This version of the form is not currently in use and is provided for reference only. Download this version of

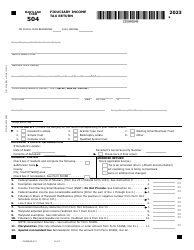

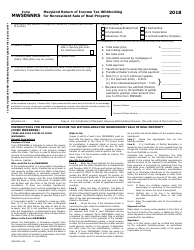

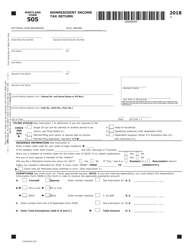

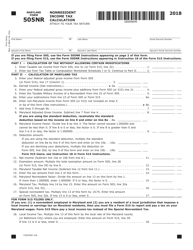

Maryland Form 504NR (COM/RAD-319)

for the current year.

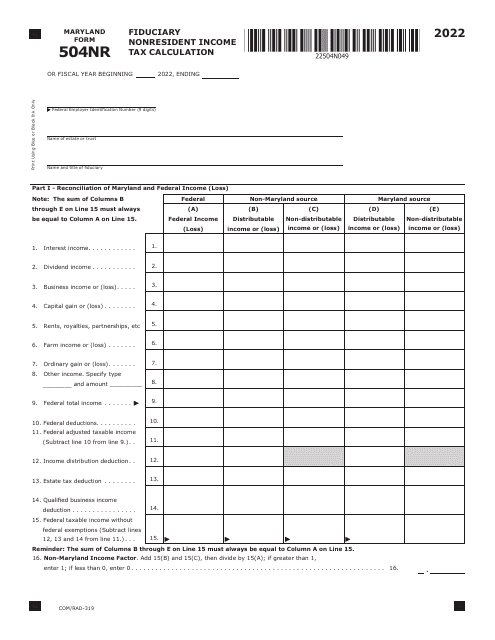

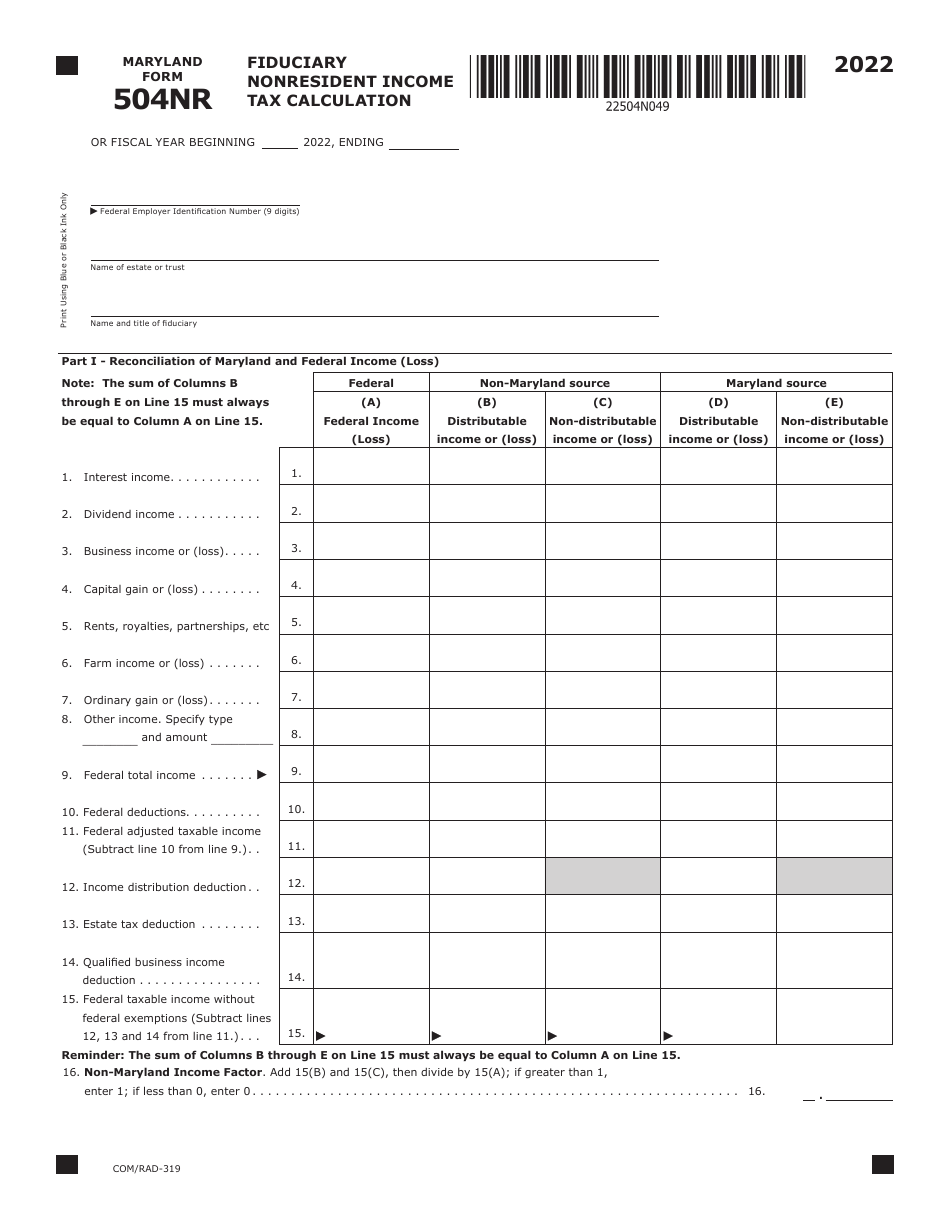

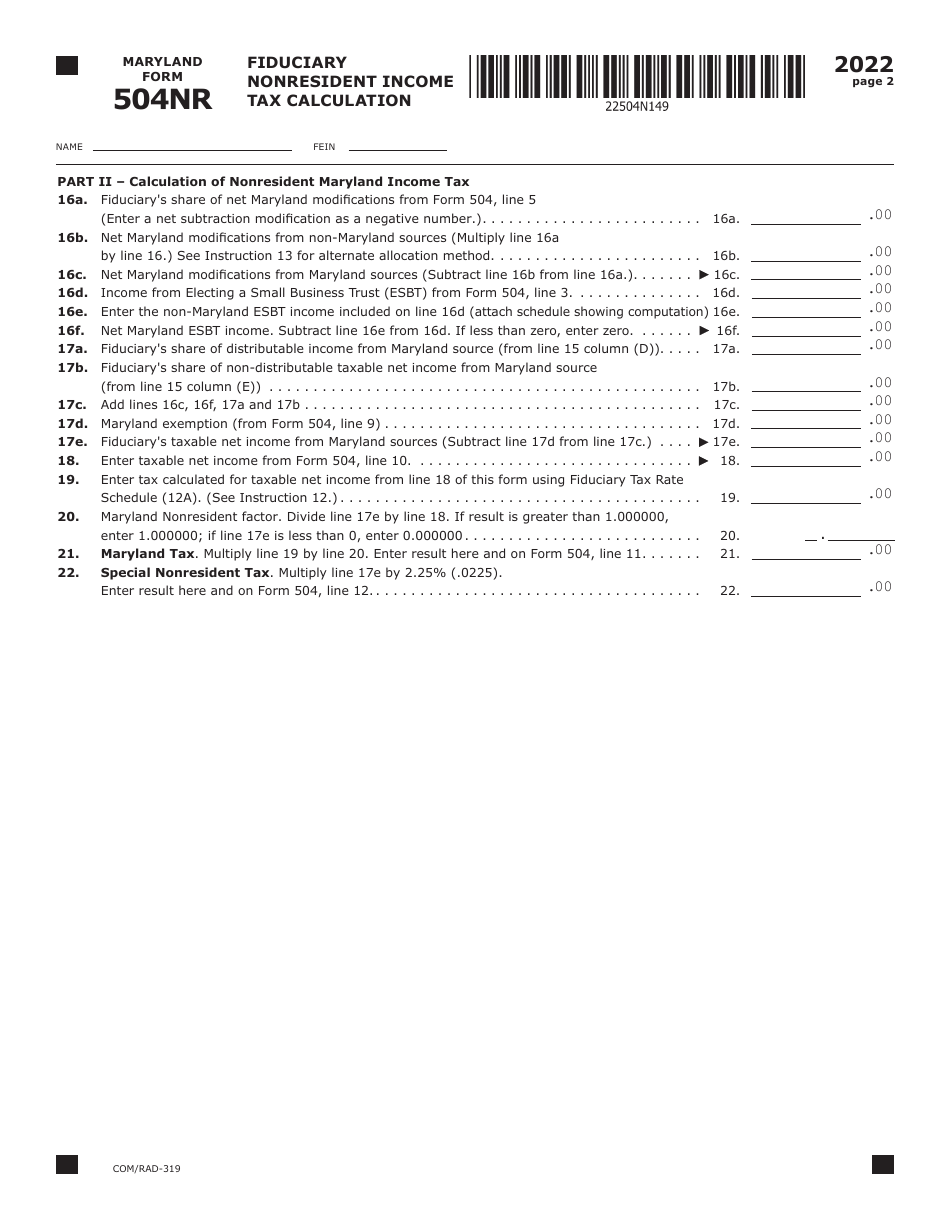

Maryland Form 504NR (COM / RAD-319) Fiduciary Nonresident Income Tax Calculation - Maryland

What Is Maryland Form 504NR (COM/RAD-319)?

