This version of the form is not currently in use and is provided for reference only. Download this version of

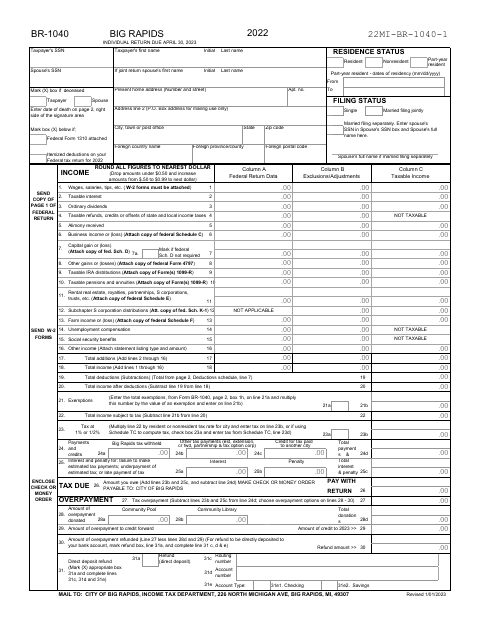

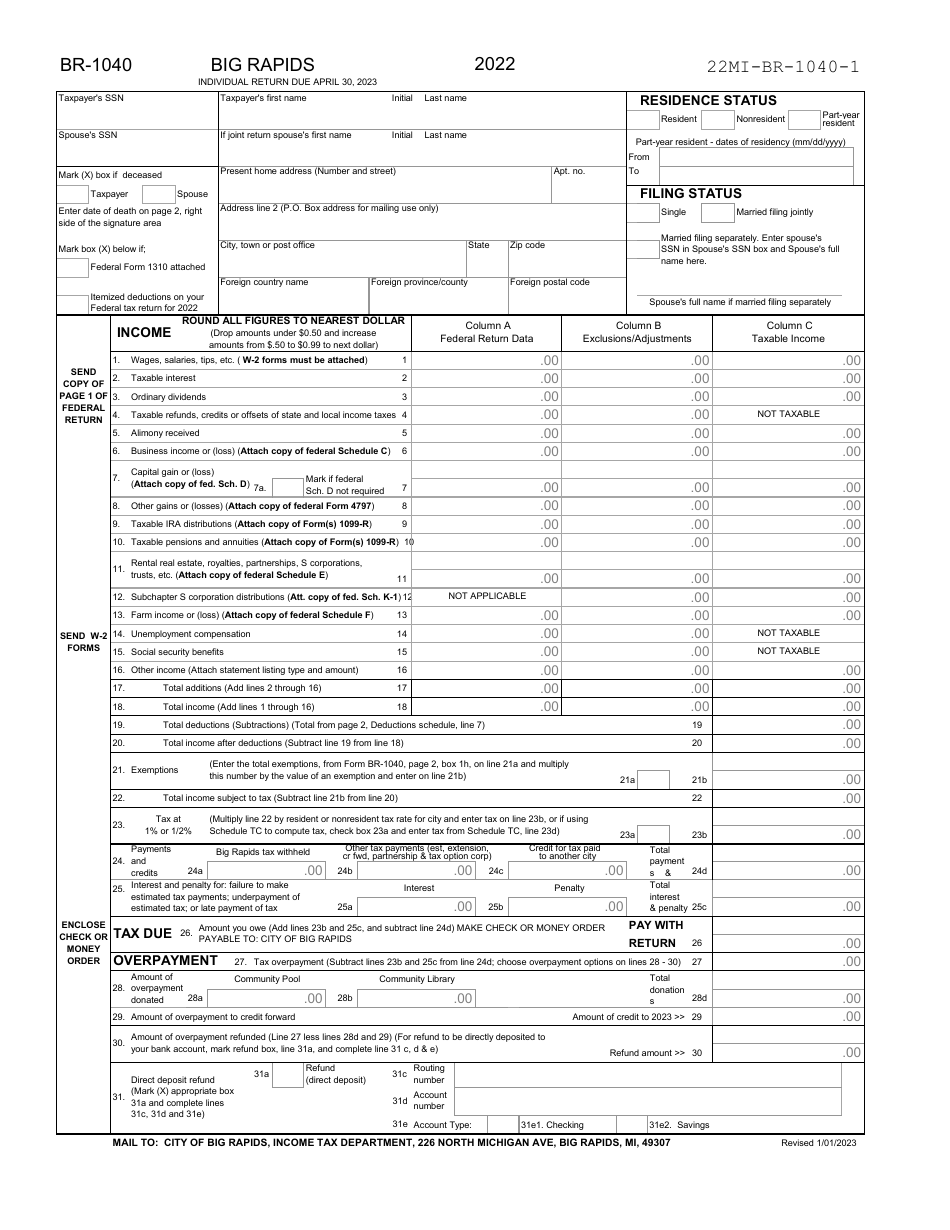

Form BR-1040

for the current year.

