This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8839

for the current year.

Instructions for IRS Form 8839 Qualified Adoption Expenses

This document contains official instructions for IRS Form 8839 , Qualified Adoption Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8839 is available for download through this link.

FAQ

Q: What is IRS Form 8839?

A: IRS Form 8839 is used to claim the adoption credit or exclusion for qualified adoption expenses.

Q: What are qualified adoption expenses?

A: Qualified adoption expenses are expenses that are directly related to the legal adoption of an eligible child.

Q: Who can claim the adoption credit or exclusion?

A: Taxpayers who have incurred qualified adoption expenses and have adopted an eligible child can claim the adoption credit or exclusion.

Q: What is the adoption credit?

A: The adoption credit is a non-refundable credit that reduces the taxpayer's overall tax liability.

Q: What is the adoption exclusion?

A: The adoption exclusion allows taxpayers to exclude certain expenses from their taxable income.

Q: What documentation is required to claim the adoption credit or exclusion?

A: Taxpayers must provide documentation that shows the legal adoption of an eligible child and the amount of qualified adoption expenses.

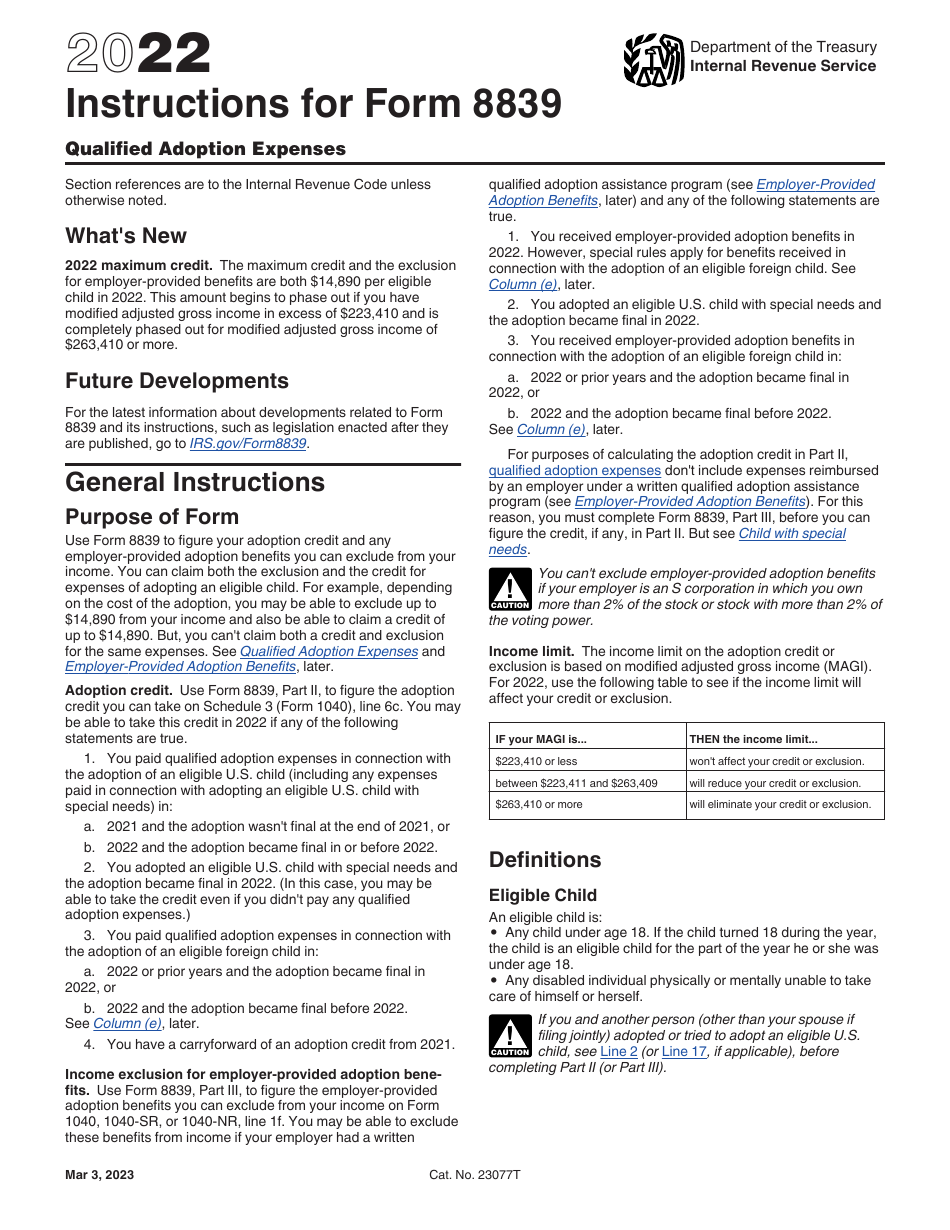

Q: Are there income limits for claiming the adoption credit?

A: Yes, there are income limits for claiming the adoption credit. The credit is gradually phased out for taxpayers with modified adjusted gross incomes above certain thresholds.

Q: When is the deadline to file IRS Form 8839?

A: The deadline to file IRS Form 8839 is typically April 15th, unless an extension has been granted.

Q: Can I claim the adoption credit in addition to the adoption exclusion?

A: No, taxpayers can only claim either the adoption credit or the adoption exclusion for the same adoption expenses.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.