This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD4

for the current year.

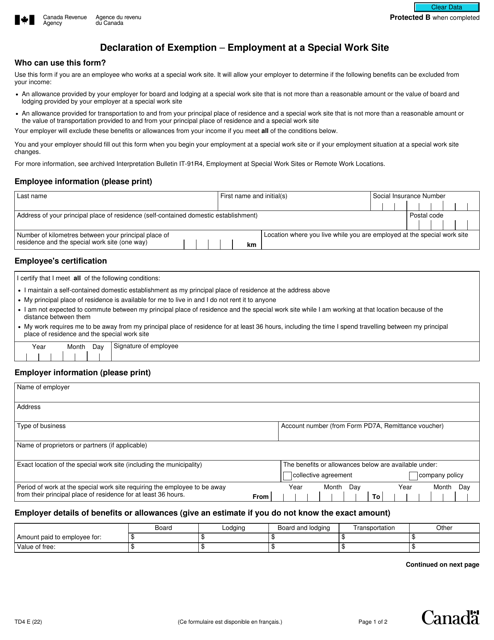

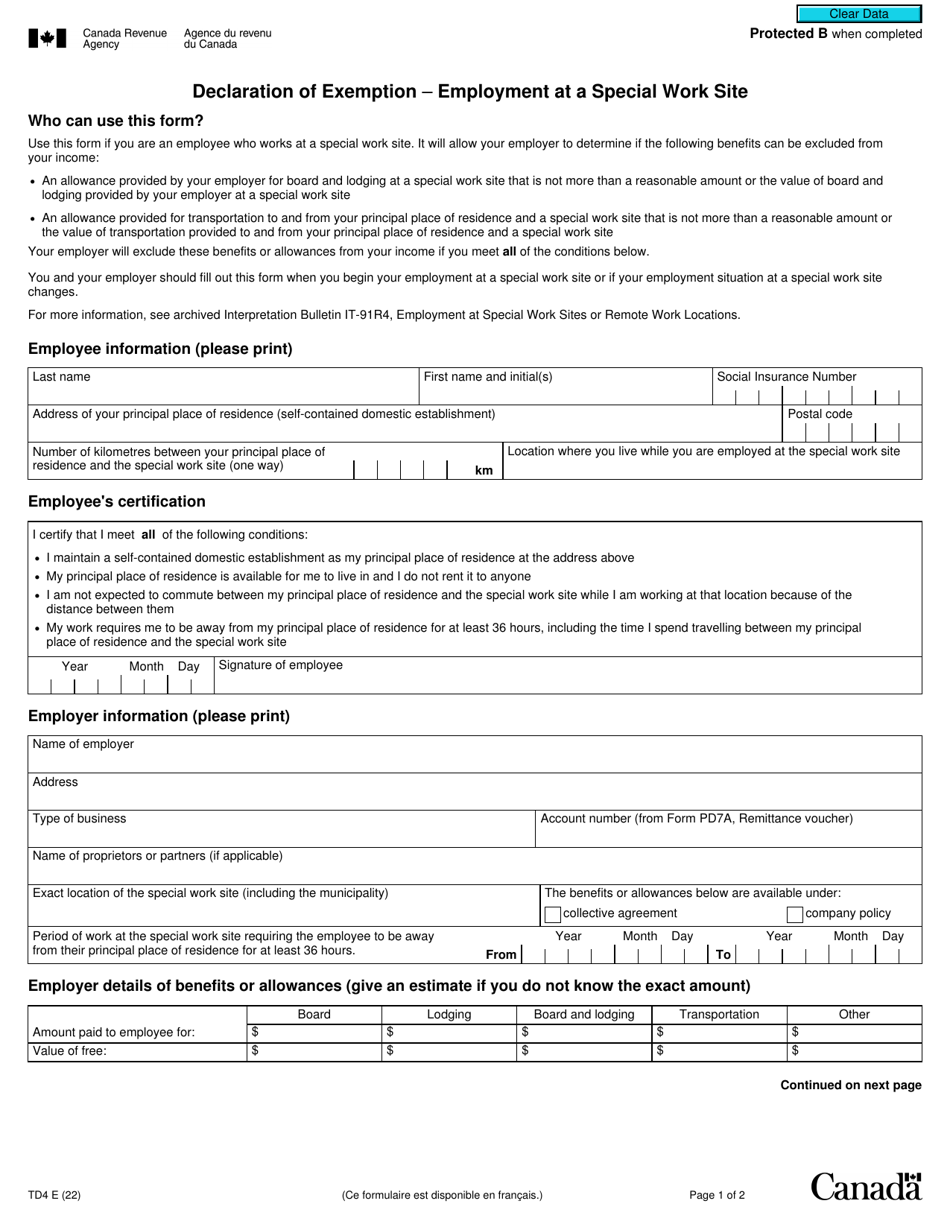

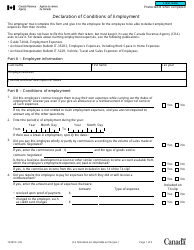

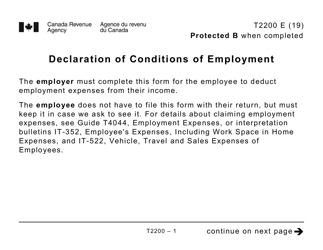

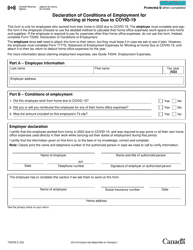

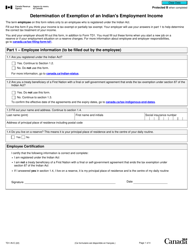

Form TD4 Declaration of Exemption - Employment at a Special Work Site - Canada

Form TD4 Declaration of Exemption - Employment at a Special Work Site is used in Canada to declare your exemption from provincial or territorial income tax deductions while working at a special work site. It allows you to ensure that the correct amount of income tax is deducted from your wages.