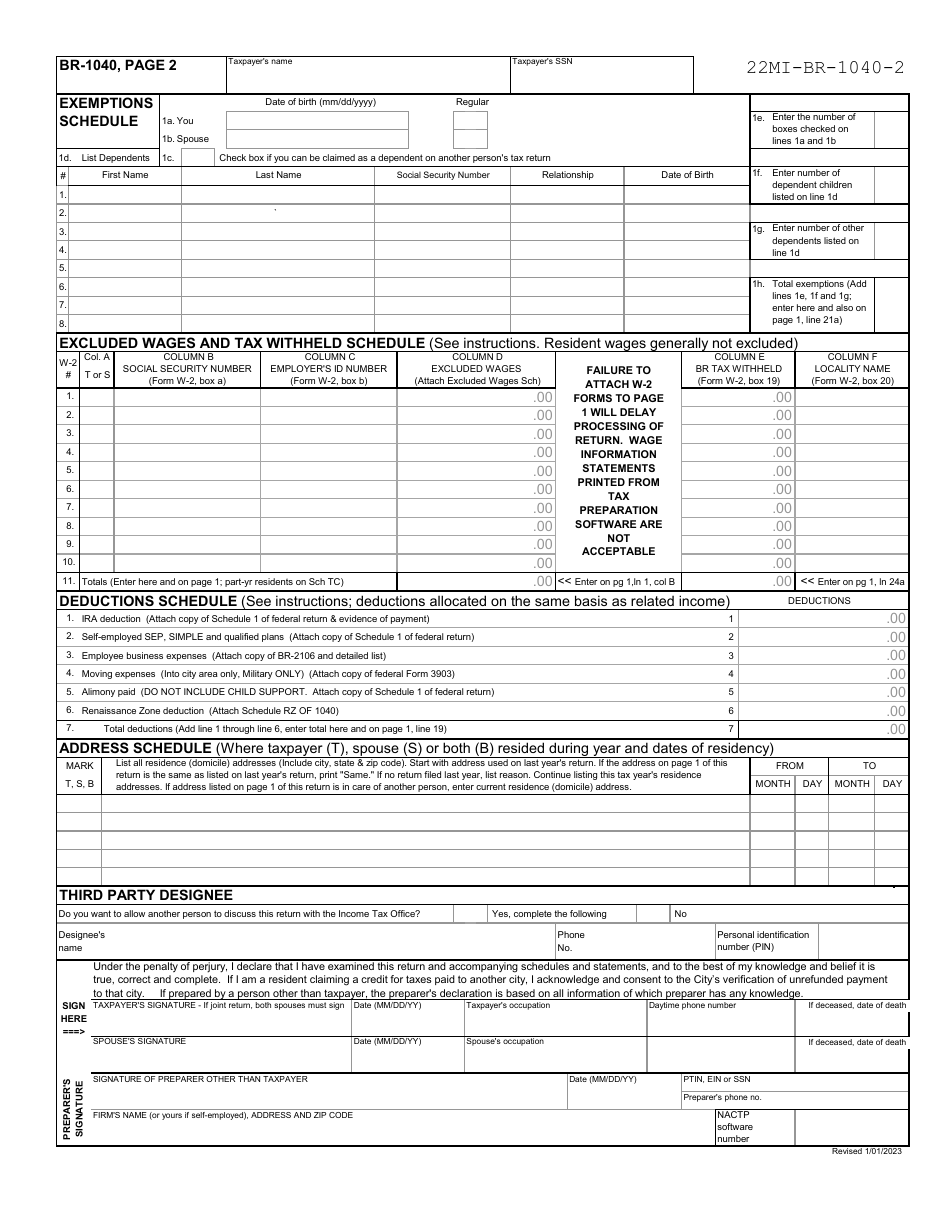

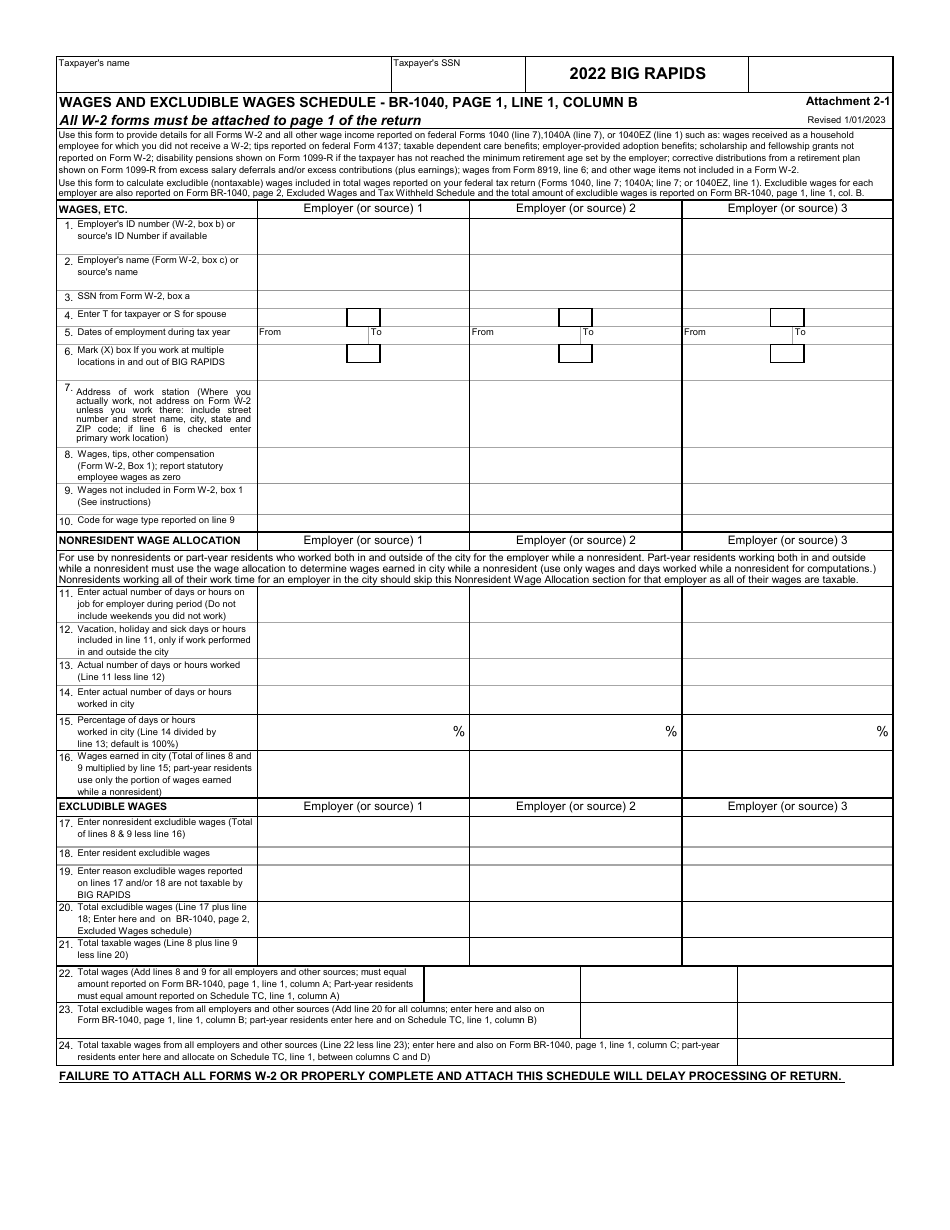

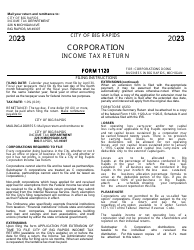

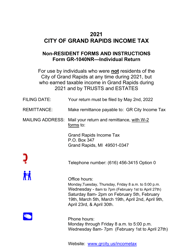

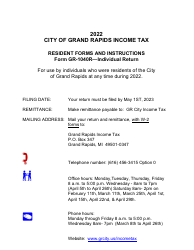

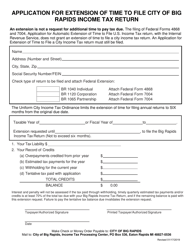

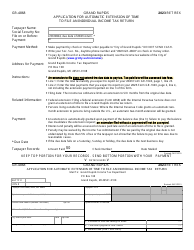

Form BR-1040 Individual Income Tax Return - City of Big Rapids, Michigan

What Is Form BR-1040?

This is a legal form that was released by the Income Tax Department - City of Big Rapids, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Big Rapids. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form BR-1040?

A: Form BR-1040 is the Individual Income Tax Return for the City of Big Rapids, Michigan.

Q: Who needs to file form BR-1040?

A: Residents of the City of Big Rapids, Michigan who have earned income need to file form BR-1040.

Q: When is the deadline to file form BR-1040?

A: The deadline to file form BR-1040 is usually April 30th.

Q: What information is required to complete form BR-1040?

A: Form BR-1040 requires information on your income, deductions, and credits.

Q: Are there any penalties for late filing of form BR-1040?

A: Yes, there may be penalties for late filing of form BR-1040. It is important to file your taxes on time to avoid penalties and interest.

Q: Can I file form BR-1040 electronically?

A: Yes, you can file form BR-1040 electronically if you choose to do so.

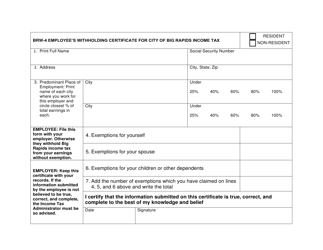

Q: Are there any exemptions available on form BR-1040?

A: Yes, there may be exemptions available on form BR-1040. Consult the instructions or the City of Big Rapids, Michigan's tax department for more information.

Q: What should I do if I have questions about form BR-1040?

A: If you have questions about form BR-1040, you should contact the City of Big Rapids, Michigan's tax department for assistance.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Income Tax Department - City of Big Rapids, Michigan;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BR-1040 by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Big Rapids, Michigan.