This version of the form is not currently in use and is provided for reference only. Download this version of

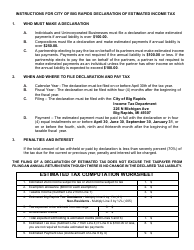

Instructions for Form BR-1040

for the current year.

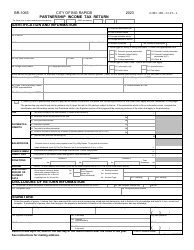

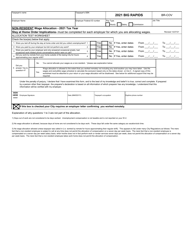

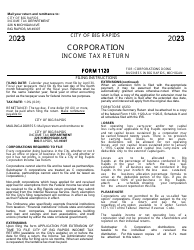

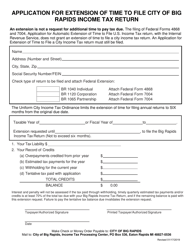

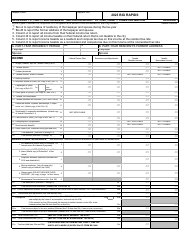

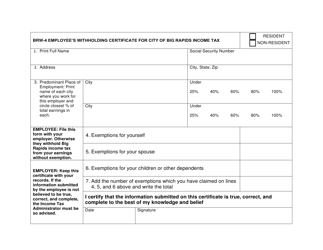

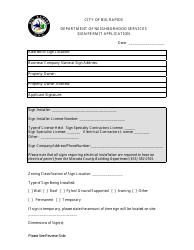

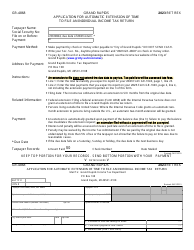

Instructions for Form BR-1040 Individual Income Tax Return - City of Big Rapids, Michigan

This document contains official instructions for Form BR-1040 , Individual Income Tax Return - a form released and collected by the Income Tax Department - City of Big Rapids, Michigan. An up-to-date fillable Form BR-1040 is available for download through this link.

FAQ

Q: What is Form BR-1040?

A: Form BR-1040 is the Individual Income Tax Return specifically for residents of the City of Big Rapids, Michigan.

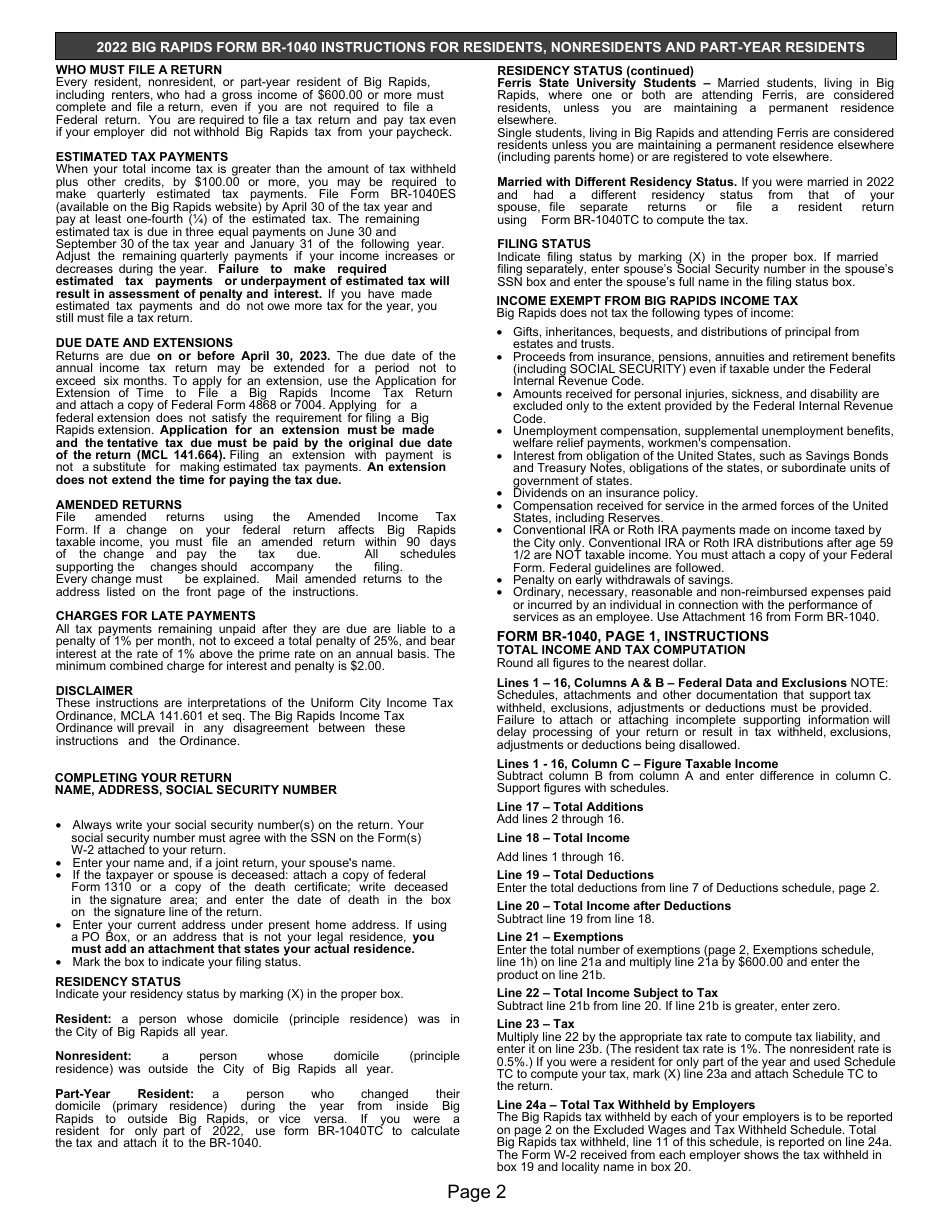

Q: Who needs to file Form BR-1040?

A: Residents of the City of Big Rapids, Michigan who have earned income during the tax year need to file Form BR-1040.

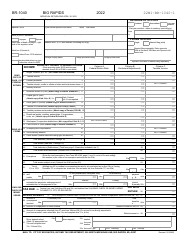

Q: What information is required on Form BR-1040?

A: Form BR-1040 requires information such as personal details, income sources, deductions, and tax credits.

Q: When is the deadline to file Form BR-1040?

A: The deadline to file Form BR-1040 is typically April 15th of the following year, unless otherwise specified by the City of Big Rapids, Michigan.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Income Tax Department - City of Big Rapids, Michigan.