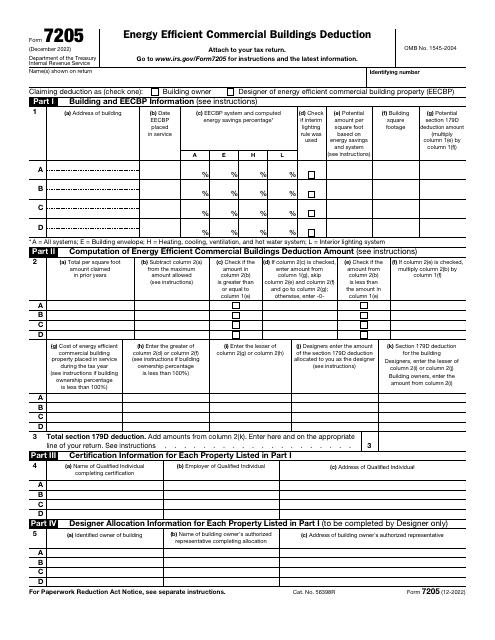

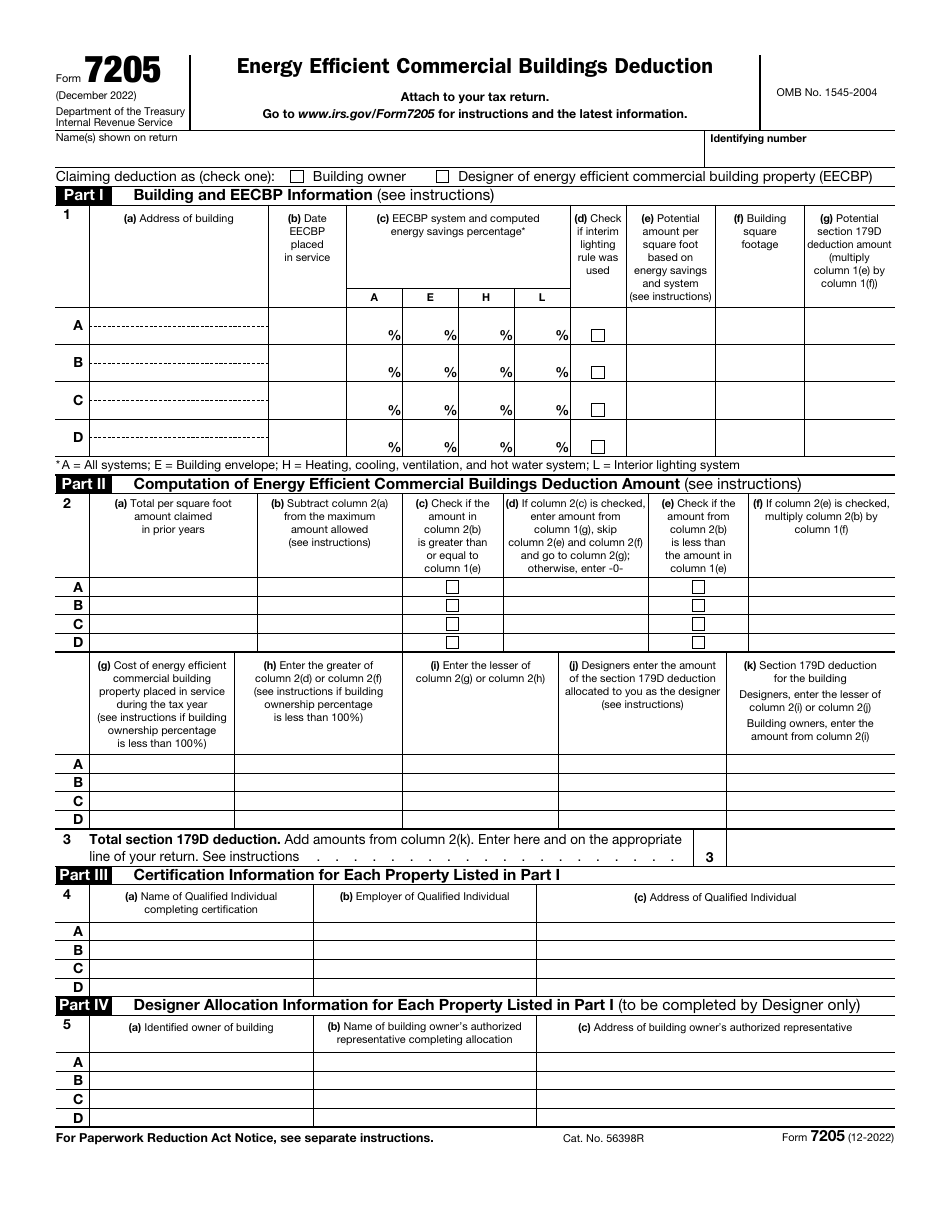

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 7205

for the current year.

IRS Form 7205 Energy Efficient Commercial Buildings Deduction

What Is IRS Form 7205?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2022. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 7205?

A: IRS Form 7205 is a form used by taxpayers to claim the Energy Efficient Commercial Buildings Deduction.

Q: What is the Energy Efficient Commercial Buildings Deduction?

A: The Energy Efficient Commercial Buildings Deduction is a tax incentive that allows eligible taxpayers to deduct the cost of energy-efficient improvements made to their commercial buildings.

Q: Who is eligible to claim the Energy Efficient Commercial Buildings Deduction?

A: Taxpayers who own or lease a commercial building and have made eligible energy-efficient improvements may be eligible to claim the deduction.

Q: What kind of improvements qualify for the Energy Efficient Commercial Buildings Deduction?

A: Improvements such as HVAC systems, building envelope, lighting, and hot water systems that meet certain energy efficiency standards may qualify for the deduction.

Q: How much can be deducted with the Energy Efficient Commercial Buildings Deduction?

A: The deduction amount varies based on the square footage of the building and the level of energy efficiency achieved.

Q: How do I claim the Energy Efficient Commercial Buildings Deduction?

A: To claim the deduction, taxpayers must complete IRS Form 7205 and attach it to their tax return.

Q: Are there any limitations or restrictions for the Energy Efficient Commercial Buildings Deduction?

A: Yes, there are limitations on the total deduction amount and certain certification requirements that must be met.

Q: Is the Energy Efficient Commercial Buildings Deduction available in both the United States and Canada?

A: No, the Energy Efficient Commercial Buildings Deduction is only available in the United States.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 7205 through the link below or browse more documents in our library of IRS Forms.