This version of the form is not currently in use and is provided for reference only. Download this version of

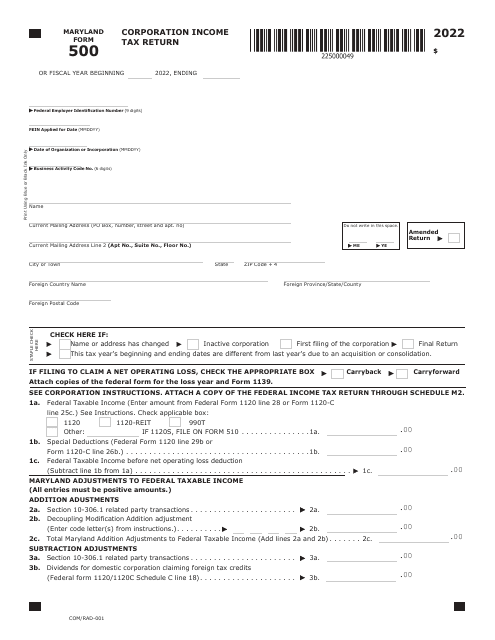

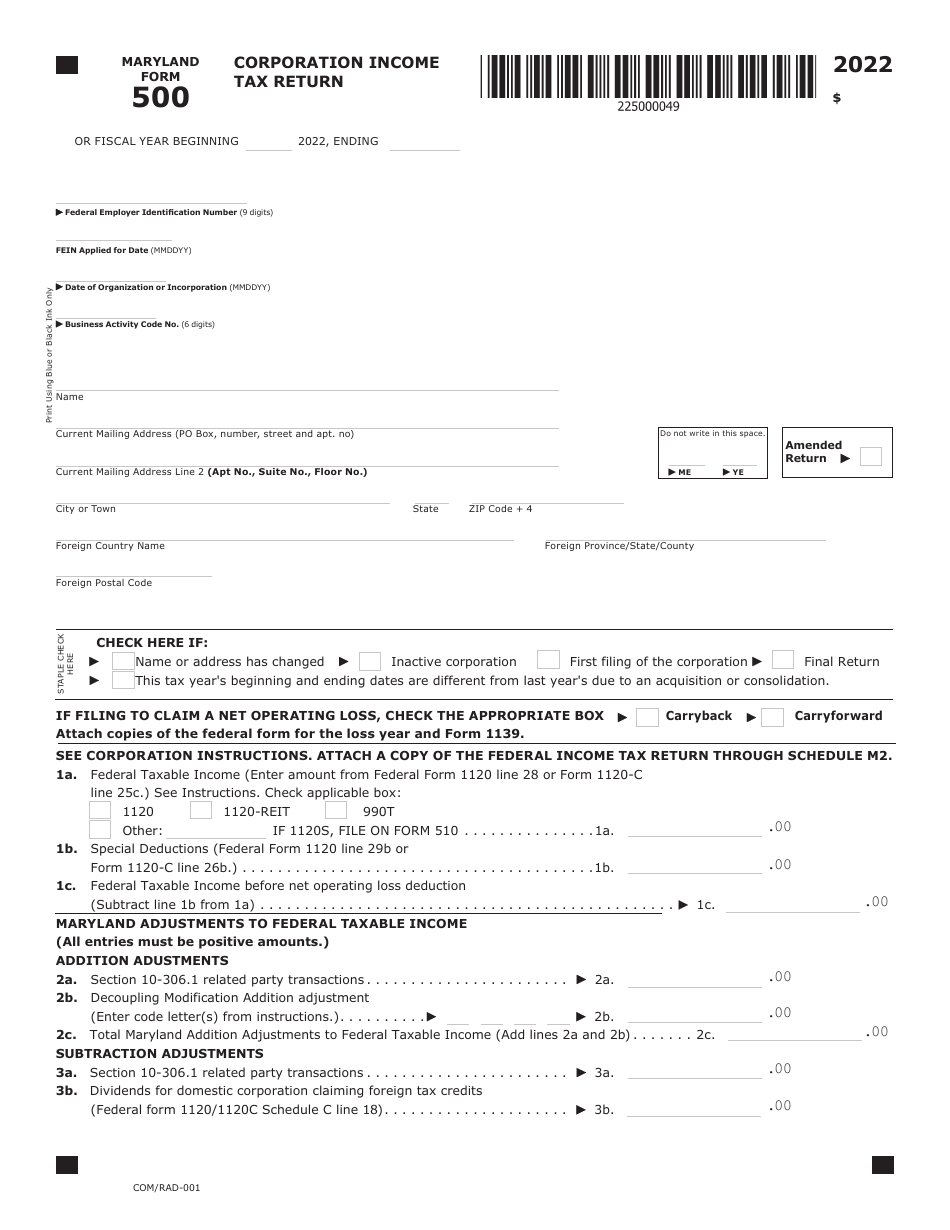

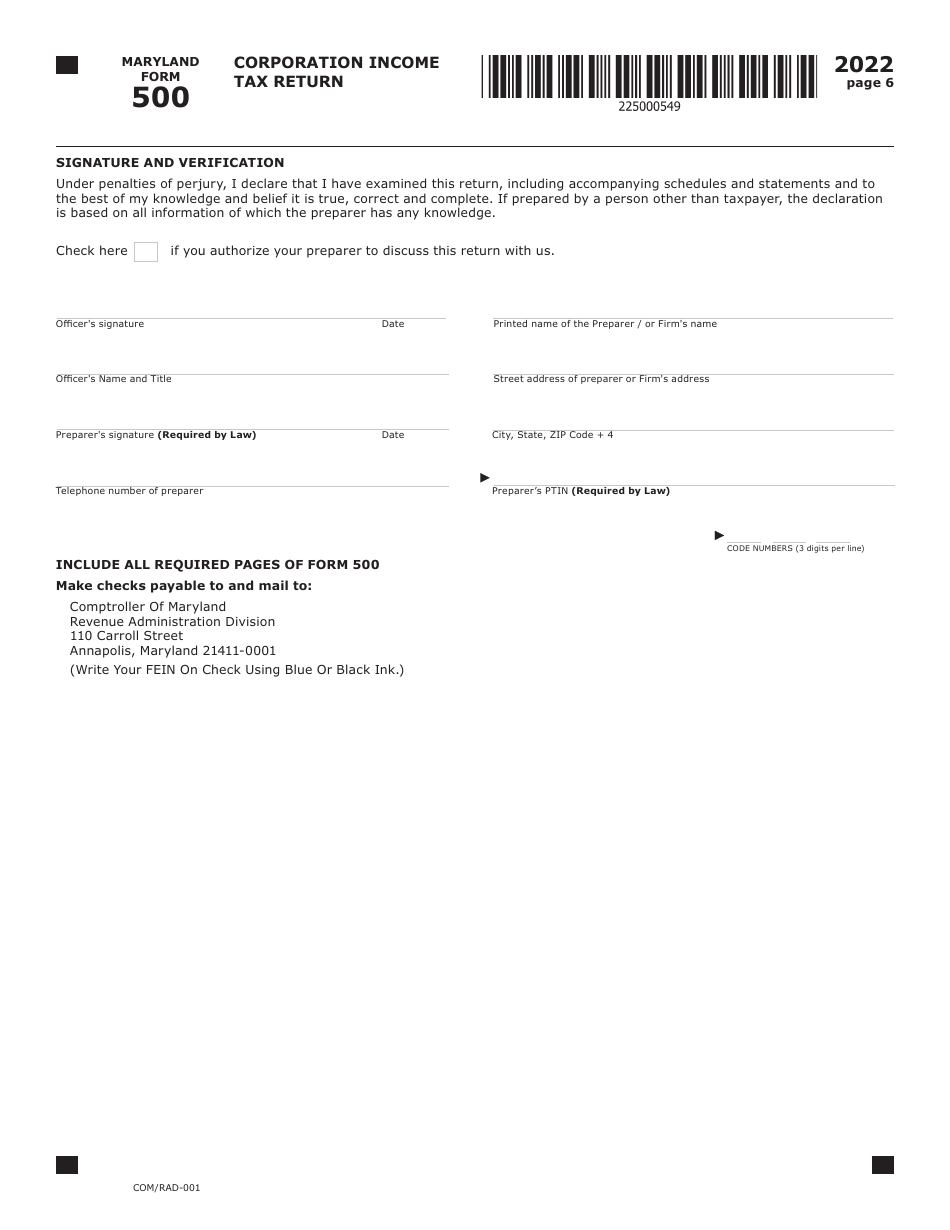

Maryland Form 500 (COM/RAD-001)

for the current year.

