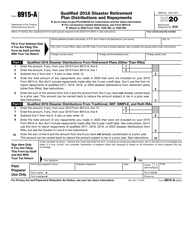

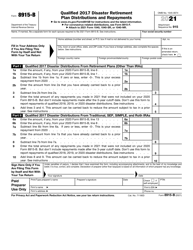

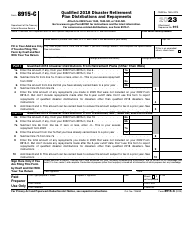

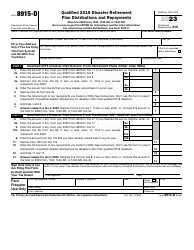

This version of the form is not currently in use and is provided for reference only. Download this version of

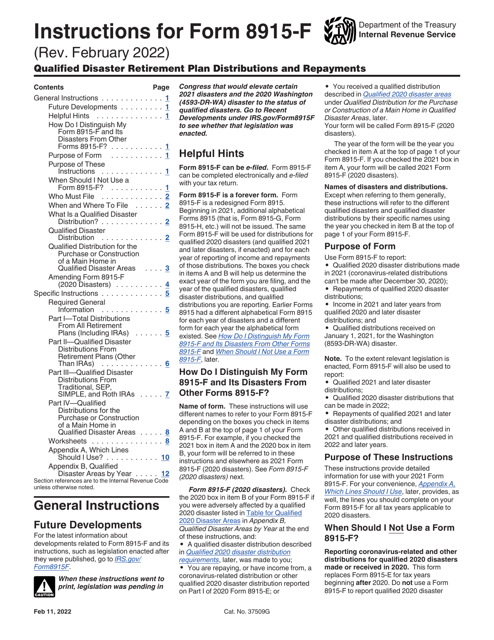

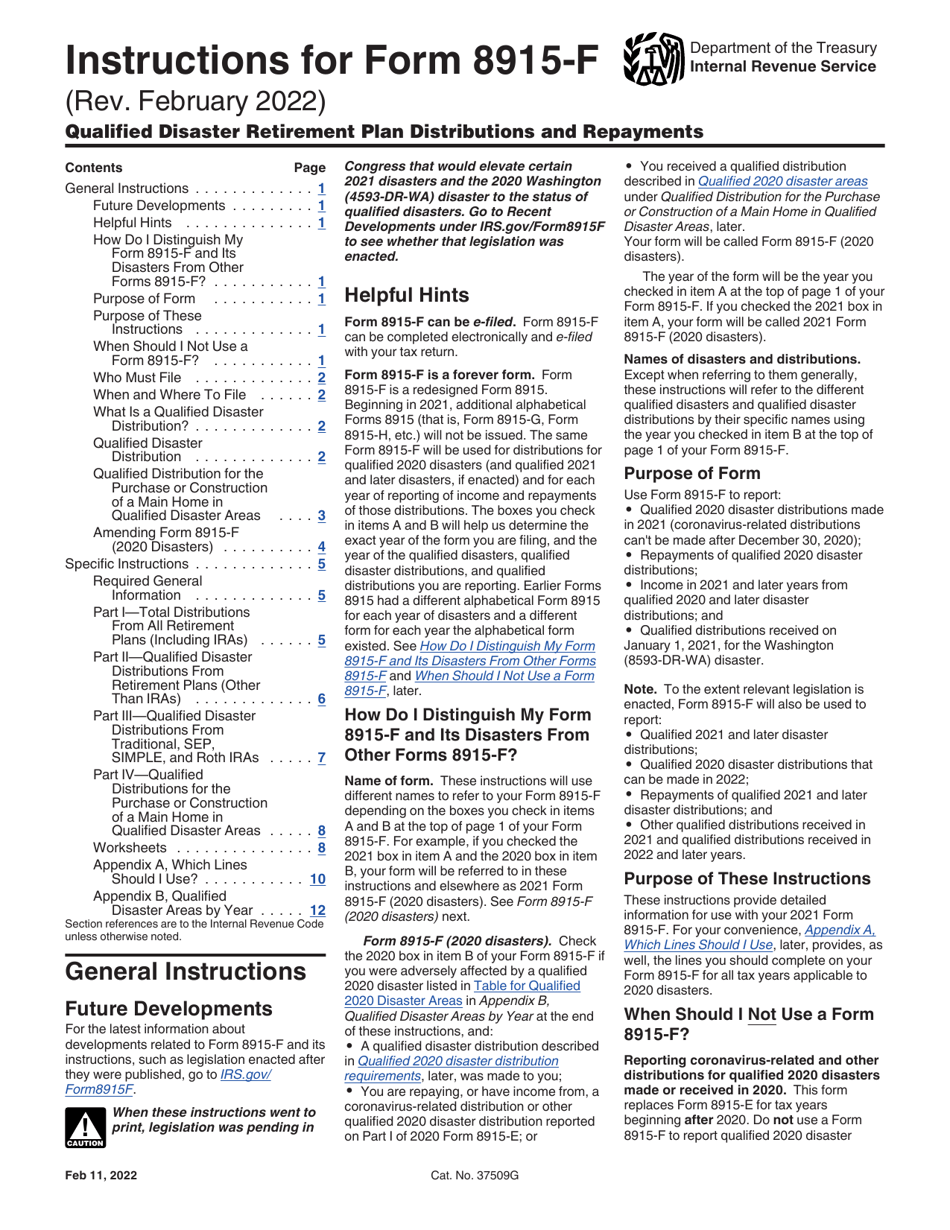

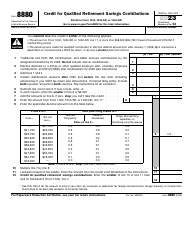

Instructions for IRS Form 8915-F

for the current year.

