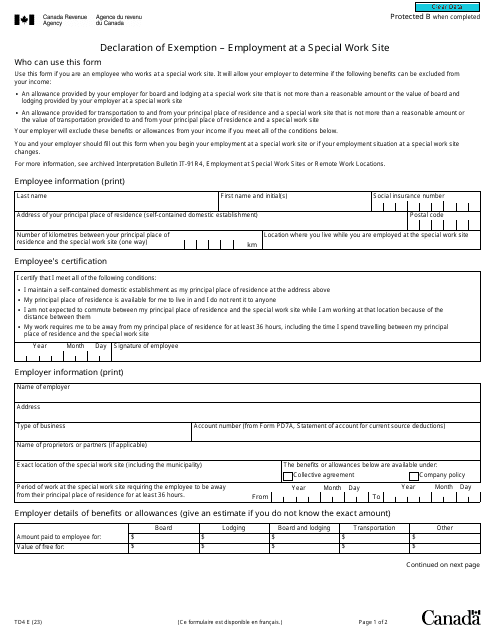

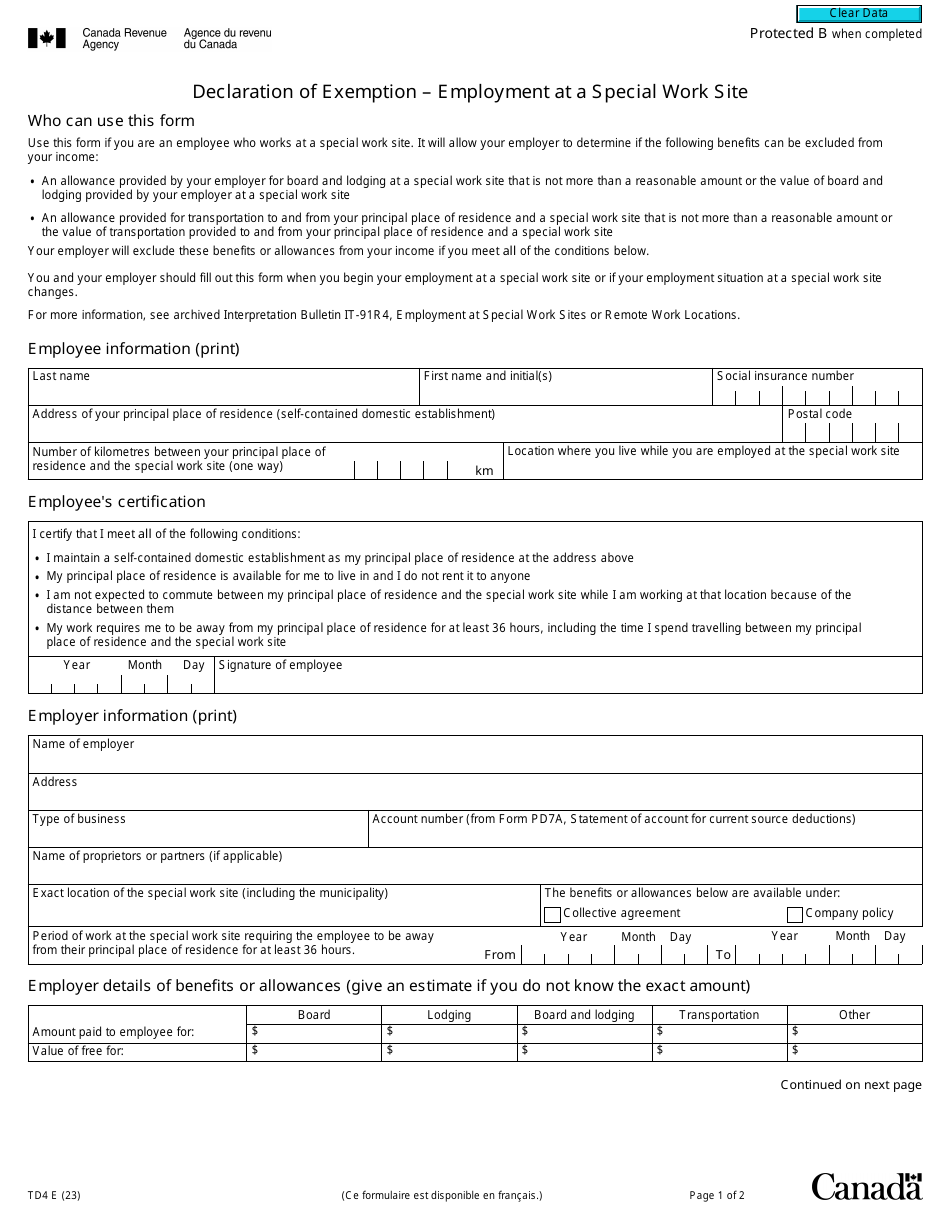

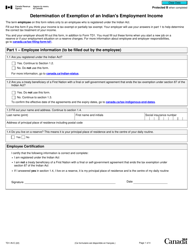

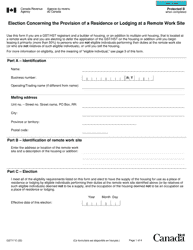

Form TD4 Declaration of Exemption - Employment at a Special Work Site - Canada

Form TD4 Declaration of Exemption - Employment at a Special Work Site is used in Canada to declare your exemption from provincial or territorial income tax deductions while working at a special work site. It allows you to ensure that the correct amount of income tax is deducted from your wages.

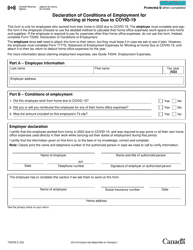

The employer files the Form TD4 Declaration of Exemption - Employment at a Special Work Site in Canada.

Form TD4 Declaration of Exemption - Employment at a Special Work Site - Canada - Frequently Asked Questions (FAQ)

Q: What is a Form TD4?

A: Form TD4 is a declaration of exemption for employment at a special work site in Canada.

Q: Who needs to fill out Form TD4?

A: Employees who are working at a special work site in Canada and are eligible for exemption from certain taxes need to fill out Form TD4.

Q: What is a special work site?

A: A special work site is a location in Canada where certain employment is exempt from income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums.

Q: What does Form TD4 declare?

A: Form TD4 declares an employee's eligibility for exemption from income tax, CPP contributions, and EI premiums at a special work site.

Q: Is Form TD4 mandatory?

A: Form TD4 is not mandatory, but it is necessary to claim exemption from certain taxes at a special work site in Canada.

Q: How often do I need to fill out Form TD4?

A: You need to fill out Form TD4 when you start working at a special work site and anytime there is a change in your exemption status.

Q: What should I do with the completed Form TD4?

A: You should give a copy of the completed Form TD4 to your employer, and keep a copy for your records.