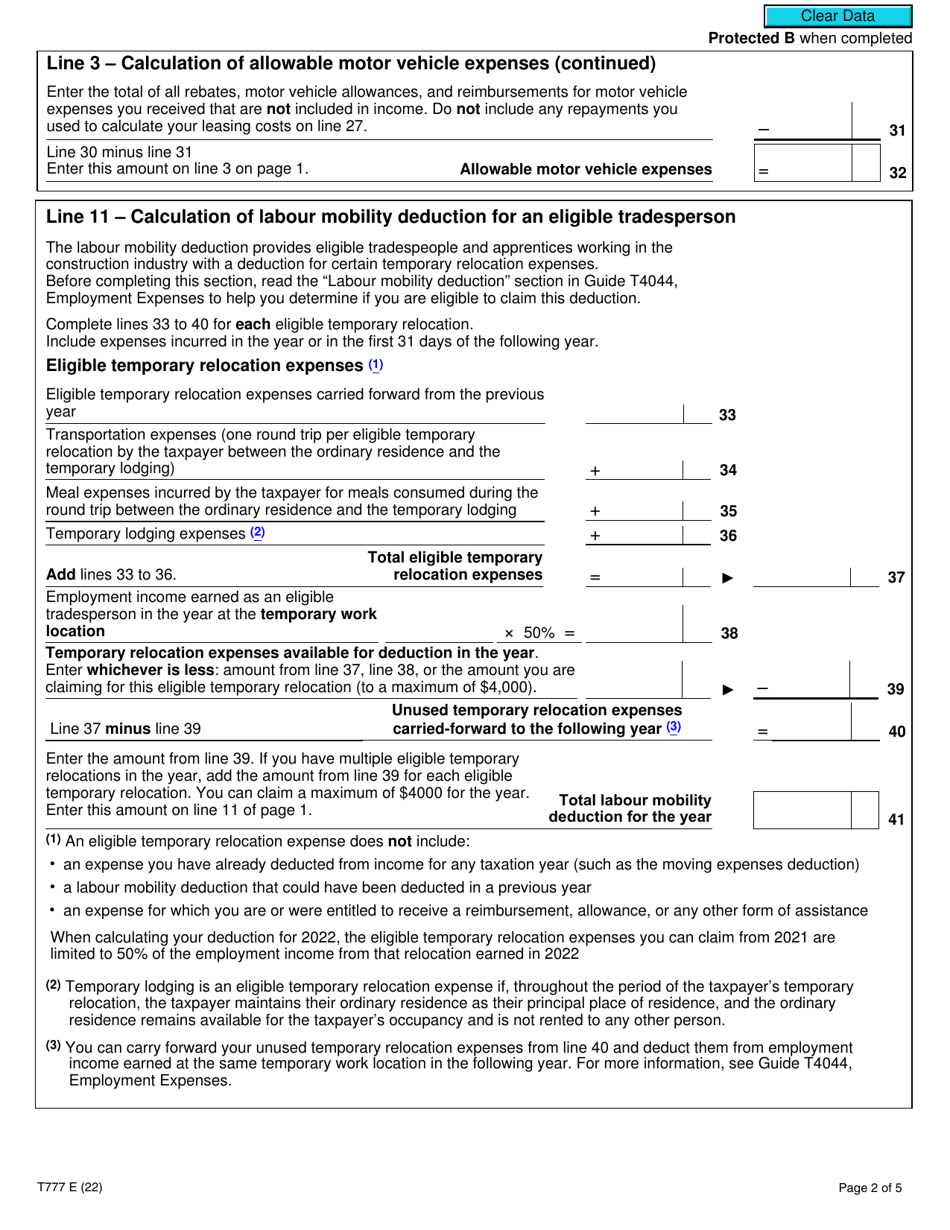

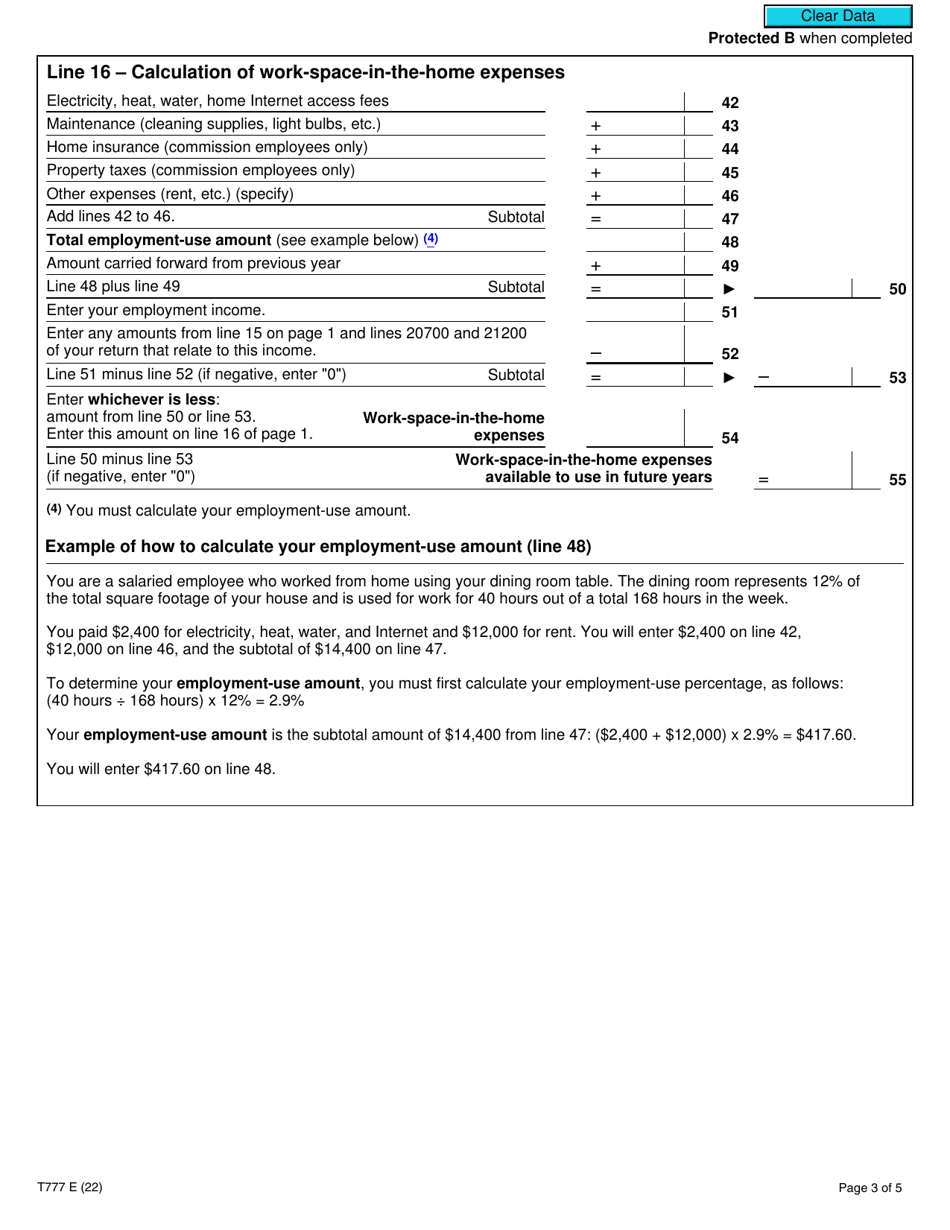

A: Common employment expenses that can be claimed on Form T777 include vehicle expenses, home office expenses, and professional dues.

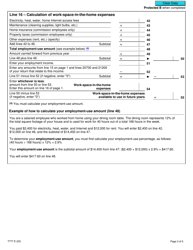

Q: How do I fill out Form T777?

A: You need to enter your personal information, employment details, and the amounts of your allowable expenses on the form.

Q: Can I file Form T777 electronically?

A: Yes, you can file Form T777 electronically if you are using certified tax software or an authorized service provider.

Q: What supporting documents should I keep for Form T777?

A: You should keep all receipts, invoices, and other supporting documents related to your employment expenses for at least six years in case the CRA requests them.

Q: What happens if I claim ineligible expenses on Form T777?

A: If you claim ineligible expenses on Form T777, the CRA may disallow them and you may be subject to penalties or additional taxes.

Q: Can I carry forward unused employment expenses from previous years?

A: No, you cannot carry forward unused employment expenses from previous years. They must be claimed in the year they were incurred.