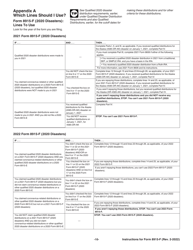

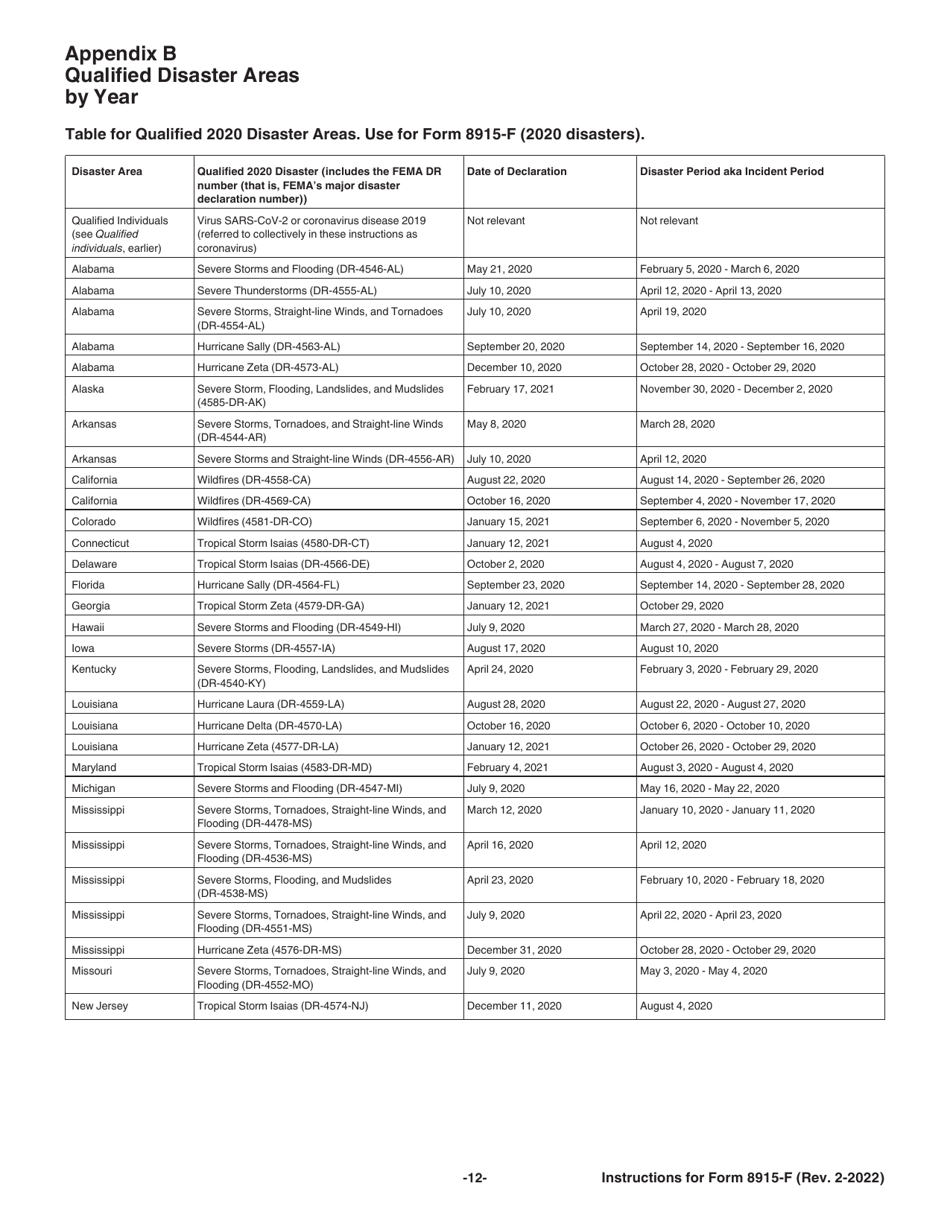

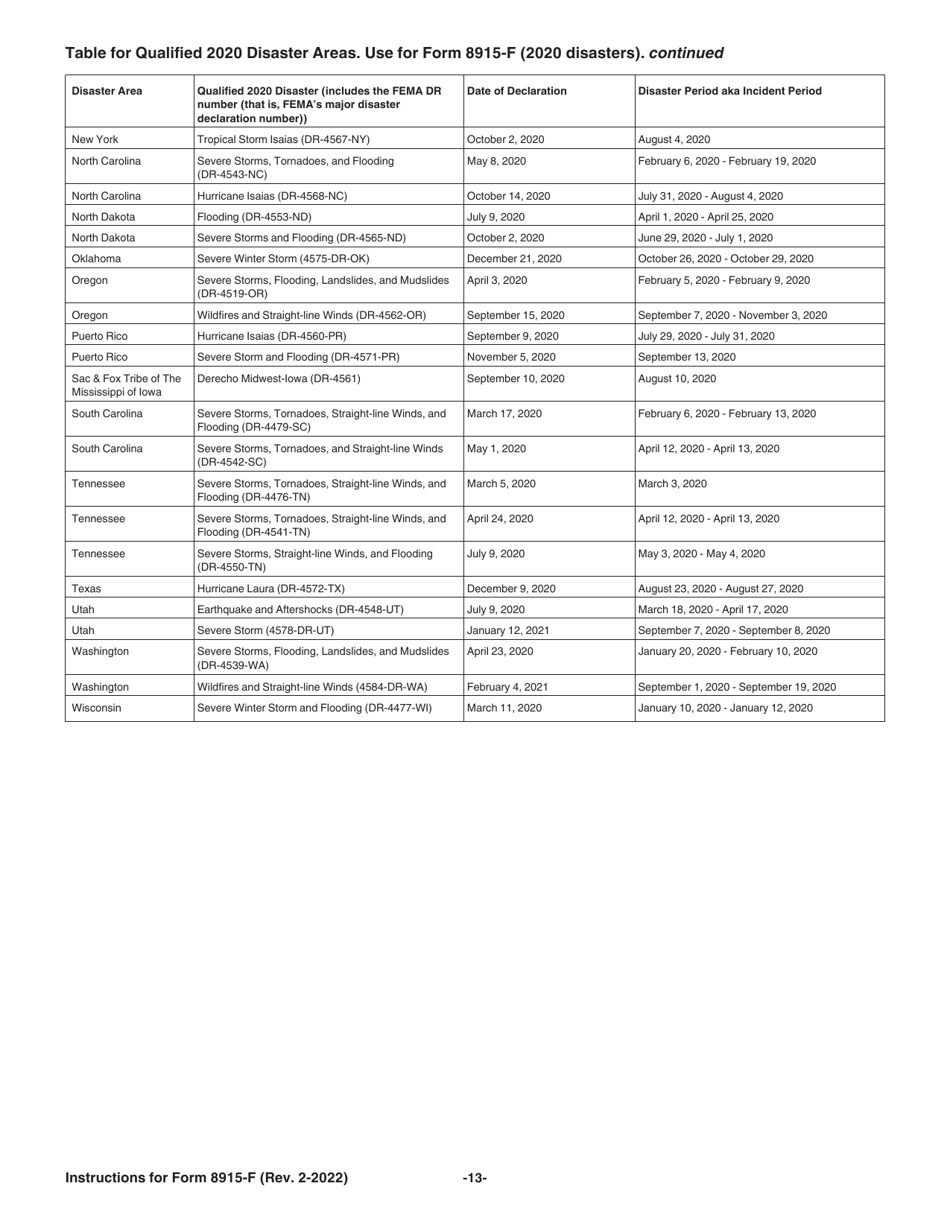

Instructions for IRS Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments

This document contains official instructions for IRS Form 8915-F , Qualified Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8915-F is available for download through this link.

FAQ

Q: What is IRS Form 8915-F?

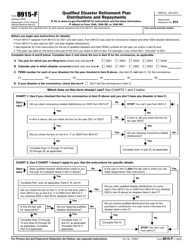

A: IRS Form 8915-F is used to report qualified disaster retirement plan distributions and repayments.

Q: What are qualified disaster retirement plan distributions?

