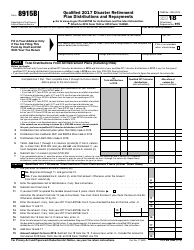

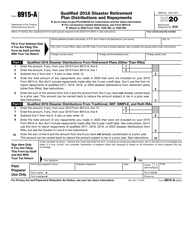

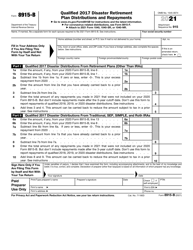

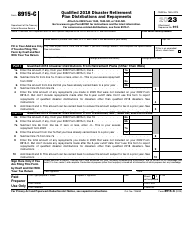

This version of the form is not currently in use and is provided for reference only. Download this version of

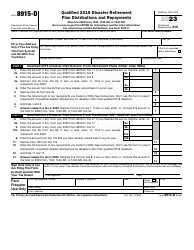

IRS Form 8915-F

for the current year.

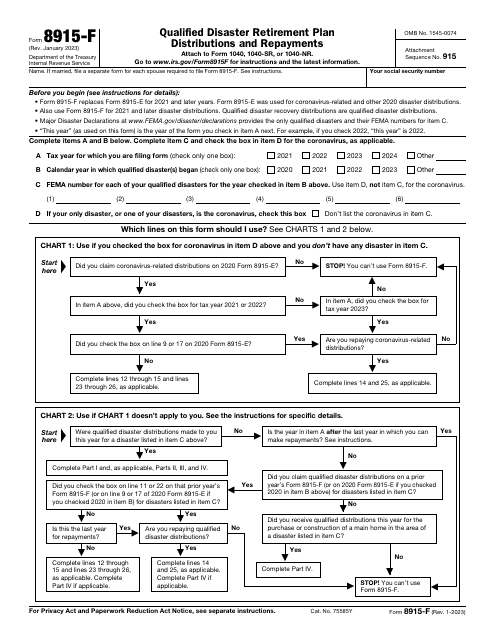

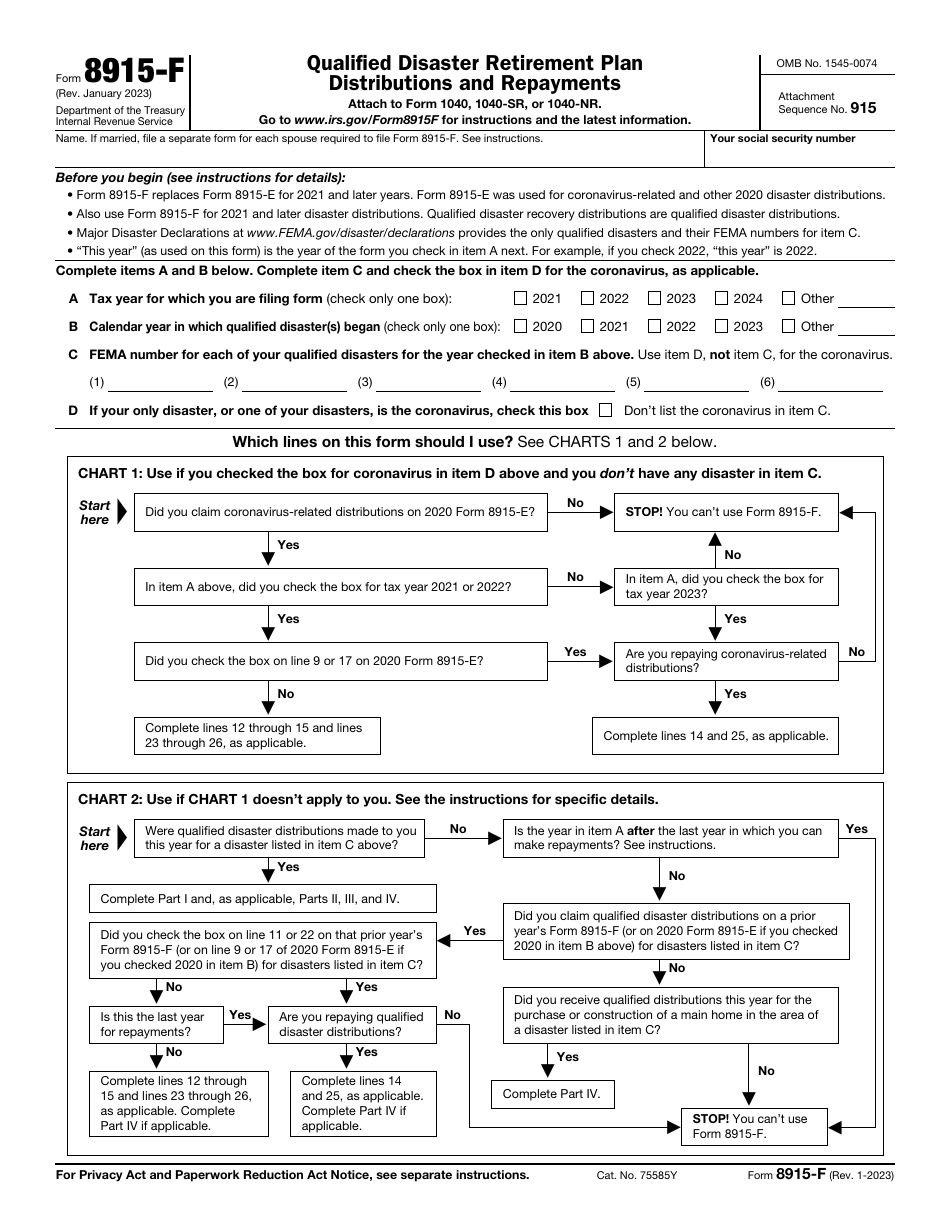

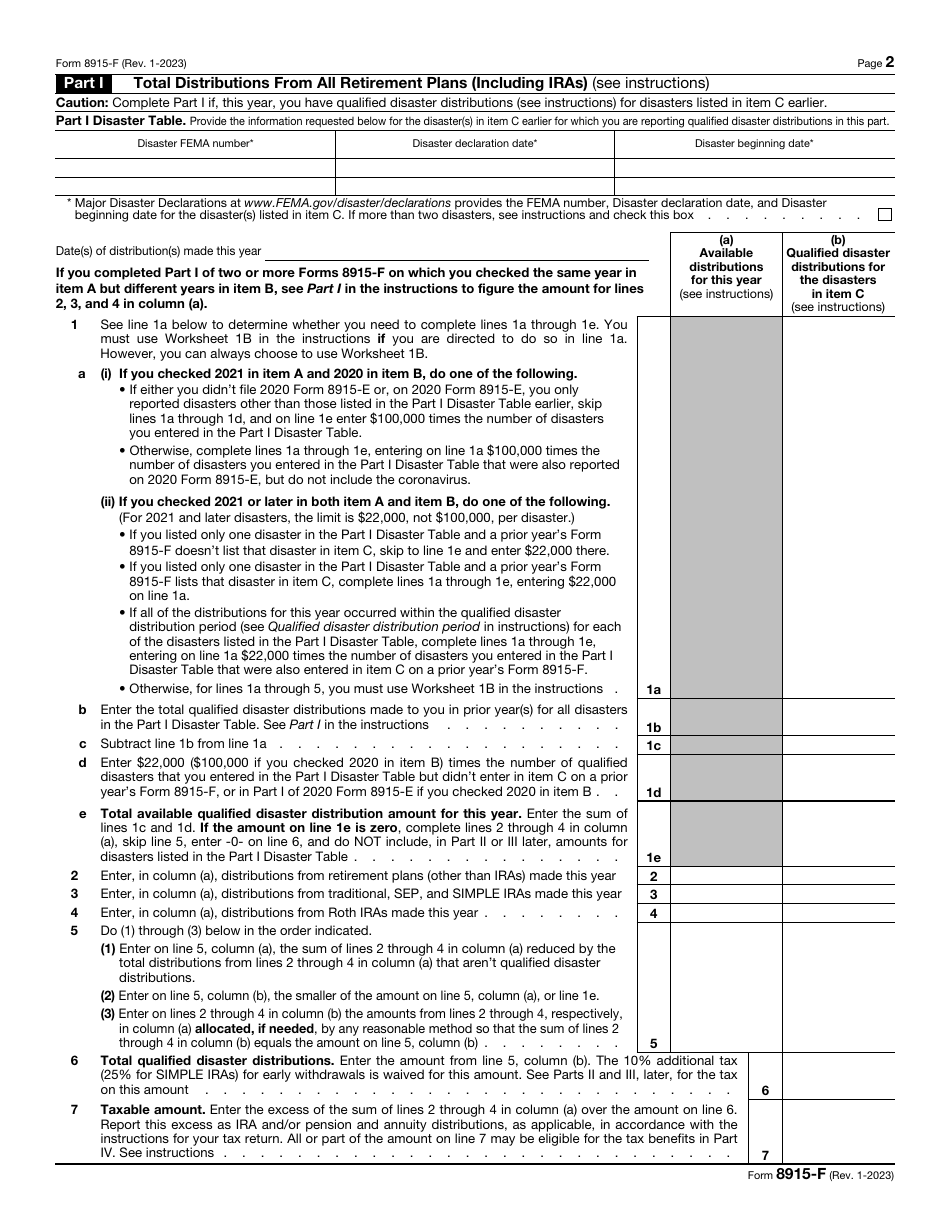

IRS Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments

What Is IRS Form 8915-F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2023. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8915-F?