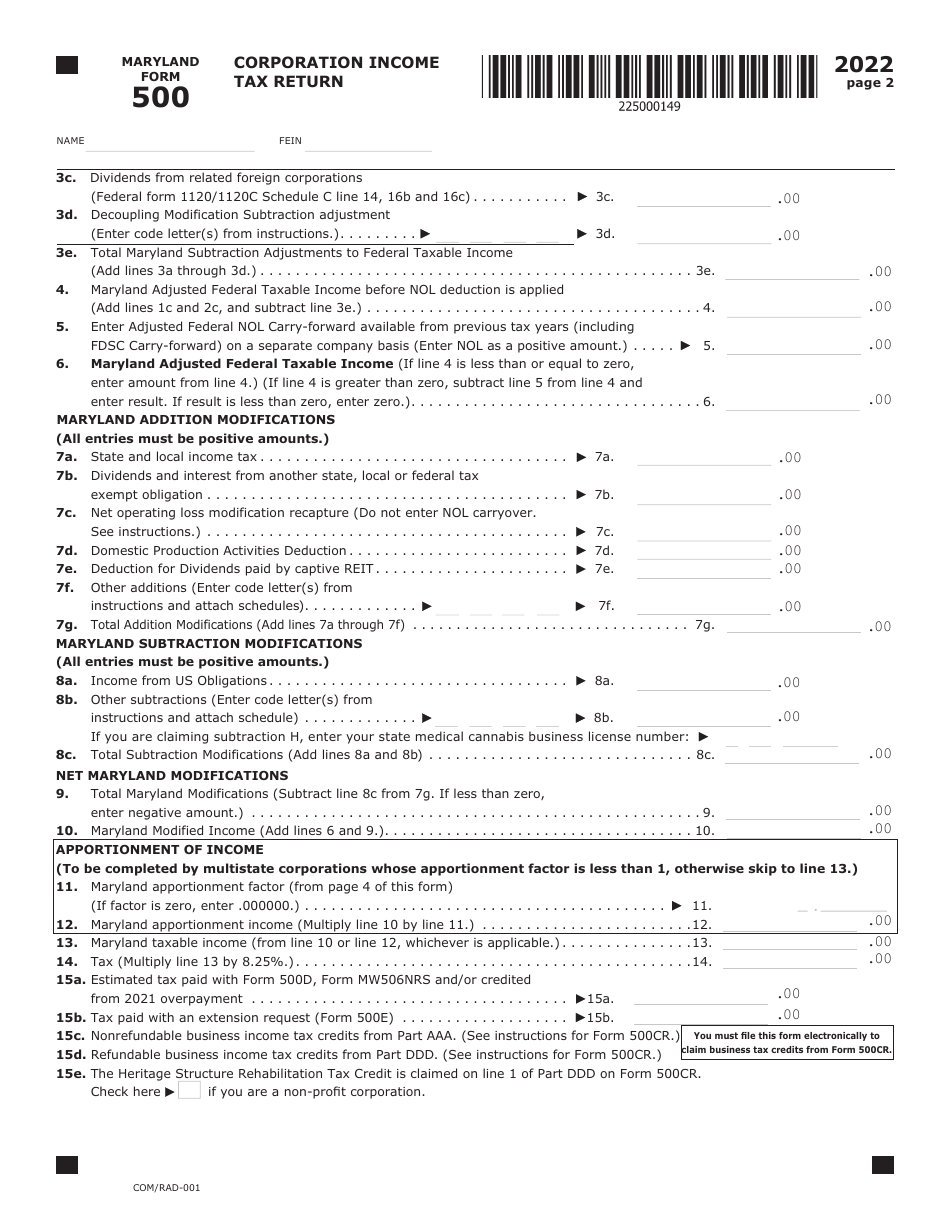

Maryland Form 500 (COM / RAD-001) Corporation Income Tax Return - Maryland

What Is Maryland Form 500 (COM/RAD-001)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Maryland Form 500?

