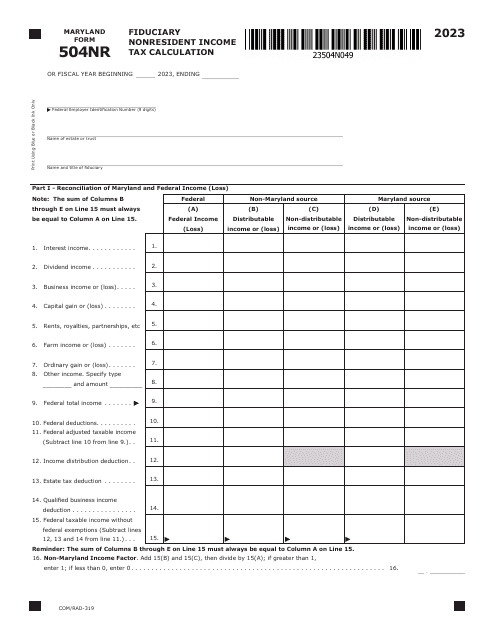

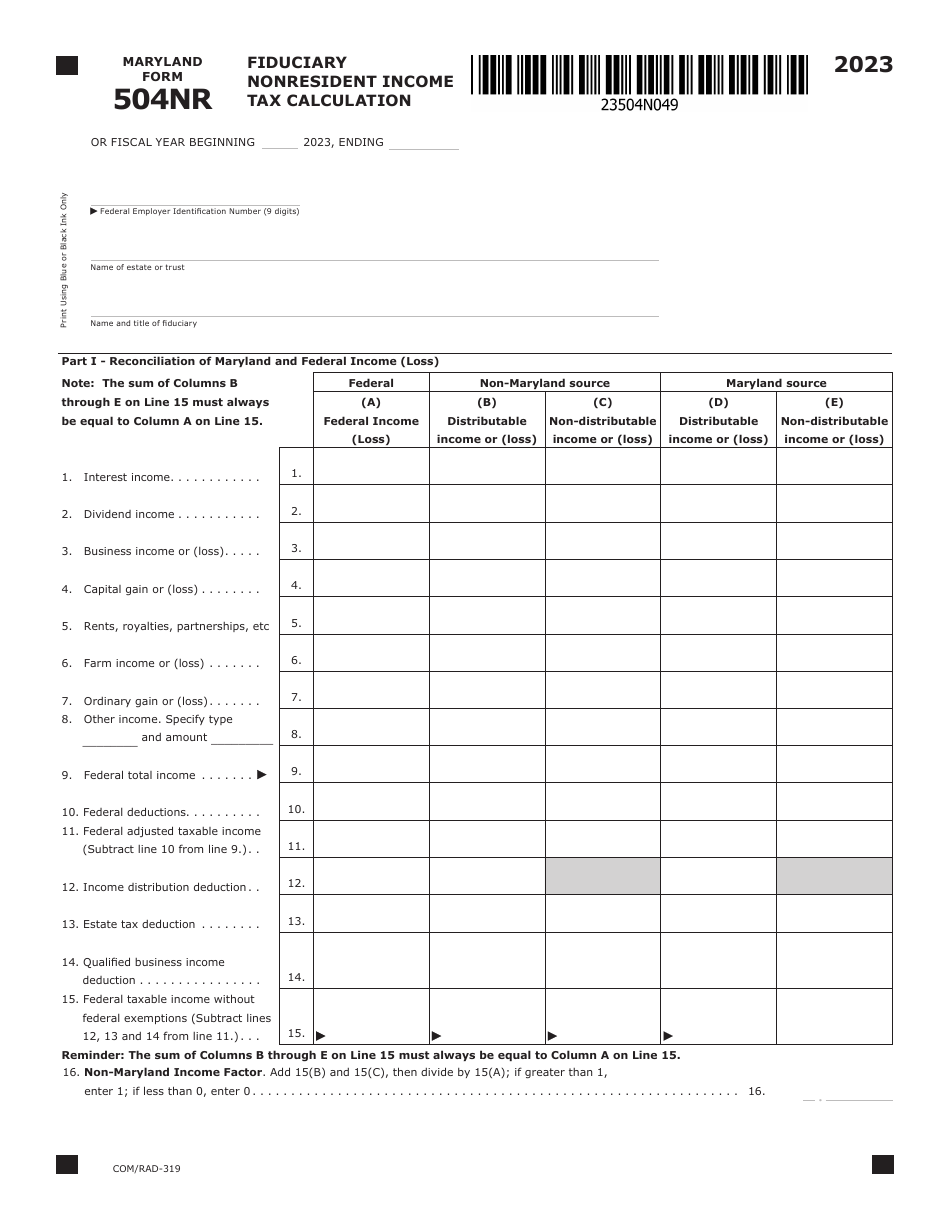

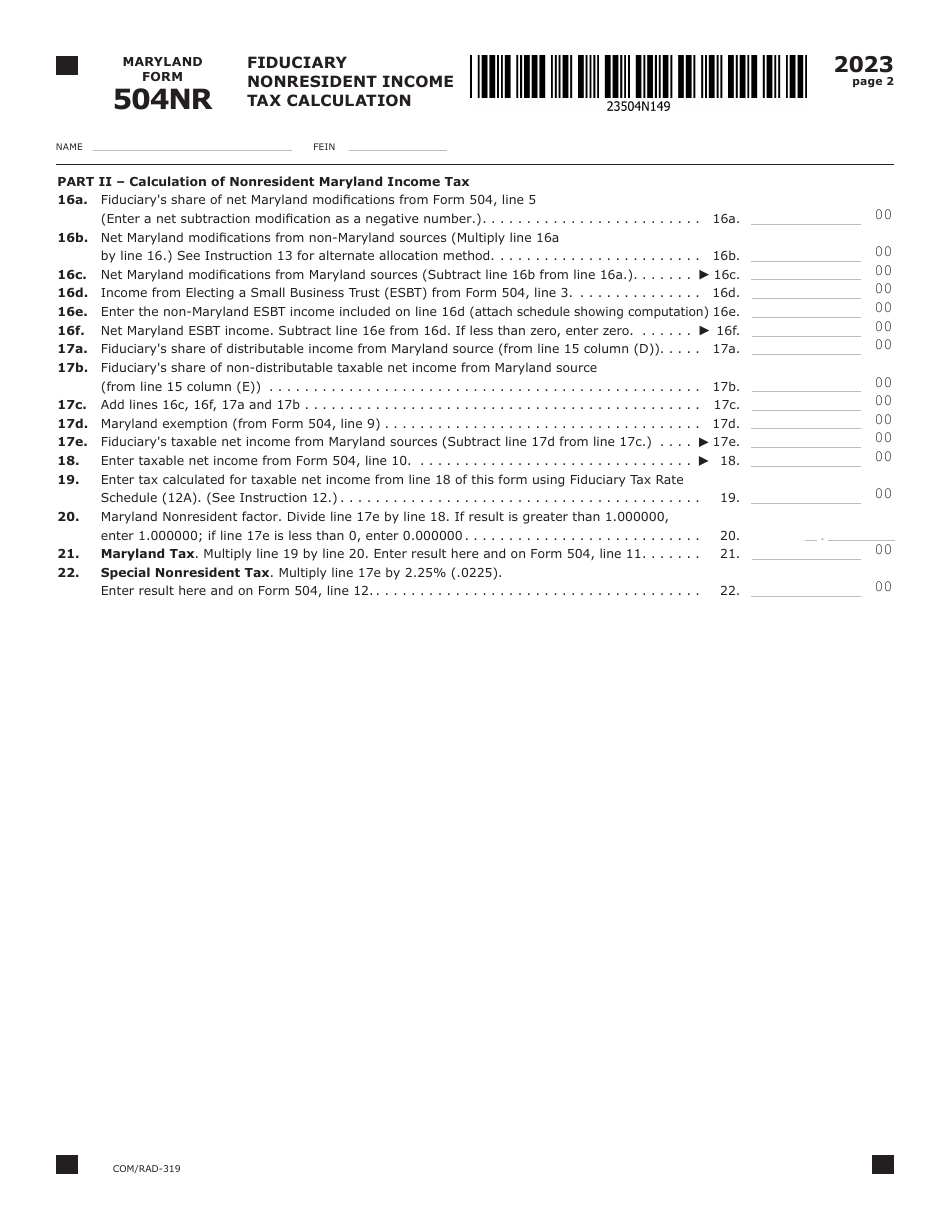

