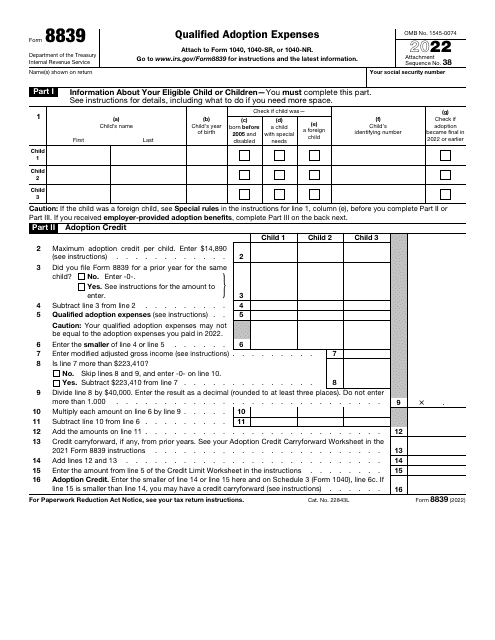

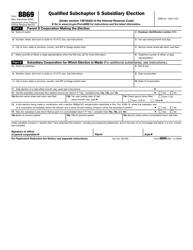

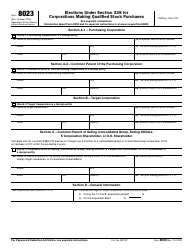

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8839

for the current year.

IRS Form 8839 Qualified Adoption Expenses

What Is IRS Form 8839?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8839?

A: IRS Form 8839 is a tax form used to claim qualified adoption expenses.

Q: What are qualified adoption expenses?

A: Qualified adoption expenses are expenses related to the legal adoption of a child, such as adoption fees, court costs, and attorney fees.

Q: Who can claim qualified adoption expenses?

A: Individuals who have adopted a child and incurred qualified adoption expenses can claim them on their tax return.

Q: What is the purpose of claiming qualified adoption expenses?

A: By claiming qualified adoption expenses, individuals may be eligible for a tax credit or exclusion, which can help offset the costs of the adoption.

Q: How do I file IRS Form 8839?

A: IRS Form 8839 can be filed along with your annual tax return. It is important to follow the instructions provided by the IRS and accurately report your qualified adoption expenses.

Form Details:

