This version of the form is not currently in use and is provided for reference only. Download this version of

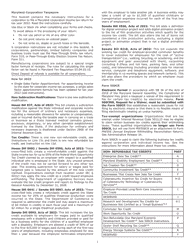

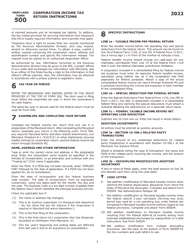

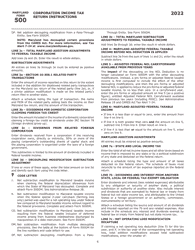

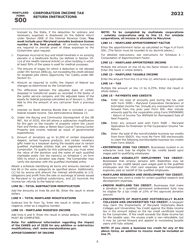

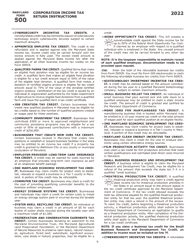

Instructions for Maryland Form 500, COM/RAD-001

for the current year.

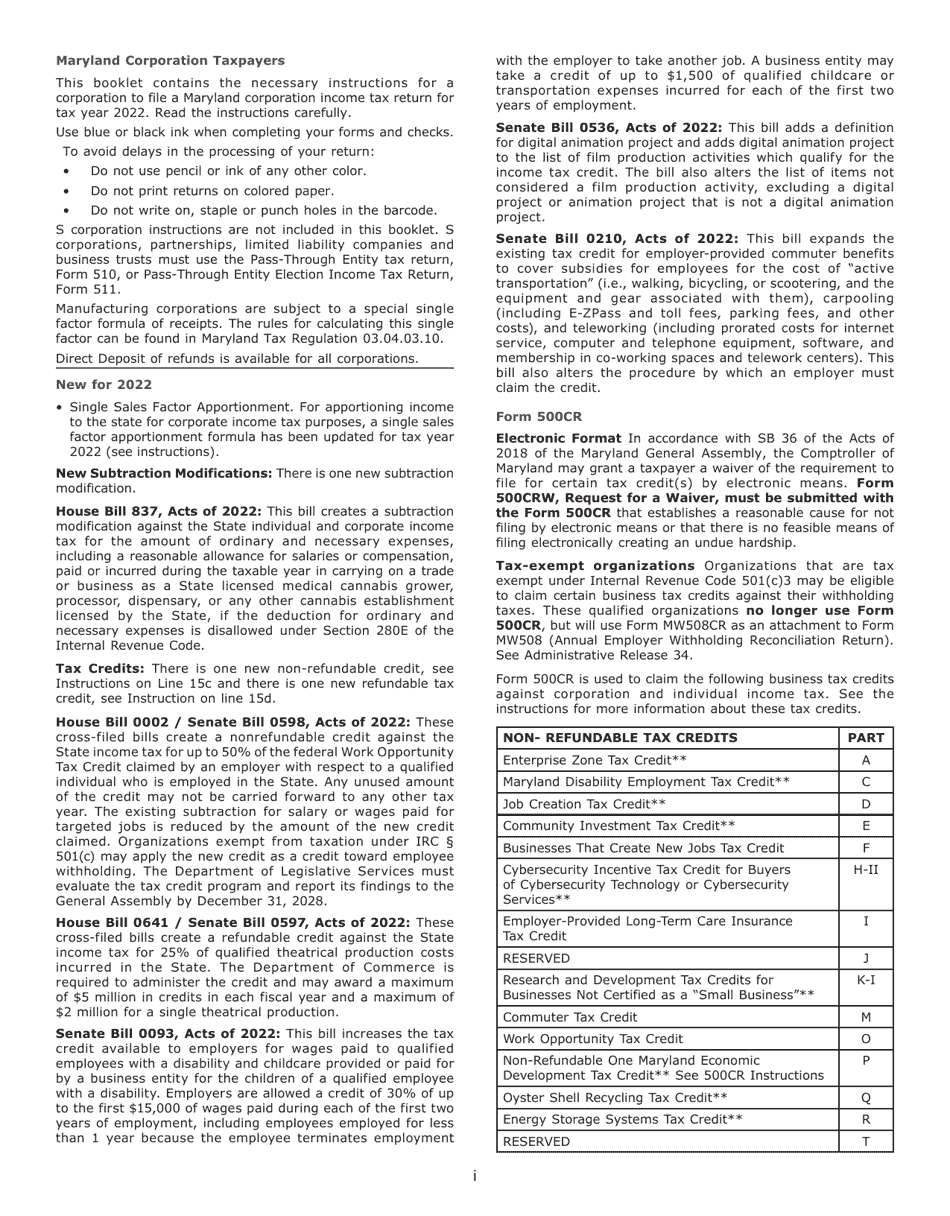

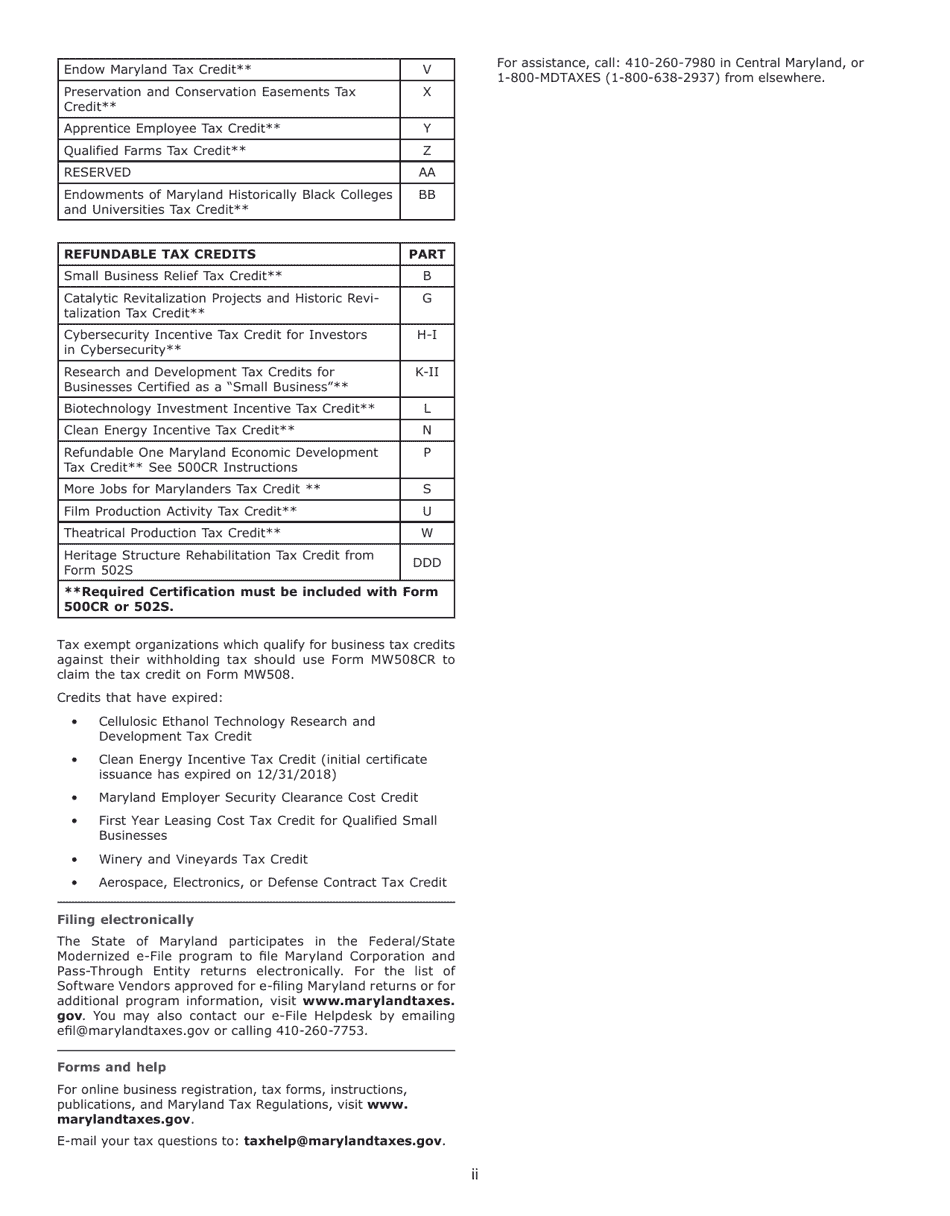

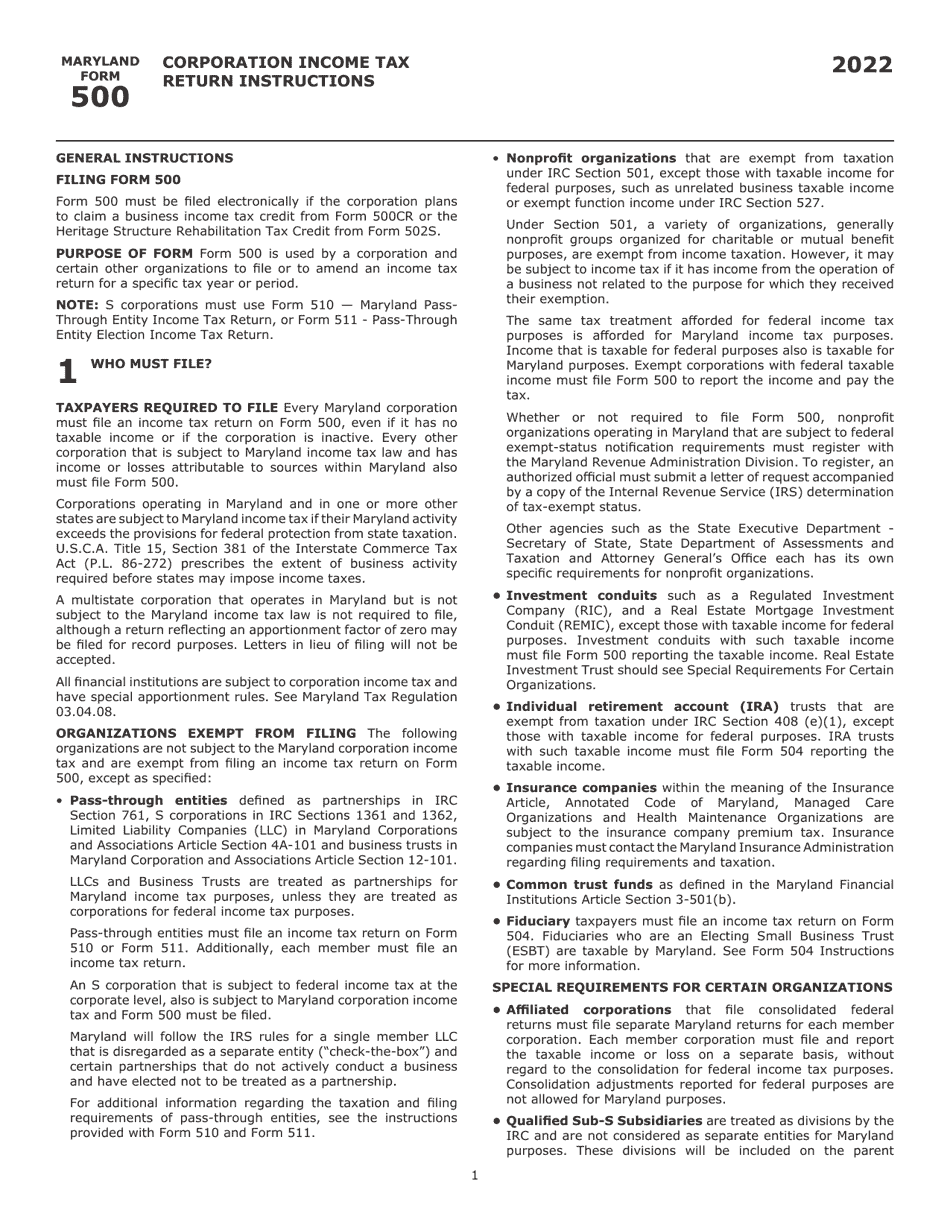

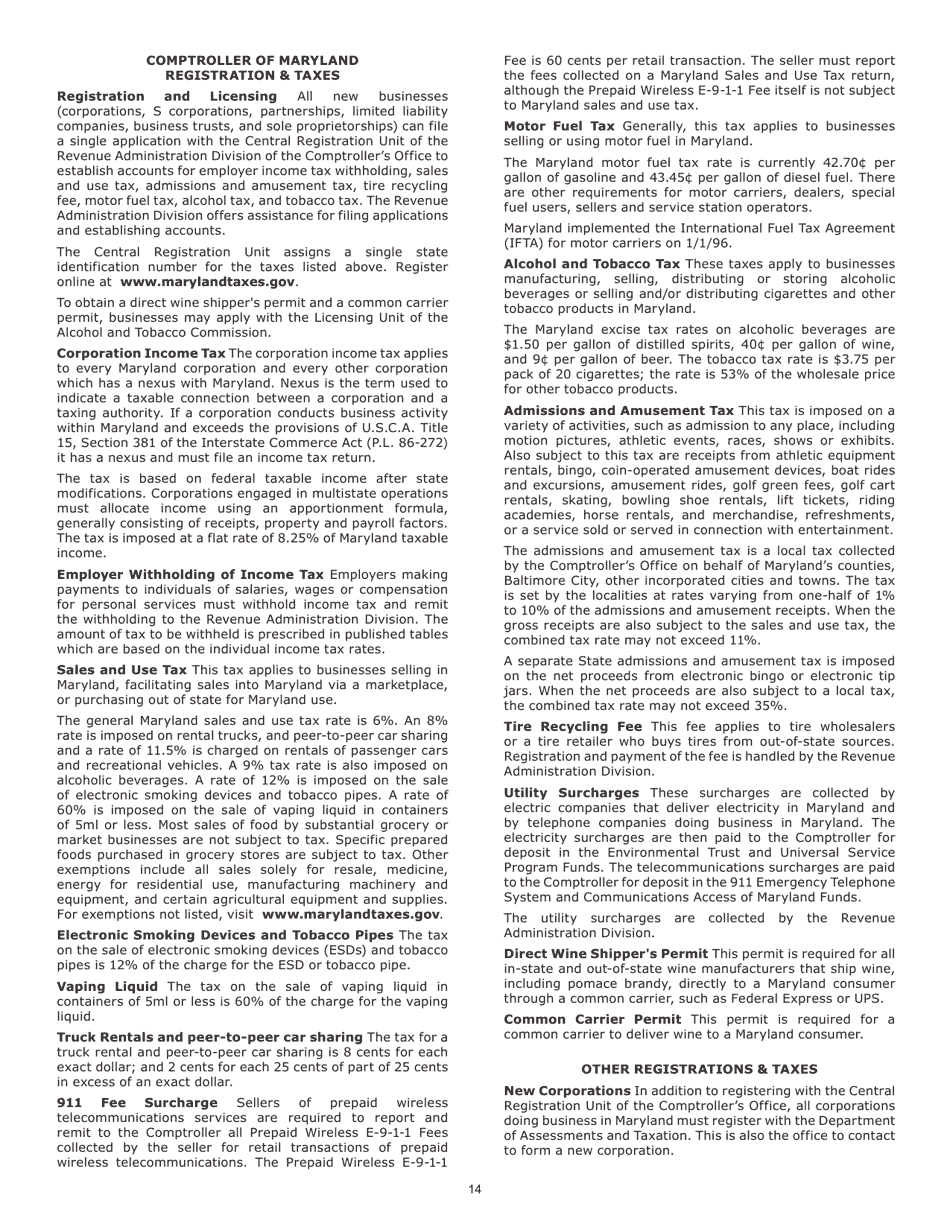

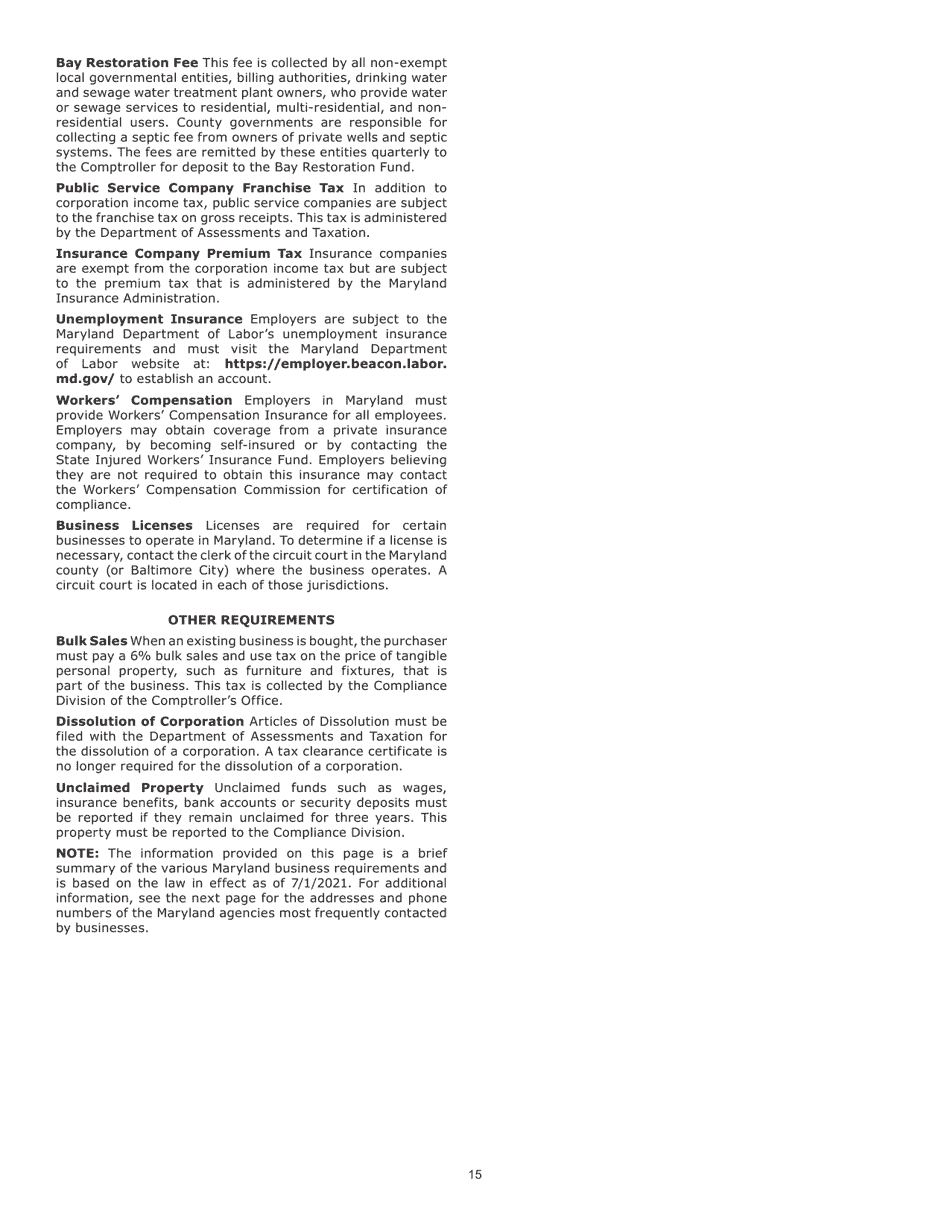

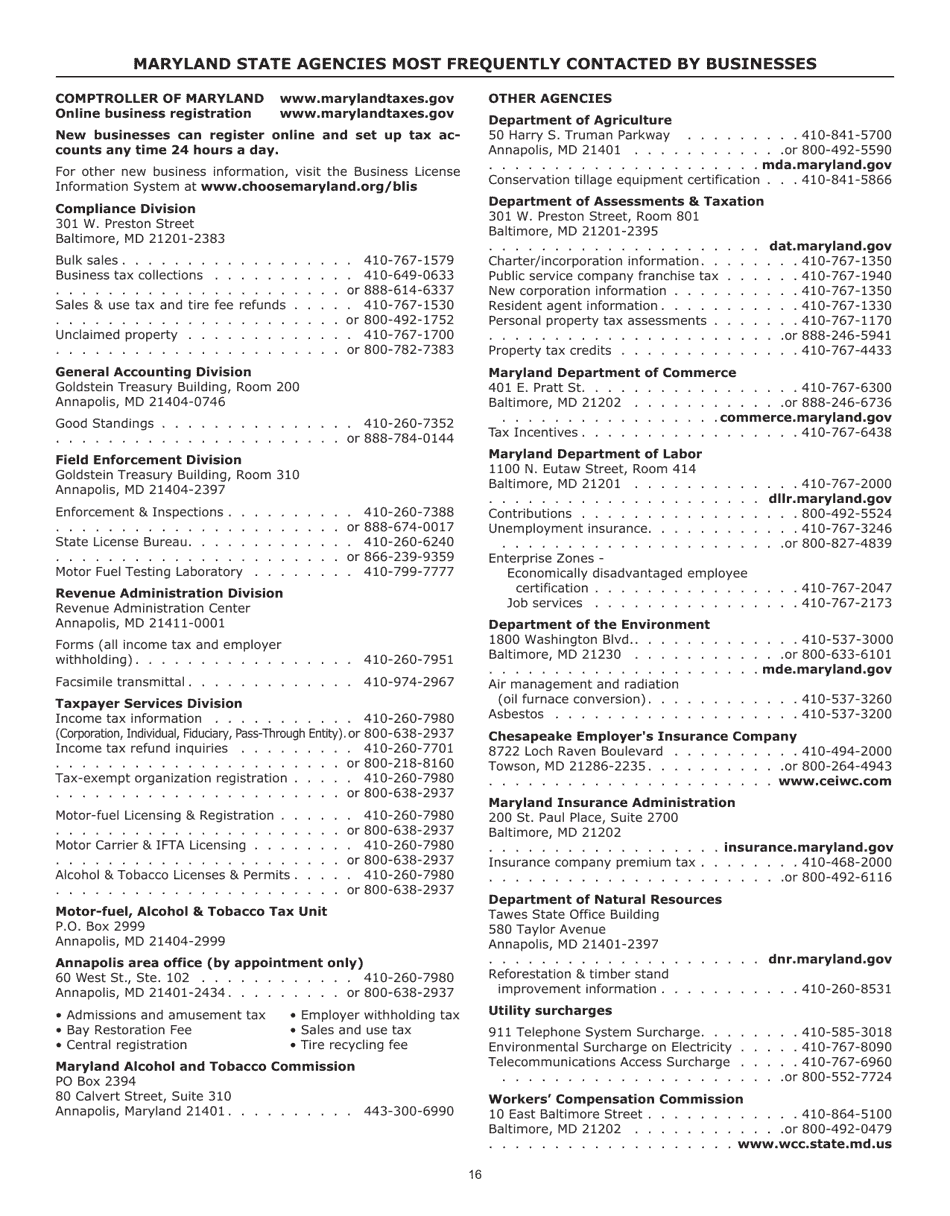

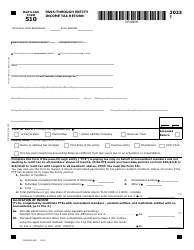

Instructions for Maryland Form 500, COM / RAD-001 Corporation Income Tax Return - Maryland

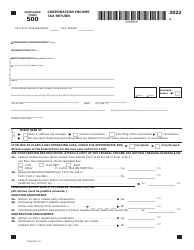