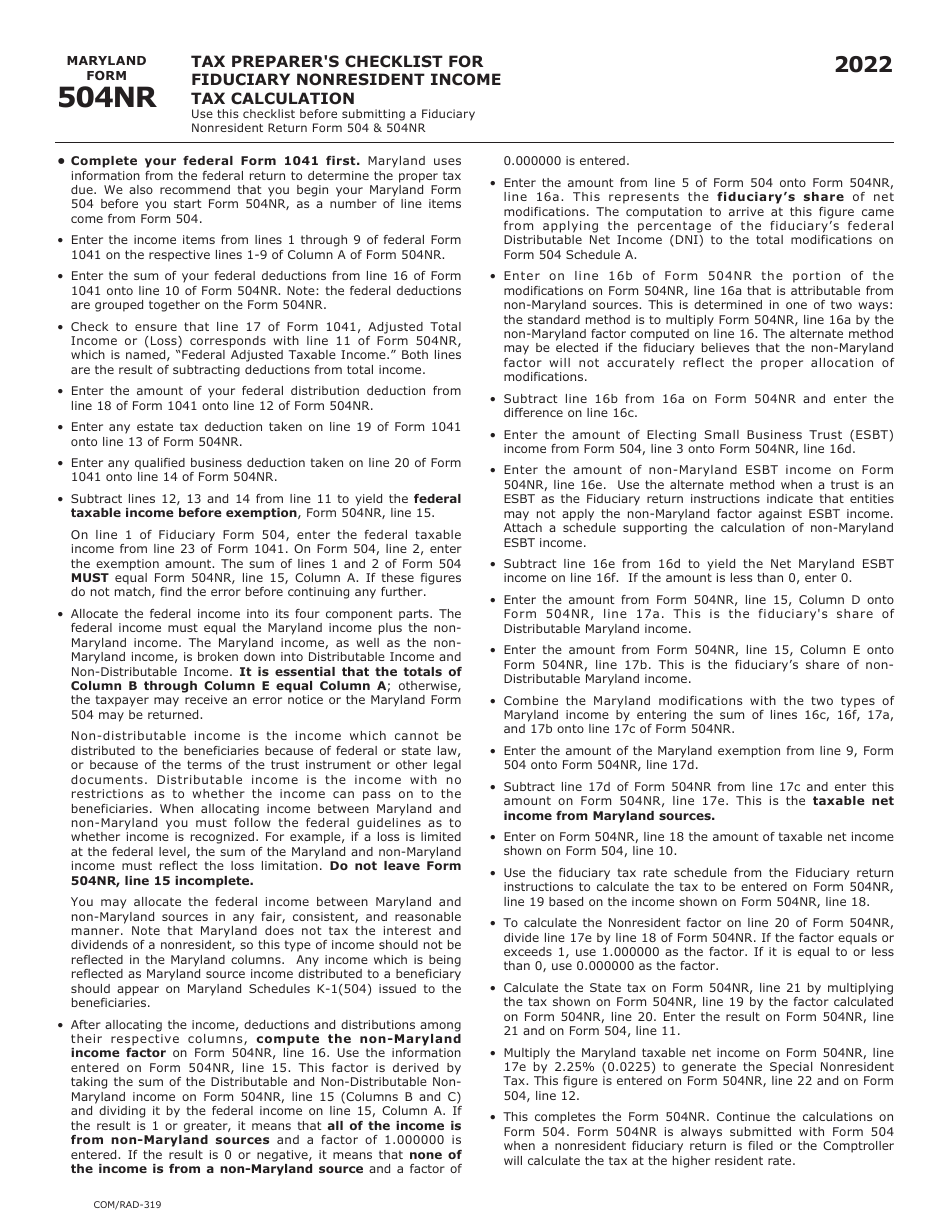

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 504NR?

A: Maryland Form 504NR is a tax form used for calculating fiduciary nonresident income tax in Maryland.

Q: Who needs to file Maryland Form 504NR?

A: Individuals or entities who are nonresidents of Maryland and have fiduciary income from Maryland sources need to file Maryland Form 504NR.

Q: What is fiduciary income?

A: Fiduciary income refers to income earned through a trust, estate, or other fiduciary relationship.

Q: What does Maryland Form 504NR calculate?

A: Maryland Form 504NR calculates the tax owed on fiduciary income earned in Maryland by nonresidents.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 504NR (COM/RAD-319) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.