A: IRS Form 8915-F is used to report qualified disaster retirement plan distributions and repayments.

Q: What are qualified disaster retirement plan distributions?

A: Qualified disaster retirement plan distributions are withdrawals from retirement plans made in response to a qualified disaster.

Q: Who can use IRS Form 8915-F?

A: Individuals who received qualified disaster retirement plan distributions and wish to report them or repay them can use IRS Form 8915-F.

Q: What is the purpose of using IRS Form 8915-F?

A: The purpose of using IRS Form 8915-F is to report qualified disaster retirement plan distributions and repayments to the IRS.

Q: How do I report qualified disaster retirement plan distributions?

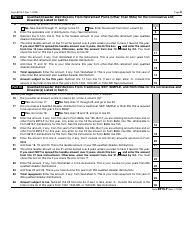

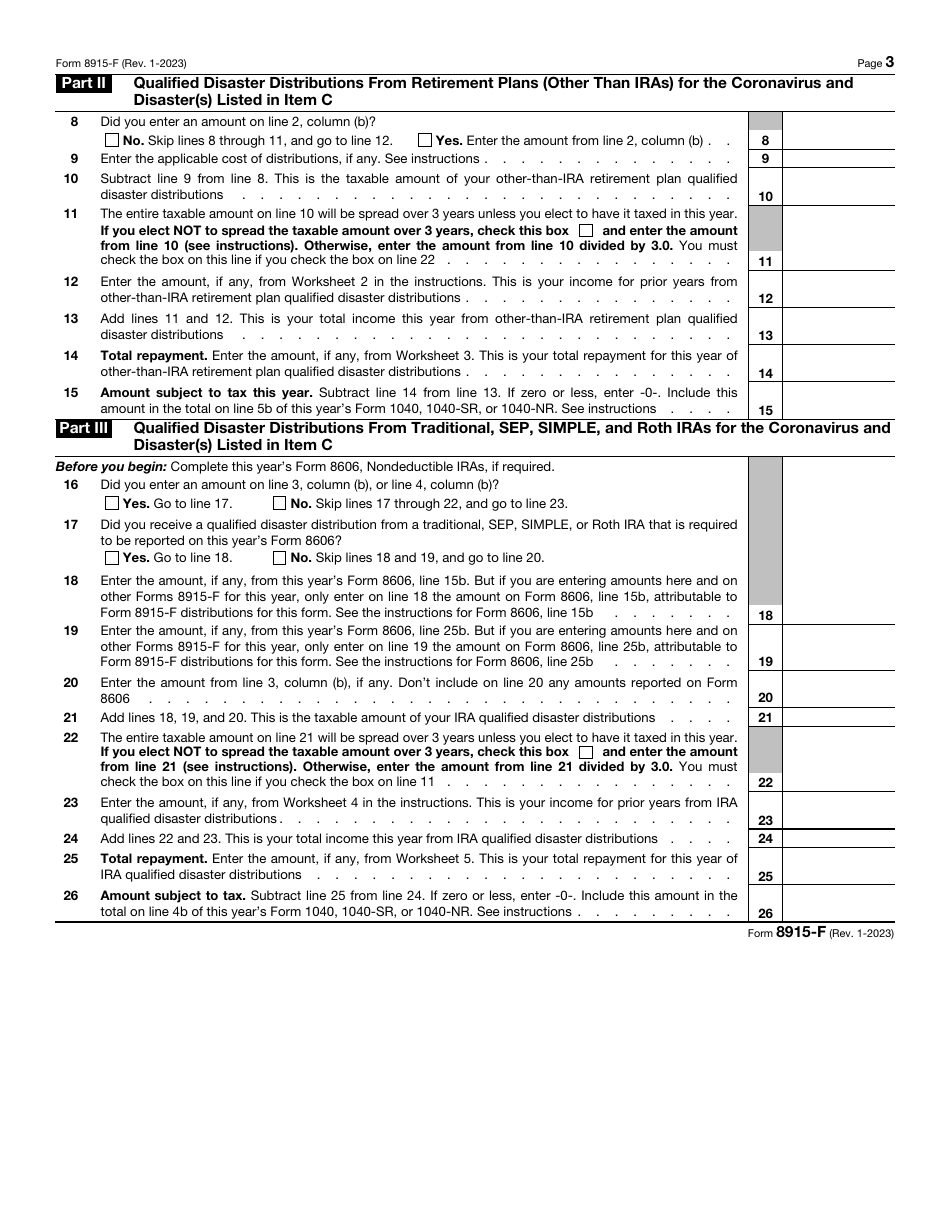

A: Qualified disaster retirement plan distributions should be reported on Part 2 of IRS Form 8915-F.