A: Qualified disaster retirement plan distributions are distributions from a retirement plan that are made on account of a qualified disaster.

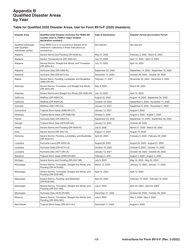

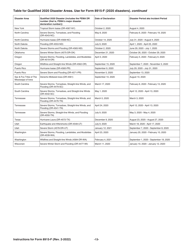

Q: What are qualified disasters?

A: Qualified disasters are events that are designated as federally declared disasters by the President of the United States.

Q: Who can use IRS Form 8915-F?

A: Individuals who received qualified disaster retirement plan distributions or made repayments of such distributions can use IRS Form 8915-F.

Q: What information is required on IRS Form 8915-F?

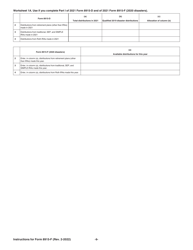

A: IRS Form 8915-F requires information about the taxpayer, the disaster, the retirement plan, and the distributions and repayments.

Q: When is IRS Form 8915-F due?

A: The due date for IRS Form 8915-F may vary depending on the specific disaster and the taxpayer's circumstances. The instructions for the form will provide the applicable due date.

Q: Are there any special rules or provisions related to IRS Form 8915-F?

A: Yes, there are specific rules and provisions related to qualified disaster retirement plan distributions and repayments. It is recommended to carefully review the instructions for IRS Form 8915-F or consult a tax professional for guidance.

Instruction Details:

- This 13-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.