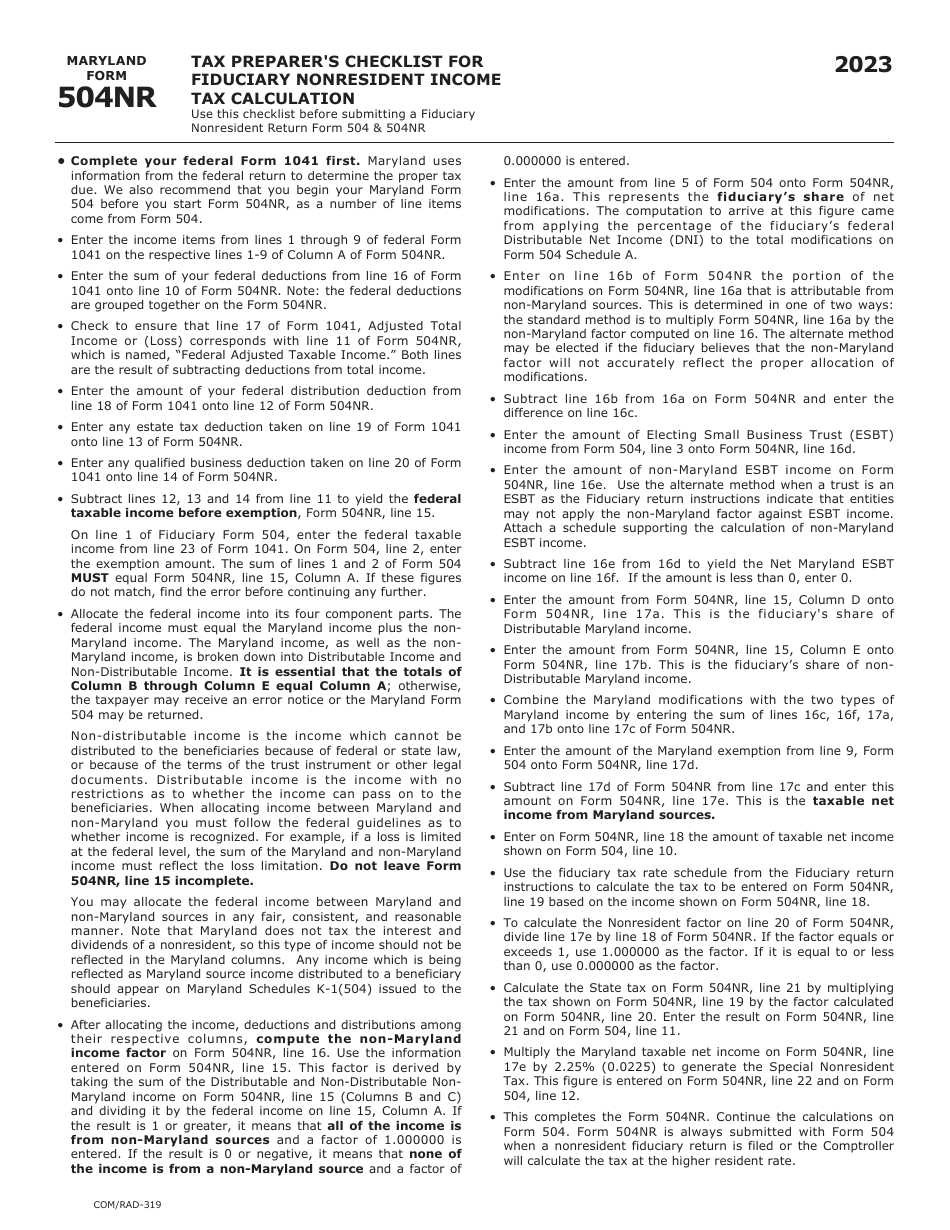

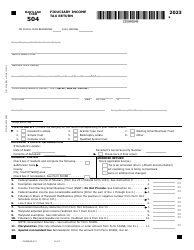

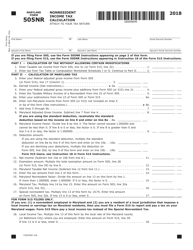

Maryland Form 504NR (COM / RAD-319) Fiduciary Nonresident Income Tax Calculation - Maryland

Fill PDF Online

Fill out online for free

without registration or credit card