A: Maryland Form 500 is the Corporation Income Tax Return for businesses operating in Maryland.

Q: Who needs to file Maryland Form 500?

A: Businesses operating as corporations in Maryland need to file Form 500.

Q: What is the purpose of filing Maryland Form 500?

A: The purpose of filing Form 500 is to report and pay corporate income tax to the state of Maryland.

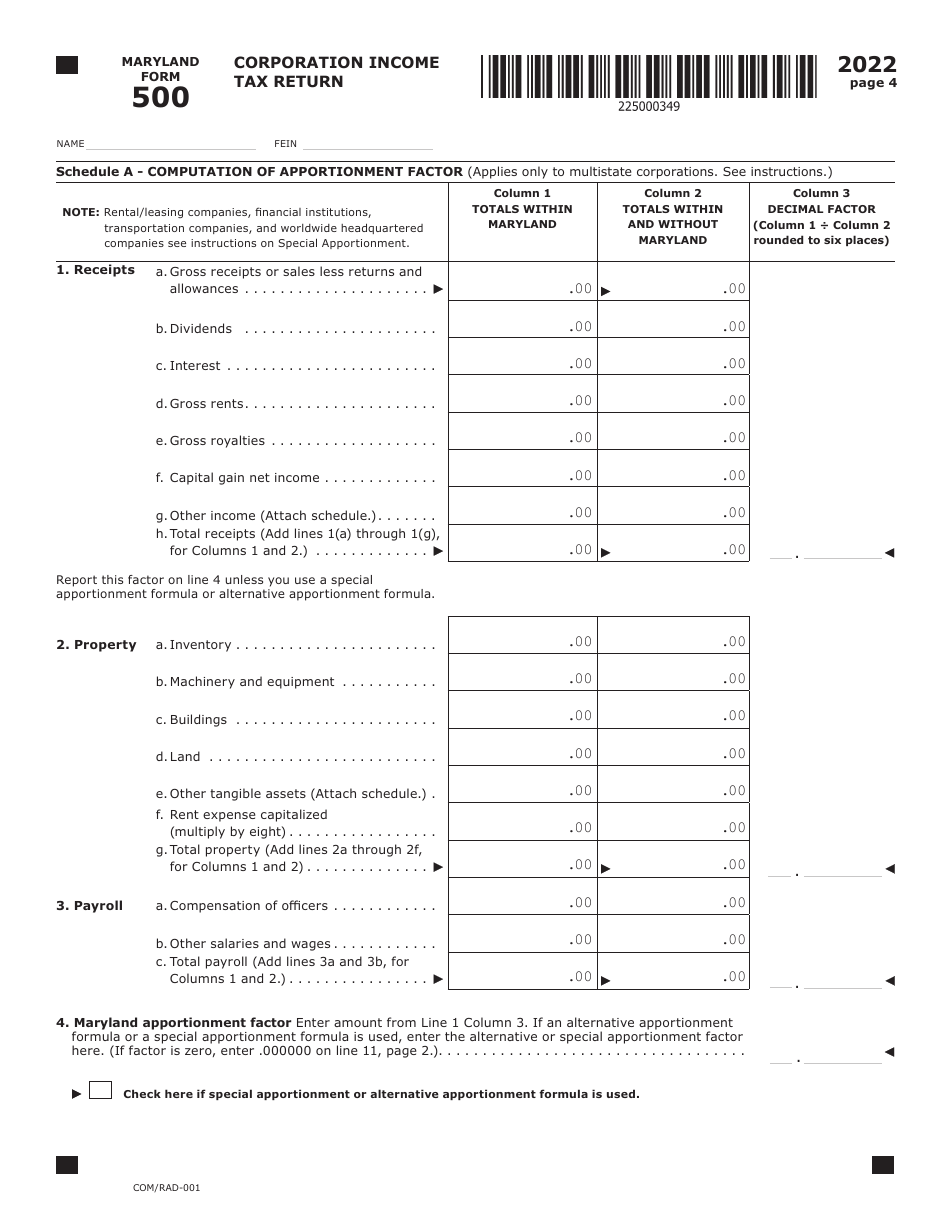

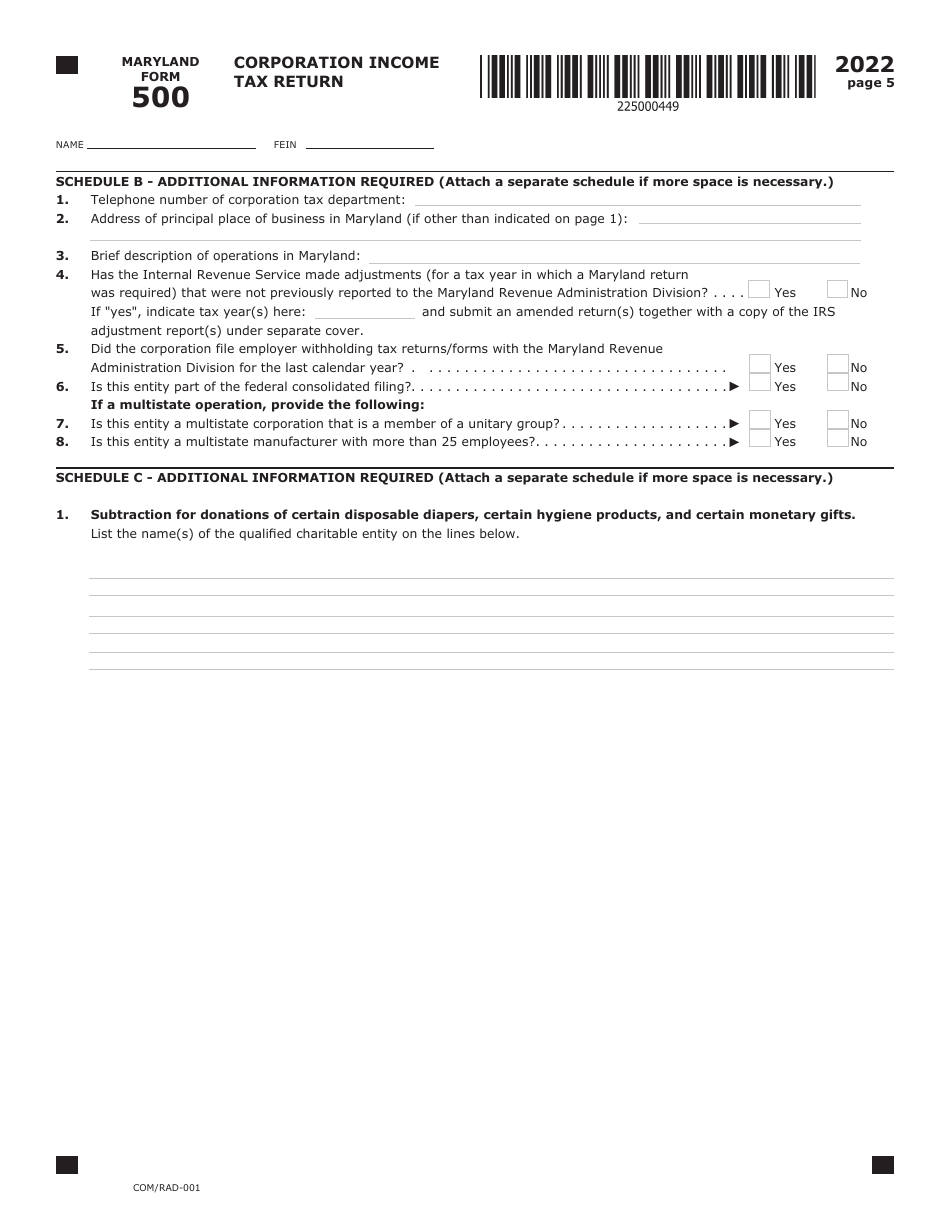

Q: What information do I need to complete Maryland Form 500?

A: You will need to provide information about your corporation's income, expenses, deductions, and credits.