This document contains official instructions for Maryland Form 500 , and Form COM/RAD-001 . Both forms are released and collected by the Maryland Taxes. An up-to-date fillable Maryland Form 500 (COM/RAD-001) is available for download through this link.

FAQ

Q: What is Maryland Form 500?

A: Maryland Form 500 is the Corporation Income Tax Return for businesses operating in Maryland.

Q: Who needs to file Maryland Form 500?

A: Corporations that conduct business in Maryland or have income derived from Maryland sources need to file Form 500.

Q: What information do I need to complete Maryland Form 500?

A: You will need to provide information about your business, including income, deductions, credits, and any tax payments made.

Q: When is the due date for Maryland Form 500?

A: Maryland Form 500 is generally due by April 15th, or the 15th day of the fourth month following the close of the taxable year.

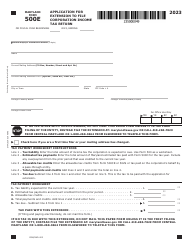

Q: Are there any extensions available for filing Maryland Form 500?

A: Yes, corporations can request an extension of time to file Form 500, but they must still pay any tax owed by the original due date.

Q: Is electronic filing available for Maryland Form 500?

A: Yes, corporations can choose to file Form 500 electronically using the approved e-file system.

Q: Are there any penalties for late filing or failure to file Maryland Form 500?

A: Yes, there are penalties for late filing or failure to file Form 500, including interest and possible assessment of additional taxes.

Instruction Details:

- This 19-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maryland Taxes.