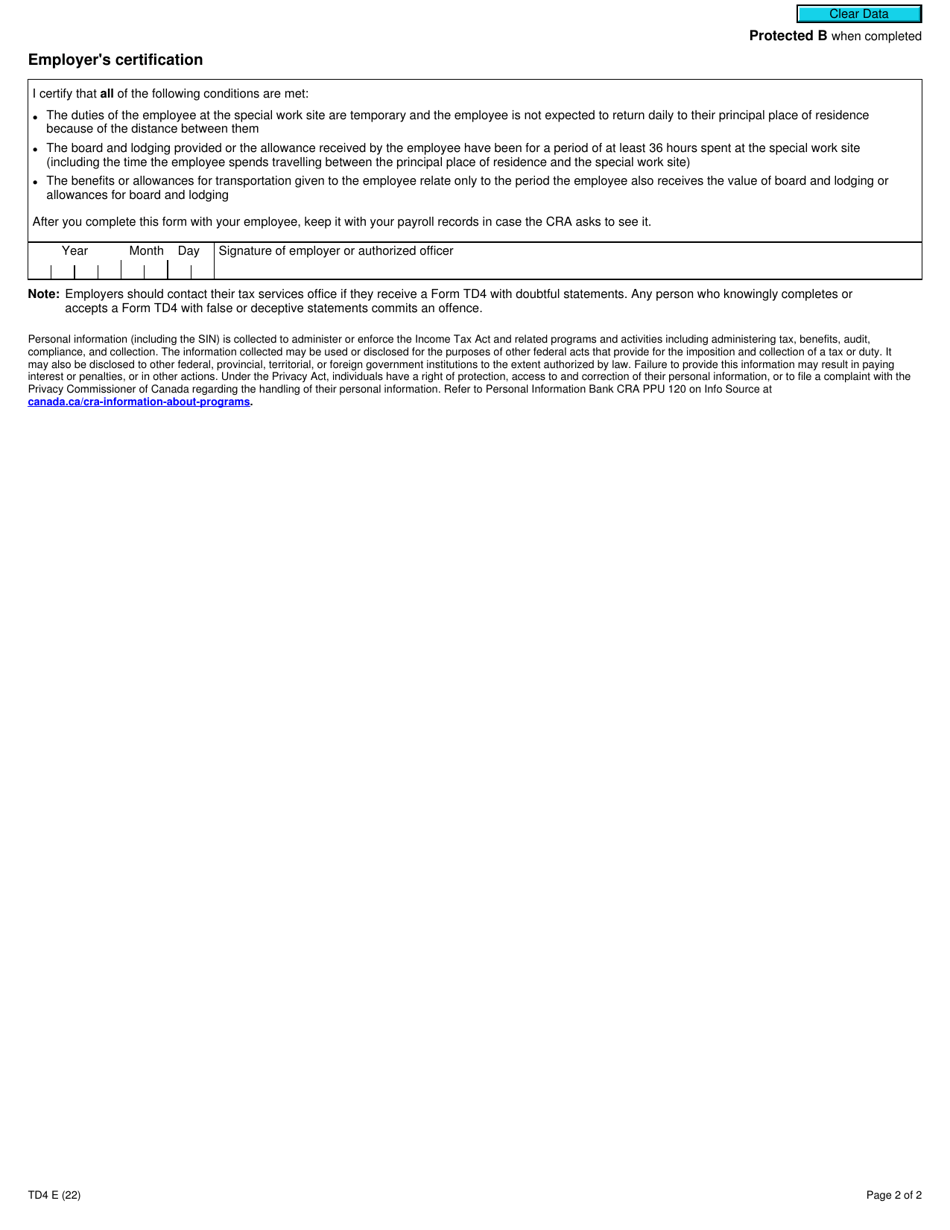

The employer files the Form TD4 Declaration of Exemption - Employment at a Special Work Site in Canada.

FAQ

Q: What is a Form TD4?

A: Form TD4 is a declaration of exemption for employment at a special work site in Canada.

Q: Who needs to fill out Form TD4?

A: Employees who are working at a special work site in Canada and are eligible for exemption from certain taxes need to fill out Form TD4.

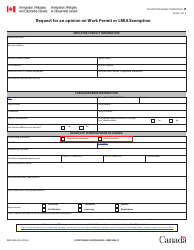

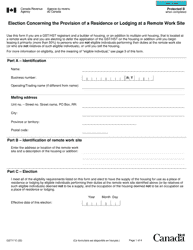

Q: What is a special work site?

A: A special work site is a location in Canada where certain employment is exempt from income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums.

Q: What does Form TD4 declare?

A: Form TD4 declares an employee's eligibility for exemption from income tax, CPP contributions, and EI premiums at a special work site.

Q: Is Form TD4 mandatory?

A: Form TD4 is not mandatory, but it is necessary to claim exemption from certain taxes at a special work site in Canada.

Q: How often do I need to fill out Form TD4?

A: You need to fill out Form TD4 when you start working at a special work site and anytime there is a change in your exemption status.

Q: What should I do with the completed Form TD4?

A: You should give a copy of the completed Form TD4 to your employer, and keep a copy for your records.