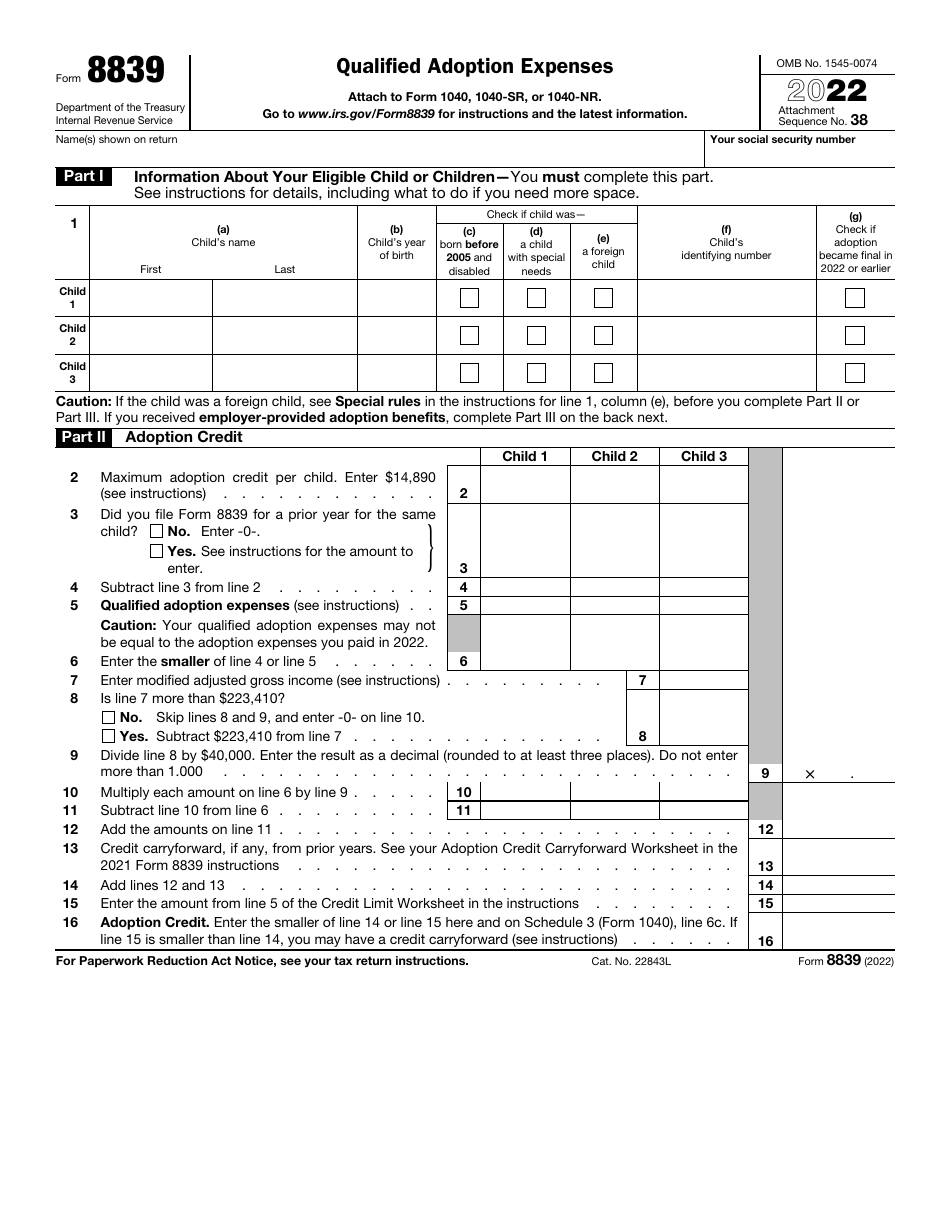

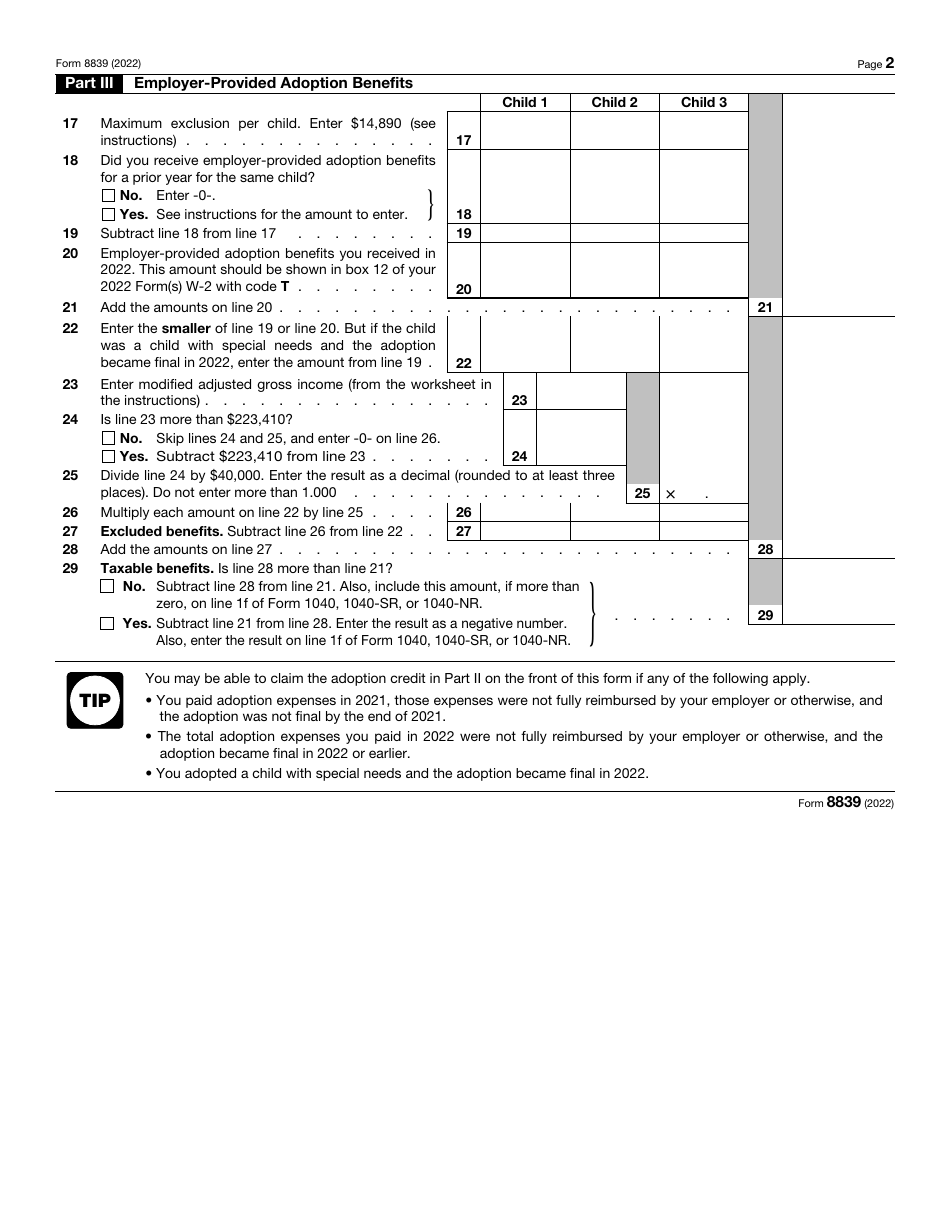

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8839 through the link below or browse more documents in our library of IRS Forms.