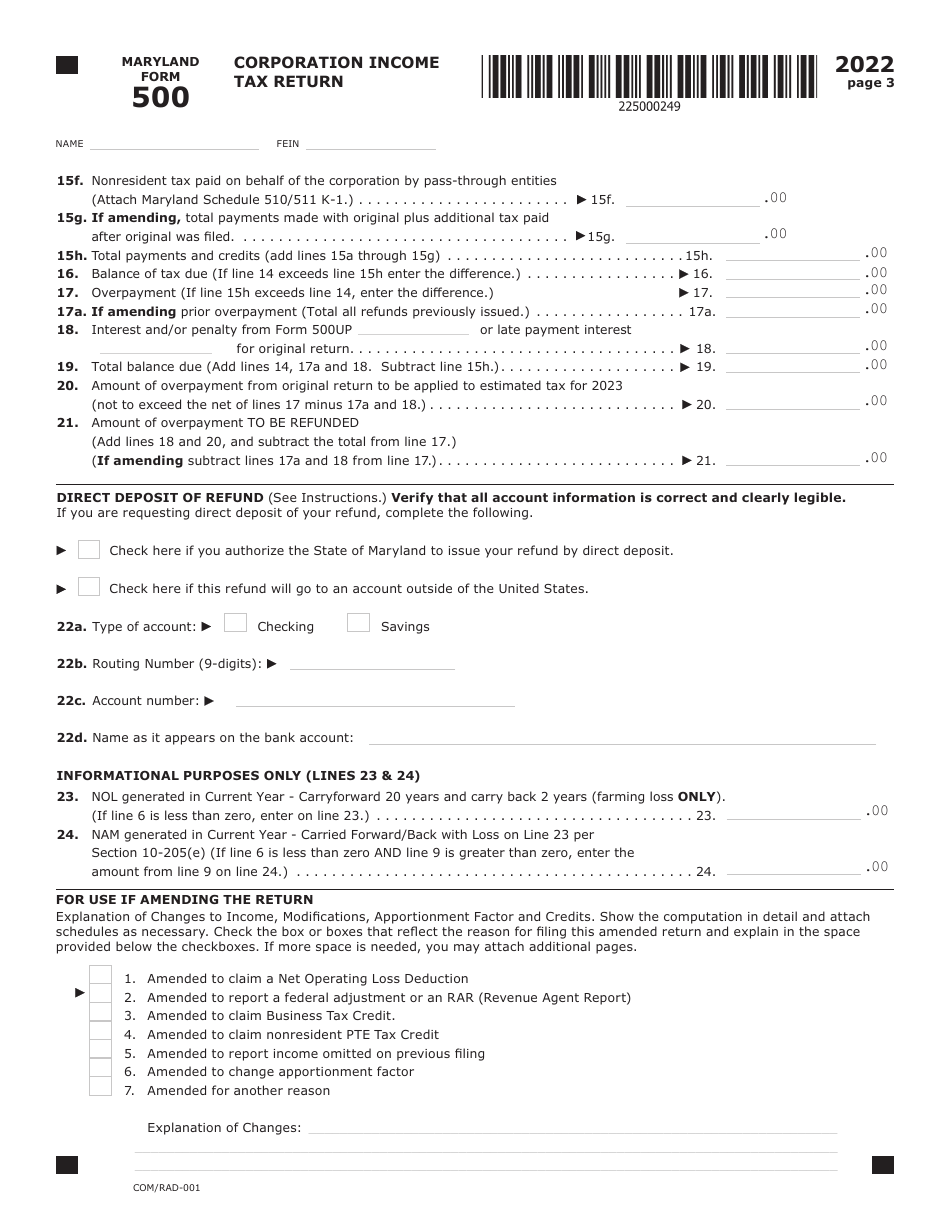

Q: When is the deadline to file Maryland Form 500?

A: The deadline to file Maryland Form 500 is the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Maryland Form 500?

A: Yes, there are penalties for late filing of Form 500, including interest charges on any unpaid tax amounts.

Q: Can I e-file Maryland Form 500?

A: Yes, Maryland Form 500 can be e-filed using the Maryland Business Express system.

Q: Do I need to include payment with Maryland Form 500?

A: Yes, you must include payment for any tax due with your filed Form 500.

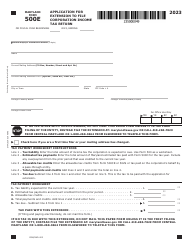

Q: Can I request an extension to file Maryland Form 500?

A: Yes, you can request a 6-month extension to file Form 500 by submitting Form 500E along with the required payment.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 500 (COM/RAD-001) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.