This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 7205

for the current year.

Instructions for IRS Form 7205 Energy Efficient Commercial Buildings Deduction

This document contains official instructions for IRS Form 7205 , Energy Efficient Commercial Buildings Deduction - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 7205 is available for download through this link.

FAQ

Q: What is IRS Form 7205?

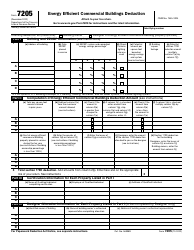

A: IRS Form 7205 is a form used to claim the Energy Efficient Commercial Buildings Deduction.

Q: What is the Energy Efficient Commercial Buildings Deduction?

A: The Energy Efficient Commercial Buildings Deduction is a tax incentive for eligible building owners who have made qualifying energy-efficient improvements.

Q: Who is eligible to claim the Energy Efficient Commercial Buildings Deduction?

A: Eligible building owners, including individuals, corporations, partnerships, and tax-exempt organizations, can claim the deduction.

Q: What type of buildings qualify for the deduction?

A: Buildings that are placed in service after December 31, 2005, and before January 1, 2024, and meet specific energy efficiency requirements may qualify for the deduction.

Q: What types of improvements are eligible for the deduction?

A: Certain energy-efficient improvements to the building envelope, interior lighting, heating, cooling, ventilation, and hot water systems may be eligible for the deduction.

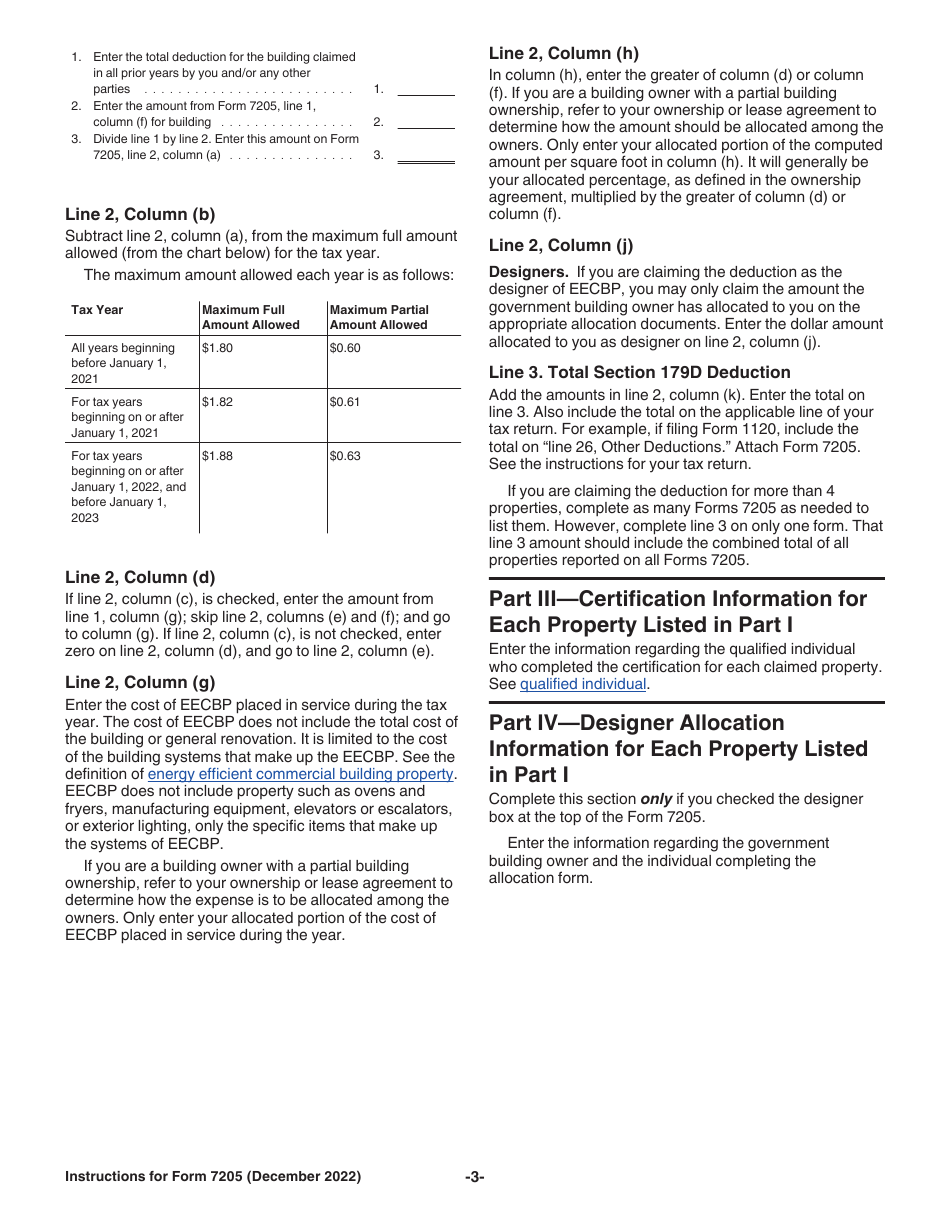

Q: How much can be deducted?

A: The deduction can be up to $1.80 per square foot of the building's floor area, depending on the level of energy efficiency achieved.

Q: How do I claim the Energy Efficient Commercial Buildings Deduction?

A: To claim the deduction, you need to complete IRS Form 7205 and attach it to your tax return for the year in which the improvement was placed in service.

Q: What documentation do I need to support my claim?

A: You should keep records of the certification statements from qualified individuals who determined the energy efficiency of the building or improvement, as well as any other supporting documents.

Q: Are there any limitations or restrictions on the deduction?

A: Yes, there are certain limitations and restrictions, such as a maximum deduction amount and specific requirements for government-owned buildings.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.