Q: How do I report repayments of qualified disaster retirement plan distributions?

A: Repayments of qualified disaster retirement plan distributions should be reported on Part 3 of IRS Form 8915-F.

Q: Are there any special rules or requirements for using IRS Form 8915-F?

A: Yes, there are specific rules and requirements for using IRS Form 8915-F. It is important to read the instructions provided with the form to ensure compliance.

Q: Is IRS Form 8915-F applicable only to certain states or regions?

A: No, IRS Form 8915-F is applicable to all states and regions within the United States.

Q: Can I e-file IRS Form 8915-F?

A: As of now, IRS Form 8915-F can only be filed by mail. It cannot be e-filed.

Q: When is the deadline for filing IRS Form 8915-F?

A: The deadline for filing IRS Form 8915-F may vary depending on the specific circumstances. It is important to check the instructions and any applicable tax deadlines to ensure timely filing.

Form Details:

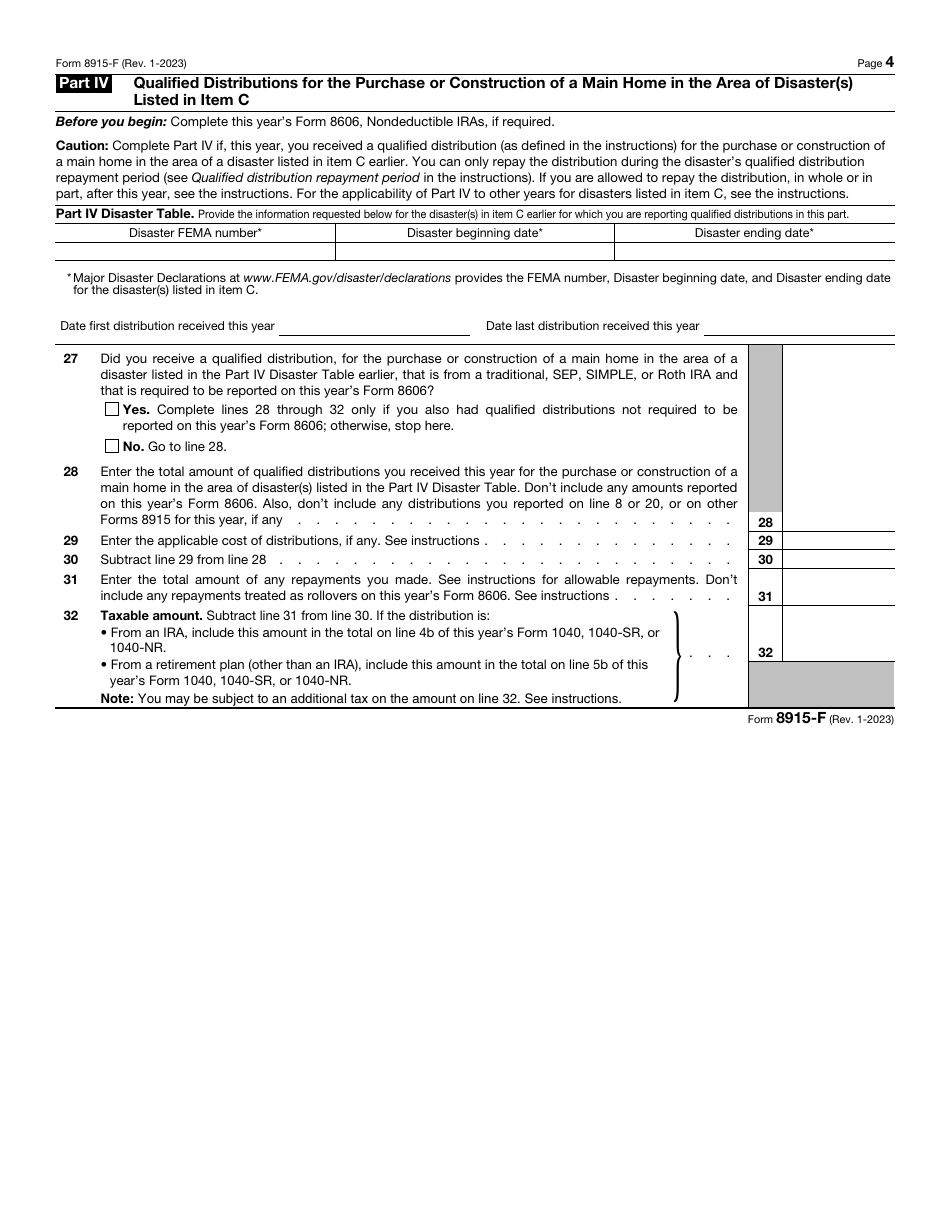

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8915-F through the link below or browse more documents in our library of IRS Forms.